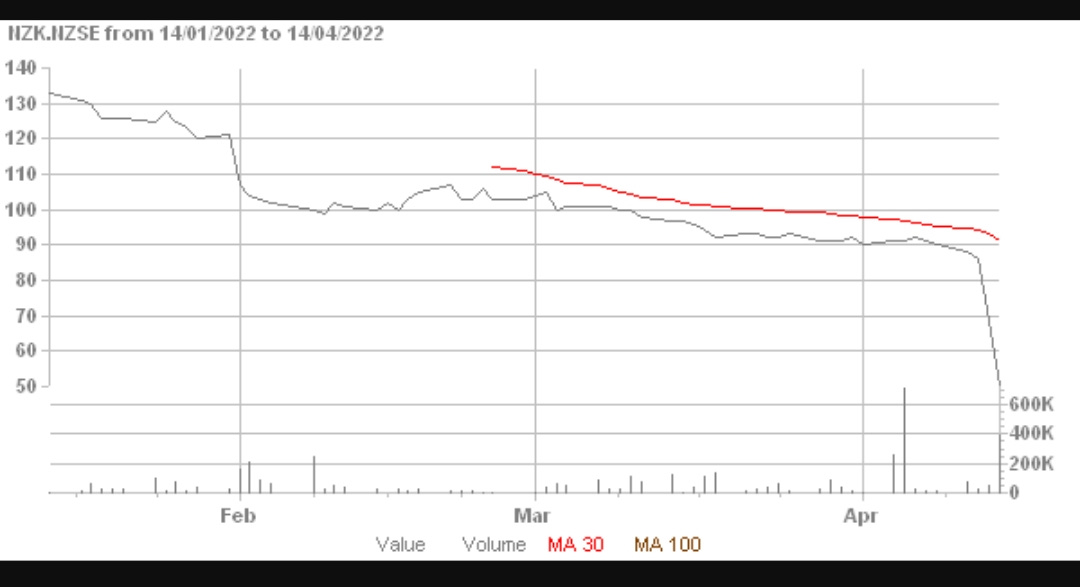

Three Month Trading History

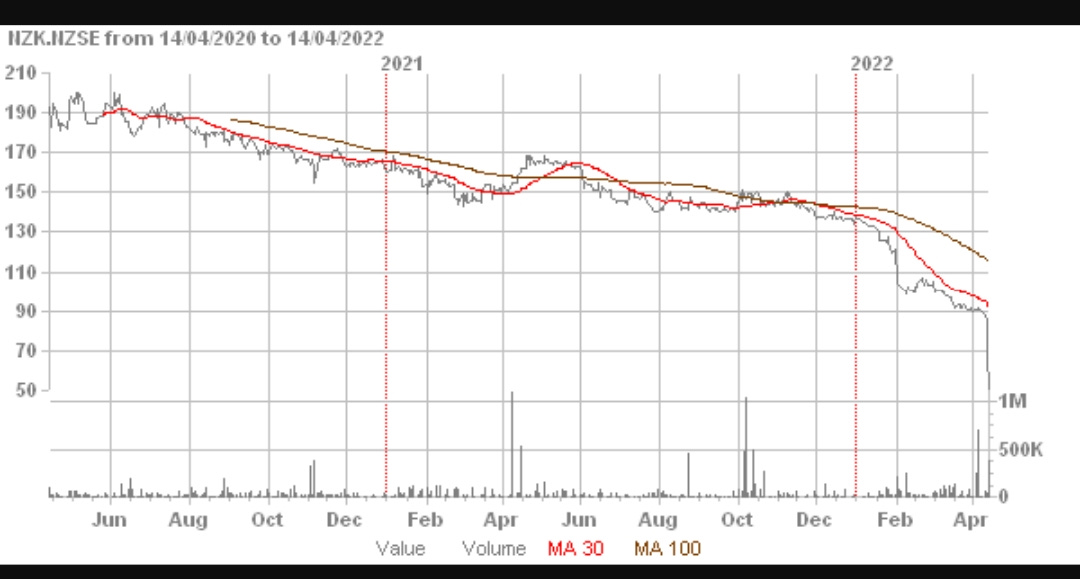

Two Year Trading History

Overview

As the three month chart above shows things have been dire for this company in the last few weeks.

It closed today, Thursday 14 April, 2022 at just 50 cents.

Interestingly, in the last two years there have only been two days of higher volume than there was on 5 April, 2020.

Roughly 700,000 shares went through in advance of the announcement of the massive loss and capital raising.

The preceding day also had a high volume of around 250,000 shares.

We infer nothing from these trades except that their timing raises some questions.

The company does not pay a dividend.

