Key Positives:

Very profitable with high returns

Excellent operating cash flows

Reasonable dividends

Increased inventories in anticipation of supply chains' disruptions

Key Negatives:

Reserves hide large write-down in equity investment in KMD Brands in prior year

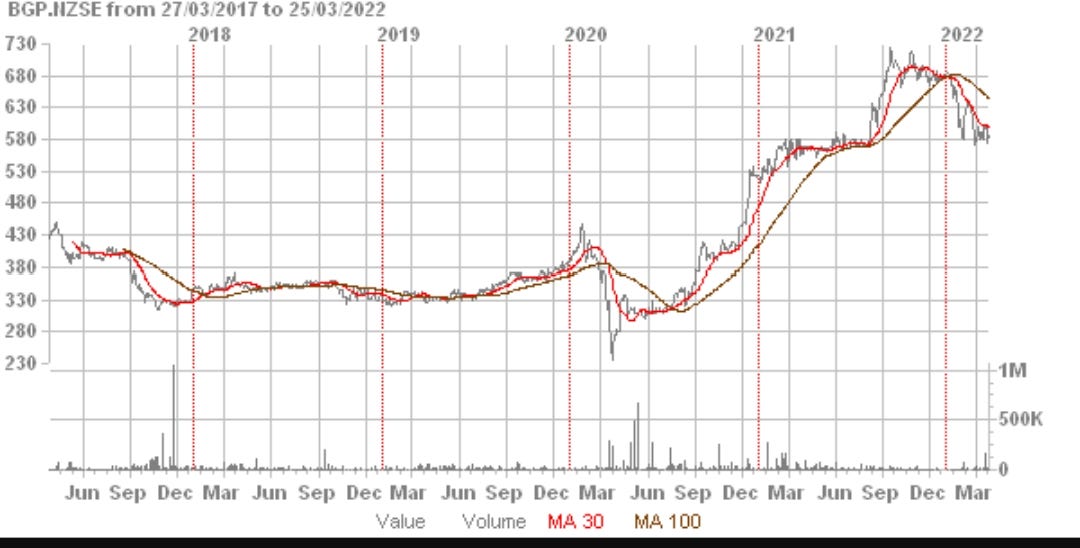

Five year trading history:

Source: Direct Broking

Overview

Briscoes Group trades on both the NZX and ASX under the code BGP.

As one of New Zealand's best public companies it has done well through the Covid period.

Recent extraordinarily easy central bank policies resulted in a property boom without precedent. Naturally homeware, the core business of BGP, was one of the beneficiaries of these policies.

Capital gains have given people the wherewithal for home improvement and lots of new home construction was also beneficial.

The outlook however is now a little cloudy. Interest rates are rising although slowly. New home construction continues apace but is somewhat mitigated by supply chain problems with construction materials.

However, generally the New Zealand economy is quite strong; the legacy of central bank stimulation.

It is, of course, impossible to know what lies ahead given the rising inflation, supply chain problems, Ukrainian war and rising interest rates.

The company's financial statements are unusual in that they reflect non-identical periods.

The prior period covers 53 weeks ending 31 January, 2021 while the latest period covers 52 weeks ending on 30 January, 2022.

Usually odd changes like these are taken to either capture or exclude some material revenues or expenditures.

The reason is usually either to improve profits (on which bonuses are calculated) or to smooth profits (for the benefit of investors who like to see steadily increasing numbers).

However, in this case the odd accounting periods are traditional and occur from time to time for some New Zealand retail companies.

It just makes comparisons from period to period a little harder.

