Note: All amounts in NZ$ unless otherwise stated.

Date

1st March, 2023

Share Price

12.2 cents

Trading History

Source: Direct Broking

The share price has performed poorly over the last one-and-a-half years and from a high of 28.5 cents and is now trading at 12.2 cents. It reacted badly to the latest result and fell from 14.1 cents to its current price.

Returns

The two year capital return (not including dividends) can be calculated as follows:

The real (inflation adjusted) capital return is approximatedly -61.3% over the last two years.

It’s the real return that matters not the nominal return in an economy with inflation.

Key Points

Dividend cancelled

The future depends on repowering Te Rere Hau wind farm

Net profit after tax -$3.48m

Two year capital return of -61.3%

Total earnings of $1.80m rely on derivative gains of $5.27m

Net debt $9.31m

Sustainable net operating cash flow is -$0.84m

Large writedown coming on the $21.74m carrying amount of wind turbines if repowering proceeds

Overview

NZ Windfarms (NWF) was reviewed in a note a few days ago and the half year accounts have just been published.

A repowering proposal is currently before the Environmental Protection Authority.

The existing Te Rere Hau comprises 97 two-bladed wind turbines of which 92 are currently operating.

The repowering proposal is for the scrapping of the existing wind turbines and their replacement with up to 30 more efficient and quieter (alleged) three-bladed turbines.

The company uses energy derivatives some of which were realised in HY23 and some of which are unrealised. These include interest rate swaps and variable volume fixed price agreements (VVFPA).

Revenue

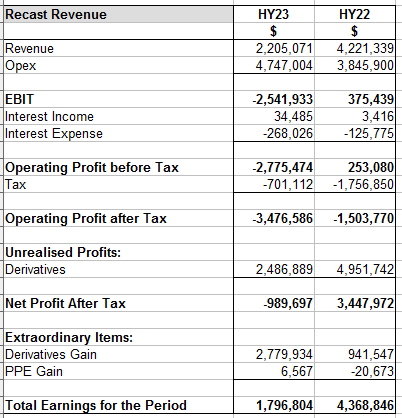

The revenue statement is particularly poor and relies on unrealised and realised derivative gains. An argument can be made to include realised derivatives above EBIT but the more conservative approach is used here because the company’s business is not derivatives trading.

Derivative gains can also be derivative losses as occurred in FY21.

Operating profit after tax is -$3.48m on revenue of just $2.21m. The company used gains on derivatives to boost its revenue line to $7.47m.

Of interest is that there were no reversals of impairments to PPE or intangibles in HY23. These accounts had boosted the FY22 result by $3.13m.

Total earnings for HY23, which include derivative gains were 58.9% lower at $1.80m than the pcp’s total earnings.

There is no funding cost cover in HY23 while in HY22 it was acceptable.

Balance Sheet

Both receivables and payables were significantly reduced but term debt rose. The realised derivative gains helped increase cash and cash equivalents to $3.30m on HY23’s balance date.

There was $1.70m of cash & cash equivalents on hand on the pcp’s balance date.

Net debt at balance date is $9.31m and not the $5.8m claimed. The published accounts omitted lease liabilities from the calculation.

The carrying value of the existing wind turbines at balance date is $21.74m and this amount supports the very high equity ratio of 78.1%. If these wind turbines were scrapped as part of the repowering process (as seems to be the plan) the equity ratio would fall to around 63.3%. This figure does not include dismantling and disposal costs of the three-blade turbines. Alternatively, perhaps they have a salvage value.

Operating Cash Flow

Published net operating cash flow was $2.82m but using this method the adjusted NOCF is $1.94m.

Underlying NOCF is determined by subtracting the derivative realised cash gain of $2.78m which leaves -$0.84m. This is worse than the pcp’s which was -$0.02m.

Summary

This is a company which has relied on derivatives to produce a profit. Some of the derivative gains are not even realised.

Derivatives can also incur losses as happened in FY21. In fact, in FY21 the losses on derivatives were a massive $10.29m which were ameliorated somewhat by using PPE and intangible impairments reversals of $3.13 which were recorded as operating expense account offsets.

Derivatives, therefore, are best placed below the net profit after tax line in a recast revenue statement as they are not a core, reliable or even fully realised source of income.

Without the derivative gains the company made a operating loss after tax of $3.48m in HY23. It’s no surprise that the dividend has been ‘paused’ (read cancelled) for HY23.

The company also relies on realised derivatives receipts to produce a positive NCOF without which it would have a NOCF of -$0.84m.

This is not a company doing well by most measures and it’s quite obvious that the repowering of the Te Rere Hau facility is very important to the company.

It has the luxury of a high equity ratio which has given it time to look at another alternative. Even if the existing turbines are written off the equity ratio is still high.

However, if the existing wind turbines are scrapped for the repowering expect a capital raising and perhaps additional debt to pay for the purchase and installation of the new two-bladed wind turbines despite the high equity ratios.