Photo by Douglas Bagg on Unsplash

Key Points

Unprofitable

Good operating cash flow

Poor equity ratio

Needs recapitalisation

No dividend

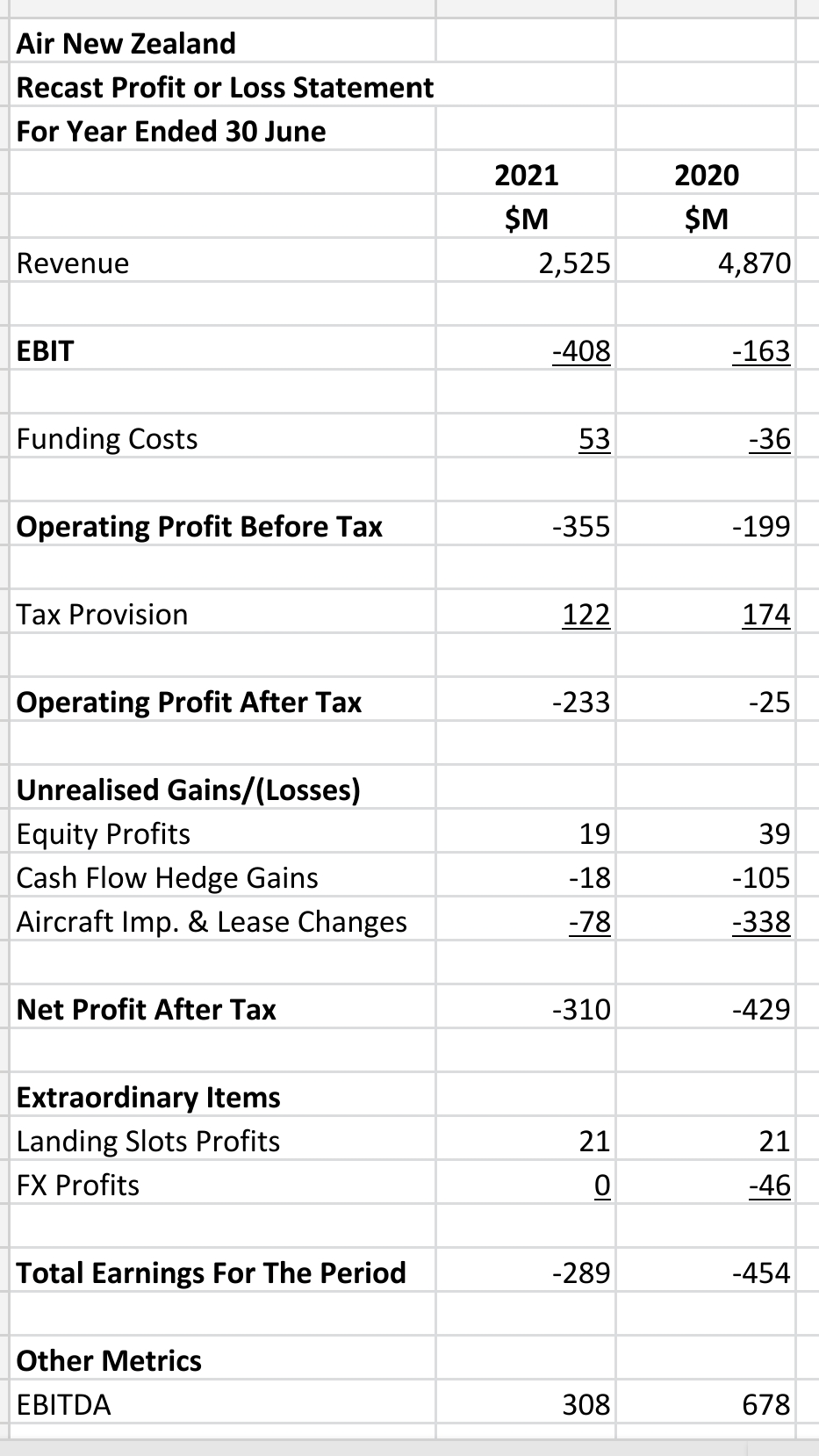

Recast Revenue Statement

AIR is losing a lot of money. In the financial year ended (FYE) 30 June, 2020 it lost a total of $454 mn while in FYE 30 June, 2021 it lost $288 mn.

Covid hit three quarters of the way through FYE 2020 and it's full effect was plain in the FYE 2021.

