Note: All amounts in NZ$ unless otherwise stated.

Key Points

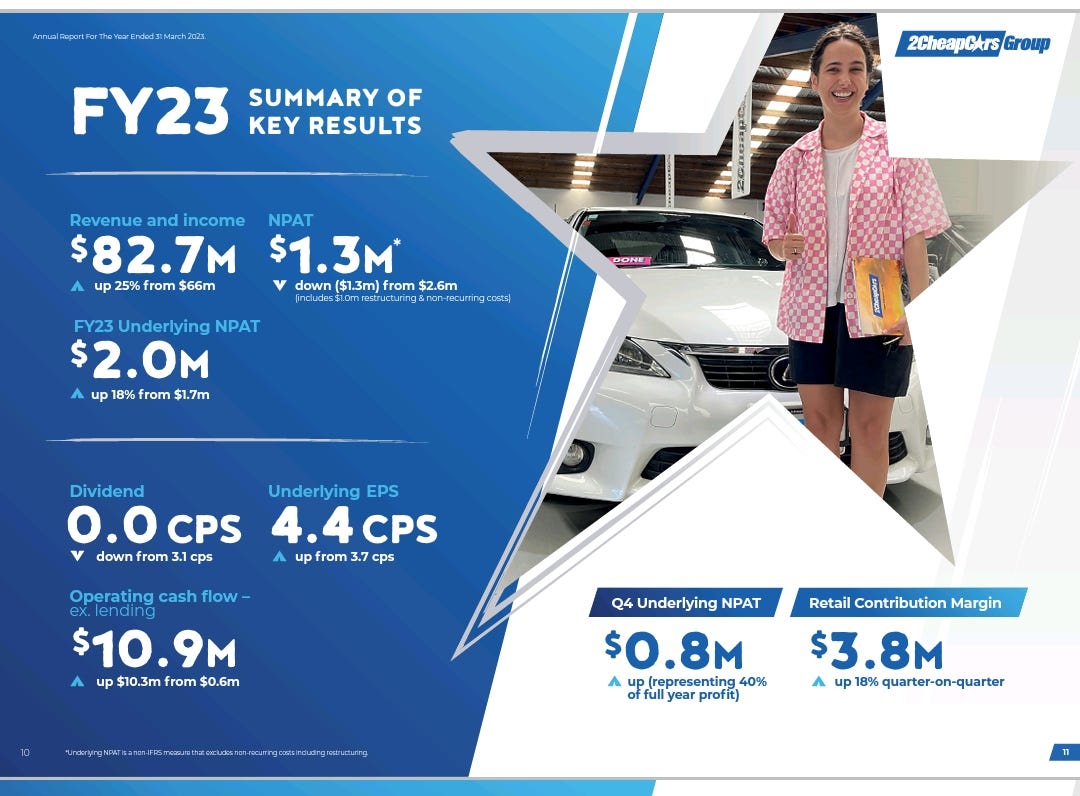

No dividend declared

Statutory (real) NPAT declined

Inventory reduction positively affected net operating cash flow

Net operating cash flow strong

Equity ratio significantly improved

Overview

The company highlighted the following information in their financial statements FYE 31st March, 2023:

Source: 2 Cheap Cars Annual Report

The use of the term ‘underlying NPAT’ raises a question. The 18% increase in underlying NPAT reflected better on the companythan the 50% decrease in statutory NPAT.

There was an impressive increase in net operating cash flow from $0.3m to the current period’s $10.9m. However, this requires adjustment for the principal portion of lease payments and the small cash dividend amount under our method.

2CC has, by all accounts, been performing well over the last few months following a period of uncertainty in the company. The forecasts are for strongly increased profits in the coming year.

Originally known as New Zealand Automotive Investments, 2CC operates a used car brand called 2 Cheap Cars, a car purchasing company in Japan for supply purposes and a vehicle financing business.

This quite tacky brand name has now become the name of the whole listed entity although the share market code remains NZA.

In March a note was posted here stating in the summary that the company may have turned the corner (pun intended) with the appointments of new directors including the well known turnaround specialist and liquidator, Michael Stiassny.

Trading History

NZX:

Source: Direct Broking

The company has an unusual trading history over the last two years. This has provided some good opportunities for traders and/or investors.

The shares fell from highs of around 94 cents in January, 2022 to a low of around 26 cents in May, 2023 before staging an abrupt recovery in July, 2023.

The shares then fell somewhat before a second recovery rally in October, 2023 to a high of around 88 cents.

Revenue Statement

The gross margin which is calculated on revenue from car sales to cost of sales improved to 9.34% in the current period compared with 8.78% in the prior period.

EBIT declined to $2.91m in the current period from $3.89m in the prior period producing funding cost cover of 2.7 times in the current period and 5.6 times in the prior period.

NPAT was $1.29m in the current period and $2.59m in the prior period. NPAT to sales is 1.56% in the current period and 3.93% in the prior period.

Opex were up significantly.

Balance Sheet

The balance sheet has few intangibles and an equity ratio which has improved from 40.2% to 56.1% as a result of the repayment of trade finance facilities through mainly better net operating cash flow.

The inventory level was significantly reduced at the current period’s balance date at $8.38m compared to the prior period’s $13.01m.

Cash Flow Statement

The company is showing strong net operating cash flows, which even with dividends and principal portions of lease payments deducted as per our method, are $8.61m in the current period versus -$4.11m in the prior period.

