Photo by Ant Rozetsky on Unsplash

Key Points

Large negative operating cash flow

High returns on equity

High funding cost cover

Acceptable equity ratio

Source: Direct Broking

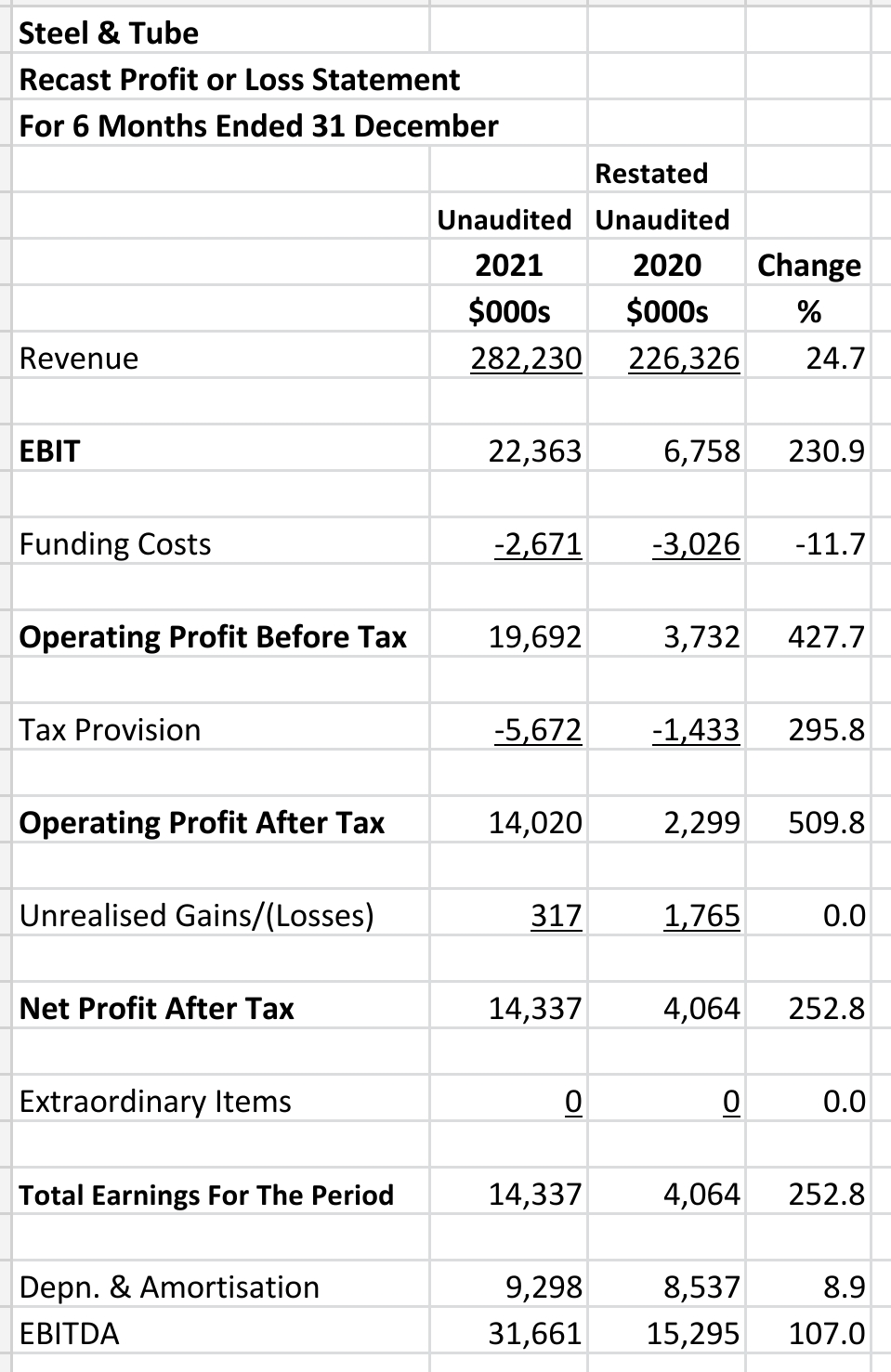

Recast Revenue Statement

Profitability was strong with an EBIT of $22.4 mn and total earnings of $14.3 mn.

Of note is the increasing tax amount which indicates profits are genuine.

Recast Balance Sheet

Horizontal Analysis:

There has been a significant increase in inventories. They have increased by 34.8% although revenues are up 25.7% from period to period. However, total assets have increased only 3.1%.