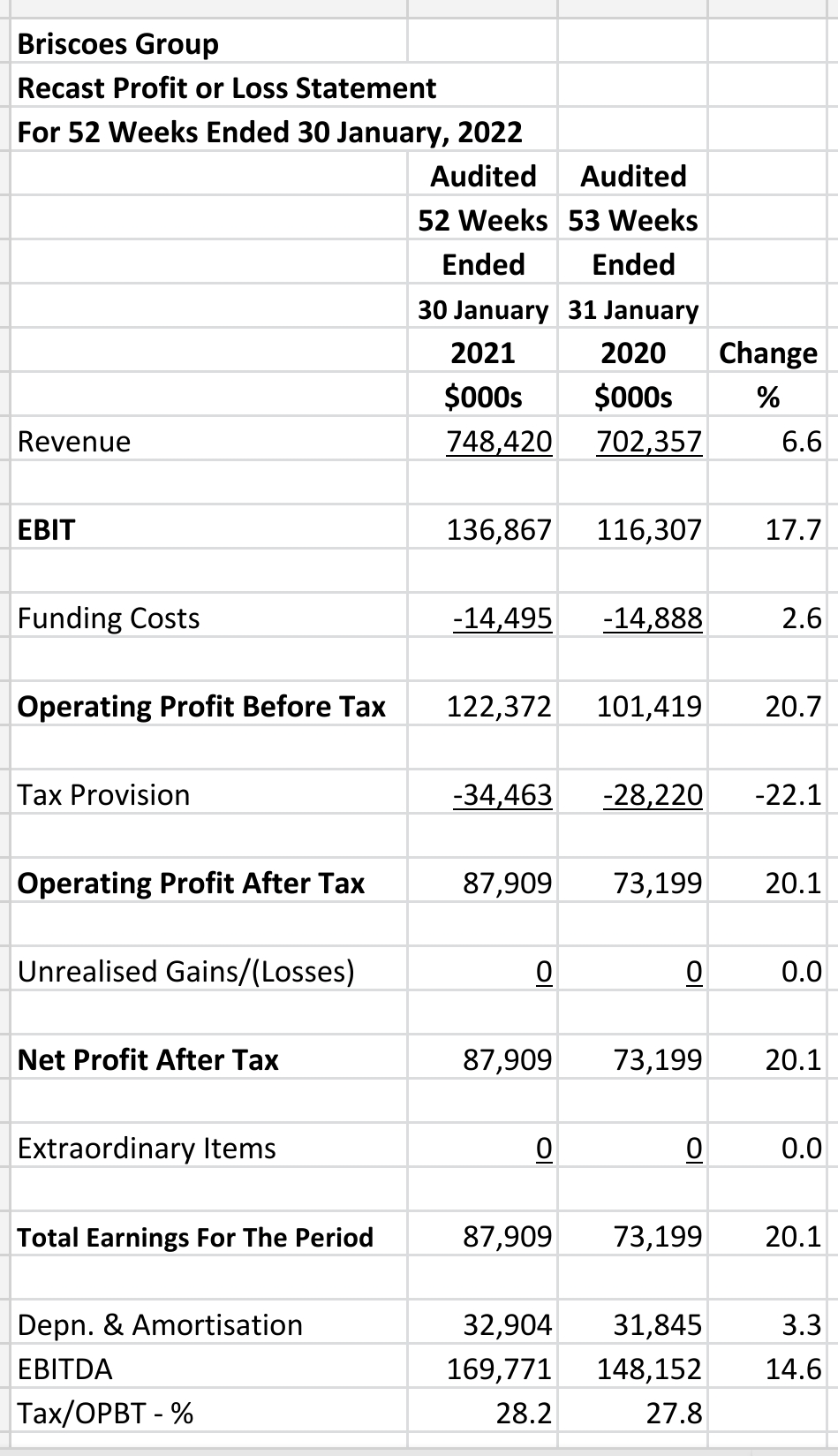

Recast Revenue Statement

Essentials:

Total earnings up by 20.1% to $87.9 mn on the company reported revenue statement

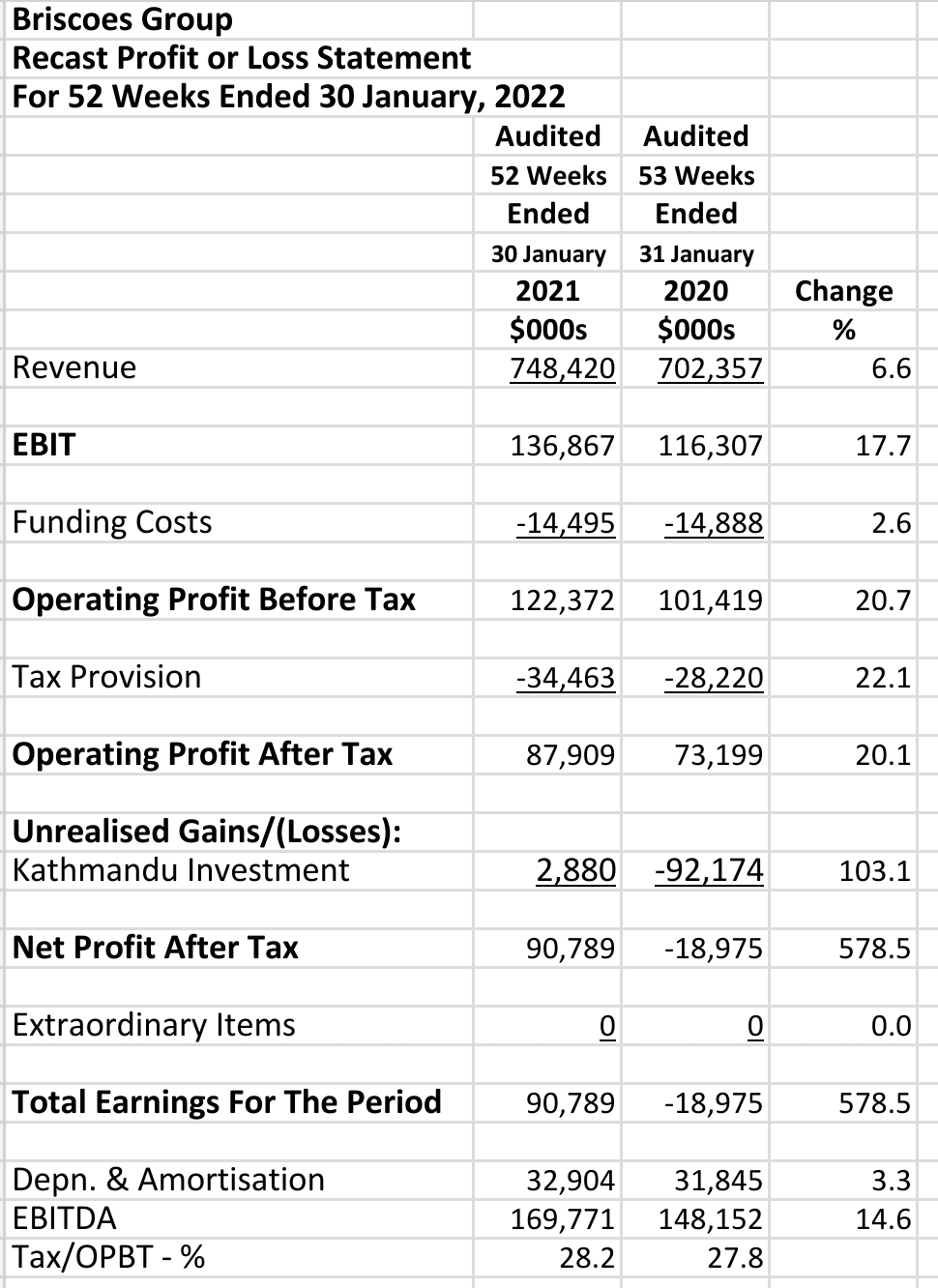

Total earnings in prior period a loss of $19.0 mn if unrealised investment losses included

Total earnings in current period $90.8 mn if unrealised investment gains included

Company Reported Total Earnings:

The revenue statement for the prior period of 53 weeks was noticeable for the absence of what would have been an unrealised loss on BGP's investment in the company known at that time as Kathmandu.

