All amounts are in New Zealand dollars unless otherwise stated.

NZX Trading History:

Source: Direct Broking

ASX Trading History ($AU):

Source: Direct Broking

Overview

My Food Bag is listed on both the NZX and ASX under the code MFB.

Its share price performance on both stock markets since its IPO has been very disappointing.

The company trades at less than half its IPO price.

We previously sent out a basic analysis of the HY21 results to 30 September, 2021.

An alert was sent out when the stock fell through the $1.00 price level.

We sent out another alert when the company passed $1/4 billion in market capitalisation losses based on the original IPO price of $1.85.

The latest financial statements are for the year ended 31 March, 2022 (FY22).

The company has narrowly missed the prospectus forecast for net profit after tax. It recorded $20.007 mn against a prospective $20.056 mn.

The stock rallied on the day of the announcement which was made on 20 May 2022.

The IPO

The IPO occurred in March, 2021 at a price of $1.85 per share.

The original shareholders sold much of their holdings in the IPO.

That was a warning sign.

The private company had been funded significantly by shareholder loans and $51.095 mn was repaid to the private company shareholders in the prior period through the IPO process.

The company paid $13.3 mn in dividends to the private company shareholders in FY21 and nothing to the public company shareholders in the same year.

The final dividend declared for FY21 was $7.1 mn and it was paid prior to the IPO. The company listed before balance date and the new shareholders at that time received none of the final dividend.

The first dividend as a public company was paid for HY22.

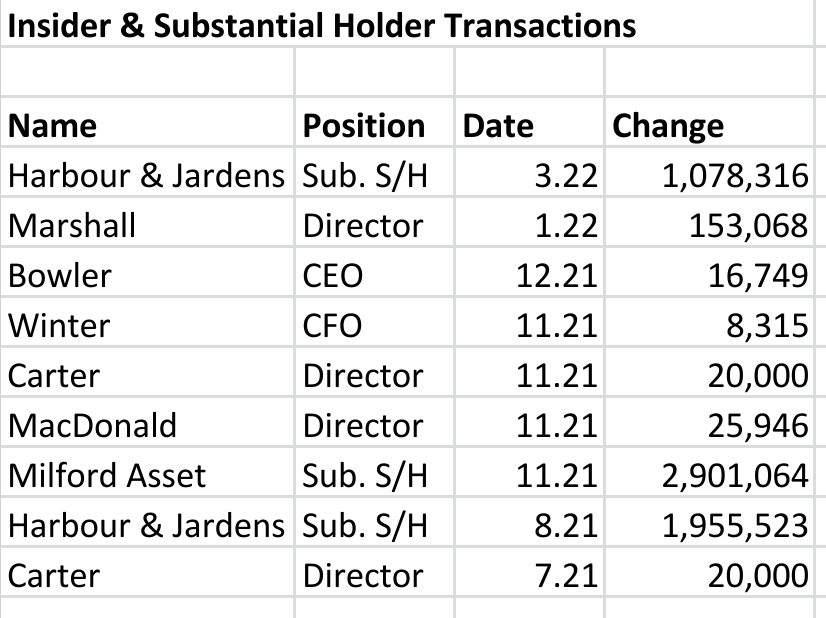

Insiders & Substantial Holders

Key Points:

Insider and substantial holder transactions in the last ten months have been increases

