Photo by Audrey Grace Paul on Unsplash

Key Points

Position still deteriorating

Extremely low equity ratio of 12.6%

Loss of $272 mn

Shareholders' funds $811 mn

Capital raising needed

Operating cash flow improving and positive at $89 mn

No dividend

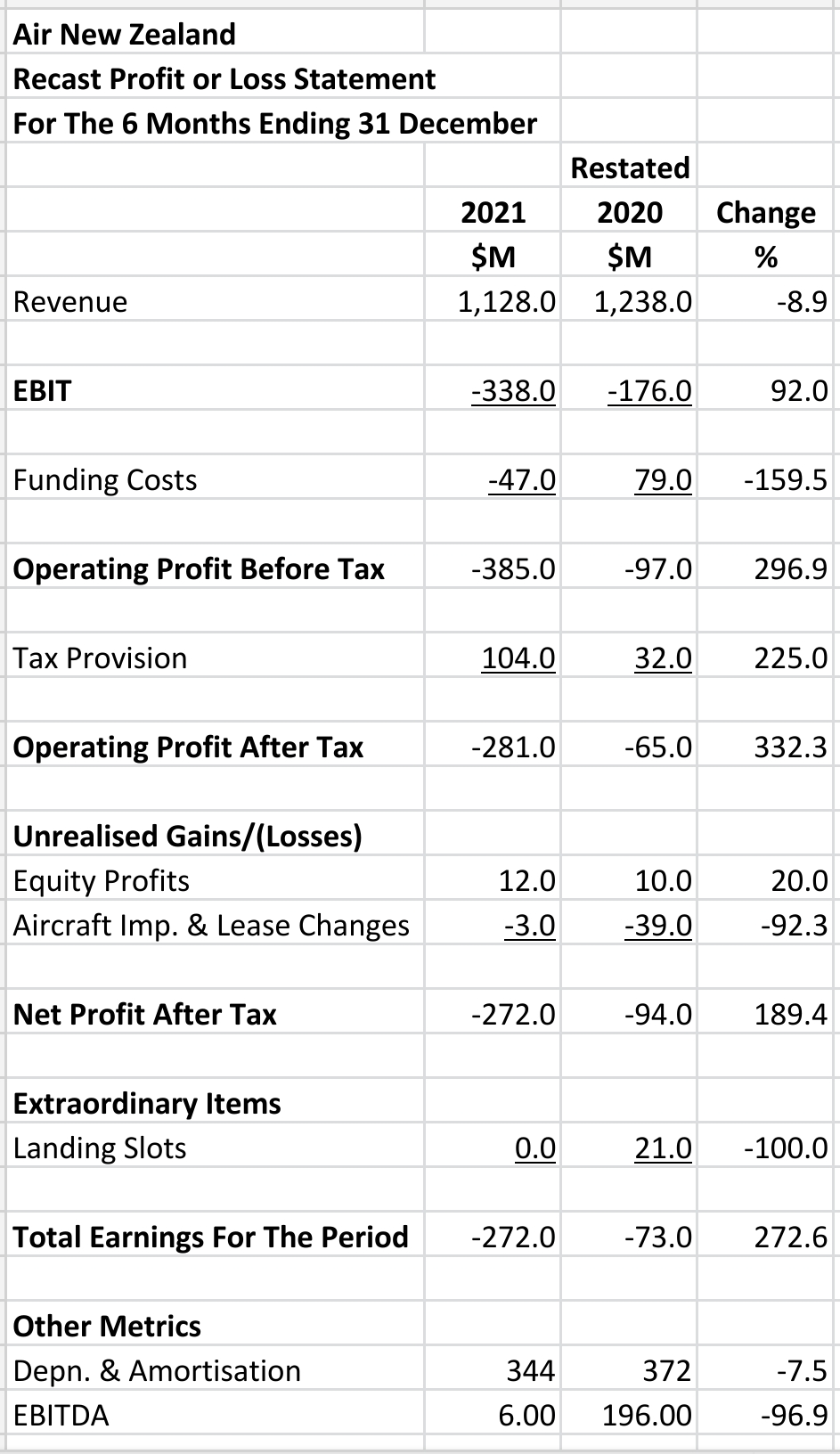

Recast Revenue Statement

Profits were lower in the six months to 31 December, 2021 than in the comparable period in the previous year.

Revenue fell 8.9% while total earnings were -$272 mn on strongly negative EBIT of -$337 mn.