The unrealised loss on this investment of $92.2 mn was nicely tucked away in the reserves.

In fairness, a much smaller gain of $2.9 mn for the latest period was also put through reserves when, if it had appeared in the revenue statement, it would have put the company over $90 mn in total earnings for the year.

The taxation provisions in both periods were around 28% indicating that a minimum of tax minimisation hocus pocus was employed.

Revenue Statement with KMD Brands Unrealised Gains:

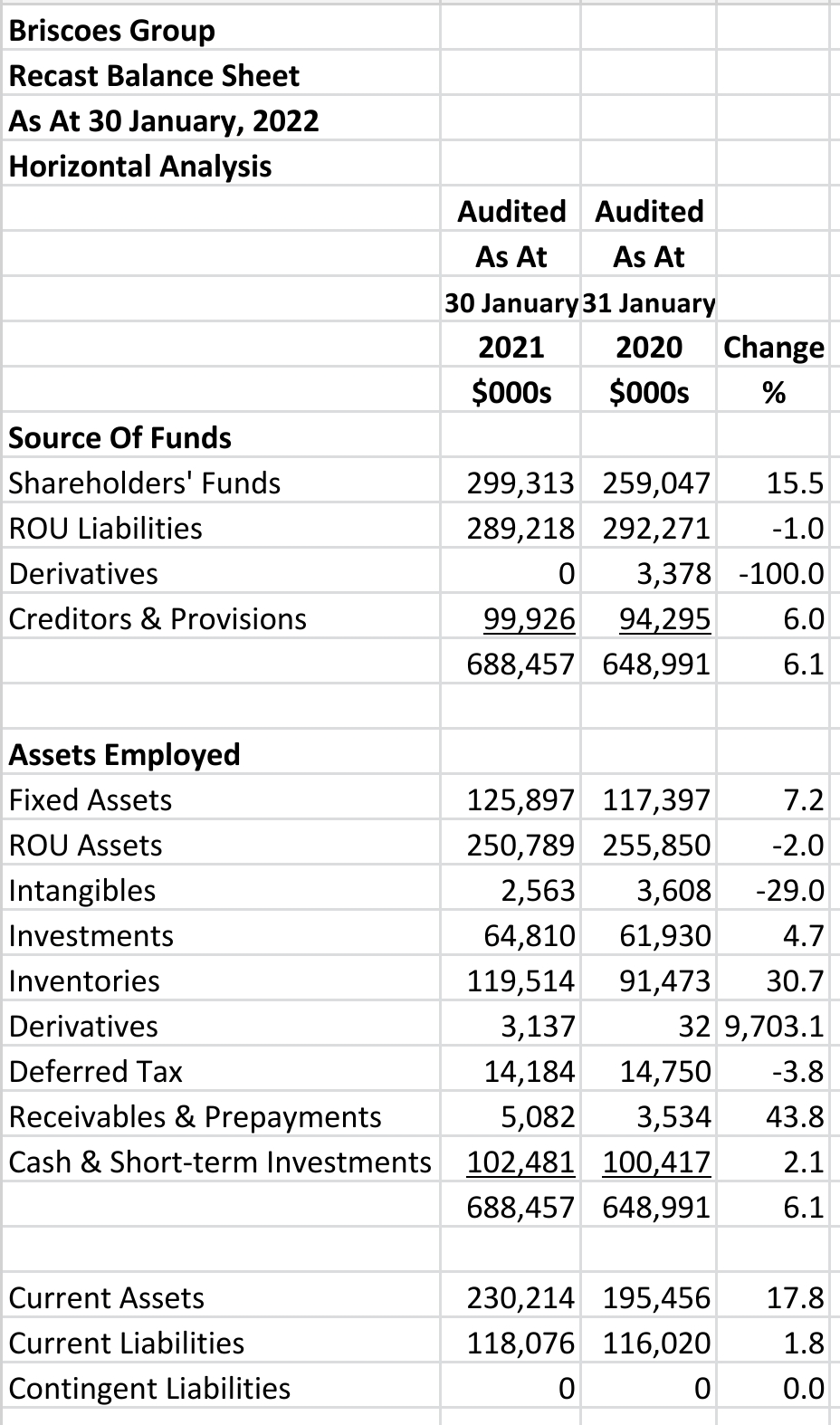

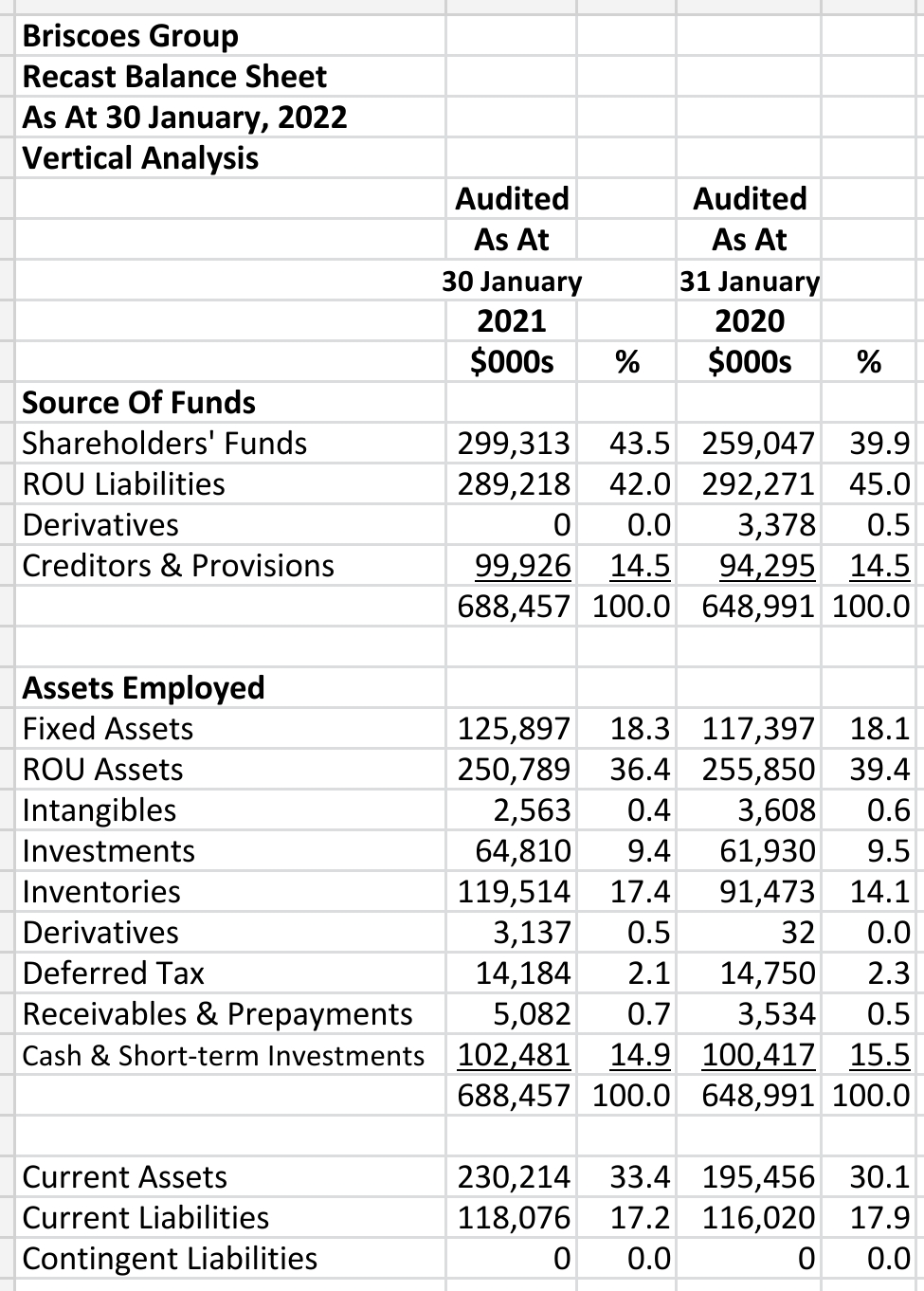

Recast Balance Sheet

Essentials:

Shareholders' funds up by 15.5% to $299.3 mn

No contingent liabilities

High level of payables compared to receivables

30.7% increase in inventories to $119.5 mn

Highly liquid with $102.5 mn in cash and short-term investments

Horizontal Analysis:

Vertical Analysis:

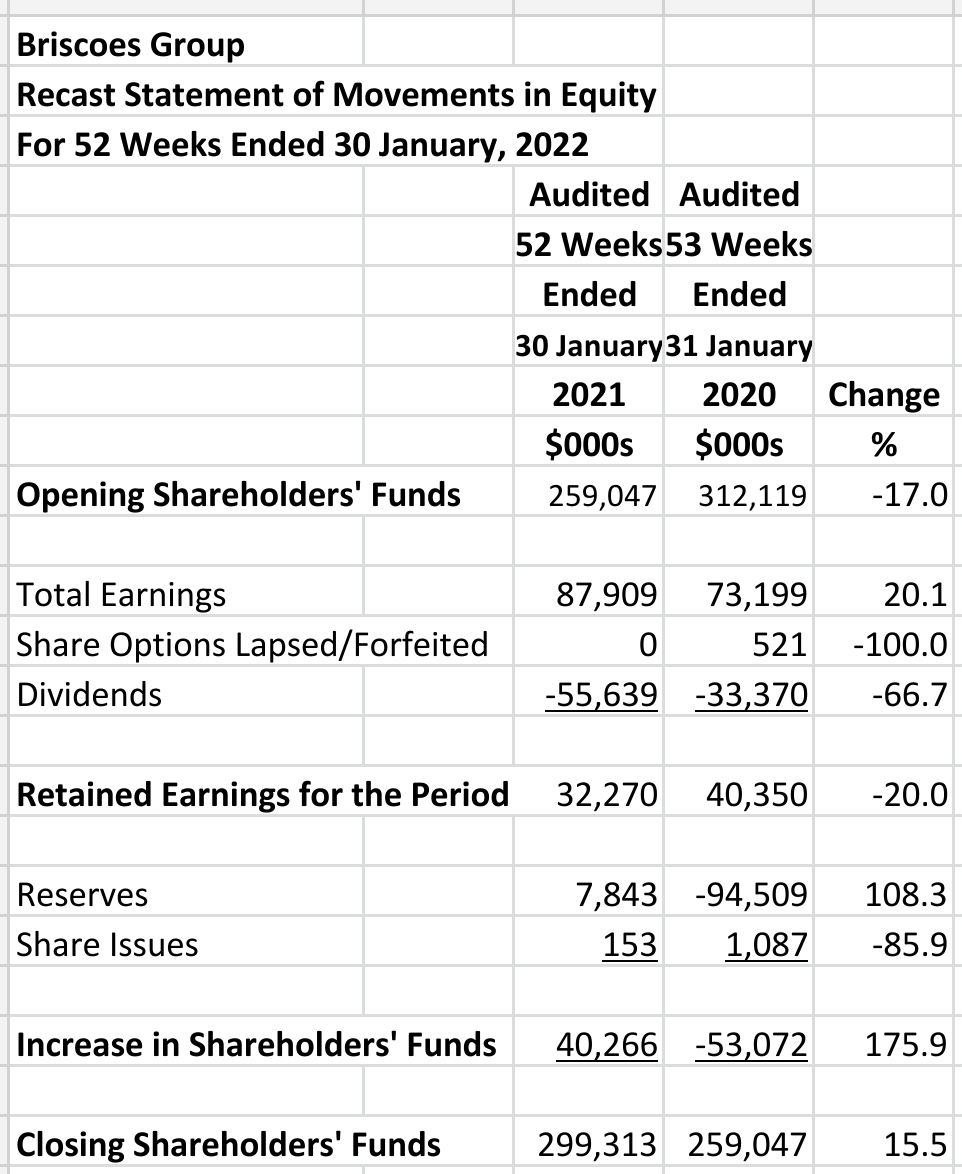

Recast Movements in Shareholders' Equity

Essentials:

$92.2 mn unrealised loss through reserves in prior year

Small unrealised gain on investments in latest year

The massive unrealised loss of $92.2 mn on the company's investment in Kathmandu (now KMD Brands) in the prior period is hidden in the reserves.

In the latest period a $2.9 mn gain is placed in the same reserve account.