The prior period included a large dividend of $3.03m which is included in operating cash flow because it is a cost of capital (as is interest).

The reduction in inventories also helped with the increased net operating cash flow. Although recorded on the balance sheet on an accruals basis the difference of $4.63m is significant.

Nevertheless, net operating cash flow was much improved although not close to the 2CC’s stated $10.9m (on a sustainable basis).

Segmental Information

Same store sales (yard-by-yard sales) information was not provided and it would have been very useful for demographic purposes but it’s understandably commercial sensitive.

A Note on Competition

A director and significant shareholder, Eugene Williams, left the company but retained his shareholding (at least until the sale to the majority shareholder was voted on and passed by other shareholders at the recent AGM).

Williams left his role and directorship in 2CC along with some staff and other directors.

He has opened two new used car saleyards under the brand NZ Cheap Cars. These operate on the North Shore and in the Eastern suburbs of Auckland. Interestingly, 2CC closed its yard near the NZCC operation.

The new chairman Michael Stiassny has commented that it is unfortunate that the prior second largest shareholder is effectively attacking the company and damaging his own share value (at the time) through competing so directly with 2CC.

A site visit to the NZCC’s yard on Hillside Road on the North Shore was revealing. The yard is situated directly behind the 2CC yard on the same tarsealed area.

The cars at NZCC in general seem to be slightly cheaper than those at 2CC. Both yards operate from uncovered areas with 2 Cheap Cars having some road frontage and thus the advantage of being the first yard to be seen by visitors.

NZCC vehicles also come with a Automobile Association free inspection unlike 2CC’s.

Enquiries made to salespeople at NZCC revealed that many, if not most, of their staff came from 2CC.

The impact of this competitor, through direct competition and growth, on 2CC remains to be seen. They are not yet buying anywhere near the volumes of vehicles that 2CC are buying.

One can only imagine the level of vitriol between the previous biggest shareholders in 2CC for one of them to operate in this way.

Summary

This company appears to have somewhat recovered from the problems between the directors and between the major shareholders.

It is forecasting strong profits for the half and full years ahead in FY24 although its current profits are down. It has strong operational cash flow partly due to an inventory sell down. Without the reduction in inventory net operating cash flow is still strong.

An important question is how significant is the competing company’s threat to the business.

The company’s largest shareholder now owns around three quarters of the company which raises questions of whether he will have too much influence on the directorship and management. There are now, however, some independent directors on the board.

The share price has rallied strongly on the basis of encouraging statements made by the current directors about trading in FYE 2024 and it will be interesting to see if these forecasts are realised.

Subscriber Report on Car Purchase from 2 Cheap Cars

A subscriber submitted the following sobering report on his recent experience in purchasing a car from 2CC and it’s included as an addendum for interest’s sake (submission edited):

‘I purchased a vehicle from 2CC in August, 2023. I tried to purchase a similar vehicle from NZ Cheap Cars (NZCC) before the 2CC purchase was made. NZCC prices were somewhat lower on a similar vehicle and I missed out as it sold quickly.

After picking up the vehicle from 2CC the warning lights came on within a few hundred metres from the yard. This turned out that the salesman had put only a minimum few litres of petrol in the vehicle.

After paying for the vehicle and going to the yard to pick it up the salesman came out with one key fob. There was no other and they didn’t advise me of this before purchase. Cost to get a backup fob: $350-550. Really sharp practice IMO.

After a week of driving the warning lights came on again together with the skid warning light. A Nissan mechanic found that one front brake hose was losing fluid onto the hub and disc brakes and this had been happening for quite a while as the powder coat was falling off on the adjacent hub.

The car was legally off the road as a result of this problem.

When the salesman was contacted he only suggested that I contact ‘Claims’ and wanted no other involvement and offered no other help.

The Claims voicemail box was full and not taking any additional messages. The company responded quickly to emails though.

The initial diagnosis required a new brake hose which was not available (according to the Nissan service centre) in the country and would have to be brought in from Japan as the car was an import. This meant a six week wait during which the car could not be legally driven.

Nissan turned out to be wrong.

Another mechanic was able to correctly diagnose the problem. The only requirement was tightening up a nut on each brake hose (as both front hoses leaked). This took around three weeks to resolve and then only because I took the vehicle to a brake specialist.

2CC were slow to help and after three weeks had still not generated a purchase order for the brake hose (which turned out not to be required).

The engine oil was black although they said they had replaced the oil and the filter. I checked the oil sticker on the window and the oil change was done 200 km before in Japan apparently.

The CVT fluid has not been changed but they had told me this in response to my question before purchase. I serviced the CVT and filters at a cost of $454. Anyone who knows about CVTs knows you must service them and the serviceman said the fluid was dark black.

In summary, the car had some issues which were luckily resolved with no help from 2CC who were very slow in generating a purchase order (and still hadn’t after three weeks). They replied to emails quickly though. Had I not got a second opinion the car would have been off the road for 1 1/2 months from a week after purchase.

Overall, given their lack of post-purchase support for a faulty vehicle for which they were legally responsible and abovementioned sharp practice I would not recommend purchasing from this company.

Additionally, their full Claims voicemail box may speak volumes on their car quality.’

Editors Note: What a terrible experience! They should have taken the car and fixed it and provided a vehicle to use during that process. Or alternatively refunded your money.