Photo by Nathan Waters on Unsplash

Key Points

Adequate equity

Sound balance sheet

Good profits

Successful restructure

Low operating cash flow (after dividends)

Source: Direct Broking

Recast Revenue Statement

The NZ media trumpeted a 41.3% rise in profits but the reality is not so simple. There were significant items of -$43 mn and -$86 mn in the 6 months ended 31 December, 2021 and 31 December, 2020 respectively. In the current period this item related mainly to a foreign currency translation reserve movement around the Rocla sale.

Net profit after tax provides a clearer picture and this showed a relatively minor 3.4% increase to $214 mn in the current period.

Revenue only nudged up by only 1.9% while EBIT actually fell slightly.

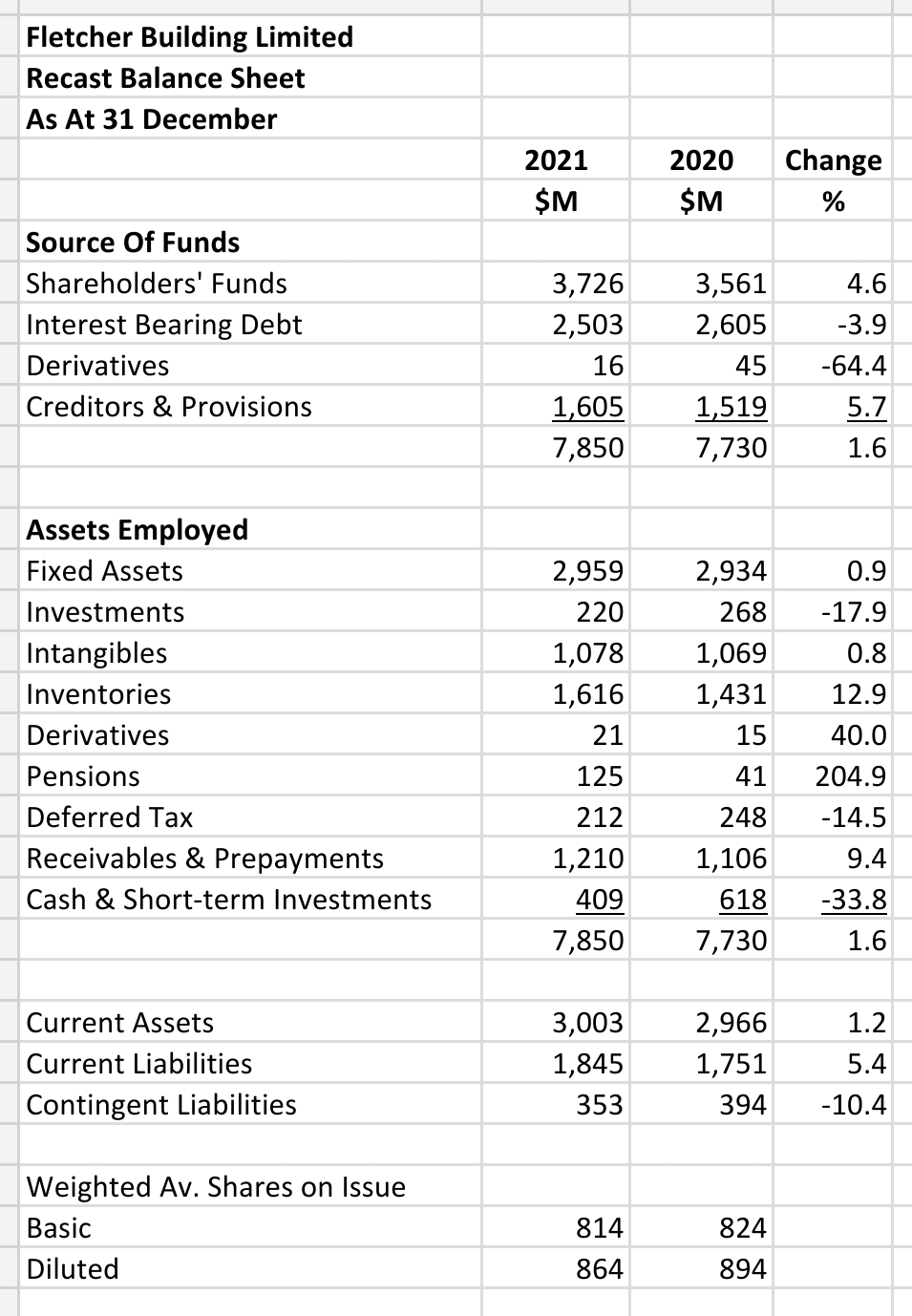

Recast Balance Sheet

Horizontal Analysis:

Shareholders' funds rose by 4.6% period to period (which are not consecutive) while interest bearing debt fell by 3.6%.

Inventories rose by 12.8% while cash on hand and short-term investments fell 33.8% to $409 mn.

Vertical Analysis:

Shareholders' funds to total assets increased period over non-consecutive period from 46.1% to 47.5%.

