Note:

All figures in NZD (New Zealand dollars).

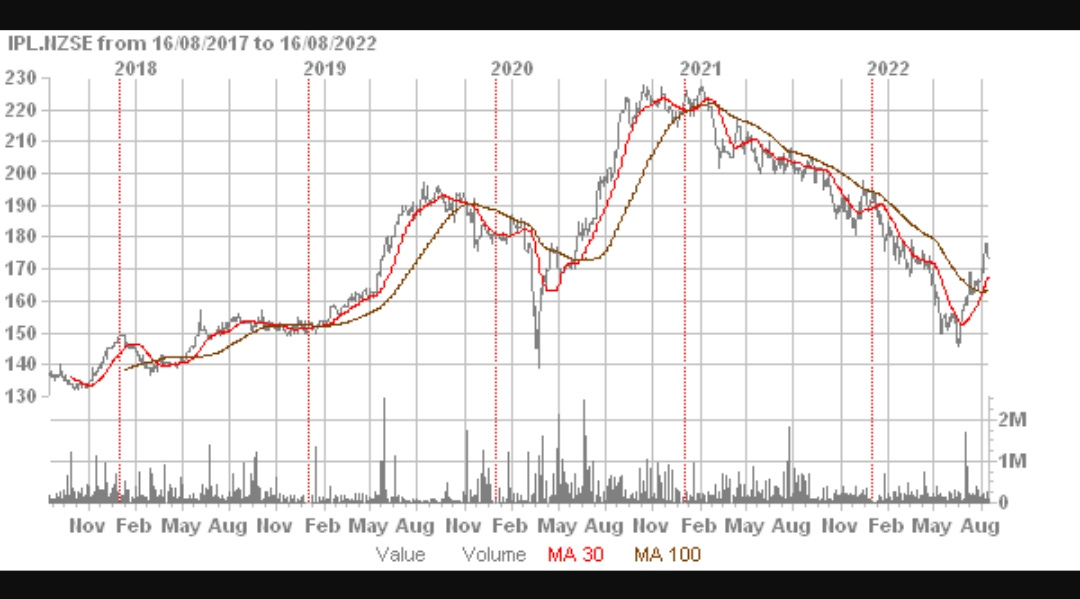

Trading History

Key Points:

Two year high of $2.27

Two year low of $1.47

Recent strong rise from $1.47 to $1.77 over less than two months

Source: Direct Broking

Source: Direct Broking

Comments:

One could be forgiven for thinking it’s odd that the company’s share price has been rising during a period when interest rates increased been signaled to rise more by New Zealand’s central bank.

The company, however has low debt compared to assets and investors may feel that the company will benefit more from rent rises for its than it will incur increased interest costs.

Also the vast majority of its debt is in bonds that it has issued with low coupon rates. This protects the company from commercial property or corporate interest rate rises.

Overview

Investore Property (IPL) is listed company on the NZX and is managed by another NZX listed company; Stride Investment Management (SPG.NZX).

IPL’s share price fell significantly through the Covid period.

However, its price has recently been recovering.

In February this year we published an analysis of the company’s interim accounts to 30.9.21.

The five year analysis below provides information better shows trends for the company than the previous format of two years can provide.

Recast Revenue Statement

Key Points:

Unrealised investment property revaluations in the latest period of $91.0 mn

Fall in total earnings in latest period to $118.2 mn

Operating profit after tax $26.6 mn

EBIT $48.5 mn

Comments:

The company’s main objective is to increase shareholders’ wealth and this occurs generally through unrealised investment property revaluations.

These revaluations are not supported by external accounting transactions but are some peoples’ opinions qualified though they may be.

But a massive portion of the company’s earnings come from these revaluations. In the current period $91.0 mn of $118.2 mn in total earnings came from this source.

In the prior period a very large $139.3 mn of $161.3 mn in total earnings came from revaluations.

The total earnings were down in the current period because of lower investment property revaluations of $91.0 mn compared to $139.3 mn in the prior period.

The Covid period provided windfall unrealised profits to the company as the RBNZ (Reserve Bank of New Zealand) got its montary policy completely wrong.

The company easily covers its outgoings from its rentals even taking into consideration the management fees paid to SPG. There are no liquidity issues.

Recast Balance Sheet

Key Points:

Five year cumulative property revaluations of $278.4 mn

Interest bearing debt of $351.5 mn at end of current period

Total assets of $1,238.7 mn at end of current period

Low current assets & liabilities at end of current period

Shareholders’ funds of $855.0 mn at end of current period

Comments:

The cumulative property revaluation item shows clearly how much this company (like all property investment companies) relies on unrealised property revaluations in its financial statements.

Our figures only go back five years so the revaluations before that are not known and therefore not included.

The total investment property cumulative revaluation figure is $276.4 mn and represents 32.6% of shareholders’ funds, 22.8% of investment properties’ value and 22.5% of total assets.

The growth in shareholders’ funds and total assets in FY21 and FY22 show what a boon the Covid period has been for the company.