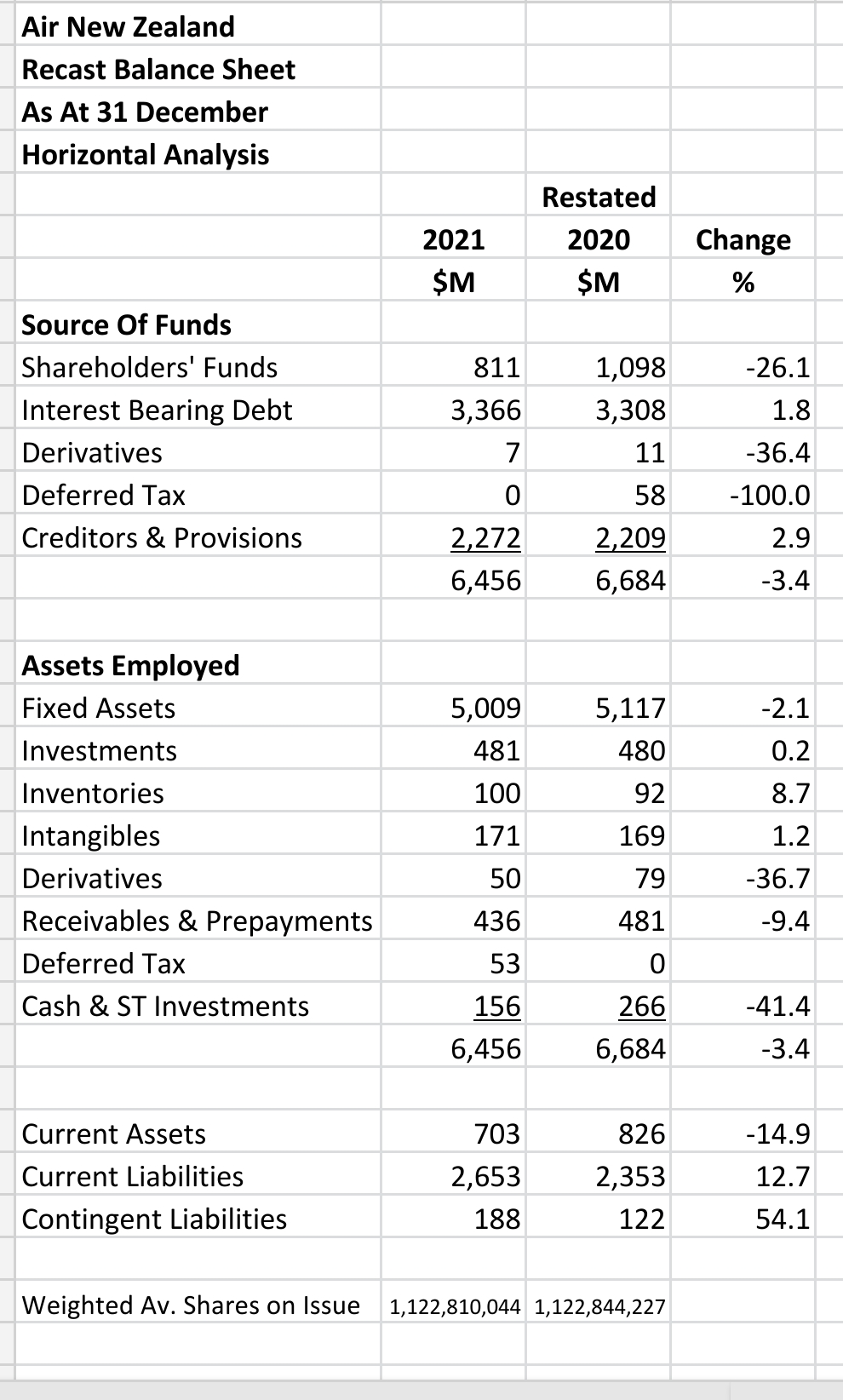

Recast Balance Sheet

Horizontal Analysis:

The equity in the company fell dramatically from $1,098 mn at balance date in the previous period to $811 mn at the end of the current six month period.

Cash and short-term investments were also badly hit at $156 mn at balance date. This was down 41.4% compared to the end of the prior period.