The announced capital raise is for $60.1 mn through a 2.85:1 rights issue at 15 cents.

This is obviously a massive discount to the share price at the time of the announcement although it's falling in the direction of the rights price.

Some existing large shareholders have agreed to take up their rights.

The underwriters, however, at such a steep discount would dilute existing shareholders who probably paid far more for their shares originally.

This would be the case in proportion to the percentage of rights not taken up.

New Zealand King Salmon is listed on both the NZX and ASX under the code NZK.

The financial statements have been published at the same time as the rights issue offer document.

The statements are for the full year ending 31 January, 2022.

Annoyingly, the prior period is for only seven months ending 31 January, 2021.

So horizontal comps are not possible except on the balance sheet.

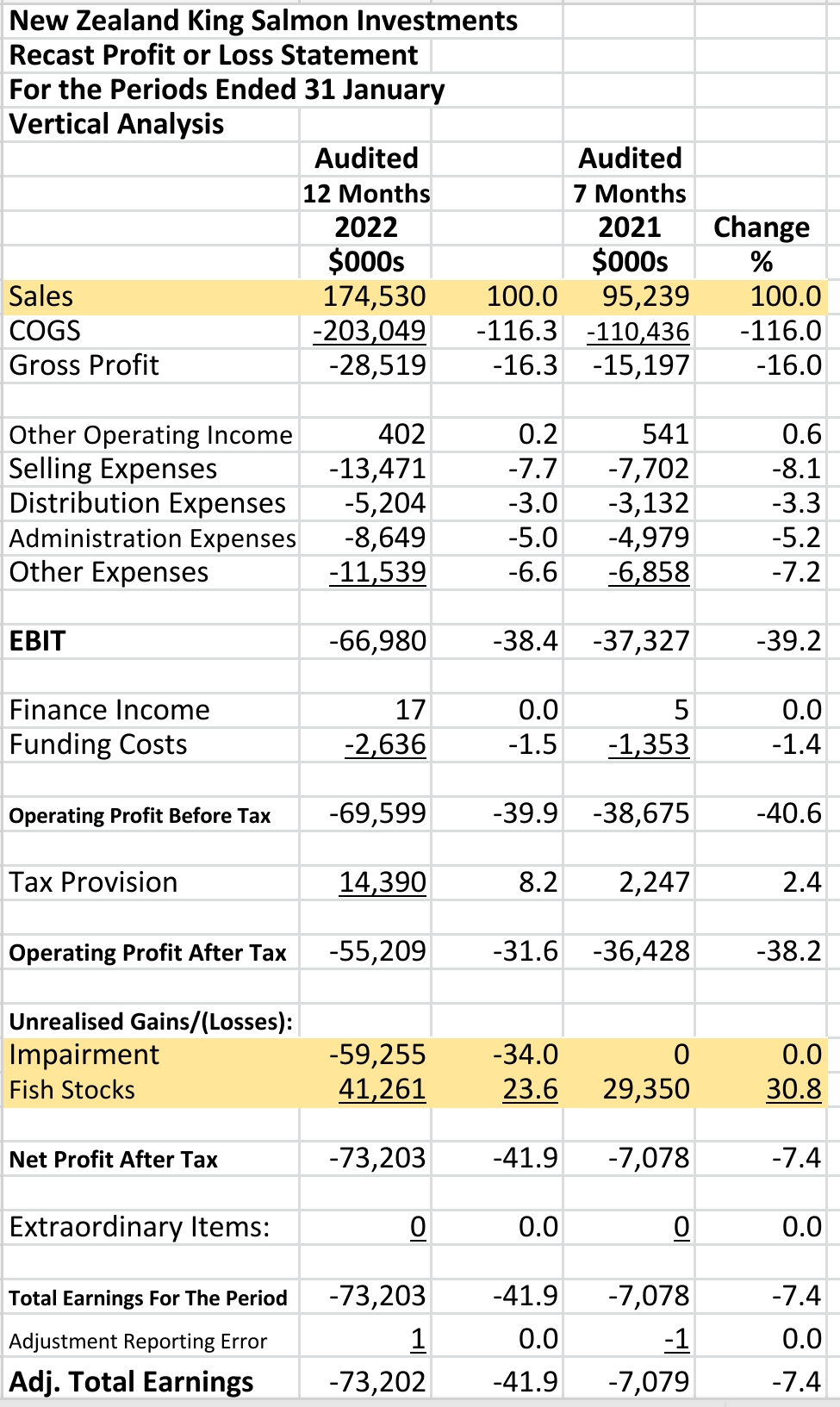

Revenue Statement

Key Points:

EBIT of -$67.0 mn

Gross Profit of -$28.5 mn

Total loss of $73.2 mn

No horizontal analysis as periods not of the same length

Vertical Analysis:

We’re not sure exactly what the published statements' ‘sales contracts with customers' means and what the conditions on those contracts are.