Revenue was down nearly half and EBIT blew out to -$408 mn.

Unlike Auckland International Airport the airline can not rely on unrealised property revaluations to mask its woeful financial position.

AIR benefited from significant foreign exchange gains and it otherwise would have blown out to over -$0.5 bn in EBIT.

The company made radical changes to cut expenses and the government created a $900 mn loan facility to keep the company going.

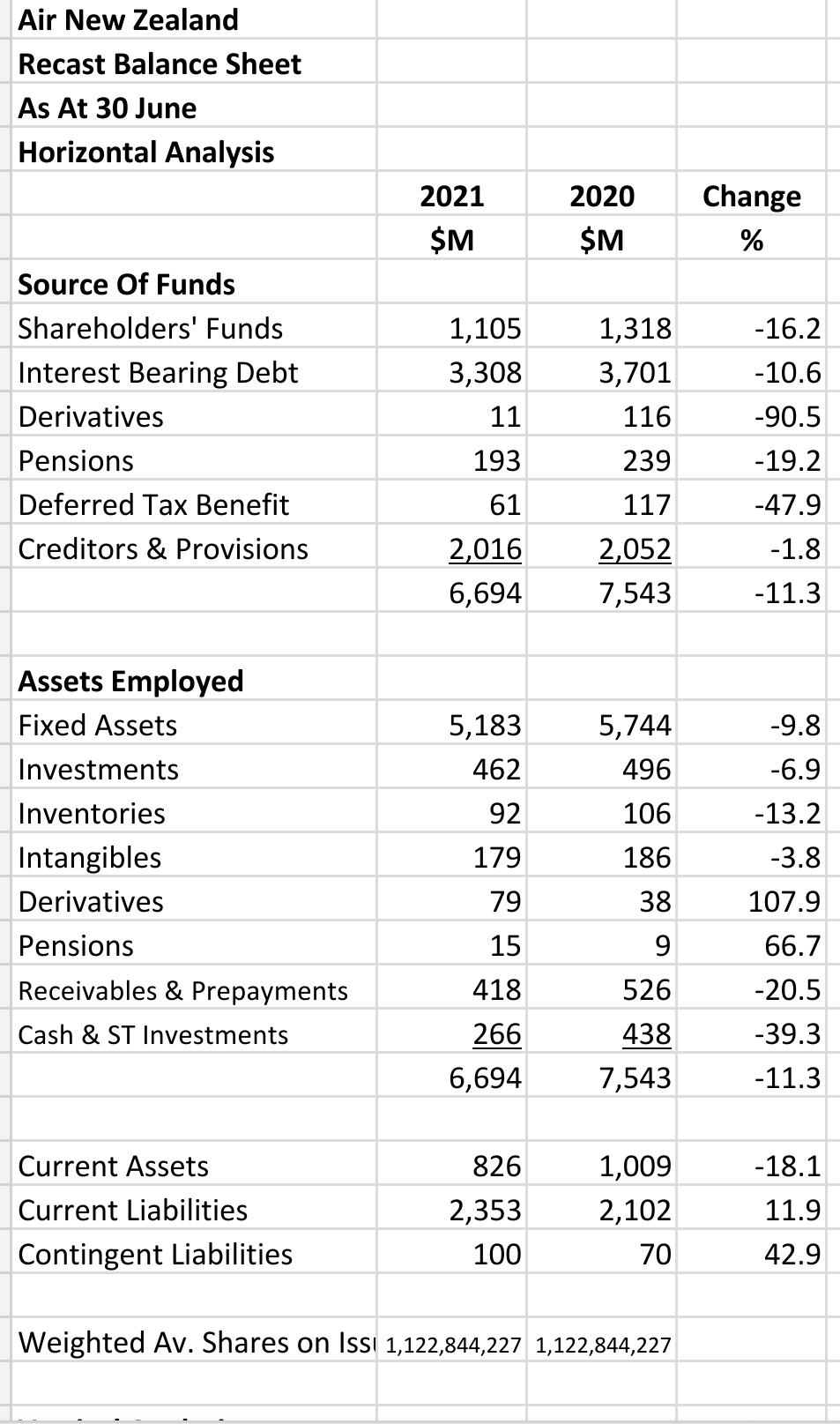

Recast Balance Sheet

Horizontal Analysis:

Shareholders' funds decreased by 16.2% by the end of FYE 2021 to $1,105 mn and the company was also able to reduce its interest bearing debt by 10.6%.