Recast Movements in Shareholders' Equity

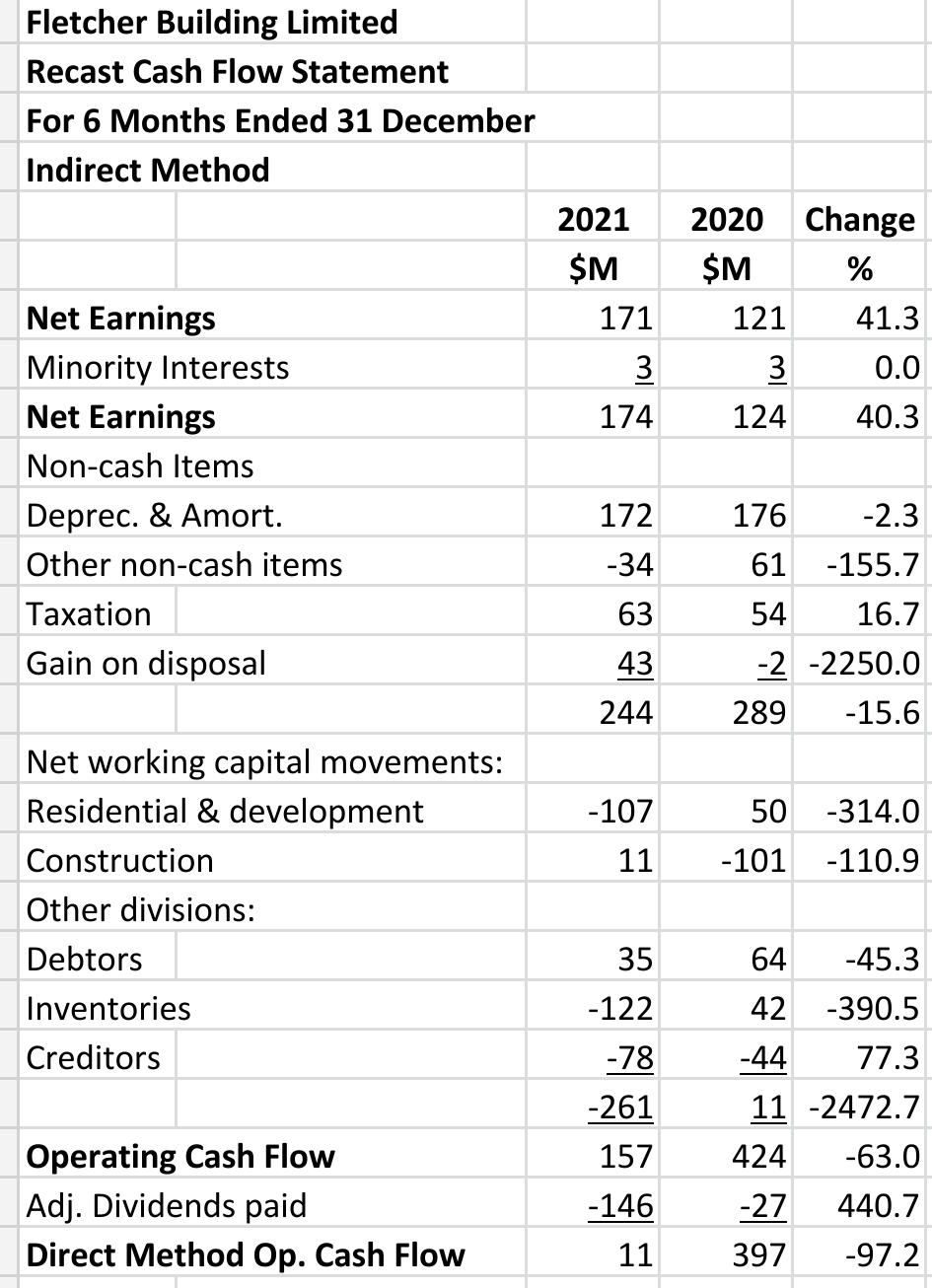

Recast Cash Flow Statement

Direct Method:

In our analysis method dividends are included in operating cash flow because they are a cost of funds and the price paid for equity use.

On that basis operating cash flow was only $11 mn in the current period. In the prior period it was much higher as a much lower dividend was paid.

In addition the difference between receipts and payments was much higher in the prior period.

Indirect Method:

The indirect method cash flow shows a large and very significant decrease in working capital of $261 mn.

There was a net purchases of fixed assets of $140 mn and the net repayment of debt of $79 million.

Ratio Analysis

Funding cost cover was a very high 6.0 in the current period and the current ratio was just acceptable at 1.63.

The equity ratio is ok for a company in these industries at 47.5%.

Basic earnings per share based on total earnings in the current 6 month period are 21.0 cents while based on net profit after tax it is 26.3 cents.

Segmental Analysis

Australia is a poor performer for the company showing only a 3.4% return based on EBIT before significant items and funds employed in the current period.

Returns in New Zealand businesses other than construction are very high however based on EBIT.

Summary

FBU is a very solid company with good profits and adequate equity.

It has come out of the problems it suffered a few years ago because of mispricing in its construction business well.

It seems to struggle in Australia though.