We moved the freight costs into cost of goods sold (COGS) but it could also have gone into distribution expenses.

We moved gains on biological assets of $41.3 mn into unrealised gains further down the revenue statement because of its low quality (no external accounting transaction).

Biological assets is an interesting term. Accounting can be funny like that.

You can imagine an accountant introducing his wife, “meet my biological asset, she earns $100k a year …” or son, “meet my biological liability who sits on the couch playing video games and costs us $100 a week in food.”

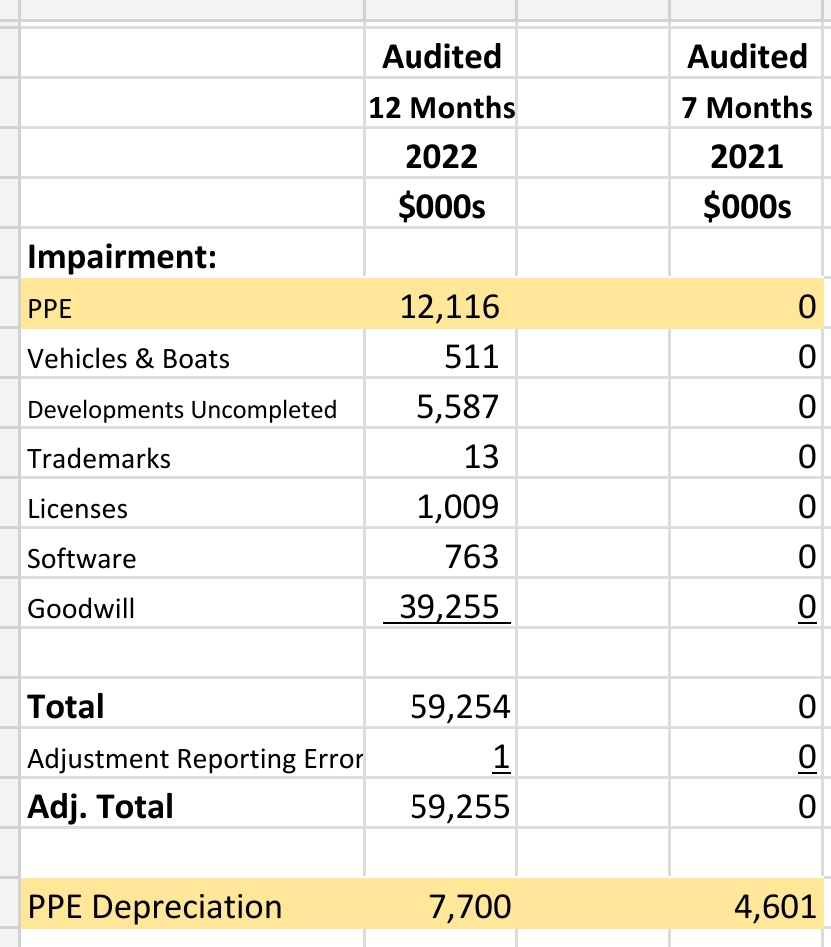

Impairment of a whopping $59.3 mn is also unrealised and appears in that section of the revenue statement.

The main impairment is $39.3 mn to goodwill.

The tax provision is a credit of $14.4 mn which may never be used. It could be removed from the revenue statement altogether and put in the notes to the accounts (despite NZ GAAP!).

The total loss comes in at $73.2 mn which is, if course, a matter of opinion because there are alternative ways of calculating it as discussed above.

Items in impairments are highlighted as they are used later in the free cash flow calculations.