Cash and short-term investments dropped significantly (39.3%) to $266 mn.

Total assets decreased 11.3% as the company down-sized.

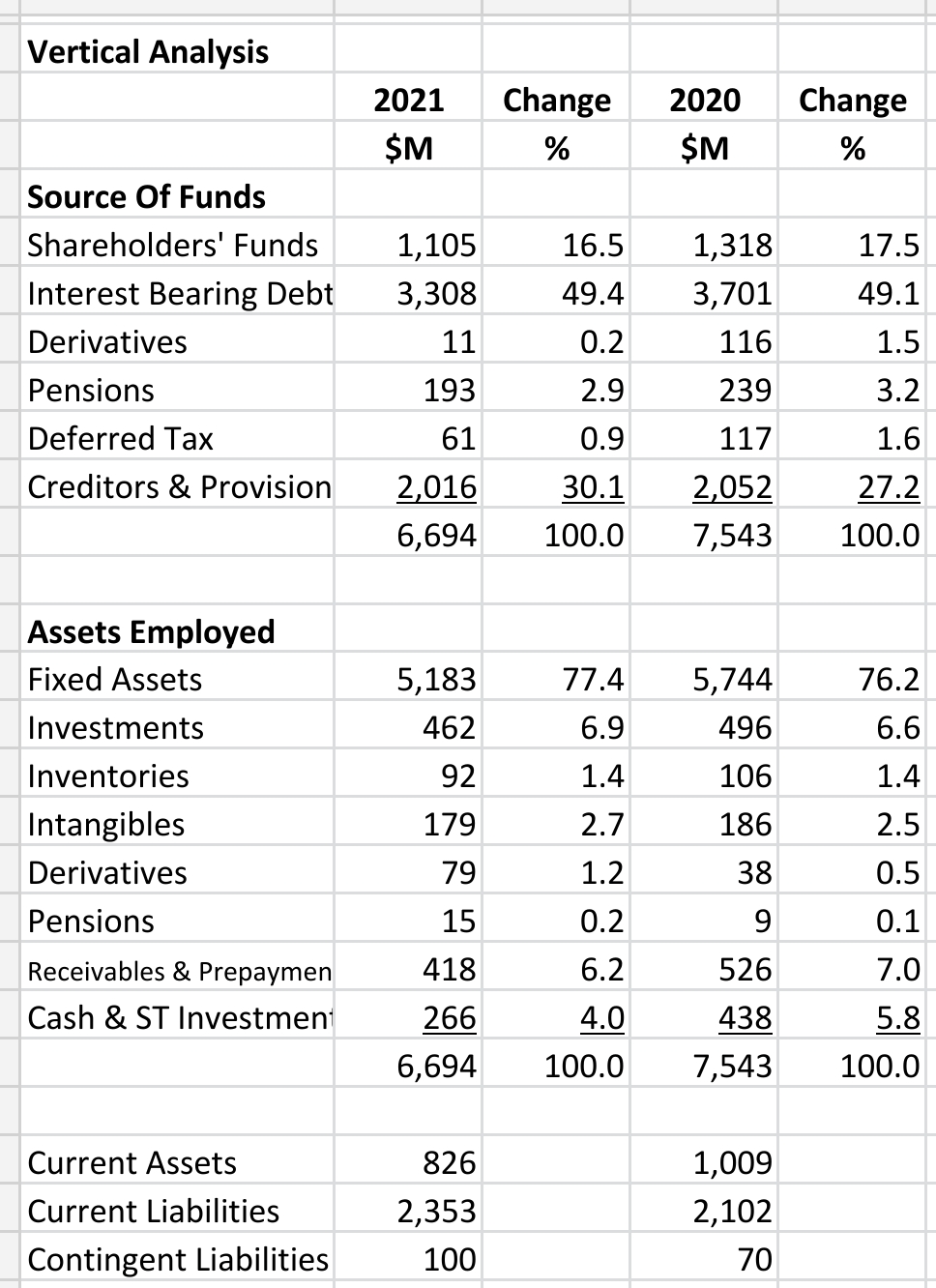

Vertical Analysis:

The company's equity ratio is very poor at 16.5%, a level at which a company might be considering liquidation. Investors and shareholders would normally be becoming very nervous.

But AIR is supported by its majority shareholder, the New Zealand Government. As well as lending the company money the government will be involved in its coming recapitalisation.

