Photo by Paul Hanaoka on Unsplash

Key Points

High equity ratio of 70.9%

Tiny profits of $1.3 mn for the half year

Very poor operating cash flow of -$18.1 mn for the half year

Strong cash position as a result of the $350 mn share issue (before issue costs)

Low interest bearing debt of $129.2 mn.

Source: Direct Broking

Recast Revenue Statement

The company has shown tiny profits of $1.3 mn on a dramatically lower half year revenue of $45.5 mn.

The company also published a pro forma profit figure based on the assumption that the IPO costs did not occur. We will stick with the actual figure.

Recast Balance Sheets

Horizontal Analysis:

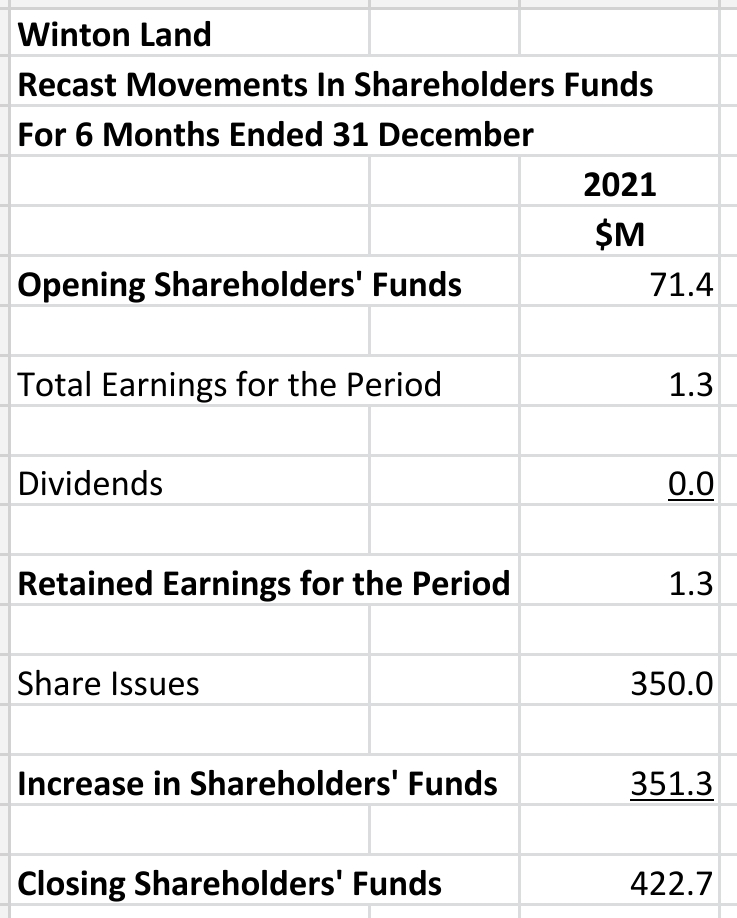

Shareholders' funds rose by 404.4% as the result of the $350 mn equity raising in the current period.

Interest bearing debt barely changed.

The company places its properties in the inventories accounts because they do not invest in property but create residential developments and operate a land bank.

The total inventories figure at balance date was $206.7 mn which was 26.0% of total assets.

Presumably, the large amount of cash in the company of $370.2 mn including deposits by customers will be put to better use to improve returns.

Vertical Analysis:

Current assets were well in excess of current liabilities in both periods.

Recast Statement of Movements in Equity

Recast Cash Flow Statement

The company has a very poor cash flow from operations at -$18.1 mn and a strongly positive cash flow from financing as a result of the share issue.

Ratio Analysis

The company had an NTA per share if $1.42 at balance date and close to zero earnings per share.

Funding cost cover was healthy at 6.8 probably because some interest was capitalised into developments.

The equity and current ratios were very strong.

The company made very poor returns in the current half year period.

Segmental Analysis

None.

Summary

The company is in a strong financial position with plenty of cash, moderate debt and high equity.

However, it's profitability is extremely low and there is a worryingly high negative operating cash flow.

The company has been very lucky in its timing of equity raising as now interest rates are on the rise and sentiment is changing in the residential property market.

It will be interesting to see how it performs in the future.

Will there be future write-downs in its land bank and will the company actually make some serious money?