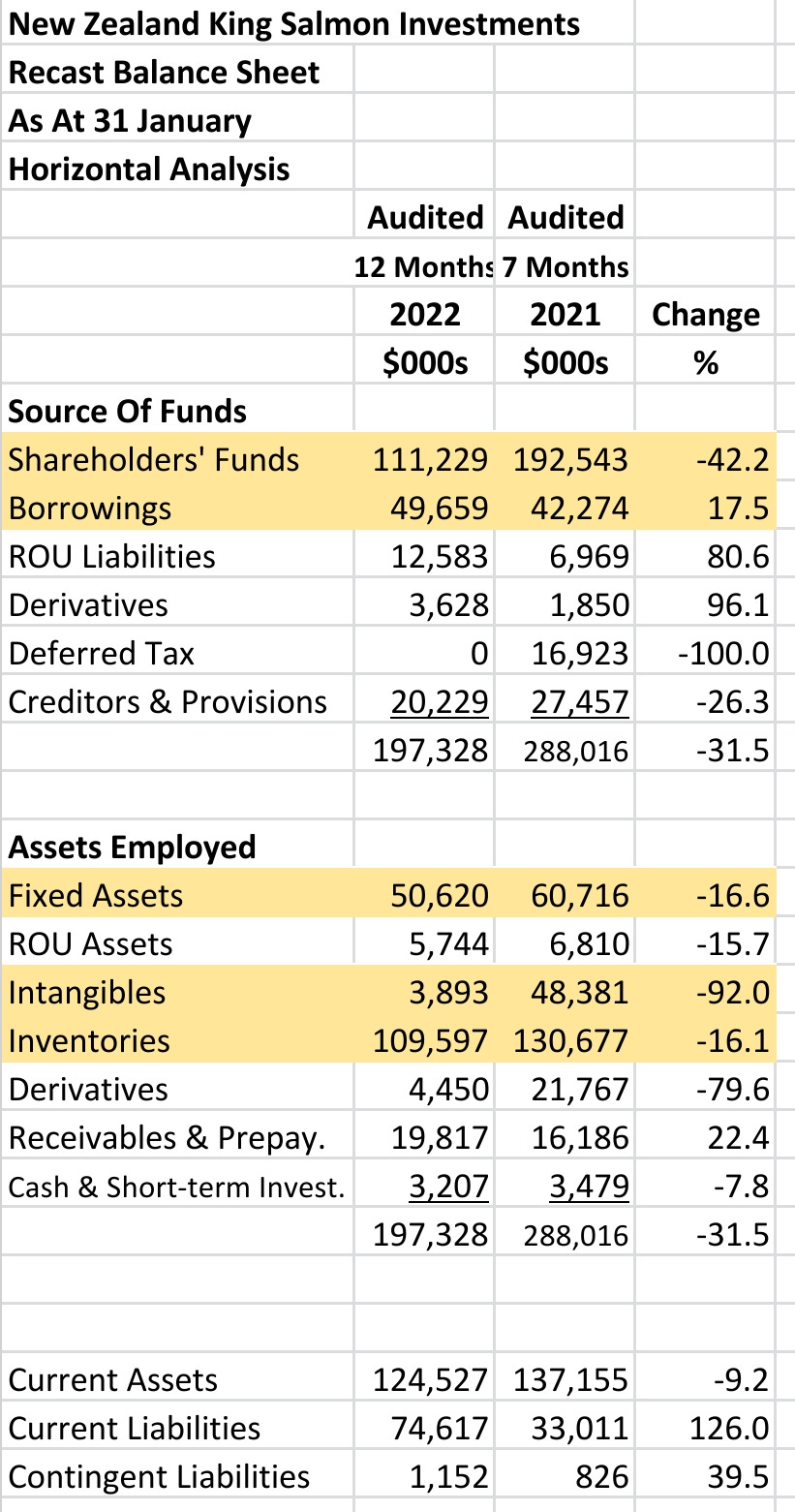

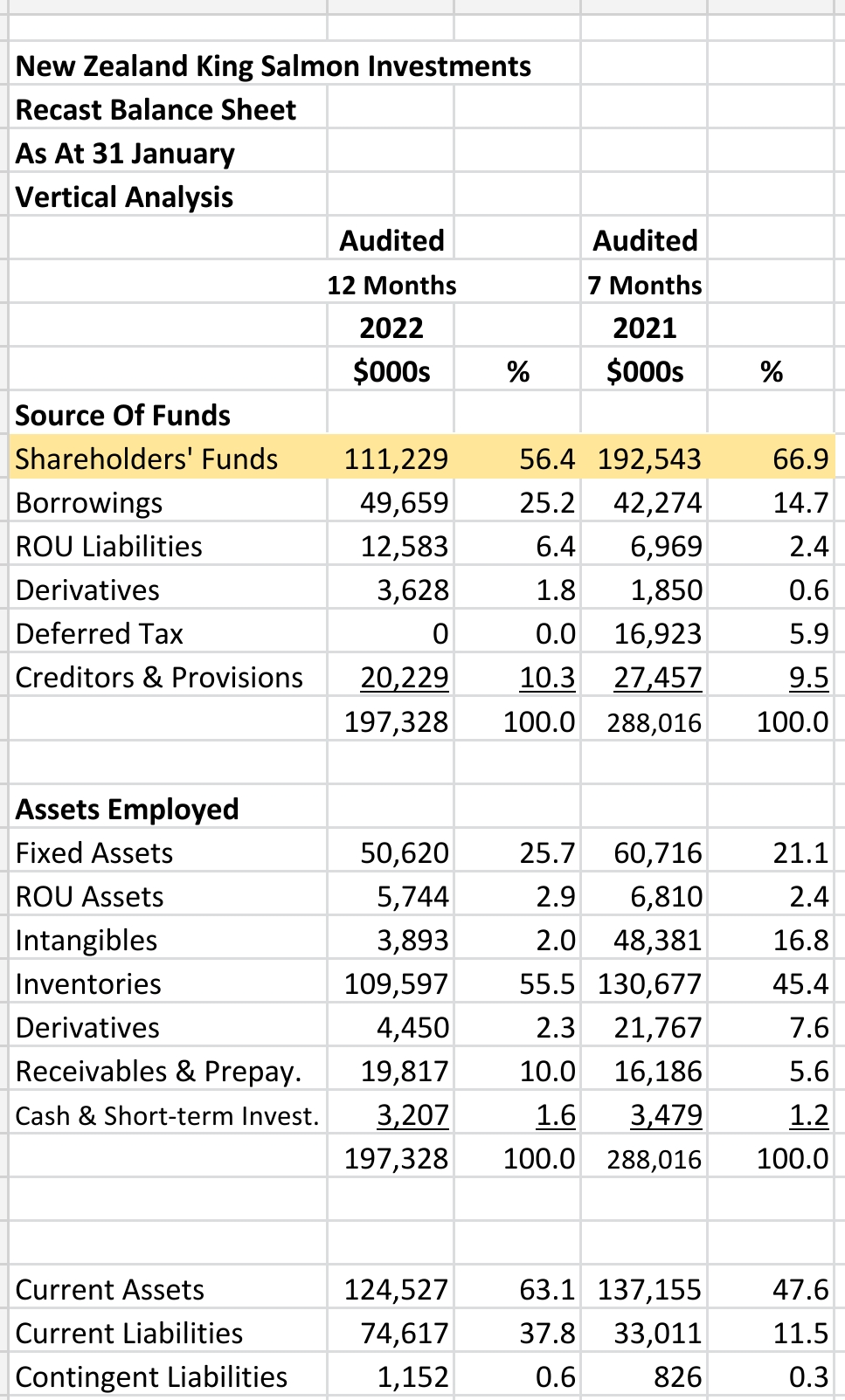

Balance Sheet

Key Points:

42.2% loss of shareholders' wealth in seven months to $111.2 mn

17.5% increase in borrowings to $49.7 mn

ROU liabilities up 80.6% to $12.6 mn

Fixed assets down 16.6% to $50.6 mn

