Note:

All amounts are in New Zealand dollars (NZD) unless otherwise stated.

Industry

Property Development

Overview

Winton Land Limited is a New Zealand and Australian residential property developer which is listed on both the NZX and ASX exchanges in December 2021 at an IPO price of $3.89.

It raised $350 mn in the IPO and the amount was used to reduce debt and fund further property developments.

We recently had an alert on the company’s vulture fund joint venture and also previously posted an analysis of the interim accounts to 31st December, 2021.

Performance Compared to IPO Forecasts:

The company has exceeded its IPO forecasts.

Vulture Fund:

WIN has established a partnership with MaxCap New Zealand Limited (MaxCap). The partnership has $200 mn equity of which WIN will provide up to $50 mn.

The partnership will focus on the acquisition and construction of townhouses and apartment developments which are under distress in New Zealand. This venture may require consents under the Overseas Investment Act 2005.

The announcement can be read here.

Trading History

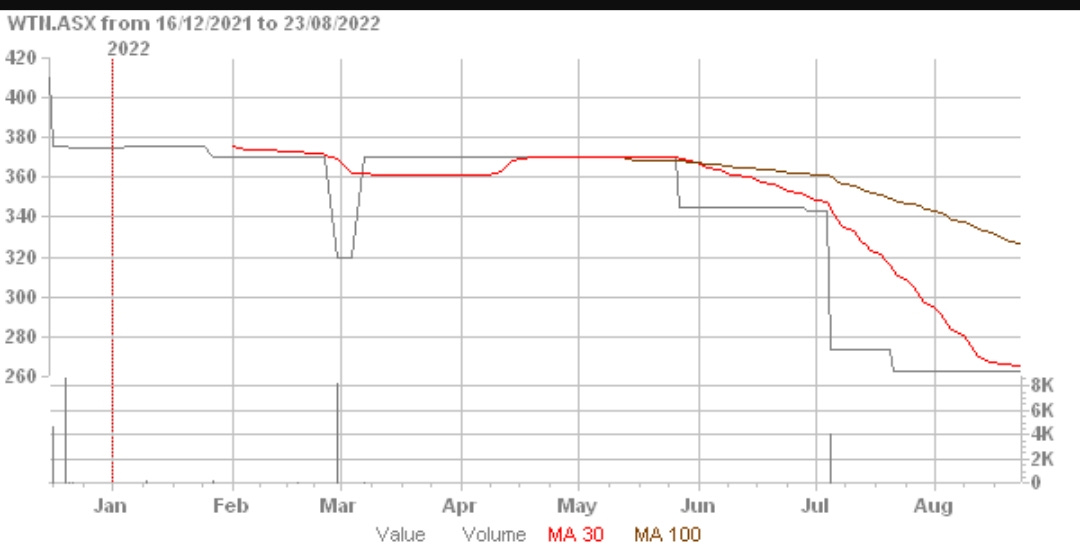

WIN's trading history took place mainly on the NZX while trading on the ASX was minimal.

The company’s stock has been in a steady retreat from its IPO price of $3.89 to currently around $2.40-2.50.

Just before the company released its annual report which includes its financial statements it announced the partnership in the vulture fund.

Based on the IPO price market capitalisation investors have lost over $400 mn at the current share price of $2.50.

The company is a property developer which develops both residential and commercial property.

It has expanded quickly and the capital from the IPO has accelerated that growth.

Cheat Sheet

Highlights:

Successful IPO which raised the amount sought

Achieved its IPO prospectus targets for its first annual result as a public company

Much higher gross margin

No interest bearing debt

Lowlights:

Dismal share price performance down around 35% from the IPO price

$18.8 mn dividend payment prior to IPO

All revenue statement items down on the prior year

Negative operating cash flow of $8.9 mn

Possible Red Flags:

Change of auditor

Reclassifiying inventory to property investments

Recast Revenue Statement

FY22 represents a partial year of just over six months of trading as a public company with the full resources provided by the IPO.

EBIT was down 25.1% while NPAT fell 18.3% to $37.6 mn. Total earnings for the year were down by 31.3% to $31.7 mn.

No dividend was declared for the year although one has been declared after balance date for the FY23 year.