Vertical Analysis:

The equity ratio was 53.7% which is a vepyable for this type of company.

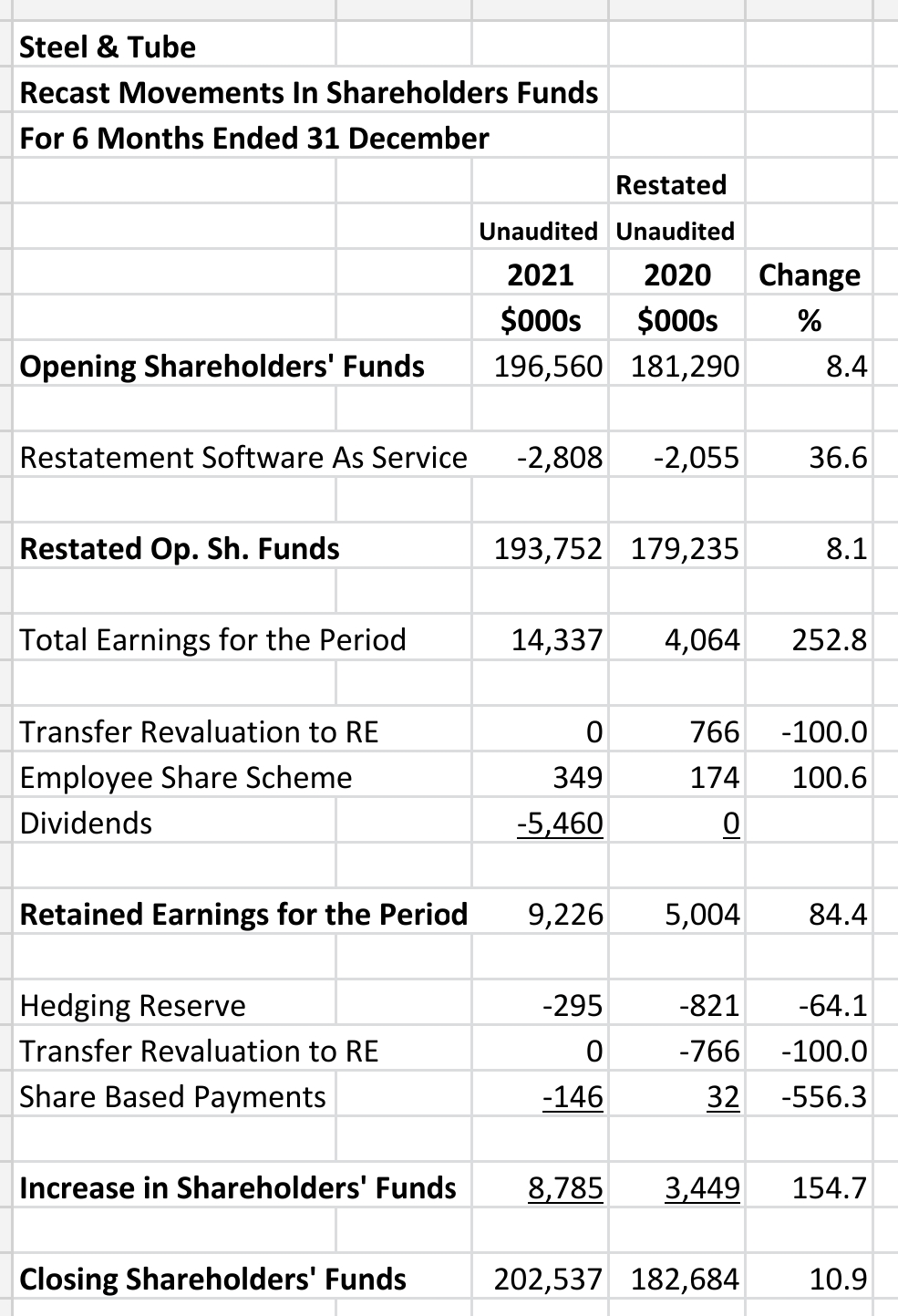

Recast Movements in Shareholders' Equity

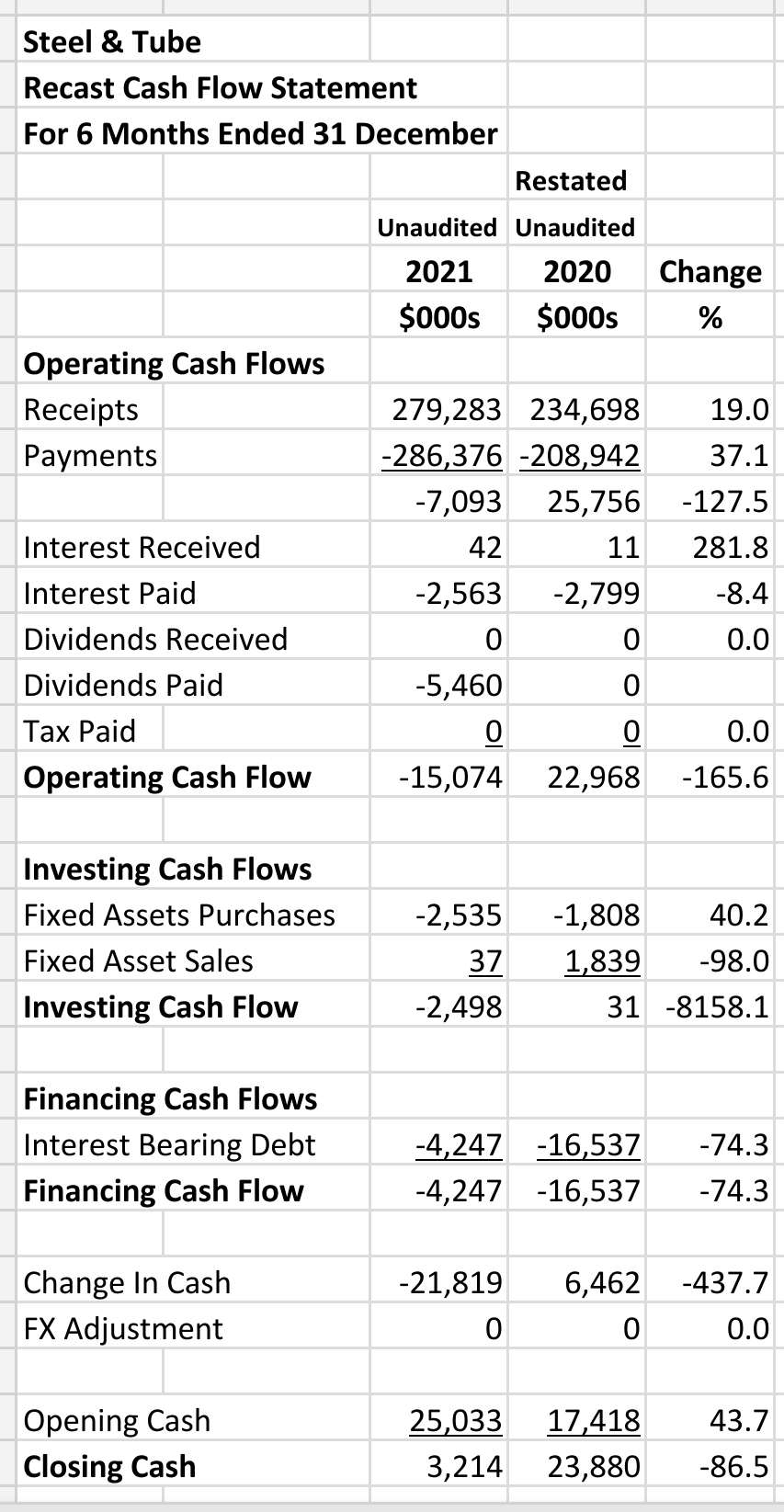

Recast Cash Flow Statement

Operating cash flow has turned negative which would still be the case even if dividends paid had not been included.

Operating cash flow was -$15.1 mn against a positive $23.0 mn in the prior period.

The cash and short-term investments at balance date was down 86.5% to just $3.2 mn.

The company blew through $21.8 mn of cash in the six month period to the end of 2021.

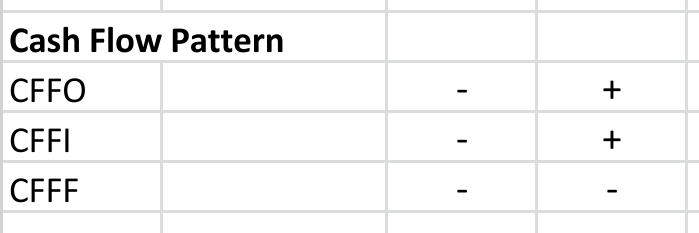

The cash flow pattern for the latest period was all negative which is generally only seen in start up companies and companies that have some issues.