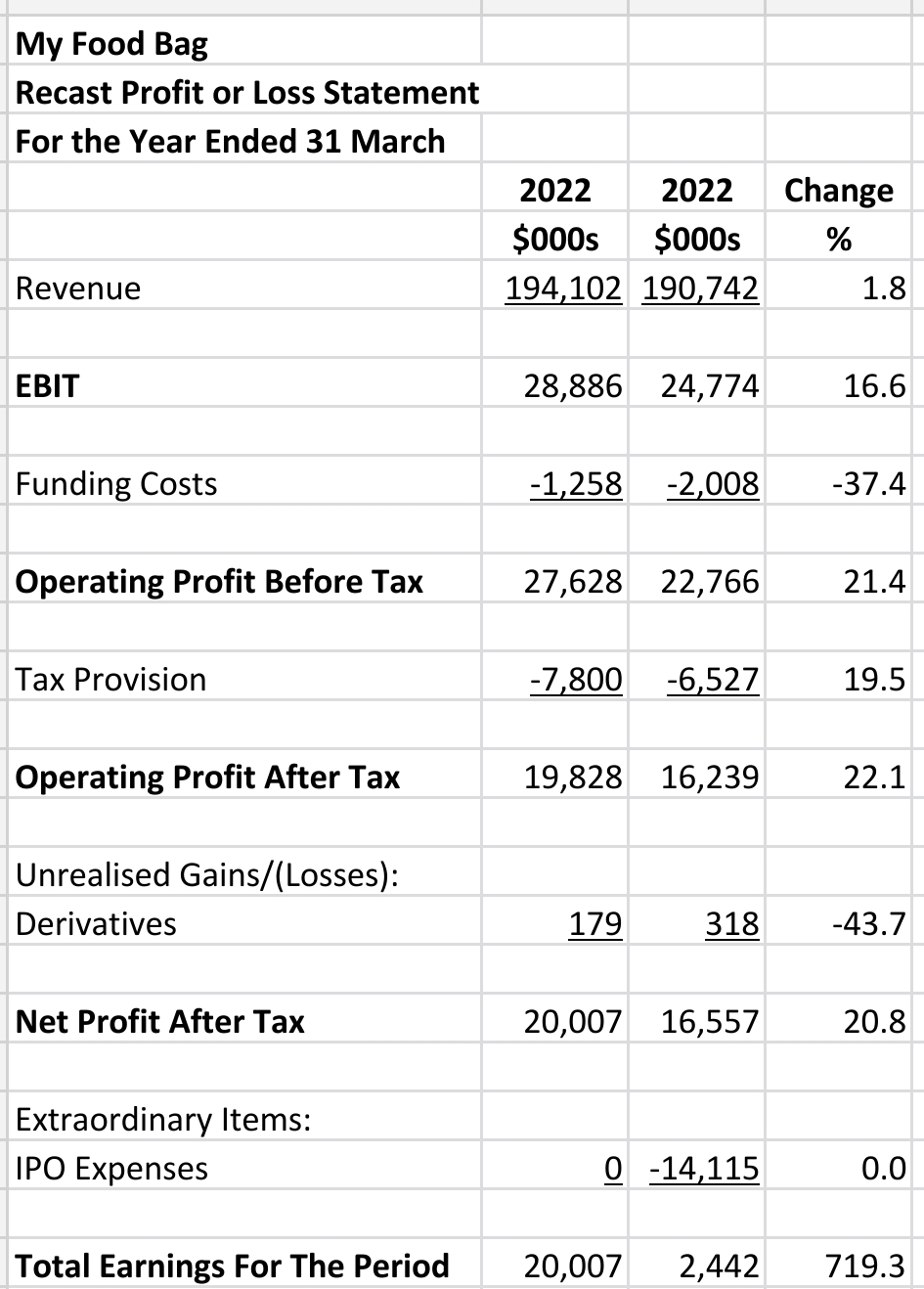

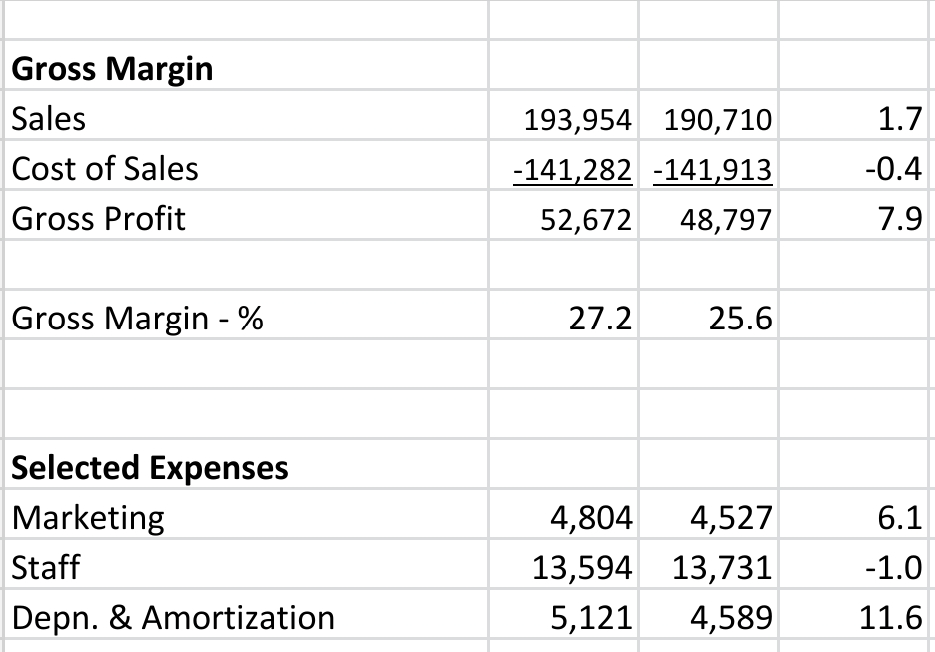

Revenue Statement

Key Points:

EBIT improved by 16.6% to $28.9 mn.

Net profit after tax was up 20.8% to $20.0 mn.

The IPO expenses (an extraordinary item) in FY21 largely accounted for the seemingly enormous increase in total earnings in between the periods.

The gross margin improved from 25.6% to 27.2% in what is an inflationary environment.

Marketing expenses rose 6.1% while sales rose 1.7%.