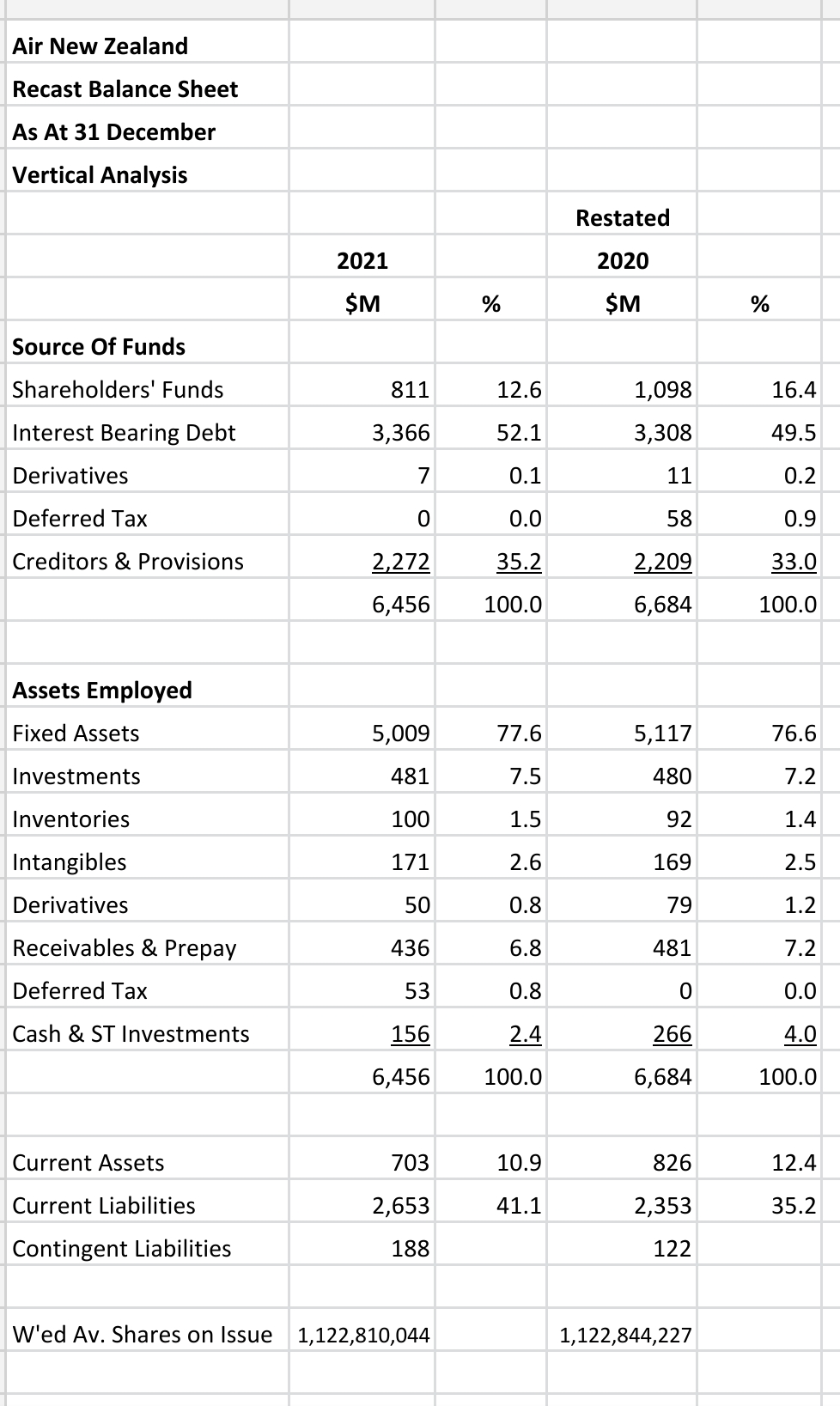

Vertical Analysis:

The equity ratio declined to 12.6% which is not that far from insolvency.

Interest bearing debt climbed to 52.1% of total assets.