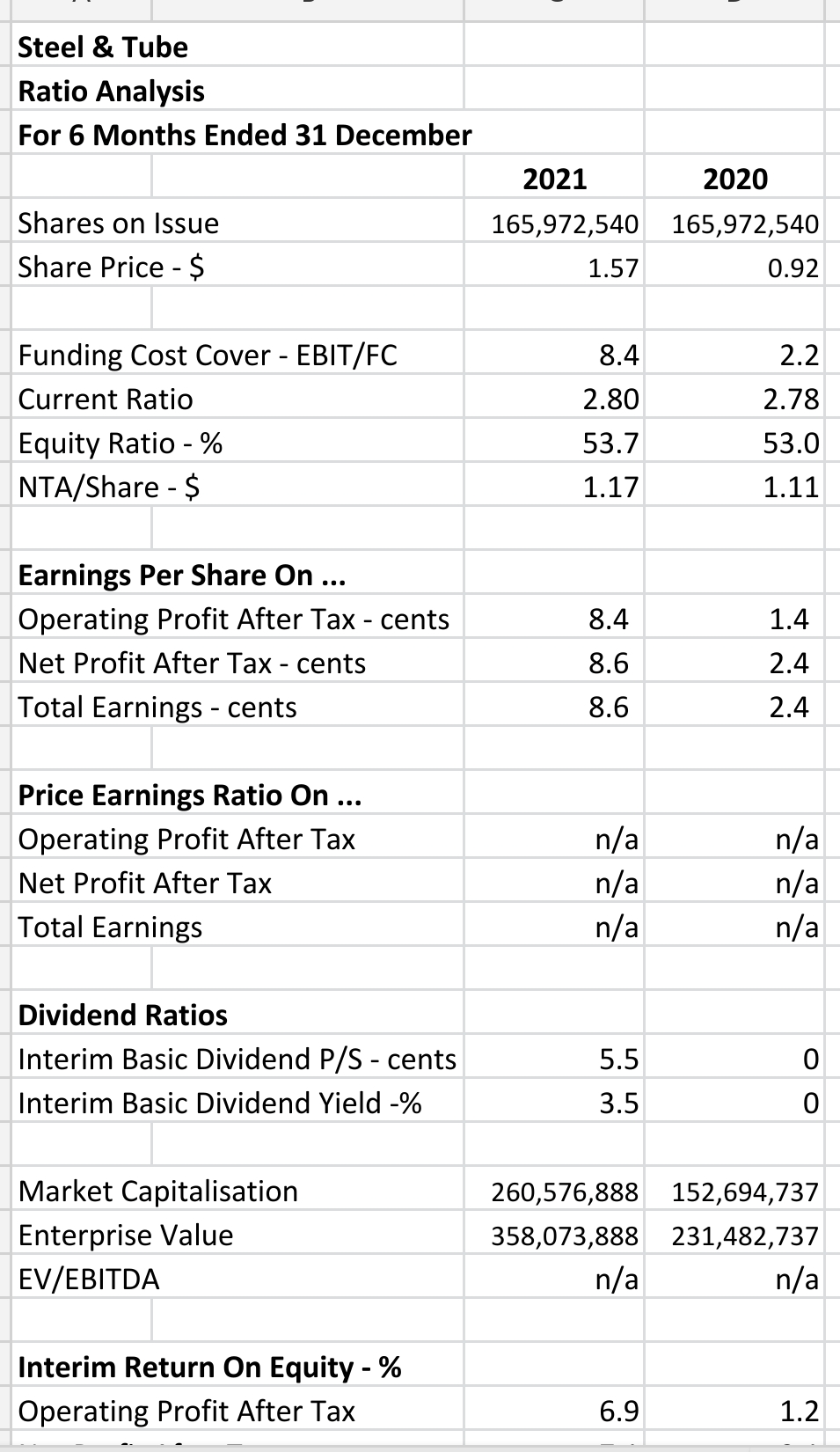

Ratio Analysis

The company had strong funding cost cover at 8.4 times.

A good dividend for the latest period of 5.5 cps was paid.

Earnings per share were strong at between 8.4 and 8.6 cents. This is very good considering its only a six month period.

The share price has continued to improve reaching $1.57 at balance date.

Segmental Analysis

Summary

This is a company that has handled Covid quite well.

It has strong profitability and excellent EBIT but cash flow from operations, the run up in inventories and the poor cash position are issues of concern.

It has an outstanding ability to pay the interest on its interest bearing debt.

It is hard to place a value on this company because cash flows and profits seem to be quite unpredictable.