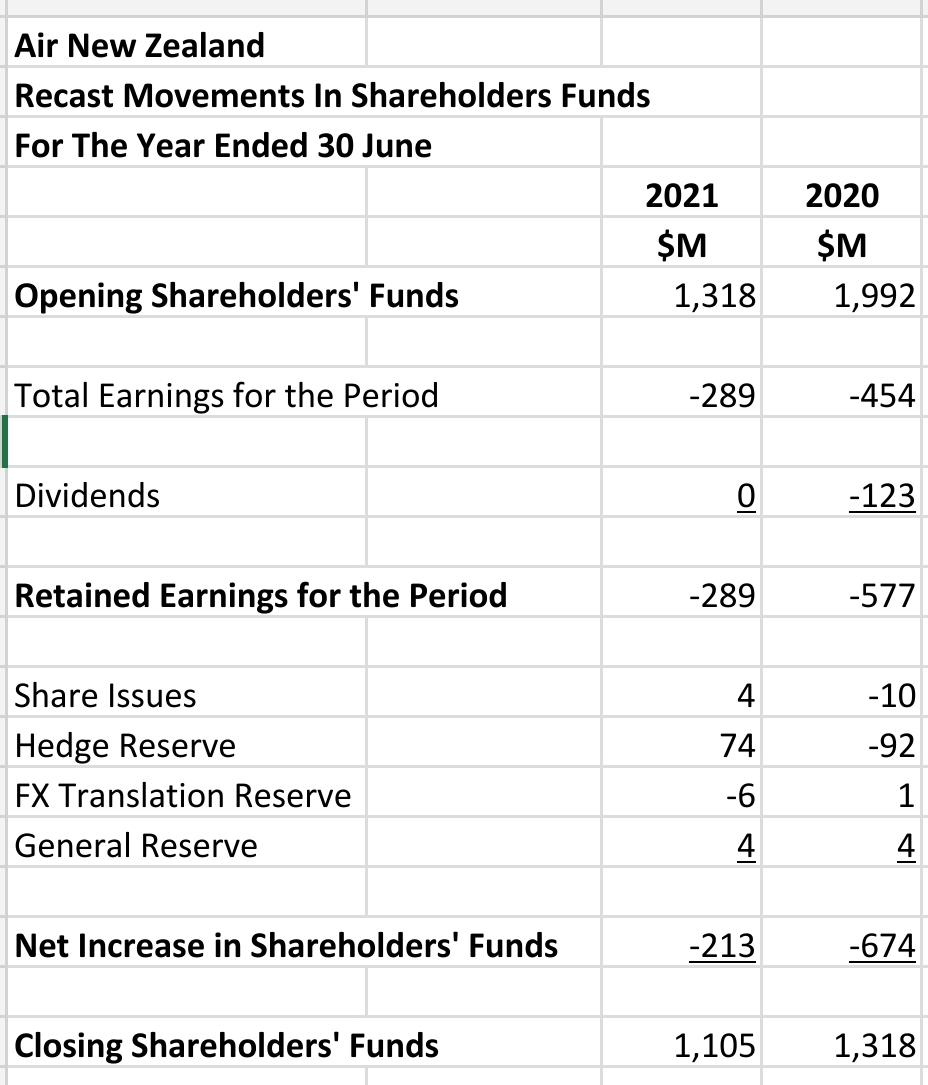

Recast Movements in Shareholders' Equity

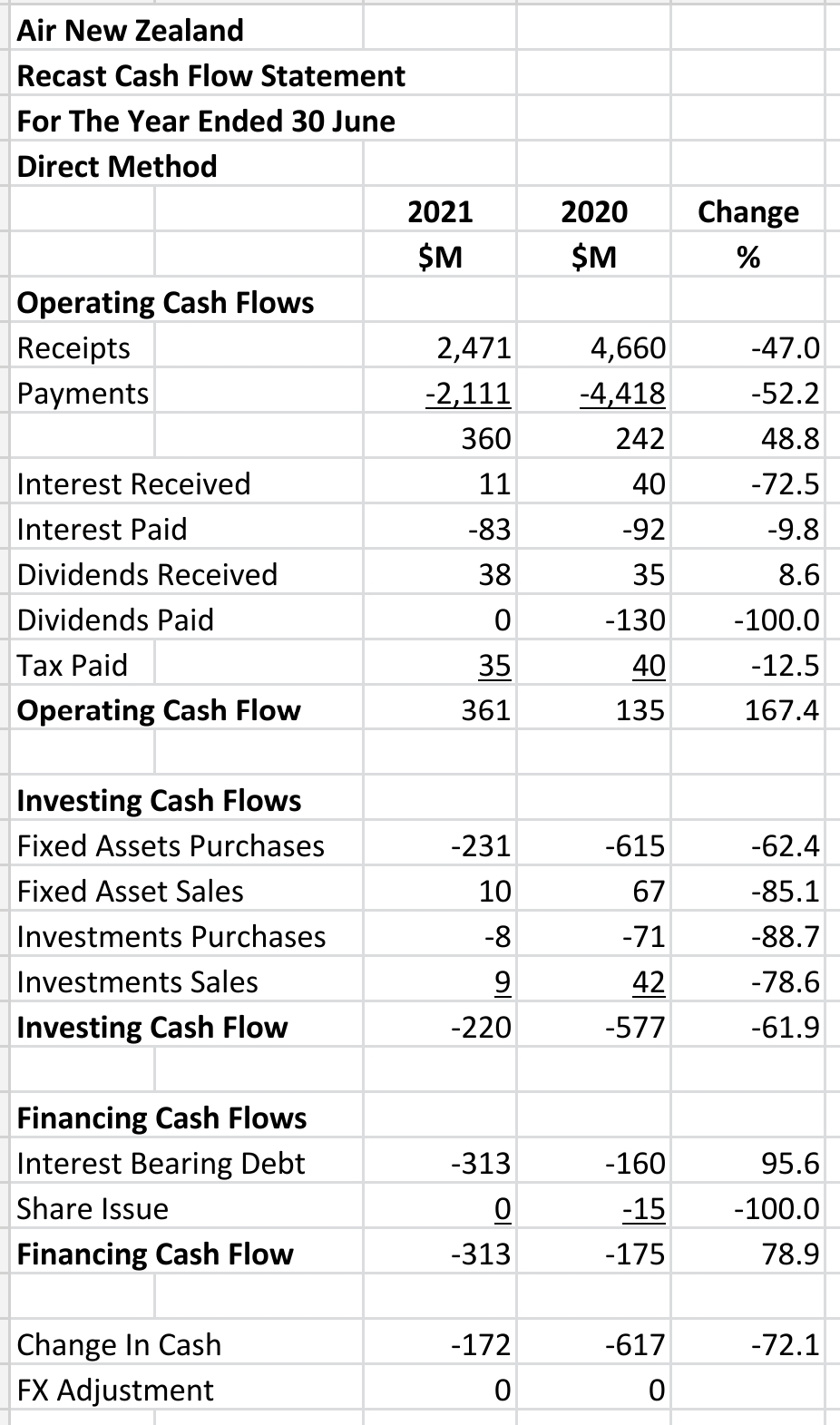

Recast Cash Flow Statement

The company has surprisingly good operating cash flows in both periods. The FYE 2021 has operating cash flow of $361 mn.

This surplus was used to pay down some interest bearing debt and to make fixed asset purchases.