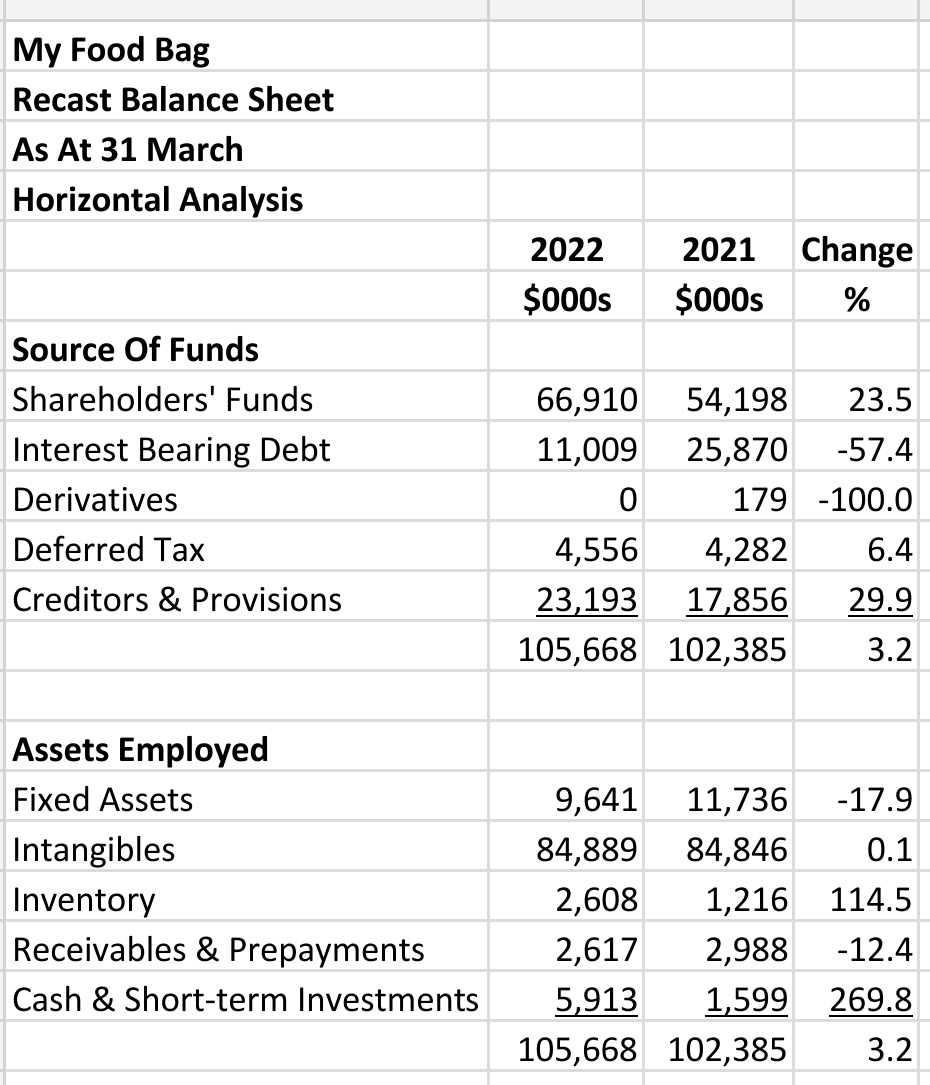

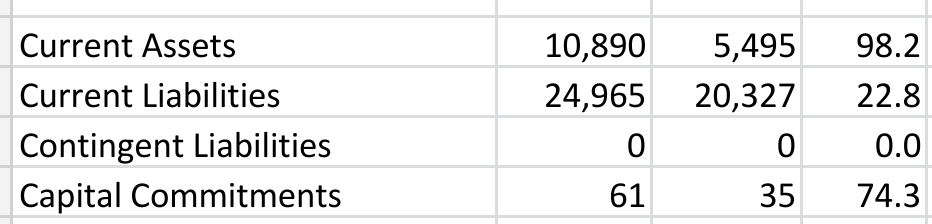

