Update: Air New Zealand (AIR.NZX, AIZ.ASX, AIR020.NZX)

Annual Accounts to 30th June, 2022 (Three Year Analysis)

Note:

All amounts in New Zealand dollars (unless otherwise stated).

Previous coverage of Air New Zealand can be found in the annual accounts for FY21 and the interim accounts for HY22.

A Personal Note

The last horrendous experience on this airline is fresh in the memory and happened just a few months ago.

Flying on this airline would not be a option here even if it were free.

At least three times this business should have been placed into either receivership/statutory management or restarted in different and perhaps multiple forms.

Firstly, the shocking episode of the Erebus disaster where the airline management, according to the Mahon Enquiry, perpetrated an ‘orchestrated litany of lies’ and blamed the pilots for the accident when, in fact, they were innocent.

Over 250 people lost their lives.

Secondly, the Ansett debacle and subsequent investment bailout in 2001 by the New Zealand Government. This saved the airline from collapse due to a disastrous investment in a foreign airline.

Thirdly, the Covid collapse. The CEO has done a great job of begging the New Zealand Government and public investors to play ball. He seems uniquely able to stand in front of a TV camera and, in soporific tones, talk as if this current disaster is business as usual. That even $750 mn losses are just small bumps on the road to a joyful aeronautic future.

It’s also worth mentioning AIR’s well documented disgraceful treatment of Kiwi Air. The real nature of AIR was evident in their denying a financially strapped competitor from the same country access to ground services in Australia (as is custom in the airline business where an airline doesn’t have its own maintenance crew at the location).

In mitigation of AIR’s post-Covid performance it is fair to say that the government’s stupidity in handling Covid both domestically and at the borders had severe effects on the airline.

The moral hazards now embedded in AIR just continue to grow.

High executive salaries are still getting paid. Leases on grounded planes are paid. Competition on domestic routes is throttled. There is no reorganisation under bankruptcy or (probably) statutory management.

More and more taxpayer money is shovelled at this turkey in the form(s) of equity and/or debt.

It will survive for a while with these new government and investor funds.

Until the next time. And the next bail out.

There is such a things as sunk costs. No matter what the government and investors have put into this airline previously the money is largely gone (except for the current bail out funds but they’re going fast).

Past handouts/investments should not affect the decisions on whether further handouts/investments should be made.

Key Takeaways

No dividend

Dangerously low equity ratio of 20.1%

Massive operating loss before tax of $808m

1.8b in cash and short term investments (some escrowed)

Losses on total earnings are 40.8 cents per share at FY22 balance date

P/E ratio -1.3 on balance date share price of 45 cents

Balance sheet propped up with $519m of tax credits

Equity at balance date of 49.7 cents per share

Net operating cash flow of $582m

Operating earnings of only -$4m (before adjustment)

Overview

Air New Zealand (AIR) trades on the NZX under the code AIR and it’s also listed on the ASX under the code AIZ. It also has a listed bond security AIR020.

AIR’s very chequered history is touched on above in the A Personal Note.

In the latest financial year the airline has made yet another massive loss. The recast net profit before tax at $808m is the highest in the three years covered. The company uses tax credits to reduce the size of this loss on the Revenue Statement.

It has an equity ratio of 20.1% which falls to just 13.9% if the accumulating tax credits are taken out. After all, will the airline ever be able to use the tax credits?

It has an surprisingly good operating cash flow of $582m which produces a good free cash flow of $241m. But this is achieved through growth in creditors & payables from $2.0b to $2.6b mostly as a result of a large increase in current revenue in advance to $1.6b from $0.7b the previous year. This is, of course a massive liability on the balance sheet.

It also received $403m of cash during FY22 from the government which will have improved the operating cash flow position.

It’s impossible to be optimistic about the future of this business.

Note:

The restatement of FY2021 was an accounting issue involving an IFRIC interpretation.

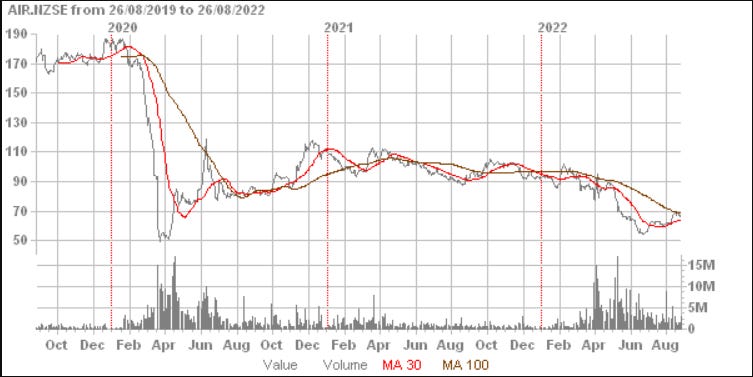

Trading History

NZX:

AIR

Source: Direct Broking

AIR020 (Bonds)

Source: Direct Broking

ASX:

AIZ

Source: Direct Broking

The bulk of the trading in the company takes place on the NZX. However, there are still significant volumes of shares traded on the ASX especially in the five month period after Covid hit and also from March, 2022.