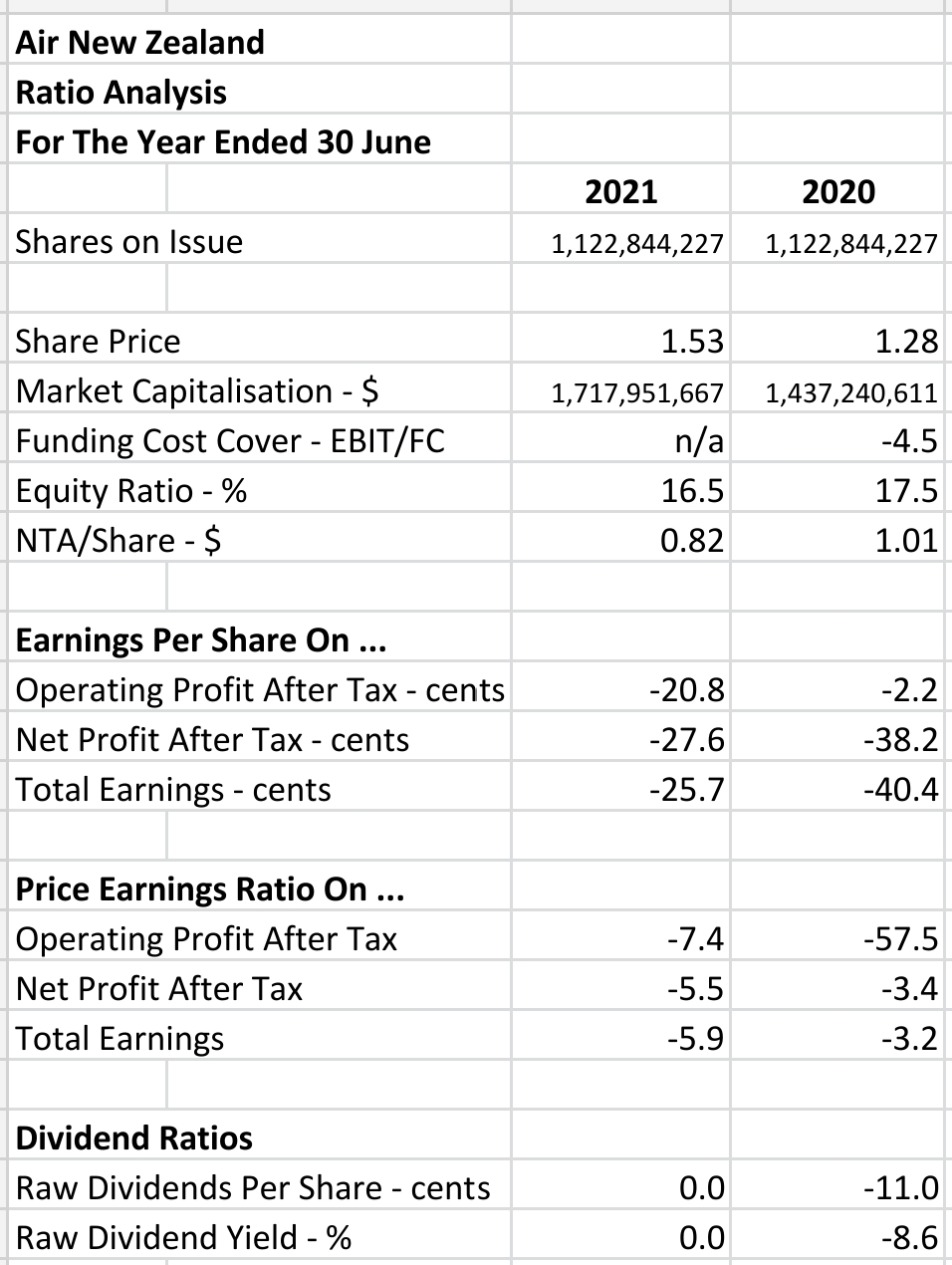

Ratio Analysis

The company had a reasonable dividend yield in FYE 2020 but the dividend was stopped in FYE 2021.

Funding cost cover was zero in both periods as EBIT in both periods was negative. Notwithstanding of course that funding costs were actually funding profits in FYE 2021.

