Note:

The currency is Australian dollars (AUD).

Overview

DGL Group was previously an NZX and ASX dual-listed company which is now only listed on the ASX since the 30th of June this year.

The CEO Simon Henry is the majority shareholder in the company.

It has been in the news in New Zealand recently for the wrong reasons and the bad press it received may have lead to its delisting on the NZX.

Coverage of this episode extended to no lesser a publication than the Financial Times (may be paywalled) and of course the local New Zealand newspapers (an example).

The share price of the company took a beating as a result of the bad press.

Unfortunately for the company, once it navigated its way through this minor catastrophe and completed its delisting more difficulties were in store for it.

Its FY22 results lead to the stock price falling precipitously on the back of high consecutive daily volumes of shares on the 31st of August and the 1st of September. This was discussed in a recent tradeshot.

In essence, the company is a roll-up organisation. It buys smaller companies at modest P/E ratios and then incorporates them into its larger organisation which trades at a higher P/E ratio. Markets usually value public companies, especially ones which are growing aggressively, at a higher price.

Some roll-ups work. Many do not such as Pacific Print Group which became Geon and Carpet Court in New Zealand.

The company pays both stock and cash for businesses. It has been buying with enthusiasm over the last few years.

Key Takeaways

EPS collapsed from 77.5 cents to 10.3 cents YoY

Highly acquisitive growth company

No dividend

Positive but falling NPAT down 43.3% to $27.9m

Very high negative free cash flow in FY22 of $77.7m

Slight fall in gross margin percentage to 37.3%

High level of property revaluations

High level of intangibles made up of mostly of goodwill from acquisitions

Excellent funding cost cover of 21.3 times

Reasonable level of interest bearing debt at $111.4m

Operating expenses down to 20.8% of sales from 24.1% YoY ex. depn & amort.

Trading History

ASX:

One Month

Source: Direct Broking

Two Years

Source: Direct Broking

The stock has plummeted from just below $2.90 on 30th August to $1.48 on the 6th of September. It bounced back a little on the 7th of September to close at $1.635.

It reached a high of around $4.20 as recently as April this year.

Recast Revenue Statement

Total earnings were down 40.9% to $27.9m on revenue which was up by 89.7% to $370.7m. Not a good sign. Massive increases in revenue are not producing better returns.

EBIT is down but not by as much as profits. It fell 17.0% to $44.8m.

The IPO costs are an extraordinary item which gives a bump to FY21’s NPAT. But NPAT fell 40.9% YoY.

They are making money, however given the provision for taxation of $13.9m.

And the company appears to have low debt servicing requirements of only $2.1m. It has significantly increased its debt so this figure will more than double in FY23.

The company’s gross margin has fallen slightly from 39.4% to 37.3%. Depreciation & amortisation is up 63.6% given the large increase in fixed assets.

Operating expenses as a percentage of sales not including depreciation & amortisation declined from 24.1% to 20.8%.

EBITDA, which differs from the company’s calculation, is listed only for interest as it is not a useful metric.

Recast Balance Sheet

The total assets on the balance sheet have grown 82.8% YoY to $507.4m from $277.5m. Interest bearing debt has grown 108.2% YoY to $305.8m. This is a company expanding rapidly.

Creditors & provisions have grown much faster than debtors & prepayments at 229.3% and 142.2% respectively. Stocks have increased by 233.9% to $48.2m.

The company has high capital commitments at $53.0m that will require funding.

There are some large property revaluations in the accounts. The revaluations are not put through the revenue statement but are shown in comprehensive income as posted to reserves. As such they still affect the balance sheet and improve the equity ratio.

There are potential remediation costs of required of chemical companies in meeting government requirements when returning land to a non-toxic or chemical-free state.

Intangibles are mostly made up of goodwill which arises on purchase of other companies. The company has only recorded very minor impairments to the intangibles in the latest period. At $277,000 they are a tiny fraction of the $98.5m of total intangibles.

Intangibles stood at 19.4% of total assets at balance date.

If the company and the acquired companies are, on average, declining in profitability as shown in the revenue statement then perhaps higher impairment charges are warranted.

Most of the goodwill is attached to the manufacturing part of the business.

At the beginning of FY21 there was a massive 64.1m in loans from CEO and majority shareholder Simon Henry to the company to support its activities. Those loans have now been repaid.