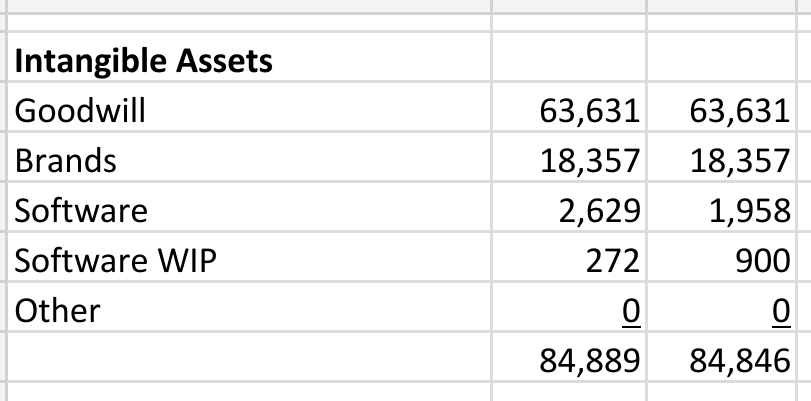

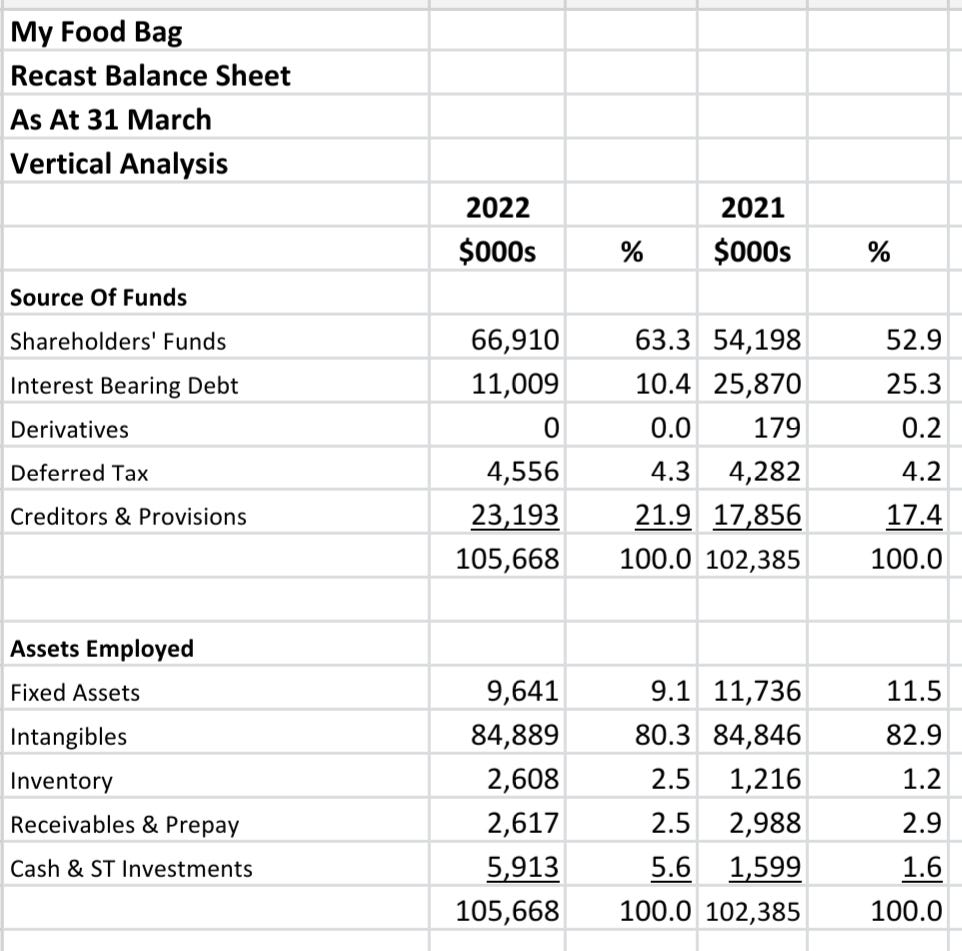

Balance Sheet

Key Points:

Shareholders' funds increased 23.5% to $66.9 mn

Debt fell 57.4% to $11.0 mn

Intangibles make up 80.3% of total assets

Cash & short-term investments increased 269.8% to $5.9 mn

Current liabilities are much higher than current assets

Equity ratio is 63.3%

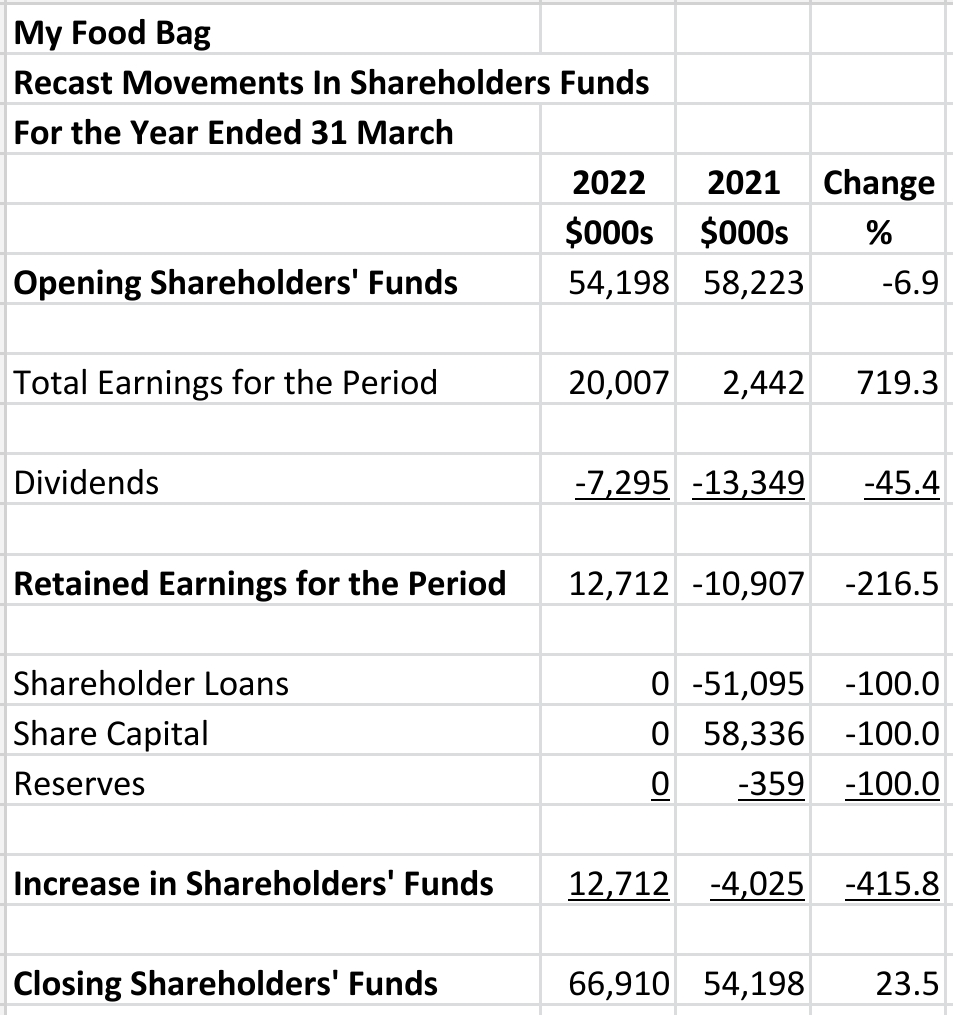

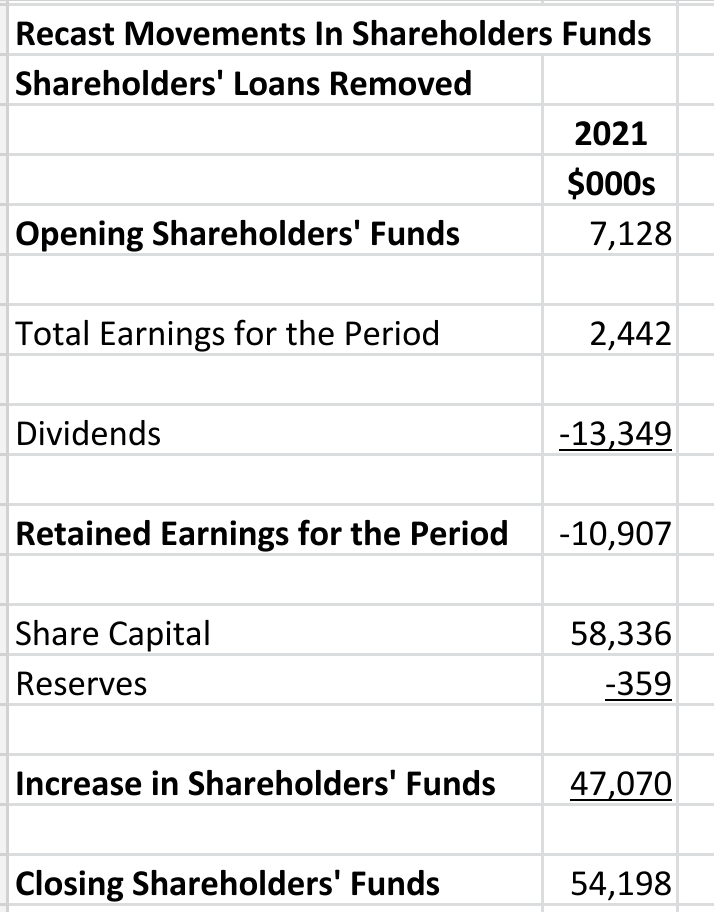

Movements in Equity

Key Points:

Dividends in FY21 were over five times higher than total earnings.