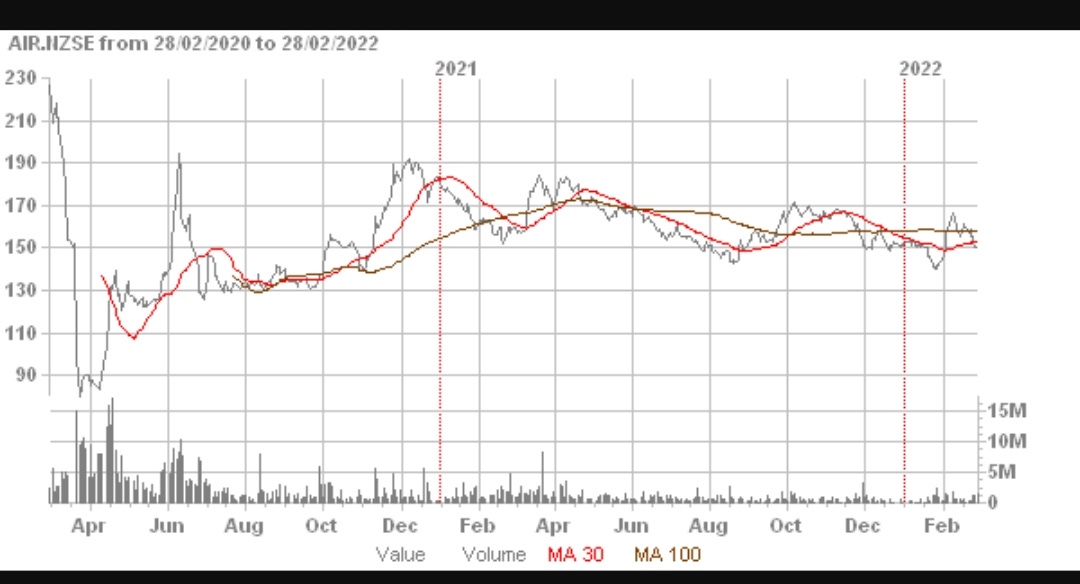

Oddly, the market capitalisation rose in the 2021 year even though the financial metrics were worse than 2020.

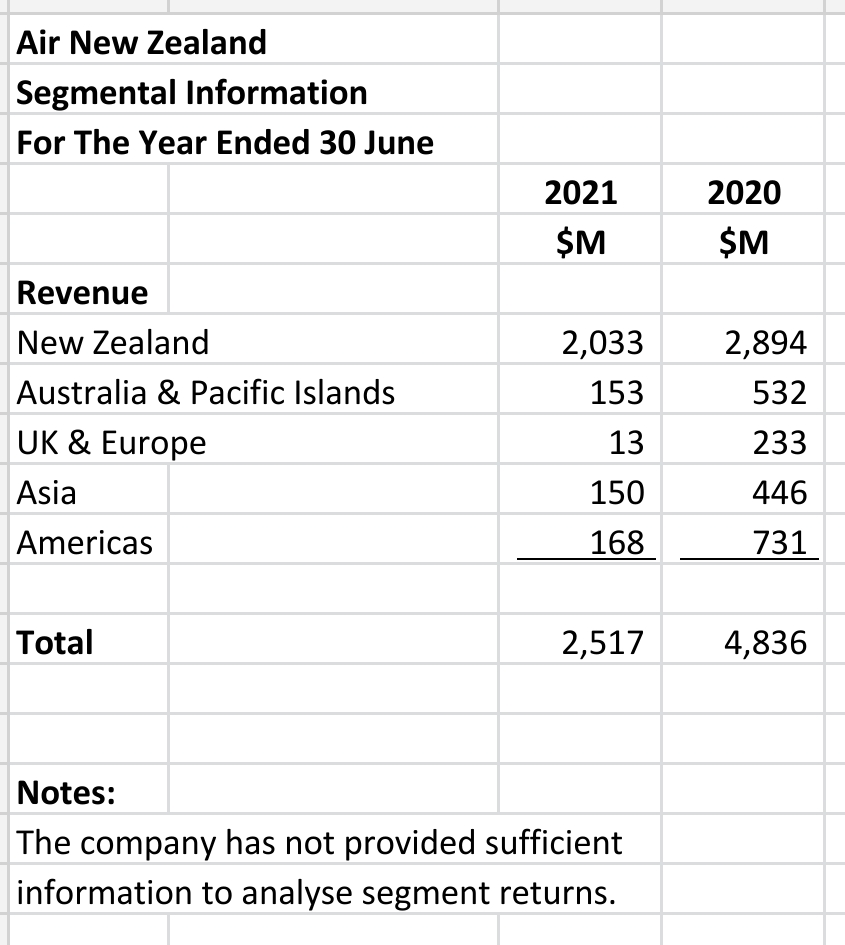

Segmental Analysis

The company does not provide enough information even in its annual accounts to work out segmental profitability or returns. There are no segment EBIT or assets employed figures to enable this kind of analysis to be done. This may be because of the need to keep this information away from competitors.

All that can be said is that the NZ segment provides the vast majority of revenue.

Summary

AIR is a company in trouble as a result of Covid and the collapse of tourism. The business is supported by the New Zealand Government which will no doubt continue its support at considerable cost to the taxpayer.

It loses lots of money and has a paper thin equity ratio.

A good argument can be made that it should have gone into receivership before the loan facility of $900 mn was provided by the government.

The business could have been rebuilt from a much lower base. It could have made economic sense if this had been done.

The cost of recapitalising the business is going to be more than $1.2 bn. The government has 52% of the company so the taxpayers will stump up for the government's share.

The opportunity to rebuild a business that makes economic sense will be lost. The company will still be shouldering many of the burdens it did when it was a much larger entity.