N.B.: All amounts are in NZ$ unless otherwise stated.

Date

8th September, 2023

Share Price

$0.80

Key Points

Dividend of 3.0 cps declared

Total earnings up at $13.2m

Sales up 34.5%

EBIT $31.4m

Basic interim earnings per share of 1.9 cents

Adjusted net operating cash flow of -$11.8m

NPAT up to $13.2m from a loss in the pcp

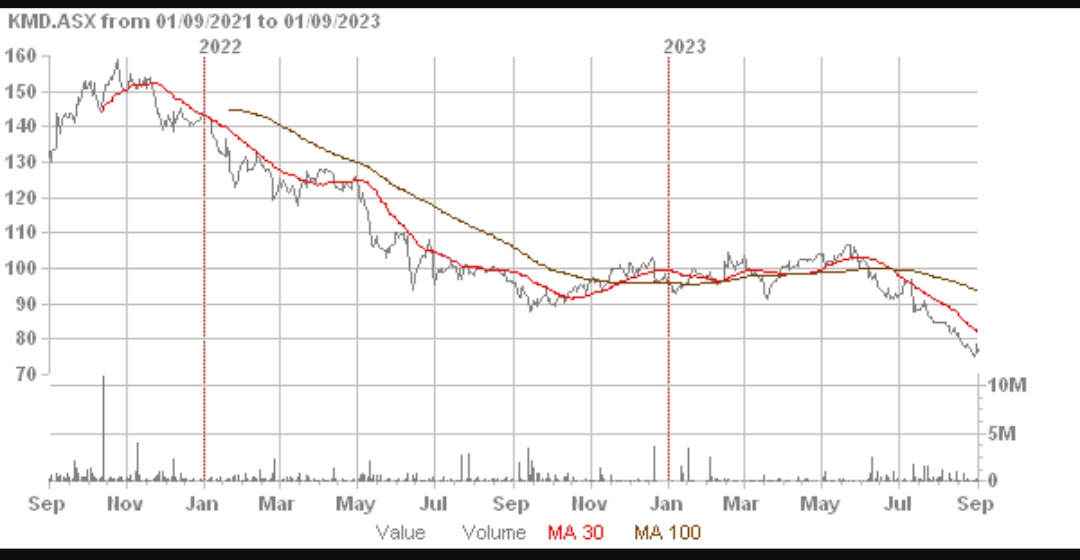

Trading History

Recently the KMD share price has been on a downward trend from over NZ$ 1.10 in early June to the current NZ$ 0.81 representing a decline of over 24%.

NZX:

Source: Direct Broking

ASX:

Source: Direct Broking

Overvew

Apologies for this tardy coverage of the KMD HY23 financial statements. The annual result for the company is due shortly and will be discussed later in a more timely way.

The company’s situation is not dissimilar to the pcp’s with respect to its poor operating cash flows.

The company published its financial highlights for the interim period; the six months ending 31st January, 2023.

and key highlights:

They drew attention to the large sales increase and the large increase in the EBITDA figure. Highlighting EBITDA is often a warning that the real performance of the company might not be good.

The difficulties with cash flow were highlighted in a previous update. The company takes advantage of accounting rules which allow lease principal payments to be listed under financing cash flow.

This practice distorts the statement of cash flows and produces a better net operating cash flow figure than would otherwise be the case.

High-low Pricing Model

A high-low pricing model is referenced in the Directors’ Report.

In this model a product is introduced at a certain price, and then gradually discounted and marked down as demand for the product decreases.

However, it appears this strategy is not being used currently, at least by Kathmandu.

Inventory Unwind

The company stated that there will be an inventory ‘unwind’ in 2HY23 which will improve the cash flow situation. They stated the ‘unwind’ will reduce inventories to $270m to $280m. The inventory at balance date HY23 was $319m implying an 'unwind’ of $39m-$49m which will translate to better net operating cash flow as inventory purchase payments will be reduced.

Dividends

The company paid out $21.3m in dividends in the HY23 period. This was more than the profit and plunged the company’s recast net operating cash flow even further into negative territory (using our method of including dividends under operating cash flow).

Foreign Currency Translation Reserve

The foreign currency translation reserve recorded a $12.6m write-down. This is a non-cash item and results from the adjustment of foreign operations’ values which change in light of movements in foreign currencies against the NZ$.

Recast Revenue Statement

The revenue statement didn’t need recasting as there were no unrealised or extraordinary items either for the current period or in the previous two interim periods.

The gross margin was up at 58.7% but down on the 2021 interim period’s gross margin of 59.0%.

Earnings before interest and tax (EBIT) improved to $31.4m from the pcp’s $0.9m. The HY23 figure is still significantly lower than in (Covid-affected) 2021 though.

Funding costs were nearly double the pcp’s at $10.2m. Funding cost cover of 3.08 times is adequate but not exceptional especially with increasing interest rates.

Both operating profit after tax and total earnings for the year were $13.2m.

Basic earnings per share were 1.9 cents per share while diluted EPS was 1.8 cents per share. This is not very good for an interim period although it was up on the pcp’s EPS but lower the 2021’s figure of 3.1 cents per share.

Recast Balance Sheet

Intangibles make up a large percentage of the total assets. They are $704.8m while shareholders’ funds total $822.1m.

The equity ratio is 52.4% which looks good but must be considered in light of the very large intangibles figure.

There has been no impairment of intangibles in the current period. The company is coming out of an atypical trading period but if earnings do not increase significantly and quickly possible impairments to intangible assets must be considered.

The large increase in borrowings is important and some of this was used to cover the dividend payment(s). Interest bearing debt was up 59.6% to $170.5m. Both current and term lease liabilities also had (smaller) percentage increases.

Recast Movements in Shareholders’ Equity

Shareholders’ equity was higher than the pcp’s but when compared to the latest full year, FY22 a large drop in shareholders’ funds from $850.5m to $822.1m occurred.

Recast Cash Flow Statement

Recast net operating cash flow was poor. When principal payments on lease liabilities are moved from financing cash flows to operating cash flows the net operating cash flow is -$11.8m.

A significant dividend was also paid out during the current period and this, if added to net operating cash flow under our reclassification system, produces a very poor operating cash flow of -$33.8m.

The overall cash flow situation was improved through borrowings which were a net $65.0m. Capex was $14.8m which left $50.2m for funding the negative operating cash flow and paying the dividend(s).

The company may have drawn attention to its planned inventory ‘unwind’ after the interim balance date in an effort to assuage investors’ cash flow concerns.

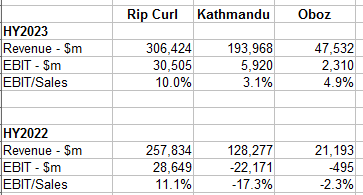

Segmental Information

In HY23 there was a turnaround in earnings at Kathmandu and Oboz both of which had negative EBITs in the pcp.

Rip Curl’s EBIT declined as a percentage of its sales.

Summary

The company had a strong growth in sales in HY23 but this did not translate to significant profits although it was a turnaround from the pcp’s loss.

The company's share price has been going down recently but this didn't start in earnest until well after the current period’s results were released.

The interim results were released on 22nd March, 2023. There was an immediately fall in the share price which quickly recovered to where it had been trading previously. The current share price decline began in early June.

There is likely to be some negative information, not yet publicly available, in this month’s annual results due on the 20th.

Perhaps there will be a dividend reduction if the net operating cash flow does not improve markedly. There will need to be meaningful improvements in profitability for the higher 2023 trading levels to be visited again.

When the FY23 results are released in a few weeks we will post a fuller analysis of the company from the more comprehensive information contained in the Annual Report for 2023.