Intangibles down 92.0% to $3.9 mn

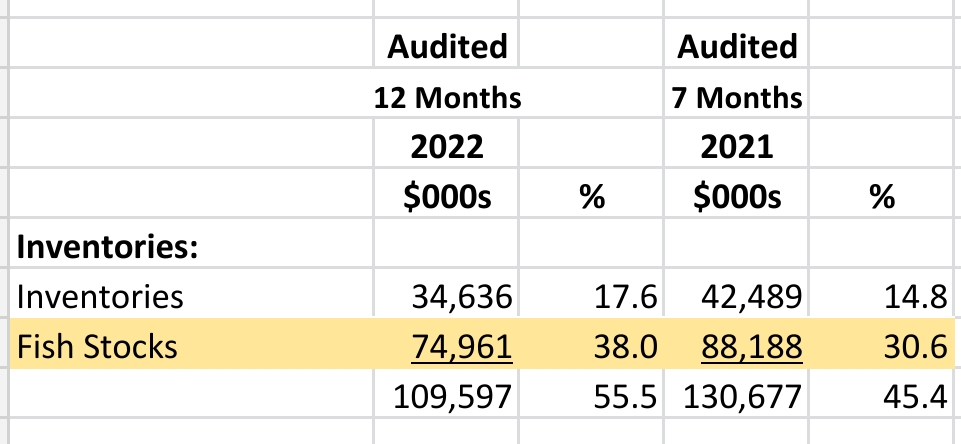

Inventories down 16.1% to $109.6 mn

126.0% increase in current liabilities as $49.7 mn of borrowings become due within 12 months

Fish stocks down 15.0% to $75.0 mn

Horizontal Analysis:

Vertical Analysis:

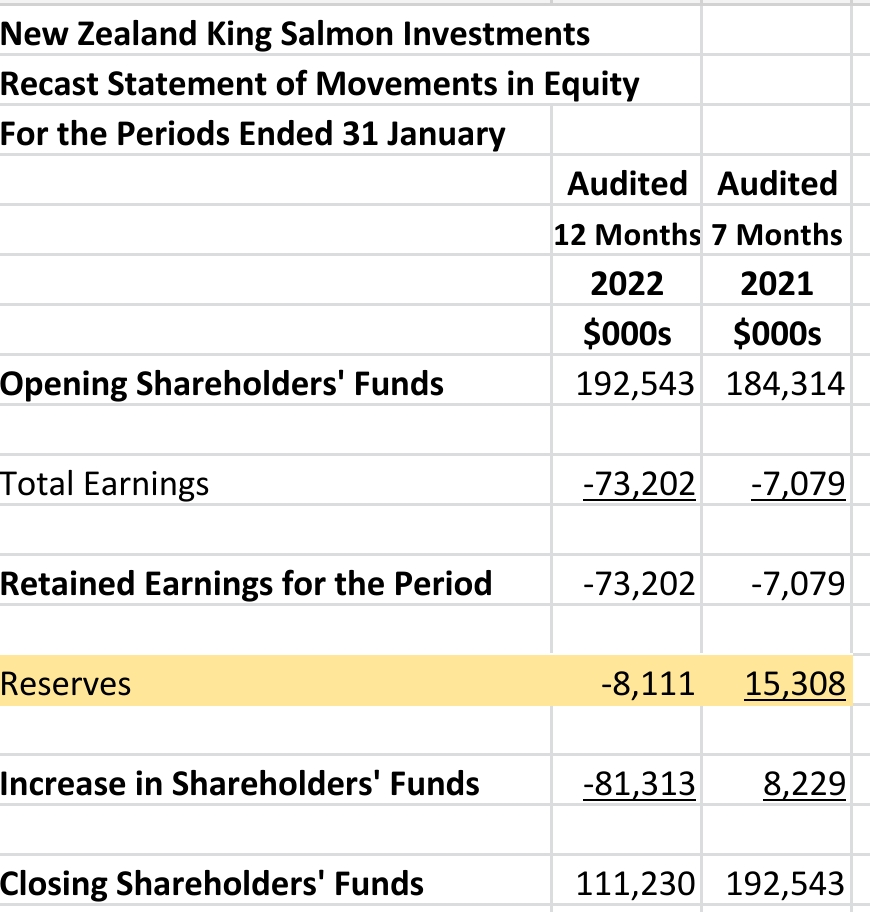

Movements in Equity

Key Points:

$8.5 mn loss (unrealised) sitting in the cash flow hedge reserve

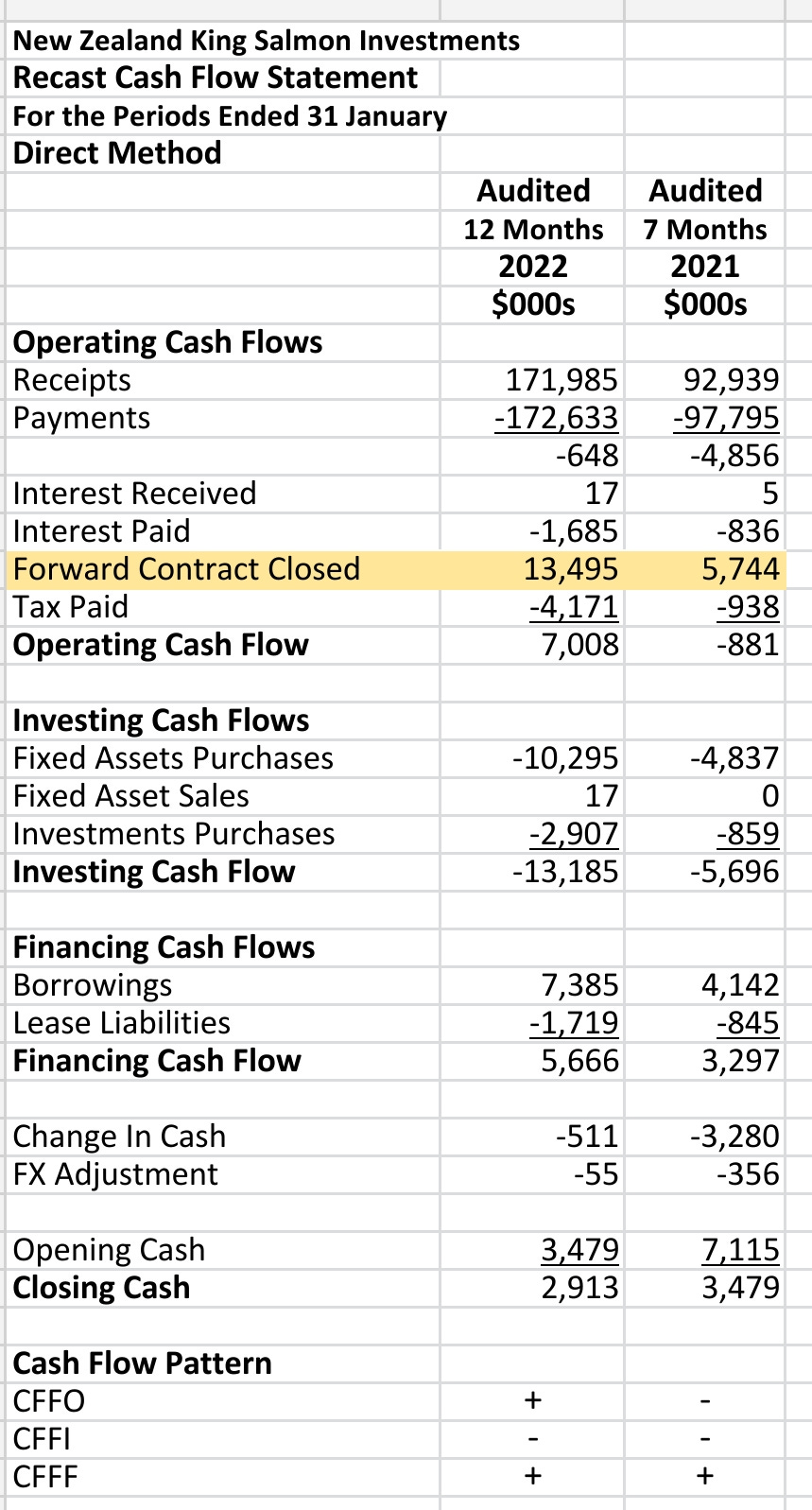

Cash Flows

Key Points:

Forward cover contract terminated early for $13.5 mn saves operating cash flow

Positive operating cash flow of $7.0 mn thanks to forward contract closure

-$13.2 mn of net investing cash flow

$5.7 mn of net financing cash flow

$2.9 mn of cash on hand at balance date

The forward cover early closure item occurs in both periods; $13.5 mn and $5.7 mn in the latest and prior periods respectively.

These are not insignificant amounts.

We don't understand these transactions except to say that it bails out CFFO in the latest period and nearly does the same in the prior period.

Do these closures put the company at risk with regard to the hedged items (currencies?) or not? Or is another type of hedging substituted?

The cash flow pattern shows a company borrowing to invest, mainly in fixed assets.