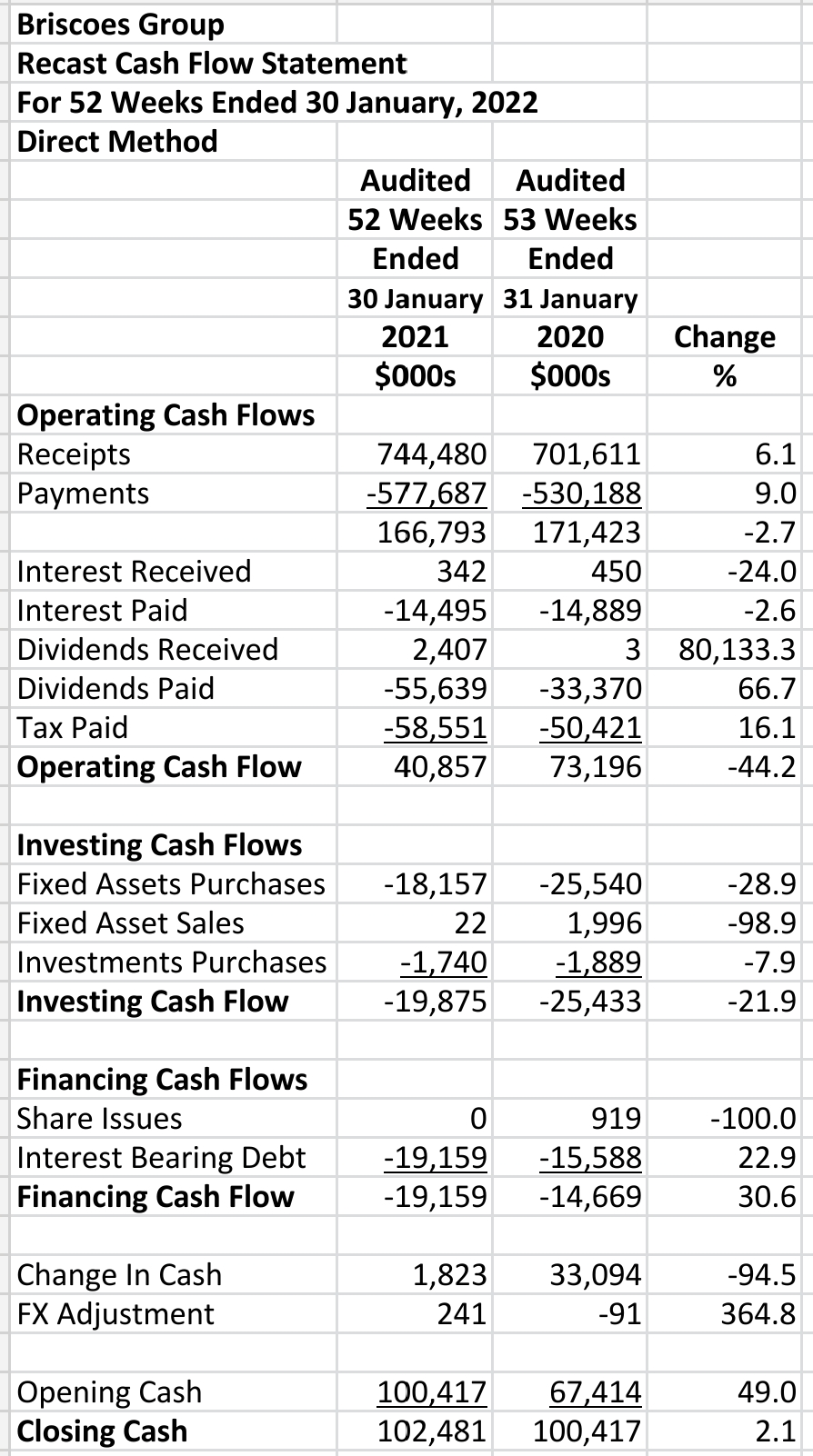

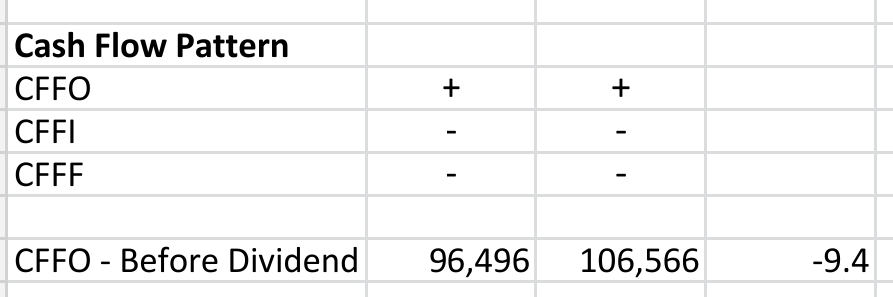

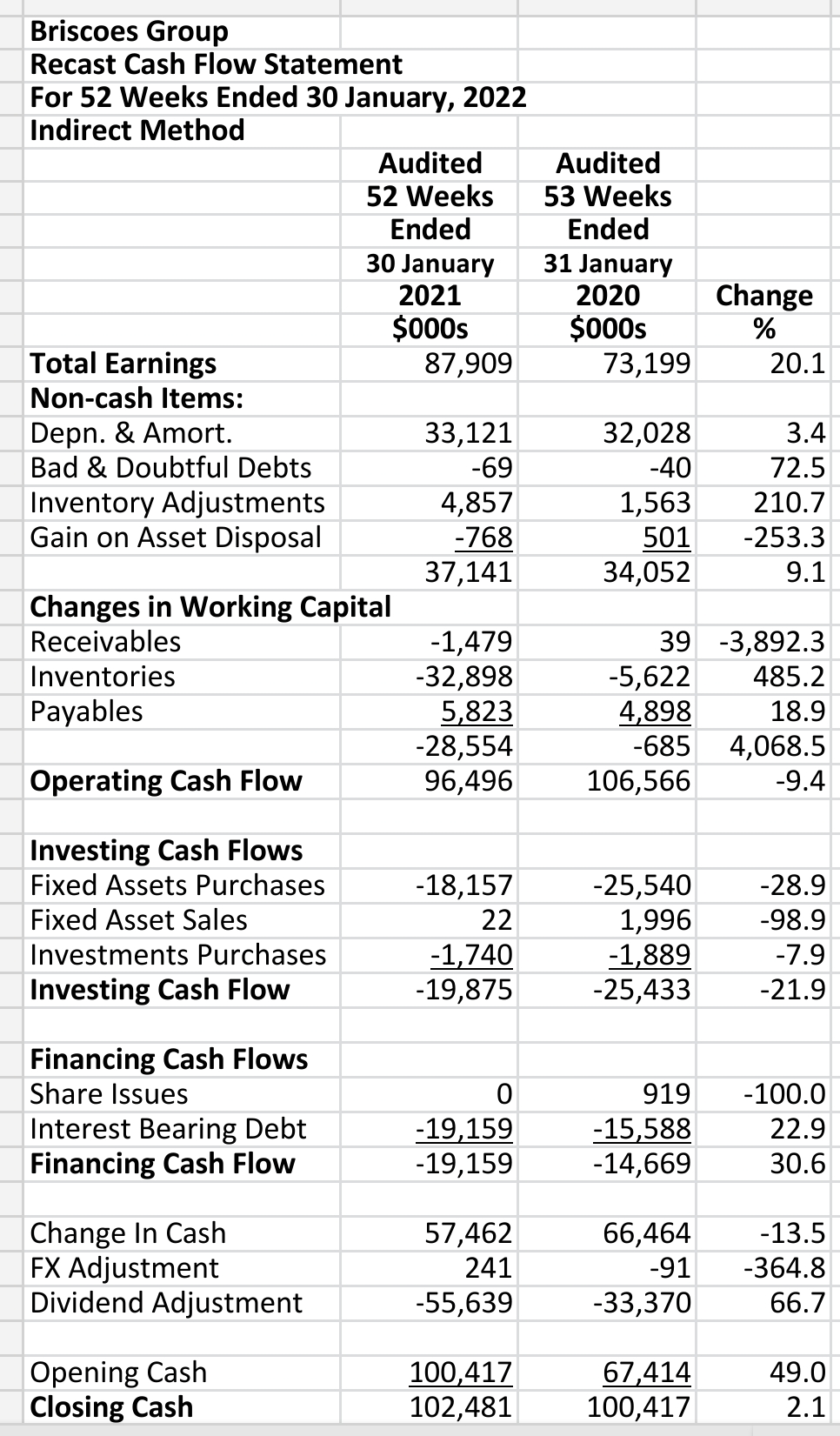

Recast Cash Flow Statement

Essentials:

Strong operating cash flows

The larger dividend reduced operating cash flow (we put dividends in cash flow from operations (CFFO))

Good cash flow pattern

Direct Method:

Indirect Method:

Cash changes with ROU liabilities are included under interest bearing debt.

