Note: NZ Automotive Investments (NZA.NZX)

HY23 Accounts, Gross Margin Compression, Dividend, Market Capitalisation, Investor Losses, Increasing EV & Hybrid Sales, OCF Improvement

Note: All amounts are in NZ$ unless otherwise stated.

Date

28th February, 2023

Industries

Vehicles Sales & Consumer Finance

Current Price

NZX: NZ$ 0.30

Trading History

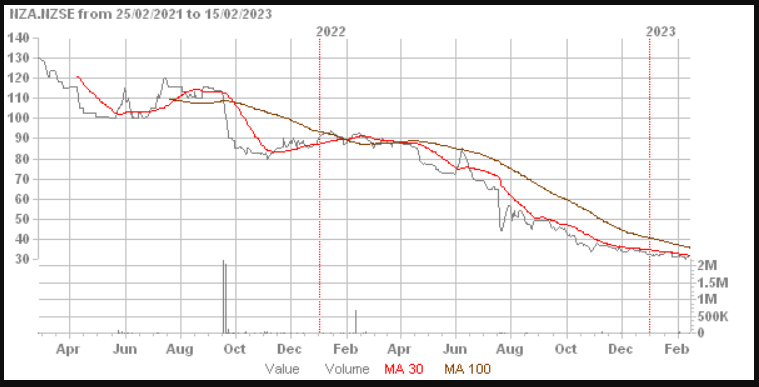

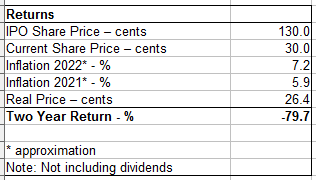

New Zealand Automotive Investments Limited (NZA) is listed on the NZX and began trading in early 2021. From a reference IPO price of $1.30 it has fallen to 30 cents.

Source: Direct Broking

NZA’s market capitalisation is just $14.6m compared to its IPO capitalisation of $59.2m. This, excluding dividend payments, represents the loss of $44.6m of wealth or $75.3% since the IPO.

In real terms, the loss is even greater or nearly 80% from its IPO reference price. This makes it one of the worst performing shares in recent times on the NZX along with the likes of MFB.

The Float

The company has a tiny float (shares that are not tied up in 5.0%+ holdings) of only 8,907k shares.

The balance date FY22 float represented just 19.6% of the outstanding shares.

The rest of the shares, 80.4%, are owned by just two entities; the family trusts of its two founders, Yusuke Sena and Eugene Williams.

Overview

The company operates in two business segments. 2 Cheap Cars Limited sells used vehicles under the 2CheapCars brand from 13 different dealerships. The subsidiary NZ Motor Finance Limited finances a portion of those sales.

NZA also has a procurement company in Japan called Car Plus KK.

Not all the vehicles come from Japan. Some vehicles come from Europe and some are sourced within New Zealand.

The company has had many problems since it listed. Four directors have resigned and two new directors have taken up roles. The company’s and investors’ hopes rest on stabilising the business especially with its bankers.

The company recently appointed both a new CEO and a new auditor.

Oddly, the auditor is based in Sydney, Australia although the company operates in New Zealand and Japan. The previous auditor, Grant Thornton resigned. The new auditor is UHY Haines Norton.

The company buys most of its vehicles in Japan but, even though the NZ$ has been rising against the Yen, and the company managed to lose $700k on its NZD/Yen hedging contracts in FY21.

These contracts were designed to protect the company against further falls in NZD/Yen.

But the NZD rose strongly in that year.

Financial Statements

The company's annual balance date is 31st March.

The annual accounts show a breakdown of revenue and income while the interim accounts do not. Thus, the gross margin on vehicle sales for HY23 cannot be determined.

Its balance sheet is almost completely free of intangibles and its equity ratio is an acceptable 42.3% at the end of HY23.

Inventory levels have been reduced to $12,671k in HY23 from $13,334k at balance date in the pcp.

Debt has been reduced to $10,600k compared to the pcp's $11,800. These figures exclude lease liabilities which are roughly the same as in the pcp.

Revenue

Vehicle unit sales were 6,296 in FY22 which was 6% up on the 2021 year.

However, when the company listed vehicle sales had averaged 11,000 units per year in the preceding three years through its then 12 dealerships.

Revenue was up 31% in HY23 versus the pcp which reversed the declines occuring in the full year periods.

Quality of Earnings

Loans for vehicles appear on the balance sheet in loan receivables and the carrying amount is calculated using discounted cash flow methods.

The quality of earnings at 2CheapCars is excellent because most of the vehicles are paid for at point of sale often with financing provided by NZ Motor Finance.

The quality of earnings at NZ Motor Finance is a different matter as the loans are subject to impairments and rely on interest and principal payments after the sales occur.

