Photo by Szymon Fischer on Unsplash

Key Points

Very strong debt servicing ability

High proportion of intangibles

No dividend paid in current period

Declining revenue

Low debt

Poor current ratio

Strong operating cash flow

Poor share price performance

Source: Direct Broking

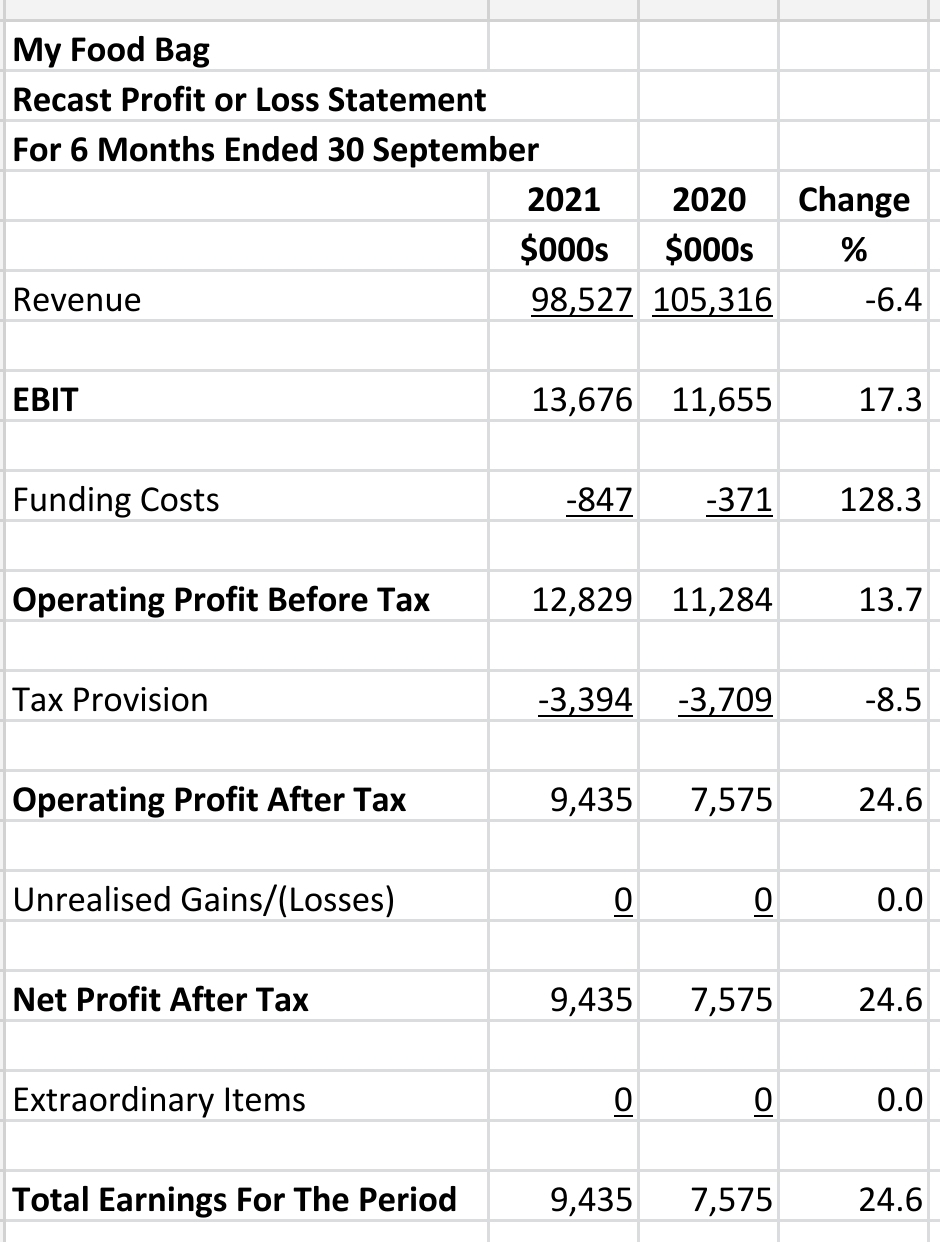

Recast Revenue Statement

The company recorded a decline of 6.4% in revenue for the half year ended 30 September, 2021.

However, EBIT rose by 17.3% to $13.767 mn and funding cost cover was a very high 16.1.

The company booked a very good $9.435 mn in total earnings for the current period which was 24.6% better than the prior period, the six months to 30 September, 2020 when the company was not listed.

Recast Balance Sheet

Horizontal Analysis:

Shareholders’ funds were 17.4% higher at the current balance date than the prior one.

Interest bearing debt which includes lease liabilities, were reduced by 43.5%.

The current ratio is very low at 0.32.

Vertical Analysis:

The company has an extremely high level of intangible assets which represent 82.5% of total assets which is an unusually high percentage.

It also has a low level of debt at only 14.2% of total assets.

Because of the very high level assigned to intangibles the equity ratio is a very high 61.9%.

Recast Statements of Movements in Shareholders’ Equity

The format used above shows the movements in equity more clearly than the format used in the accounts.

There were two significant transactions in this statement both if which occurred in the prior period before the IPO took place. This period is the six months ended 30 September, 2020.

Firstly, the shareholders at that time received a large dividend of $6.288 mn.

Secondly, there was a $6.095 equity repurchase (share repurchase).

Recast Statement of Cash Flows

Operating cash flow increased 231.2% in the current period because no dividend was paid unlike the prior period.

The company reduced its interest bearing debt (including lease liabilities) by $10.988 in the current period.

Ratio Analysis

The company did not provide information on the total number of shares issued or the weighted average number of shares in each period.

Many ratios therefore could not be calculated.

Segmental Analysis

No segmental information.

Summary

Part of the value of the business was extracted by payments to the original owners for a dividend and equity repurchase prior to the IPO.

The company was left with little debt however.

The vast majority of the assets are intangibles such as goodwill and brands.

The company is profitable but did not pay a dividend in the current period.

The shares have performed very poorly from the $1.85 IPO price to $1.07 at the time of writing. The total loss based on the IPO price is around $200 mn so far.

The annual results to 31 March, 2022 are a some time away and the company will be reviewed again at that time.