Photo by Heidi Fin on Unsplash

Key Points

Five-year senior secured fixed-rate bonds

Up to $75 - $125 mn

1.15 - 1.3% margin, minimum 3.95% coupon

Same ranking as IPL010 and IPL020

NZX code likely IPL030

Maturity February 2027

Closes 18 February, 2022

Book-build margin set 17 February, 2022

The following recast accounts are for the interim period ended 30 September, 2021.

Recast Revenue Statement

Like many property companies the bulk of this company’s profits are from property revaluations.

In the current period $44.77 mn of the total earnings of $56.944 mn are from investment property revaluations which are unrealised.

The company has a strong EBIT of $22.31 mn.

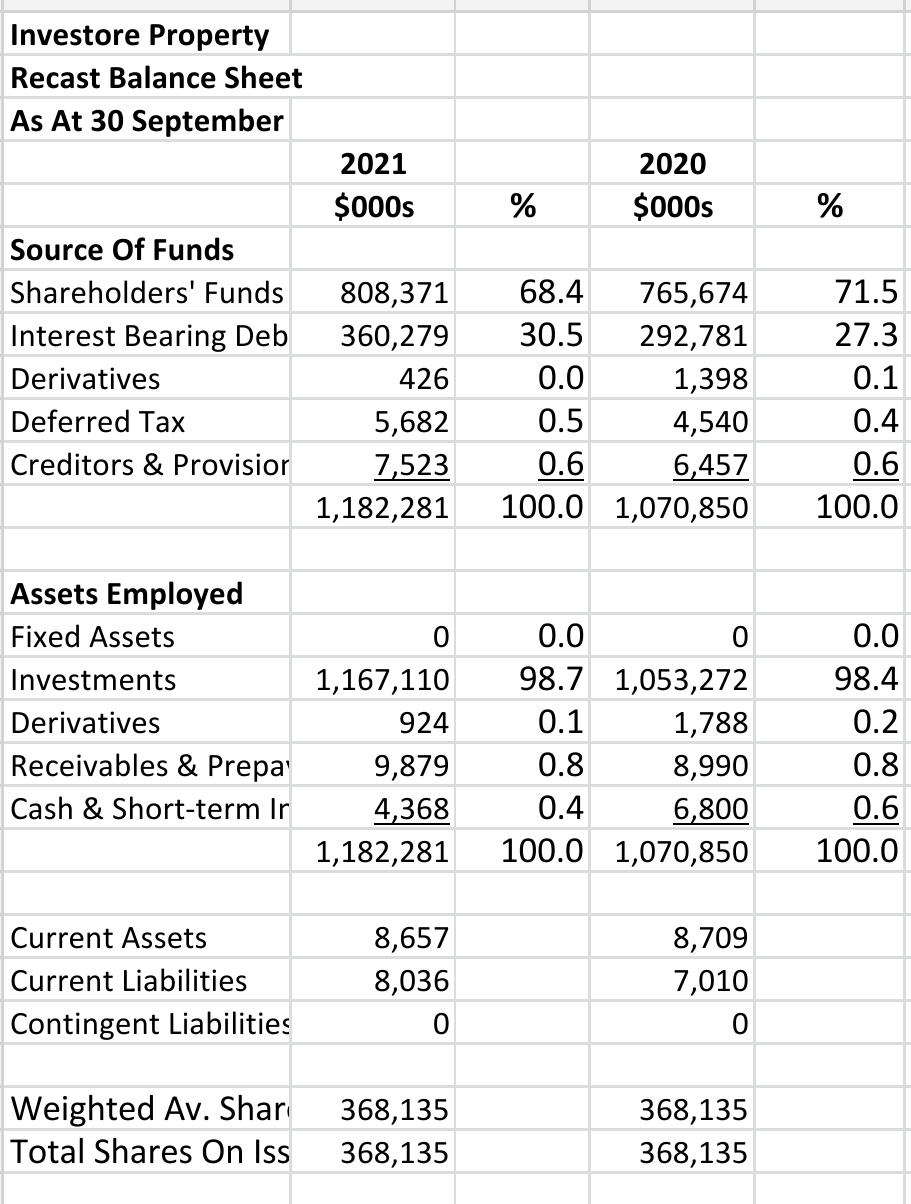

Recast Balance Sheet

Horizontal Analysis:

Shareholders’ funds increased 5.6% to $808.371 mn while interest bearing debt increased by 23.1% to $360.279 mn in the current period as against the previous interim period.

Vertical Analysis:

The equity ratio at the end of the current period was 68.4% which is a high equity but must be considered in light of the unrealised property revaluations.

Recast Statement of Movements in Equity

A 2.0% higher dividend at $14.266 mn was paid in the current period than was paid in the prior period.

The is no reserve account for unrealised property revaluations.

Recast Cash Flow Statement

If dividends paid are included in operating cash flow as they should be as they are a cost of capital then operating cash flow is negative in both periods. In the current period operating cash flow was -$1.333 mn.

The company increased its interest bearing debt by $64.154 mn and sold $10.19 mn of property to make investments of $75.165 mn.

Ratio Analysis

Funding cost cover is acceptable at 3.2.

Segmental Information

None.

Summary

The company has high equity and the cash flow to cover it's servicing requirements. However, the small negative operating cash flow needs to be watched.

The company's soundness depends on the unrealised property revaluations.

It would be useful if the company had a revaluation reserve so that the revaluations could be separated within the shareholders’ funds. This would enable the reader to see the total revaluation number over the years of operation.