In FY22 dividends were roughly a third of total earnings.

Including shareholder loans in equity massively distorts the equity at the beginning of the prior period

Removing the shareholders' loans/advances of $51.095 mn from this statement shows the paper thin equity of $7.1 mn at the beginning of the prior period, 1 April 2020.

MFB was a private company at that time.

Shareholder loans, however are borrowings and should appear in liabilities not equity.

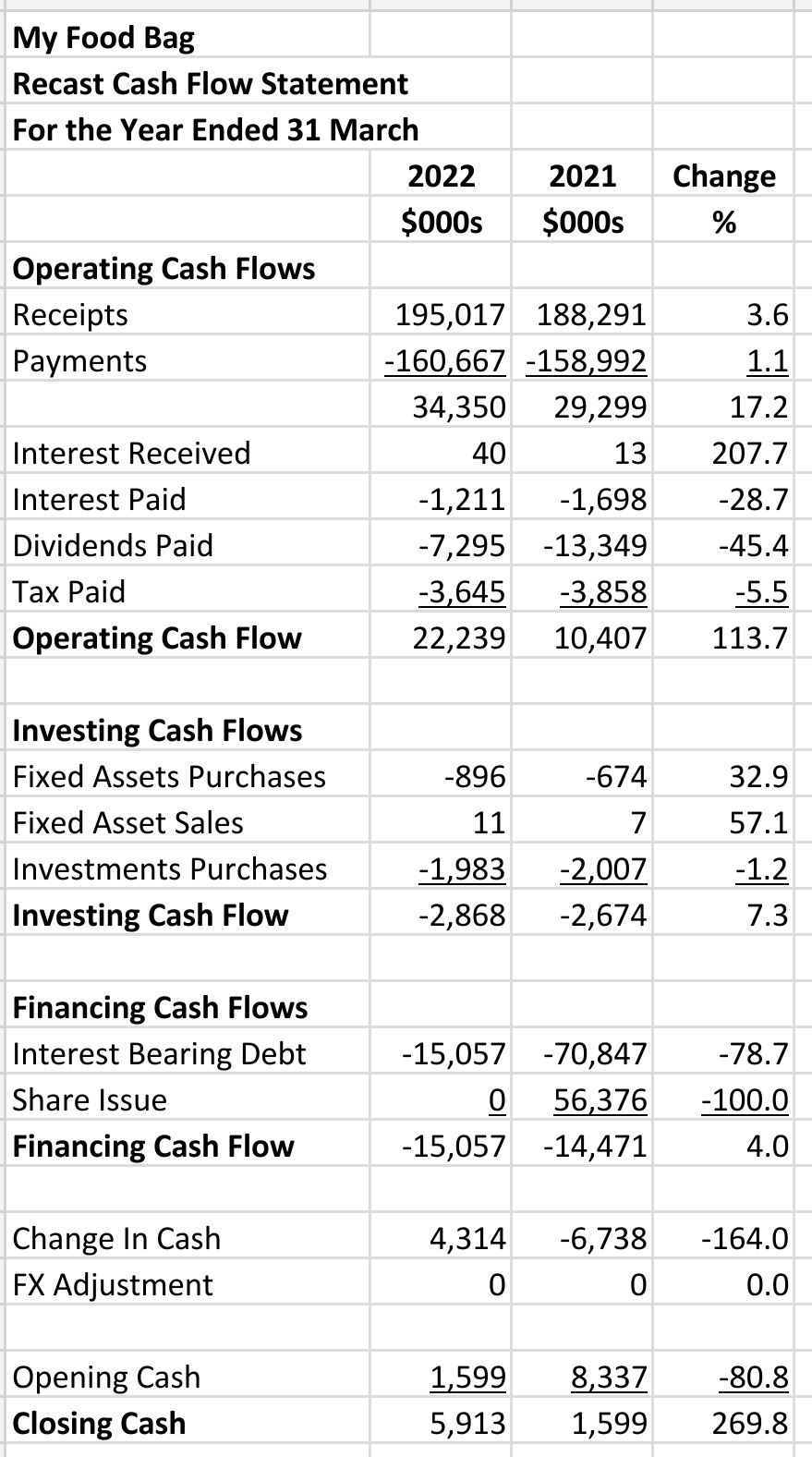

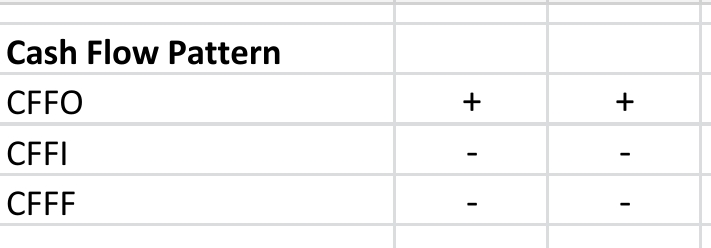

Cash Flows

Key Points:

Dividends paid are recast into CFFO from CFFF

Repayment of shareholder loans appears in interest bearing debt not share capital/issues

Operations are producing positive cash flows which are being used to reduce debt and invest in the business

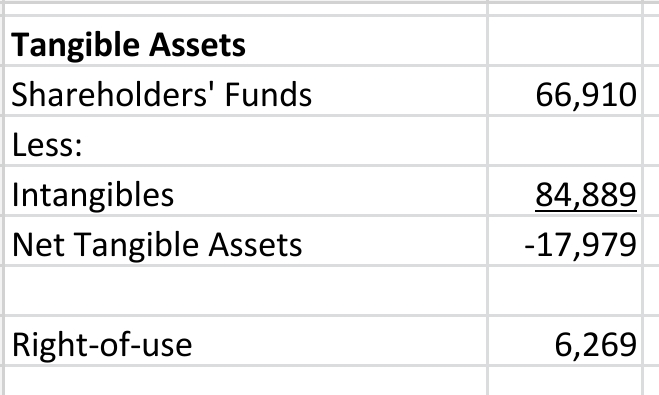

Ratios

Key Points:

Funding cost cover is 23 times

Low current ratio at 0.44

High equity ratio of 63.3%

Negative NTA/share of 7.4 cents

High dividend yield of 10.1% at balance date share price

Massive fall in market capitalisation to $232.7 mn at balance date share price

Segments

The company does not provide segmental financial information.

They state that their products are part of one product segment.

Dividing up their product information by the different key products would have been very useful.

They don't provide geographical segmental information because they say they only operate in New Zealand.

Summary

Despite being stripped of a lot of capital by the owners before and at the IPO the company appears to be doing ok.

Covid helped.

People were staying at home and ordering the company's products rather than going to the supermarket.

The business has a strong USP given the hassle for most people of going to a supermarket.

Supermarkets offer delivery services but not ones as far as we know that include recipes and their ingredients.

The company has low and falling debt with plenty of cash to meet its interest obligations.

What about a takeover?

At what price level does the company become a takeover target. It has a negative NTA so there is probably not a viable buy and liquidate scenario.

Any acquiring company is buying mostly intangibles but also profitability.

The share price, even at 80 cents is probably not down to a level that would make it a takeover target.

What about competition?

Competition is growing for the company with the likes of Hello Fresh now in the New Zealand market.

One of the reasons that the competitive threats are quite high is found in the balance sheet.

There's not a lot of capital to set up a competing operation given the potential profits.

Especially for supermarkets.

The right-of-use assets nominal amounts also do not require funding as they are an IFRS 16 construct.

MFB has, however, established a good network of suppliers from around the country.

It remains to be seen if competition emerges strongly in the future but based on historical results the company seems to be doing ok.

The share price, however doesn't seem to be in any hurry to reflect the profitability.