There was also a significant share issue in the prior period.

Recast Movements in Shareholders' Equity

Key Points:

Closing shareholders' funds $855.0 mn at end of current period

Dividends of $28.8 mn in current period

Share issue of $102.7 mn in prior period

Comments:

Closing shareholders’ funds were higher than the previous period mostly because of unrealised investment property revaluations.

In the prior period, FY21 there was a significant share issue of a net $102.7 mn which also contributed to the rapid growth of the balance sheet.

Recast Cash Flow Statement

Key Points:

Using our approach net operating cash flow is -$1.3 mn in the latest reporting period

The cash flow pattern is one typical of early stage companies in the last two years

Comments:

The company pays significant dividends based mostly on the amount of realised profits rather than including unrealised property revaluations in their calculations.

It ran small negative operating cash flows in the last two years which is of little concern as the dividends are discretionary.

IPL made a net $73.2 mn of property investments in the latest period which were financed by an increase in interest bearing debt of $75 mn.

Ratio Analysis

Key Points:

Realised EPS (earnings per share) of 7.4 cents versus total EPS of 32.1 cents in current period

Realised earnings P/E ratio (price earnings ratio) of 23.4 times versus total earnings P/E ratio of 5.4 times in current period

Equity ratio of 69.0% in the current period

Realised EPS 7.4 cents in current period

Total EPS 32.1 cents in current period

Funding cost cover 3.41 times in current period

Dividend yield of 5.3% based on end of FY22 share price

Comments:

The equity ratio of 69.0% is conservative but it’s significantly based on unrealised investment property revaluations.

EBIT easily covers interest outgoings (funding cost cover) and there are no liquidity issues.

Net tangible assets per share of $2.32 is well above the current share price of around $1.77.

There are massive differences between the EPSs and P/E ratios within each of the last two years which highlights the importance of unrealised investment property revaluations to the company’s performance.

Segmental Analysis

Key Points:

Large percentage of rent-roll from one customer

No segments available to analyse. All properties are large format retail and located in New Zealand.

Comments:

The company has a large exposure to one tenant, Countdown which comprises about 63% of the company’s rental income.

Whether this is a good or a bad thing is uncertain.

Recently there has been a lot of comment in the New Zealand press about the need for another supermarket competitor.

The Commerce Commission did a report in 2020 on the subject and coverage of that report can be found here.

If another competitor came into New Zealand such as Aldi the demand for retail space would rise which is positive for IPL.

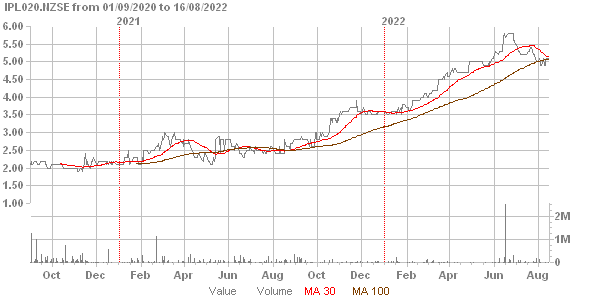

Bonds

Key Points:

All current bond issues are underwater based on yields compared to their coupon rates.

IPL010 Maturity 18.4.24 Coupon 4.40%

IPL020 Maturity 31.8.27 Coupon 2.40%

IPL030 Maturity 25.2.27 Coupon 4.00%

Comments:

All of the bonds issued by the company are trading at rates above their coupon values because of the recent increases in interest rates generally in the New Zealand economy.

Only IPL010 had times when an investor could have bought at a higher yield and received a subsequent capital gain by selling at a lower yield. This could have been achieved in the early Covid period of 2021.

IPL020 and IPL030 have both been trading with steadily higher yields since they were issued.

The company did very well with its latter two bond issues. They have probably saved themselves some millions of dollars in funding costs with their clever timing.

Summary

Investore Property is a conservatively geared company if the property revaluation figures are accurate.

It has a strong rental cash flow and relatively small interest costs to service. There are no liquidity issues.

It's reliance on a single customer for a large part of its rent-roll is of interest but may not be a concern.

As with most commercial investment property companies it relies on high unrealised property value gains to increase its wealth.

Inflation is a friend of this company both at rent review time and when revaluing properties.

The company’s fortunes are tied to unrealised property revaluations and the Covid period was a bumper period for them.

Lately the inflation-loving RBNZ has raised the OCR but it is still at stimulatory levels.

Interest costs will continue to rise but the company was very smart with its bond issues.

The dividend yield would have looked attractive a year ago but if it stays the same in FY23 it will not be exceptional.

The company’s future depends on unrealised investment property revaluations and those cannot be predicted with any accuracy.

If there were large property price corrections some or all of the unrealised revaluations might be reversed. However, the company has a conservative capital structure and falls in investment property values would have to be enormous to threaten the company significantly in the future.

Note:

Comments and suggestions can be made below. All discussion related to this article or other issues are welcome and always appreciated.

If you know someone who might be interested in this article or this website please share using the icon below.

Thank you.