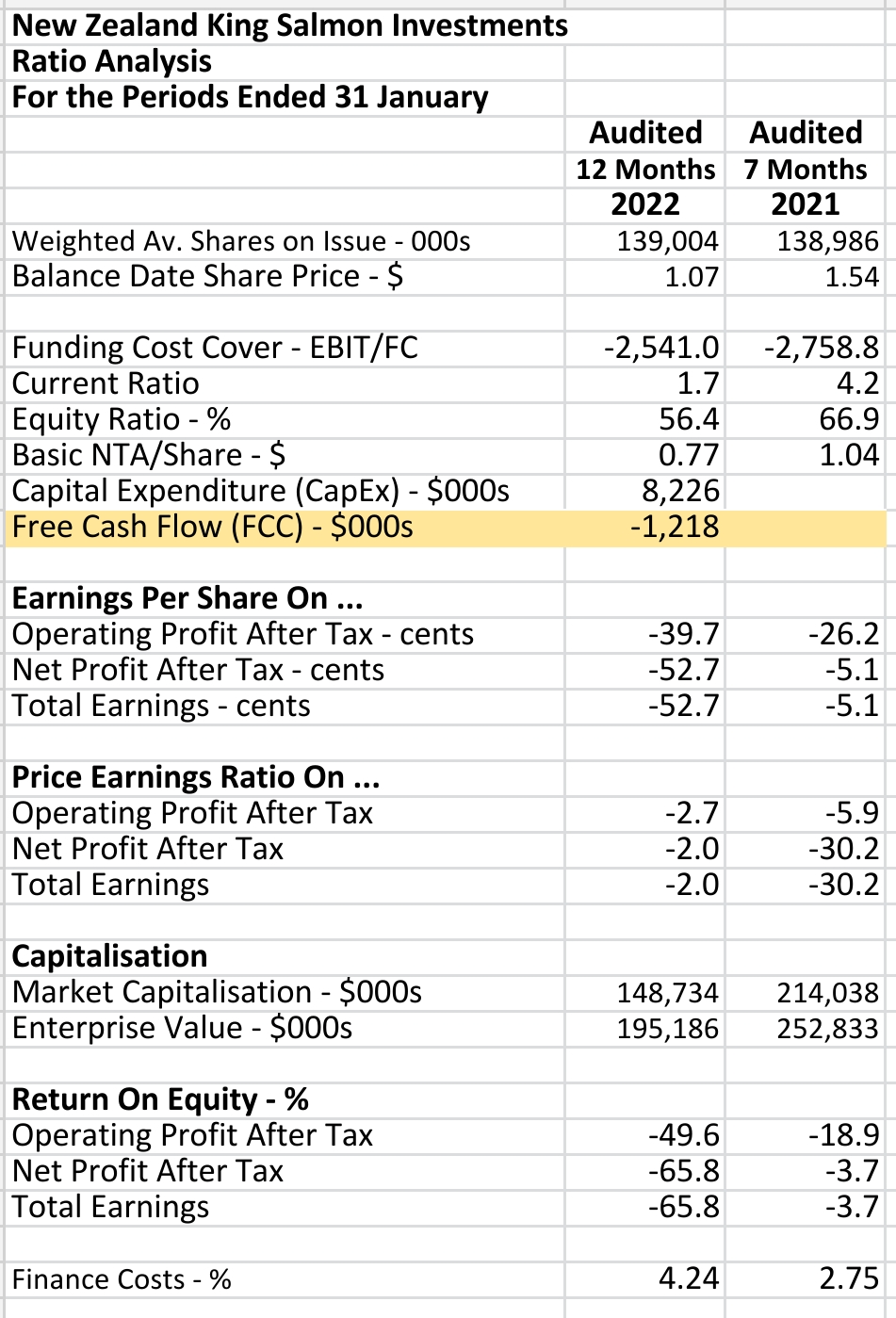

Ratios

Key Points:

Equity Ratio of 56.4%

CapEx of $8.2 mn

Free cash flow of -$1.2 mn

Large negative funding cost cover

Negative EPS of 52.7 cents on total earnings

The negative free cash flow of $1.2 mn shows the company cannot generate cash above its PPE requirements in the latest period.

As borrowings have moved from long-term to current assets the current ratio has declined to 1.7 times.

Segments

Key Points:

No EBIT data supplied so no segment returns can be calculated

Whole fish is 50.7% of the business

Ora King and Regal most important brands at 35.2% and 19.4% respectively of business

New Zealand and North America are the most important markets

Rights Issue

The rights issue whether taken up by shareholders or the underwriters is for $60.1 mn on a 2.85:1 basis at 15 cents.

Is this amount enough?

The interest bearing debt falling due within 12 months is $49.7 mn. And the balance presumably will be added to cash (what the offeror calls liquidity).

The cost of building the Blue Endeavour project will be in the tens of millions.

The current equity ratio does leave some room for further borrowing but lenders will need to see some restored profitability.

Blue Endeavour

Blue Endeavour project is the hope of the company.

It is currently fallowing some of its inshore farms.

Inshore farms will be used in whole or in part in the early stages of raising fish.

The following video animates the venture impressively:

It's easy to become excited by such a significant project presented in such a compelling way.

But the project is not yet approved and the company is hoping for a mid-2022 approval.

There are also the few years it will take to build.

It will operate in cooler waters where fish deaths should be lower.

The currents should produce healthier fish also as the cages are constantly cleaned out.

Normally, we would like to put together some pro forma forecast statements but the required information is not available.

Summary

NZK is a company at the crossroads.

We suspect rising debt (there are maturing borrowings) and losses made the banks worried despite the sound equity ratio.

So, in order to survive it must raise cash from the market.

It’s had major difficulties with its inshore fish farming operations as the result of higher sea temperatures.

A large number of fish died.

The company states that the higher temperatures are due to climate change.

It's also been affected by much higher freight rates on its products. Supply chains have obviously been stressed by the Covid period.

Now the company is looking to its deeper-sea Blue Endeavour project to take it in a more reliable and profitable direction.

The company is low in cash.

At the gross profit level it's losing large sums of money (with fair value gains in biological assets removed).

As we have discovered putting unrealised biological asset fair value gains above the gross profit line item is fraught with nasty potential consequences.

Moving these unrealised gains further down the revenue statement gives a different measure of profitability by separating out the risky earnings from the real earnings.

To the company's credit it has taken some very large unrealised impairments in advance of its capital raising.

It also has a solid equity ratio.

The success of the Blue Endeavour project requires government approval which will hopefully come by mid-2022.

It would have had an easier time raising capital had this approval already happened.

Secondly, it requires a few years to complete the project. There are risks that come with that which unfortunately, we are not qualified to judge.

There's no dividend and there's unlikely to be one for a few more years

… but only if the Blue Endeavour project is successful.