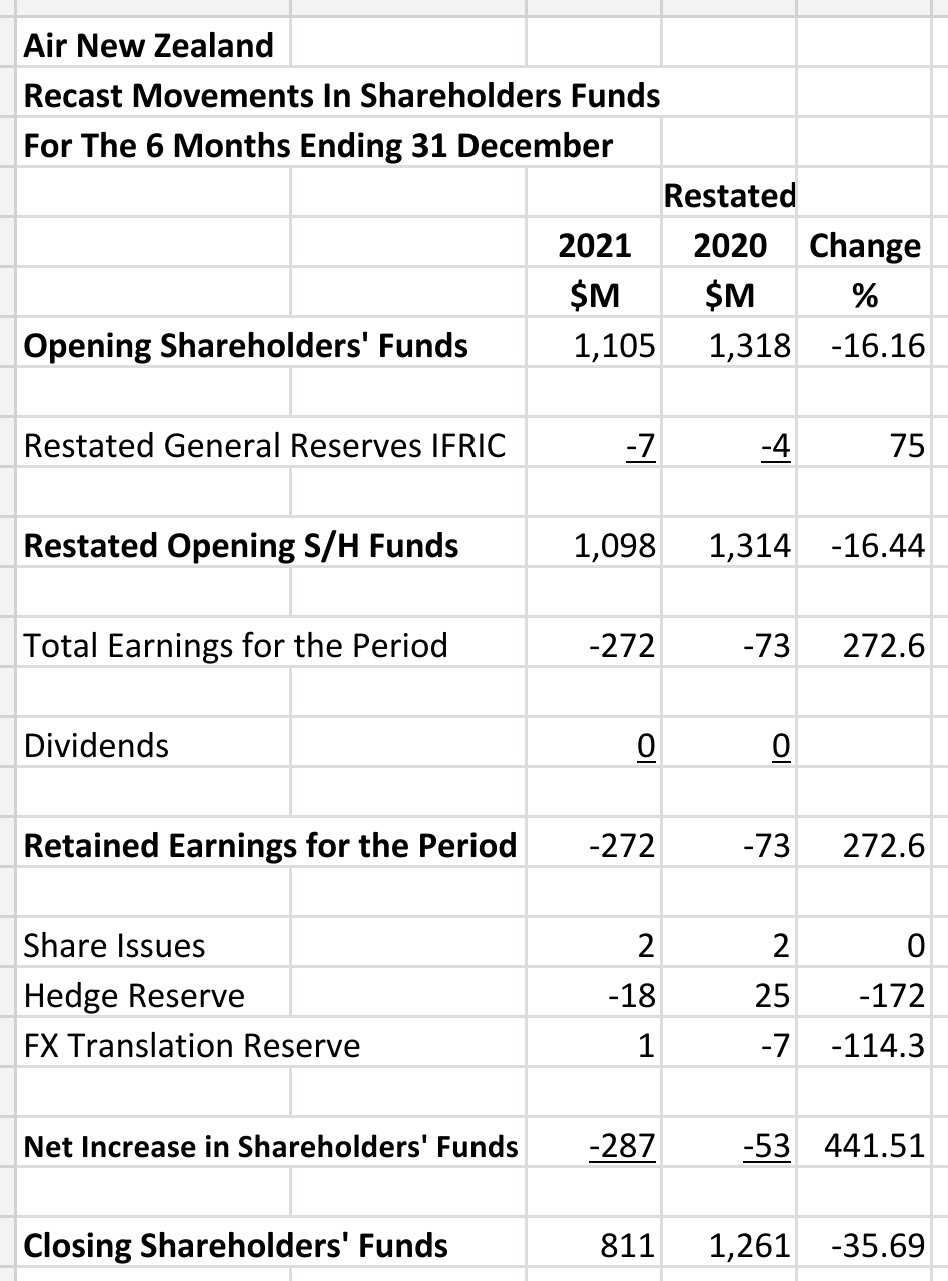

Recast Movements in Shareholders' Equity

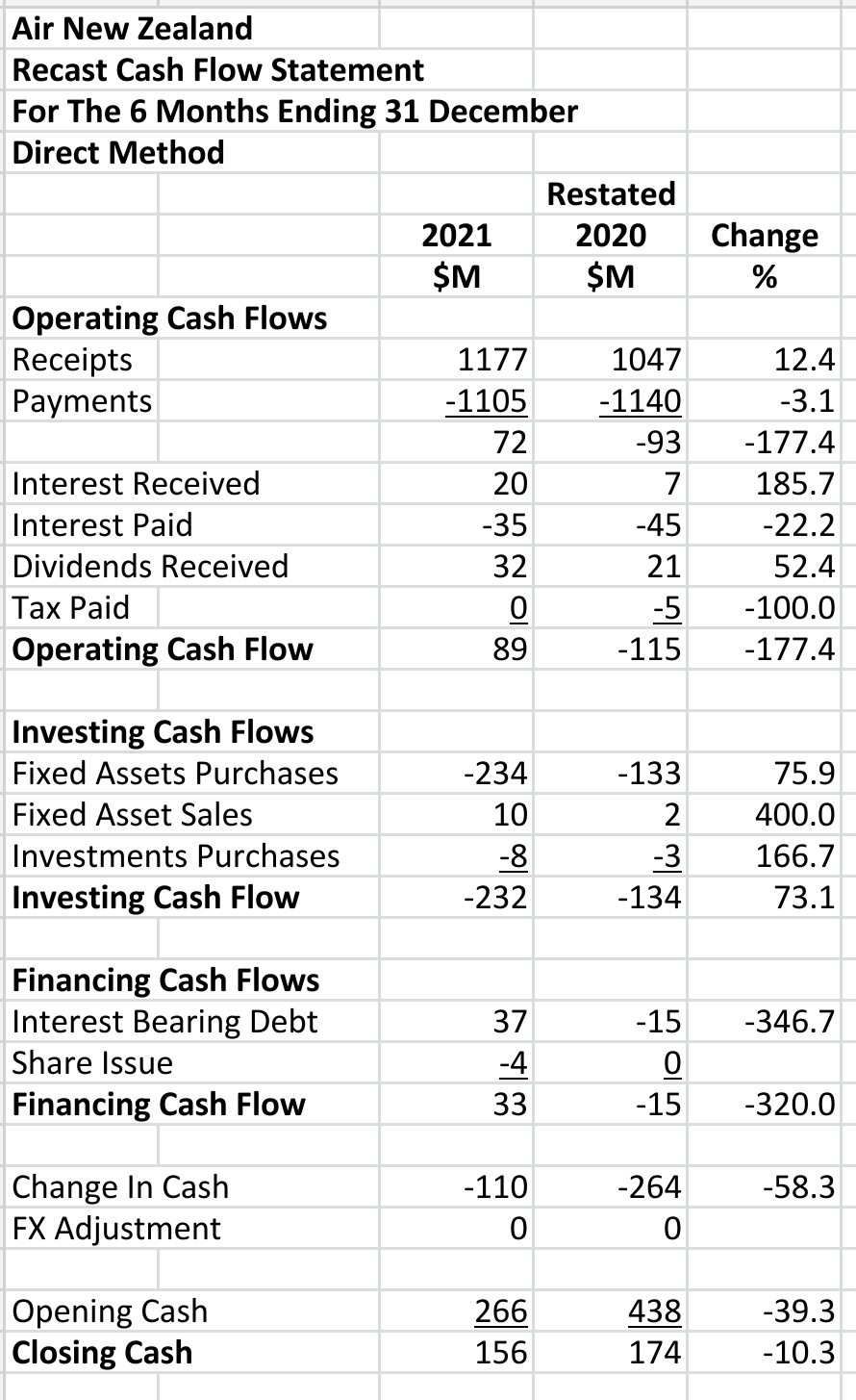

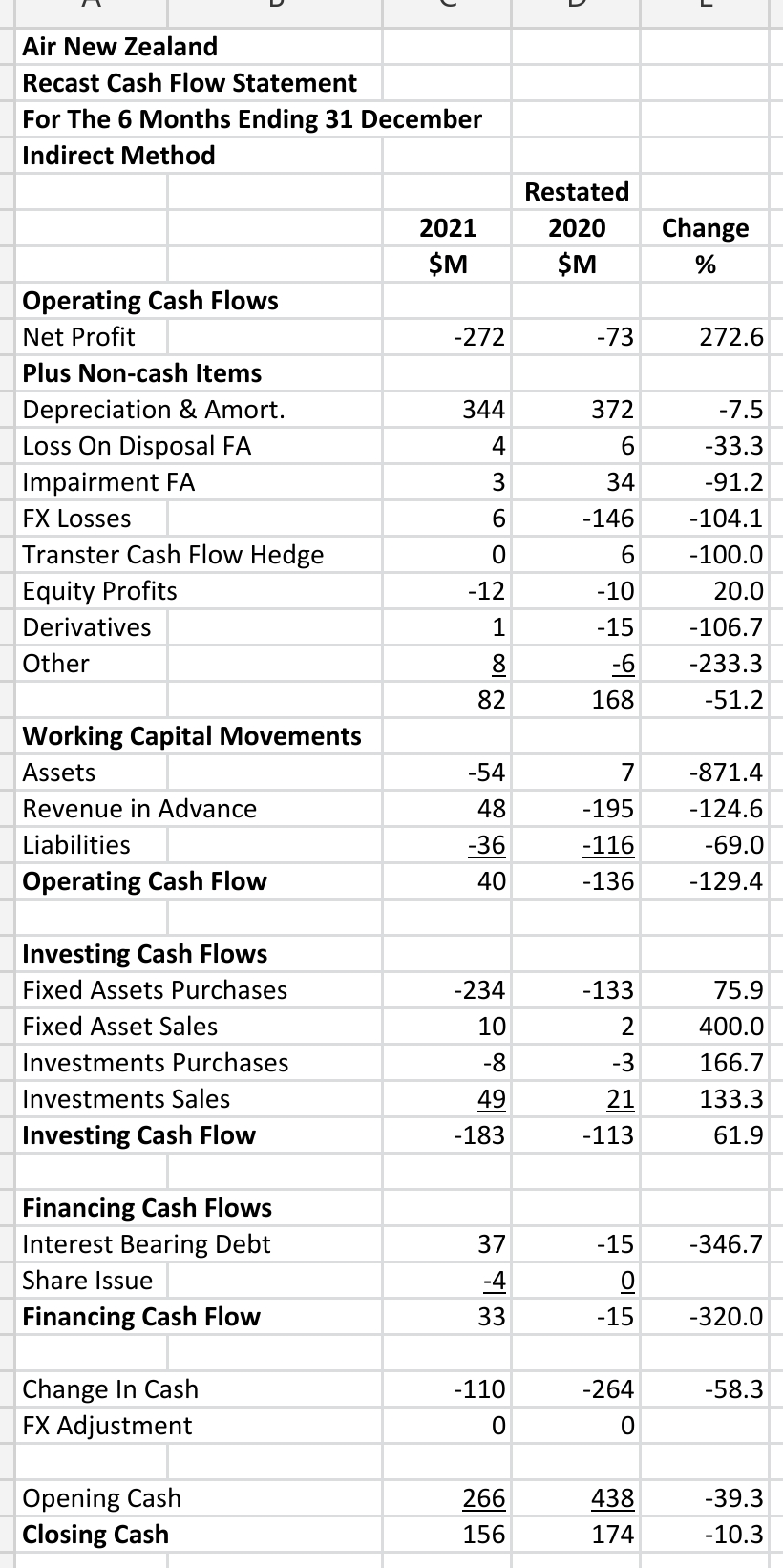

Recast Cash Flow Statement

Direct Method:

Operating cash flow rose to $89 million in the current six month period compared to -$115 mn in the prior period.

Indirect Method:

The indirect method cash flows differ from the cash flows in the direct method as we have to follow the company classification of cash flow items when we use the indirect method.

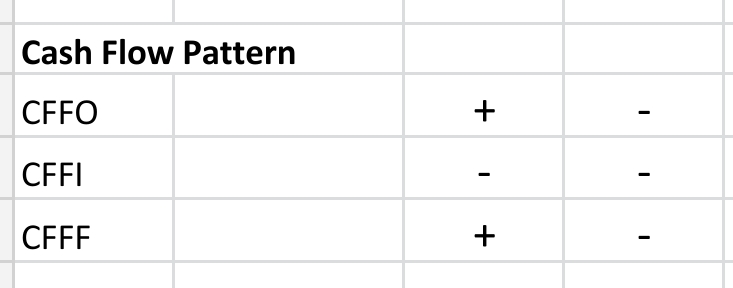

The cash flow pattern is an improvement on the prior period when all categories were negative. An all negative cash flow pattern is typically seen in a start-up business.