$7.0 mn of interest costs were capitalised to development projects within inventory. In the prior year $3.0 mn was capitalised to inventory.

The company states that interest and other holding costs incurred after completion of a development are expensed rather than capitalised.

One of the things that property developer JBL (Jeffs Brothers Limited) did wrong leading up to their collapse many years ago was they had lots of salaried staff on the payroll. When property sales slowed down they still had an army of people to pay.

WIN has a big payroll of around $7.0 mn a year and this will weigh on them if there is a significant property downturn.

Recast Balance Sheet

Total assets on the balance sheet grew 96.1% in the wake of the IPO to $496.9 mn. Interest bearing debt was eliminated while shareholders’ funds grew 441.9% to $454.1 mn.

Current assets are many times higher than current liabilities.

Concerningly, $6.4 mn of land and development costs were moved from inventory to fixed assets. The company stated this land was to be used for a retail precinct which it will be develop and operate.

WIN also reclassified $28.7 mn of land and development inventories to investment properties. It states that this includes land suitable for retirement villages and commercial property. It will be developed and held and earn deferred management fees and rental income.

So roughly $35.1 mn of inventory has been removed with these two decisions. The original intention with these properties was to develop and sell them as they were classified as inventory. This could be an indicator of difficulty selling inventory.

The company is very well capitalised so this may not be an issue. Inventory increased by 11.0% to $181.9 mn while property investment rose from nothing to $80.5 mn.

Recast Movements in Shareholders’ Equity

The significant event that changed closing shareholders’ funds by 441.9% year-on-year was the IPO share issue which netted $337.5 mn in cash.

Shareholders’ funds stood at a massive $454.1 mn at the end of the latest financial year.

Recast Cash Flow Statement

The company ended the period with a much higher cash balance (included restricted cash paid by buyers) of $204.8 mn up 484.8% on the year before.

After balance date the company settled an acquisition in Wynyard, Auckland for $93.8 mn and contracted to acquire some land in Auckland for $18.0 mn.

These transactions will obviously affect the cash balances (and/or debt) of the company.

Net cash flow from operations at -$8.9 mn are a concern. The company is expanding quickly and had they paid a dividend the cash flow from operations would have been even worse using our method of calculation.

Ratio Analysis

The large increase in the gross margin shows the effect of Covid period increases in property values. WIN probably had land prices already locked in at previous much lower levels.

The company has ample funding cost cover at 28.8 times which will go even higher now that it has no debt.

The equity ratio is an unusually strong 91.4% in the latest period up from a low 33.1% in the prior period.

The earnings per share were 12.4 cents while the P/E ratio 27.7 times based on the share price of $3.45 at balance date.

Segmental Analysis

The company provides very little information on segments and then only for the FY22 year.

Residential development has the bulk of the named category net assets at 32.7% while commercial development has the least at 3.9%.

Presumably the biggest category, Unallocated at 45.8%, applies to land held for development which will be put into one of the named categories later.

The company could do much better on its segmental reporting but its opacity probably is for commercial reasons.

Summary

WIN had a successful IPO in that it was able to raise the funds it sought. But its share price performance has been abyssmal and more than $400 mn of market capitalisation has been lost based on the IPO price.

The property market is also changing with increasing interest rates. One sign of change is the company seeing the opportunity for a vulture fund which will purchase distressed properties from lenders and developers.

It has a massive series of capital and land development commitments ahead of it. At balance date these commitments totaled $265.5 mn, a large number compared to its total assets.

A Kiwibank report today signaled that New Zealand will have a surplus of houses within 12 months.

On the bright side, the company had no debt at balance date and very strong equity.

The company recapitalised at an excellent time just as the property market was turning and has placed itself in a very strong position. It will be able to weather large changes in the property market although the sizeable payroll may become an issue for cash flow if sales start falling significantly.

But there is no escaping the fact that WIN is riding that sad conveyor belt of New Zealand IPO failures.

A previous failure was My Food Bag which is down over $250 mn in market capitalisation losses since listing. Winton, as already stated, is now down over $400 mn despite its profitability and activity.

Note:

Comments and suggestions can be made below. All discussion related to this article or other issues are welcome and always appreciated.

If you know someone who might be interested in this article or this website please share using the icon below.

Thank you.