The dividend adjustment is made in the indirect method because unlike the direct method it can't be included in CFFO.

The cash flow pattern is good with positive cash flows from operations used for financing and investing activities.

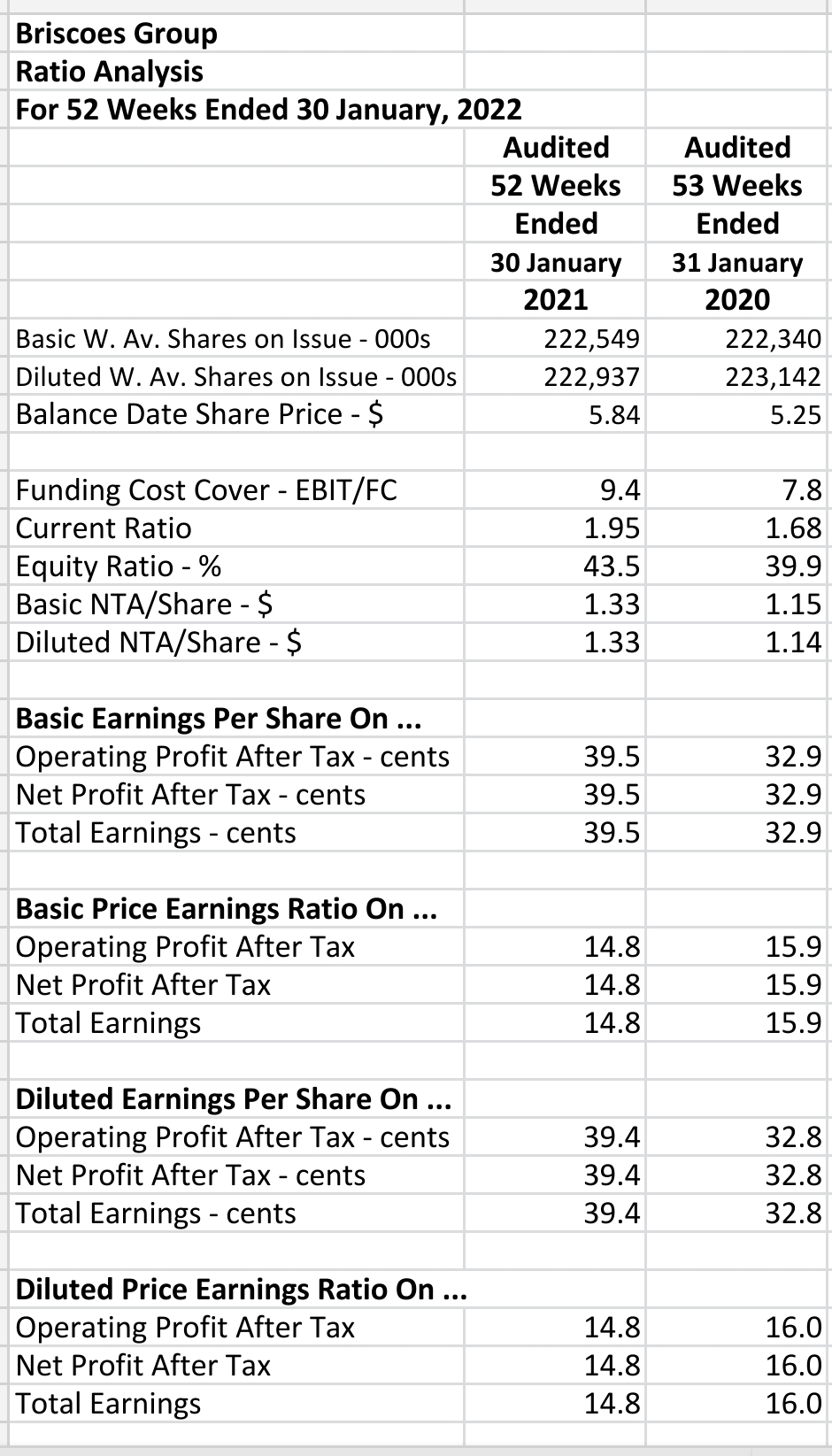

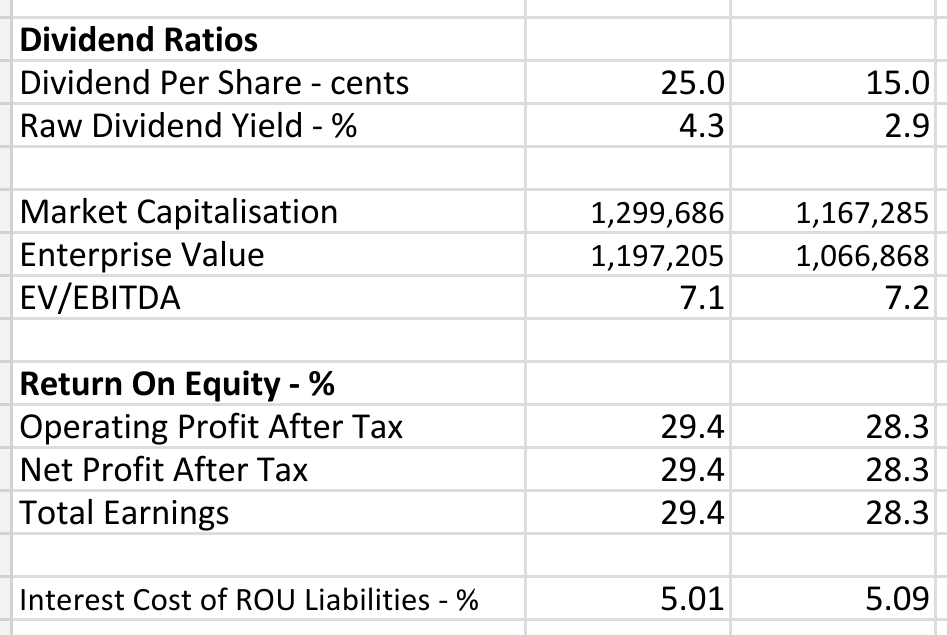

Ratio Analysis

Essentials:

Adequate equity ratio of 43.5%

Latest historical P/E ratio around 14.8 on balance date share price

Excellent funding cost cover of 9.4 times

Earnings around 39.5 cents per share

Very high returns on equity

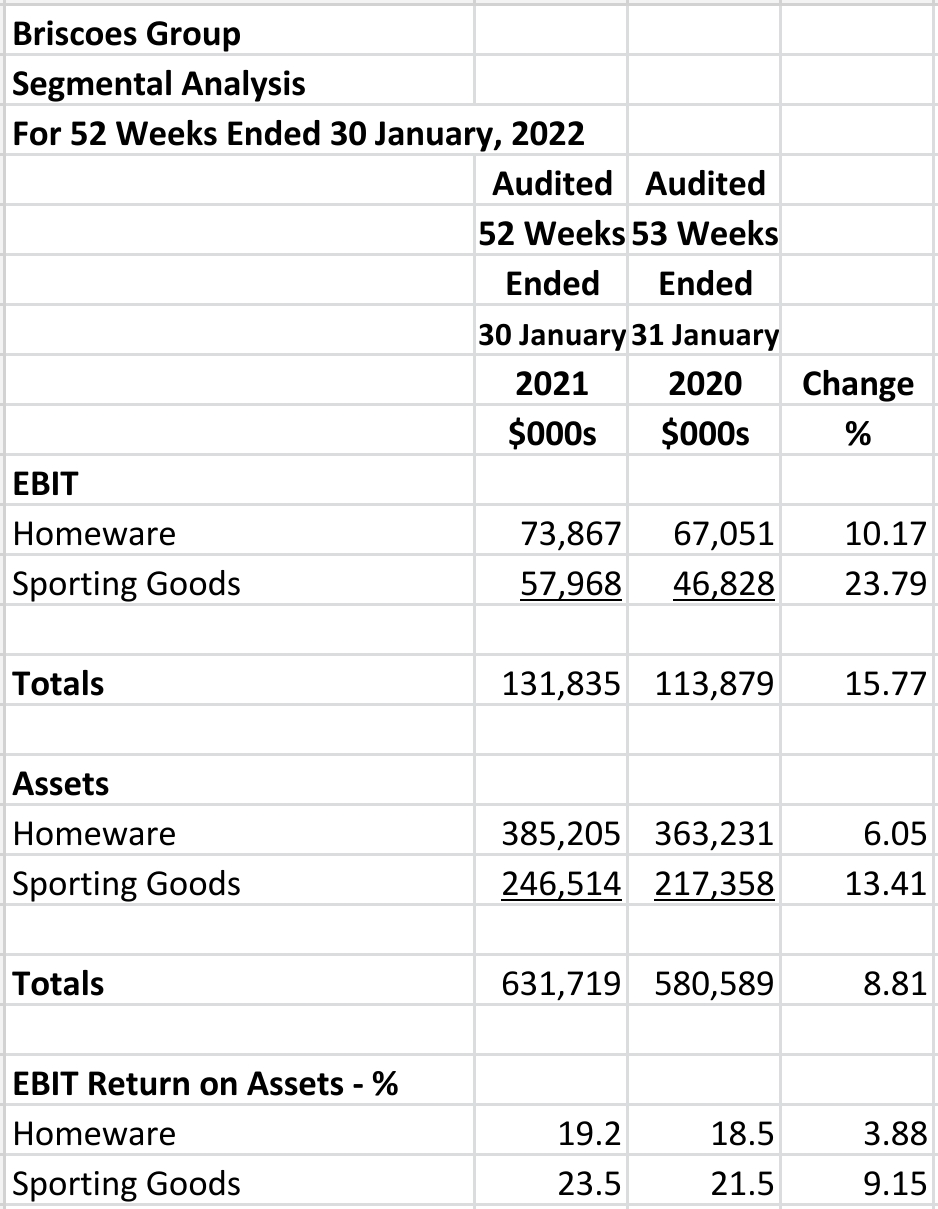

Segmental Analysis

Essentials:

Homeware the biggest EBIT earner but sporting goods growing faster

Sporting goods has the highest EBIT returns on assets percentage

Forecast

There is no doubt that the property market is cooling off which will reduce demand for homewares.

The are still many houses being built however.

There are unlikely to be massive write-downs as occurred with the then Kathmandu investment in the 2021 period unless there is a major market correction.

In fact, there may be significant unrealised investment gains if KMD Brands performs well.

Sporting activity is increasing with the restarts of schools, universities and senior competitions. This will obviously benefit the Rebel Sports’ division.

Summary

The company is one of the best in the New Zealand stock exchange.

It has high profits, high returns on equity, no interest bearing debt (but significant ROU assets), large positive operating cash flows and it pays out a significant portion of its profits in dividends.

It should continue to perform well as one of the financially top tier stocks on the New Zealand Stock Exchange.