The share price was trading around the low $1.70s on the NZX when Covid started and within a little over a month it had collapsed to 50 cents.

It recovered somewhat to a high of around $1.60 but now trades in the high 60 cents range. These numbers are not directly comparable because of the capital restructuring.

Discussion

The company’s FY22 profit announcement through the NZX included an exercise in creative speech writing.

Some of the classics from the AIR (Creative Writing Team) announcement:

Chair Dame Therese Walsh:

"The airline's continued ability to step carefully through an ongoing

pandemic while looking beyond the horizon is becoming a core capability.”

I wonder if ‘step carefully’ includes flying to Wellington and begging for part of the bail out investment.

Chair Dame Therese Walsh:

"Throughout the year we have also made improvements to the pay and conditions for our people, settling 12 collective employment agreements, increasing the base pay of our front-line workers and restarting incentive payments to staff on individual employment agreements ensure we retain our dedicated team."

They took the bail out investment and gave everyone a pay rise for a company that would have gone into receivership.

Chief Executive Officer Greg Foran:

'survive, revive, thrive' …

Shouldn’t that be ‘collapse, beg, borrow, survive, revive, survive, borrow, collapse, bail out’?

Recast Revenue Statement

All foreign exchange items in the revenue are added to funding costs. This accounts for the artificially low funding cost figures in FY21 Restated and FY21. There was a gain of $143m on unhedged interest bearing debts and lease liabilities.

Total revenue was up a meagre 8.8% as it was coming off a low base after a 48.2% decrease in FY21.

EBIT was down 90.4% at a staggering -$655m while operating profit before tax was -$808m, an equally staggering figure.

Total earnings of -$591m is misleading because of the tax credits. In fact the accumulated tax credits from the three years looked at are -$519m which make up a sizeable chunk of retained earnings and therefore shareholders’ funds. Profitability, in which case the tax credits could be used to reduce the amount of income tax, is not a certainty.

The company is still in deep trouble.

Other Metrics:

EBITDA, which is a pretty useless metric, is a paultry $13m and 96.5% down on FY21 Restated.

Depreciation & amortisation are 24.3% of total revenue which is up on the largely pre-Covid FY20 of 17.3% as would be expected.

Operating Earnings:

Foreign exchange losses have been moved to funding costs and they account for the adjustment to operating earnings.

Passenger revenues are a much smaller part of the total operating revenues at 54.0% compared to 81.5% in FY20.

Cargo revenue is strong partly because of the cargo grants (see below). In FY22 cargo represented 37.2% of total operating revenue compared to 9.3% in FY20.

Total operating revenues are up 8.6% off a low base. Fuel, which represents 20.5% of total operating revenues is up by 80.1% partly because it’s coming off a low base and more importantly because jet fuel prices are up strongly.

Labour represents 35.7% of total operating revenues in FY22, up from 24.8% in FY20.

An operating loss of $4m was made which after the foreign exchange adjustment is a loss of -$1m.

Cargo Grants:

Both the New Zealand and Australian Governments subsidised AIR through grants that in FY22 totaled $403m. The Australian subsidies have finished while the New Zealand ones continue until the end of March, 2023.

There is no information on the costs associated with this revenue stream so it is impossible to tell exactly how much the bottom line improved with the grants.

But obviously, the cargo grants will come off the total operating revenue figure. That won’t be good unless cargo revenue ramps up spectacularly.

Significant Items:

AIR puts a few items in a hold-all category called ‘Other Significant Items’ on its revenue statement. This is just a net figure and in FY22 it was -$85m. It clouds the profit figures, especially the funding costs item.

Restructuring costs could go into extraordinary items or added to costs that go above the EBIT line. There are reasonable arguments for both treatments. In this recast revenue statement it’s under extraordinary items.

Recast Balance Sheet

The company’s commitments stand at $2.8b at the FY22 balance date. Contingent liabilities are not significant.

Creditors & provisions are very high compared to receivables and prepayments.

Interest bearing debt is up 32.1% at balance date on FY22.

Adjusted Equity Ratio:

The significance of the tax credits to the equity percentage is large. Without the tax credits on the revenue statement the equity percentage is a tiny 13.9%, which could well be close to a level that the receivers would be called in.

Revenue in Advance:

Revenue in advance which in the recast balance sheet here is counted in the item creditors & provisions shows a massive increase.

