Note: NZ Windfarms (NWF.NZX)

Accounts, dividend, impairments' reversals, resource application, cash flow, potential capital raise.

Note: All amounts in New Zealand dollars unless otherwise stated.

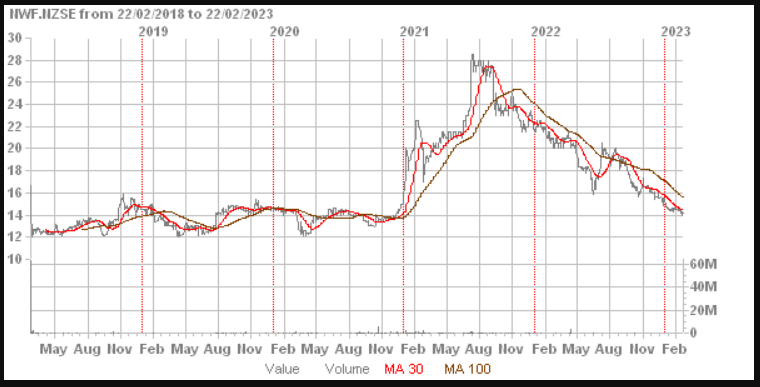

Trading History

NZX:

Quality of Earnings

The company recorded an NPAT of $5,171k in FY22 which was up on the prior year’s $312k.

However, FY22 income included $1,639k in unrealised derivative gains, two large reversal of impairment gains of $2,638k and $146k for PPE and intangibles respectively.

There was also an extraordinary gain on the sale of PPE of $13k and a realised derivatives loss of $54k.

Additionally, $1,295k of land revaluations went through FY22’s Other Comprehensive Income which slightly improves the equity ratio .

These items (not including the land revaluation), when deducted or added as the case may be, result in a sustainable or underlying NPAT of just $788k (subject to some tax variations) which is only 15.2% of the combined recurring and non-recurring items NPAT amount recorded in the accounts.

Putting impairment reversals through to improve profit is a profit boosting technique. Its sometimes called a profit smoothing technique. A company takes a big hit in one or more years and then claws some of it back in future years to even out its profits.

Sustainable earnings per share (EPS) based on the the recast figure and with 288,064k in outstanding shares is 0.27 cents ($0.0027) rather than the largely non-recurring 1.79 cents ($0.0179) recorded in the accounts.

At the current price level of 14.1 cents this produces a sustainable historical P/E of 52.2 times.

The net cash flow from operations was stated as $5,908k. Using our method which deducts lease liability repayments and dividends the operating cash flow is $2,928k.

The free cash flow which is calculated as operating cash flow (our method) less net PPE payments and less intangibles’ payments is -$139k or -0.05 cents per share.

Dividends in FY22 were $2,967k which is ridiculously high compared to recurring/sustainable profit of $788k.

Te Rere Hau Repowering

The company in this announcement referenced the ‘repowering’ of its asset the Te Rere Hau wind farm which would entail the ‘decommissioning, and removing 97 existing two-bladed turbines’.

Application has been made to the Environmental Protection Authority (EPA) for consent for this project under the fast-track provisions of the relevant legislation.

The company was granted redaction of the capital and operating costs of doing this by the EPA in this recent decision.

The existing Te Rere Hau comprises 97 wind turbines of which 92 are currently operating.

The company is making small profits with its existing double-bladed configuration and has decided to increase electricity output by scrapping the existing ones and using up to 30 three-bladed wind turbines, if approved.

Depreciation & Disposal

The useful lives on the wind turbines were originally stated as being between four and 40 years.

What is the salvage value of these wind turbines given that they appear in the accounts on balance date of FY22 at a ‘carrying value’ or book value of $23,003k? Are they sold to someone else to use for a small fraction of their book value or are they otherwise disposed of for some or no salvage value?

If the existing wind turbines have no residual value what are the costs of burying, recycling or otherwise disposing of them?

Will there be a $23.0m-odd write-off the existing turbines in a future set of accounts?

What are the costs of buying, transporting, installing, maintaining and servicing the up to 30 new and much larger wind turbines?

Depending on the answers to these questions there probably will be a capital raise coming despite the low debt and high equity of the company.

Latest

The latest market announcement two months ago referred to EBITDAF, a poor metric like EBITDA except in some specific analyses and situations. They are especially redundant in a company with such a high level of fixed-to-total assets.

Using EBITDAF of $5.0-6.5m (HY23 accounts?) is a figure which encourages optimism in uninformed investors but the reality (NPAT) may very different.

Summary

A significant amount of cash and/or debt will be required for repowering Te Rere Hau wind farm. The company does have low debt and high equity, however (notwithstanding a potential write-off of the existing wind turbines, of course).

The company is not very profitable although seems to be generating some net operating cash flow.

The interim results are due any day now. The company may provide more information on the proposed although as yet unapproved project at Te Rere Hau.