There is security against the vehicles and the impairments are not high. Vehicles depreciate rapidly once they are sold and any shortfall is owed personally by the buyer(s).

Gross Margin

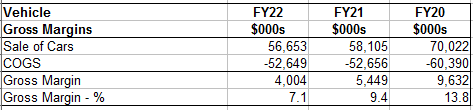

The annual accounts itemise in their notes to the accounts the revenue and income breakdowns.

The gross margins on vehicles over the last three years are shown in the table below:

Gross margins on vehicles were declining YoY.

Expenses

Across the board opex rose strongly except for property expenses which fell.

Funding cost cover was 4.0 times in HY23 compared to 9.0 times in the pcp. Rising interest rates and falling profitability had an effect but funding cost cover is still reasonable.

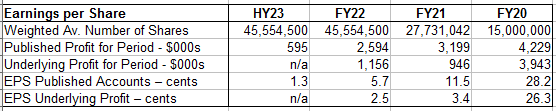

Total earnings for the period were down 60.1% to just $595k from the pcp's $1,400k which resulted in EPS of 1.2 cents for the interim period well down on the 3.1 cents in the pcp.

However, there was a non-recurring item of restructuring costs of $654k which when added back increases the underlying NPAT to $1,249k.

Underlying earnings have therefore decreased by 10.8%.

Earnings per share (EPS) based on the weighted average number of shares in the last three years and HY23 are show below:

The EPS based on the underlying profit is significantly lower in the full year periods than the EPS in the company’s published financial statements.

Net Debt

The company stated in its press release on 29.11.22 that its net debt on balance date HY23 was $4.4m. They didn’t add the lease liabilities which are significant and bring the actual net debt to $11.7m.

Dividend

A dividend of just $287k was paid during HY23. But no dividend was declared for the period. This contrasts with much higher dividends in FY22.

Dividends, except in HY23, have been rising while profits have been falling.

Perhaps this is where some of the issues between the largest shareholder and the directors lay.

Cash Flow

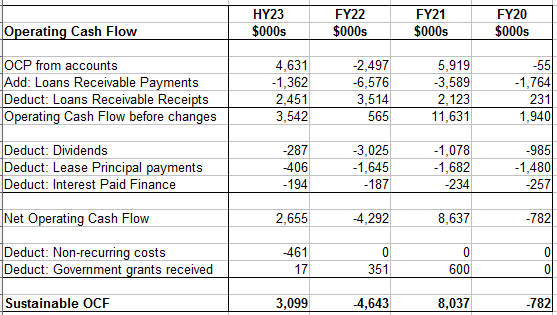

Net cash flow from operating activities, using our method of calculation, was $2,655k which is a major improvement on the pcp’s -$1,369k.

If non-recurring cash flows are removed the OCF under our method is $3,099k for HY23.

Capex was low in both periods when compared to depreciation.

The company did not have to provide an indirect cash flow or reconciliation between total earnings and operating cash flow under the interim reporting rules.

The finance company performed poorly with an NPBT of $111k against a small profit of $19k in the pcp.

2CheapCars made a NPBT of $2,182k which was down on the pcp's NPBT of $2,761k.

The company is looking for a new lender(s) to replace the existing ones who seem to be pressuring them as a result of the ructions at board level.

There have been some insignificant purchases of stock by directors in the last few months.

Loan Receivables

The company's loan receivables fell to $5,616k at the end of HY23 compared to $6,824k at the pcp’s balance date.

Before listing the NZA chair Karl Smith stated, ‘'Our strategy is to leverage the retail business to build a diversified automotive services group by growing NZAI's retail finance business.’

The retail finance business ceased lending in July, 2022 apparently under pressure from its bankers because of the turmoil in the company’s directorship.

Summary

The increase in revenue is encouraging and the company seems to have bounced back from its YoY declines.

Gross margins on vehicles have been steadily falling YoY and seem low. The data for HY23 is not available.

Of interest is the improved net operating cash flow which is strongly positive even after applying the more rigorous approach used with our method.

Perhaps the company has turned a corner (pun intended) but gross margins must stabilise and hopefully improve. This information will be available when the annual accounts FY23 are released sometime after its balance date of 31.3.23.

Hi John, sorry for the delay in replying. Overseas and have been for a while.

Do you know the reasons for the large changes in the inventory levels?

Also why do you think increasing inventories signal that they are getting their act together?

Thanks for analysis of NZAI, I am not an investor in NZAI but I hold data on their inventory by time, as a result of monitoring Turners.

NZAI stock holdings is a bit of a nightmare as they rose to nearly double their typical stock of around 300, they were 729 by July-Sept 2022 then dropped back to 360 by May 2023. They are on a rise again, now up to 421, suggesting they may have got their act together