On a current basis it has risen to $1.6b from $0.7b. Although it’s not part of operating revenue as it’s an asset it represents a stunning 59.5% of FY22 total revenue. This item represents payments in advance for transportation and is a massive commitment to expenses (which may not be profitable) in the future.

It also represents a sizeable piece of the total assets on the balance sheet. In fact, in total at the FY22 blance date it represents 22.2% of total assets which is notably above the equity percentage of 20.1%.

Recast Movements in Shareholders’ Equity

The shareholders’ funds could be overstated because of the tax credits which may or may not have value and have already been discussed.

The massive rights issue which brought in $1.2b in FY22 saved the airline from collapse.

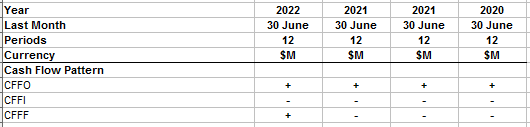

Recast Cash Flow Statement

There was a surprising operating cash flow surplus in FY22 of $582m. This was partly due to a large increase in creditors & provisions. This reduced the payments to suppliers item in the cash flow statement. The company may be dragging out payments to suppliers.

Cash Flow Pattern:

The FY22 cash flow pattern is one of a company sourcing debt and (or) equity while operating an operating surplus. It’s using the funds to reinvest in the business largely in fixed asset and investment purchases.

Ratio Analysis

The current ratio at balance date on FY22 is 78.7% which is very low as is the quick ratio at a small 0.8 times at the same balance date. The funding cost cover for FY22 at -4.3 is negative. The company can’t cover its interest commitments from its EBIT.

The funding cost cover in FY21 is distorted for previously explained reasons. The NTA/share has continued to decline and at FY22 blance date stood at just 45 cents.

Losses per share in FY22 range from 55.8 cents for operating profit before tax which is above the NTA/share. Losses per share for FY22 are 40.8 cents based on total earnings.

The P/E ratio on total earnings is -1.3 for FY22.

There is no dividend.

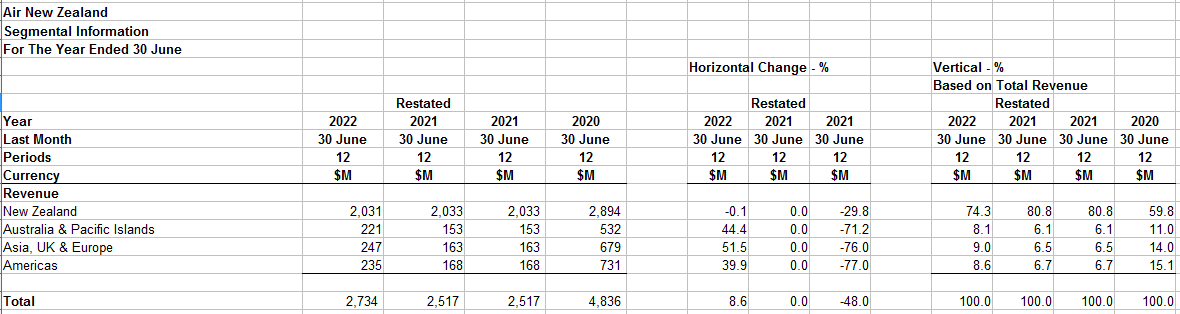

Segmental Analysis

AIR provides little segmental information. But from what there is New Zealand revenue has become a bigger part of total revenue. It was 59.8% in FY20 and 74.3% in FY22.

Bonds

The AIR020 bonds mature on 28th October this year and are trading below their 4.00% coupon at their current yield-to-maturity of 5.20%. They are unsecured and unsubordinated.

It’s a pity there aren’t other AIR bond instruments currently issued as the yield would provide useful sentiment information if their durations were over the medium to long term.

As this existing bond matures in a couple of months investors have not driven the yield up as it’s unlikely AIR will go bust so soon.

Summary

AIR is an ongoing multi-decade (40+ year) fluctuating disaster story which makes little permanent economic sense. It appears to be commercially unviable at least once a decade give or take.

It made no money even from its operations in FY22 even with the cargo grant. It made a horrendous loss before tax. It has a paper thin equity ratio.

But it has a implied guarantee from the New Zealand Government. It appears that the government will always have AIR’s back no matter what problems befall it.

On the plus side are the operating cash flow (subject to our concerns above) and its high level of cash & short-term investments given it’s flush after raising capital both debt and equity.

There really needs to be some sort of non-governmental enquiry into the consequences of selling the business completely or perhaps breaking it up and selling it in parts.

The New Zealand taxpayers need to get this turkey off their backs once and for all.

Note:

Comments and suggestions can be made below. All discussion related to this article or other issues are welcome and always appreciated.

If you know someone who might be interested in this article or this website please share using the icon below.

Thank you.