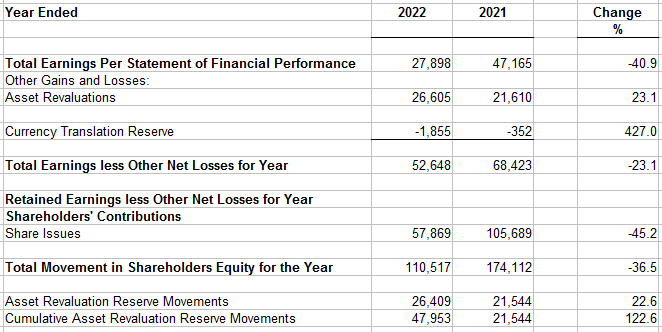

Recast Movements in Shareholders’ Equity

The issue of asset revaluations by the company is material. There is $48.0m in property revaluations taken through reserves over the last two years.

Recast Cash Flow Statement

The company produced a positive net operating cash flow of $24.3m up 27.6% YoY.

It used this operating cash flow, $59.5m of debt and share issues to purchase around $47.9m of fixed assets and $58.2m of investments.

The company finished the financial year with 41.9% less cash & equivalents at $25.4m

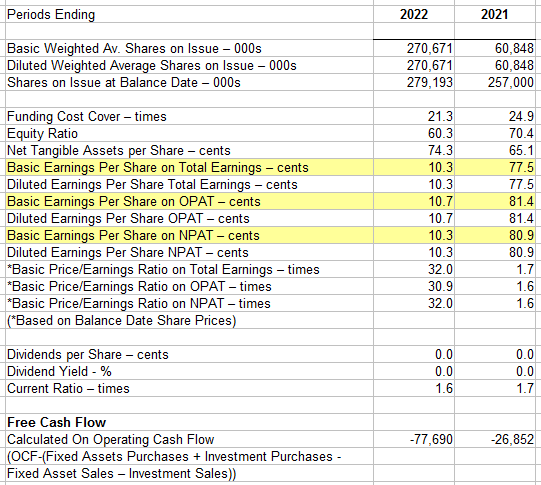

Ratio Analysis

The company’s equity ratio has declined from 70.4% to 60.3% at the latest balance date. The equity ratio is supported by property revaluations and intangibles.

Net tangible assets per share in FY22 was 74.5 cents but this figure includes substantial property revaluations.

Funding cost cover for FY22 at 21.3 times is excellent.

EPS was 10.3 cents for FY22 down from from 77.5 cents per share in FY21 resulting in a P/E of 32 at the balance date share price of $3.30 which is much higher than the current share price.

However, intangibles are taking an increasing chunk of total assets. These intangibles are mostly goodwill which is generated when the company pays above book value for many of the businesses that it acquires.

There are multiple ways to calculate the free cash flow and the calculation is listed above. Free cash flow in both years was very strongly negative. In the latest period the negative free cash flow was $77.7m using our calculation method.

Segmental Analysis

The company has provided some segmental information but not enough for the return on assets or geographical returns to be calculated. There are no EBIT numbers for example.

Chemical manufacturing has taken over from warehousing and distribution and now represents the biggest segment of the business at 37.7% of total assets.

The geographical segmental information shows the increasing importance of Australia and the change is happening rapidly. New Zealand’s importance is dwindling away.

Summary

The company is growing aggressively through acquisitions and is able to issue its own shares in part payment for the companies it acquires. This process accelerated the major decline in earnings per share which is one of the main reasons the share price collapsed.

It is rapidly expanding into Australia and leaving New Zealand behind.

The company has a resonable level of debt and some cash on hand at the balance date. Interest costs will rise strongly in FY23.

One area of concern is the level of property revaluations although they are based on registered valuations.

Another area to consider is the amount of intangibles on the balance sheet. Given the decline in profits in the latest year, did the company overpay on average for its acquisitions?

The company has falling profits even though it has had a massive increase in revenue. On a per share basis this profit slide is more of a collapse.

This throws into question the economic logic and model of what the business is doing.

Roll-ups are full of issues such synergy benefits and the level of autonomy with existing management in the acquisitions. Operating expenses have been declining relative to sales which is encouraging.

One only has to look at a few New Zealand attempts at roll-ups such as Pacific Print Group/Geon to see some dangers.

In a nutshell, the company seems to have had an immediate and severe performance decline from its acquisitions, is facing higher financing costs and has some questionable major items on its balance sheet (property valuations and intangibles).

It needs to be monitored closely as it attempts to digest these aquisitions.

Note:

Comments, suggestions and shares are appreciated and can be made below.

Thanks.