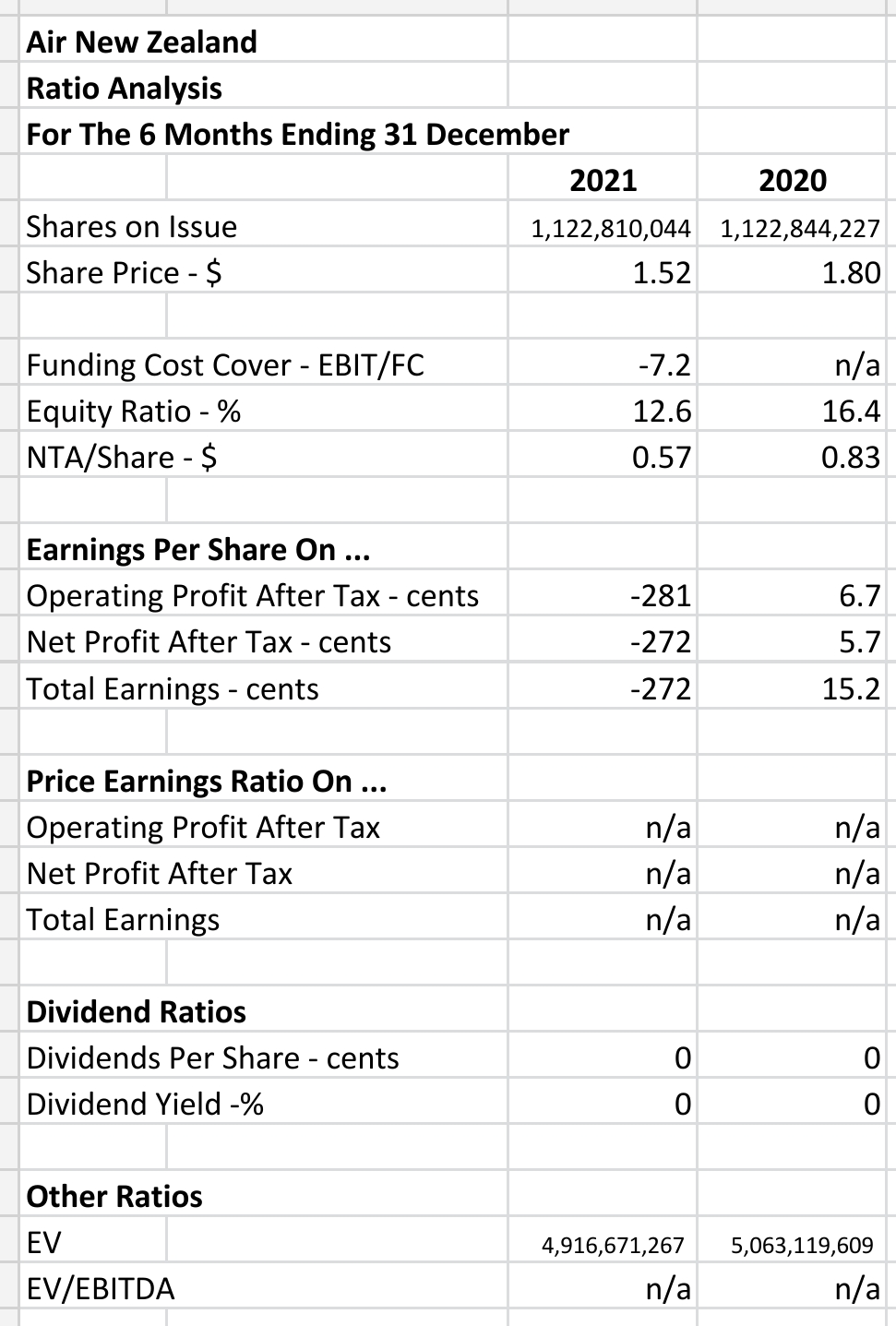

Ratio Analysis

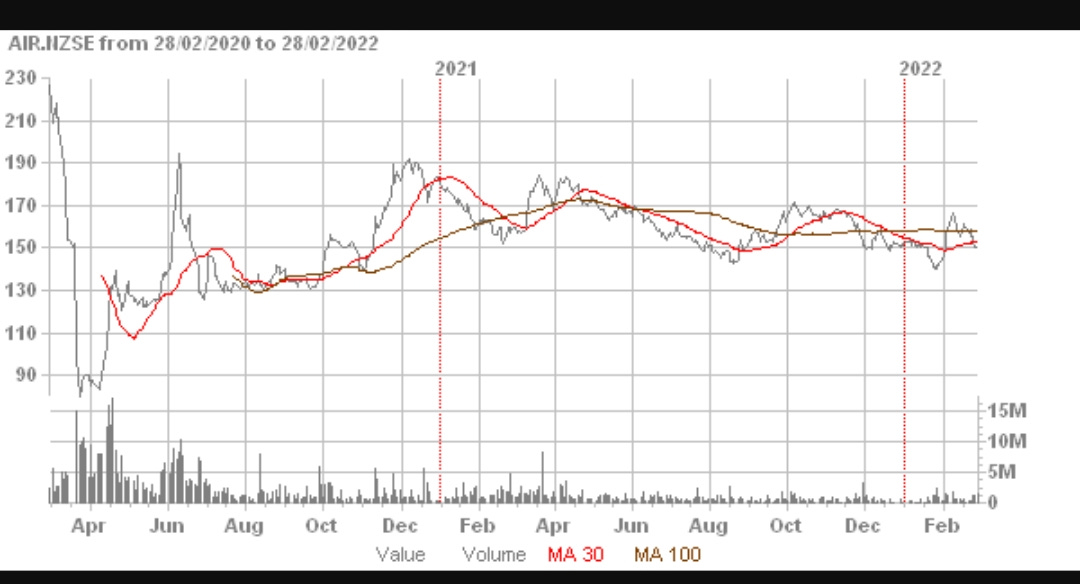

Enterprise value (EV) fell compared to the prior period. EV includes market capitalisation and interest bearing debt less cash & short-term investments.

There was no funding cost cover as the EBITs were both negative.

NTA per share declined to $0.57.

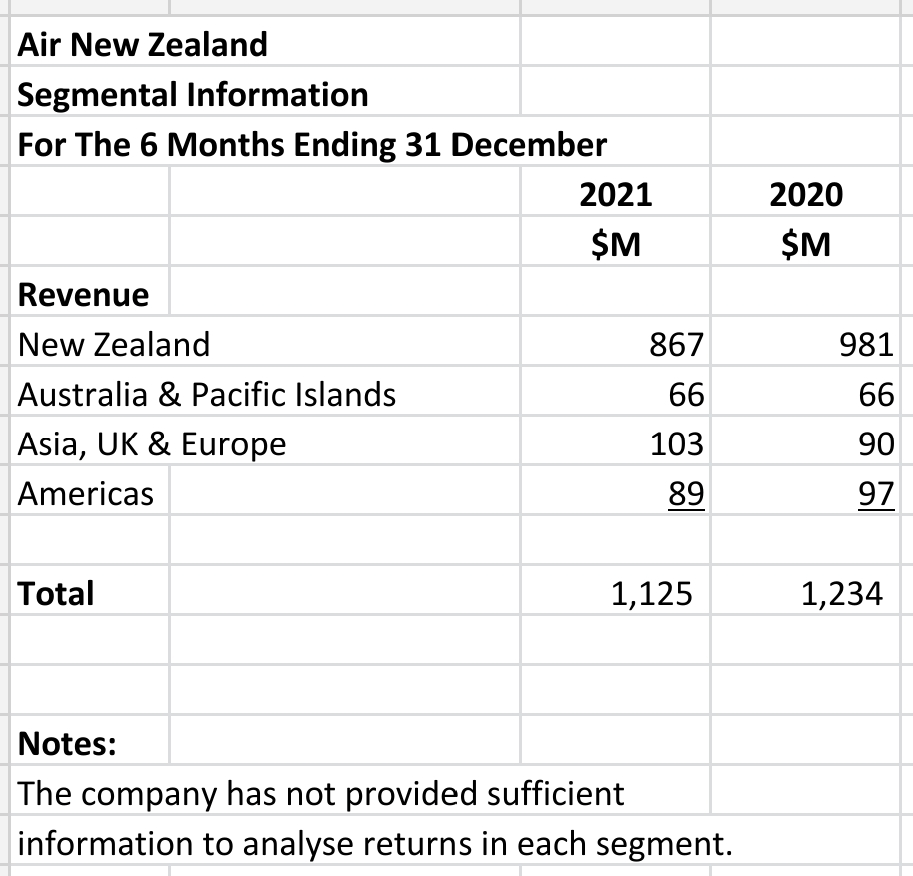

Segmental Analysis

The company does not provide sufficient information to work out returns on funds employed in the operating segments.

The bulk of revenue comes from New Zealand.

Summary

AIR is a company in crisis. It is losing lots of money and has minuscule equity.

It has made operational changes that have put operating cash flow back into positive territory.

The company must raise capital now to survive and the talk in the press is that it will go to its shareholders for over $1.2 bn New Zealand dollars.

Taxpayers, who through the government's 52% ownership, will be called upon to provide equity for this company to survive.