Photo by Jue Huang on Unsplash

Note

This was a relatively frustrating analysis. Quite a few ratios couldn't be calculated as the balance sheet prior period balance date (30 June, 2021) was not the same as the other statements' common balance date (31 December, 2020).

This was due to an accounting change related to cloud computing. The treatments of capitalisation for 'configuration and customisation costs' for cloud computing required the restatement of items.

Also the balance sheet horizontal analysis relates to a different base period than the other financial statements.

Key Points

Losing money in its core business with its current debt. Operating profit after tax is -$4.7 mn

Unrealised property revaluations of $131.5 mn create overall profit

Tax credit of $15.5 mn

Equity investment losses of $17.4 mn

Strong equity ratio at 81.5%

Positive operating cash flow of $25.8 mn

Weak current ratio of 0.2

Doesn't cover funding costs with EBIT. Funding cost cover only 0.2

Source: Direct Broking

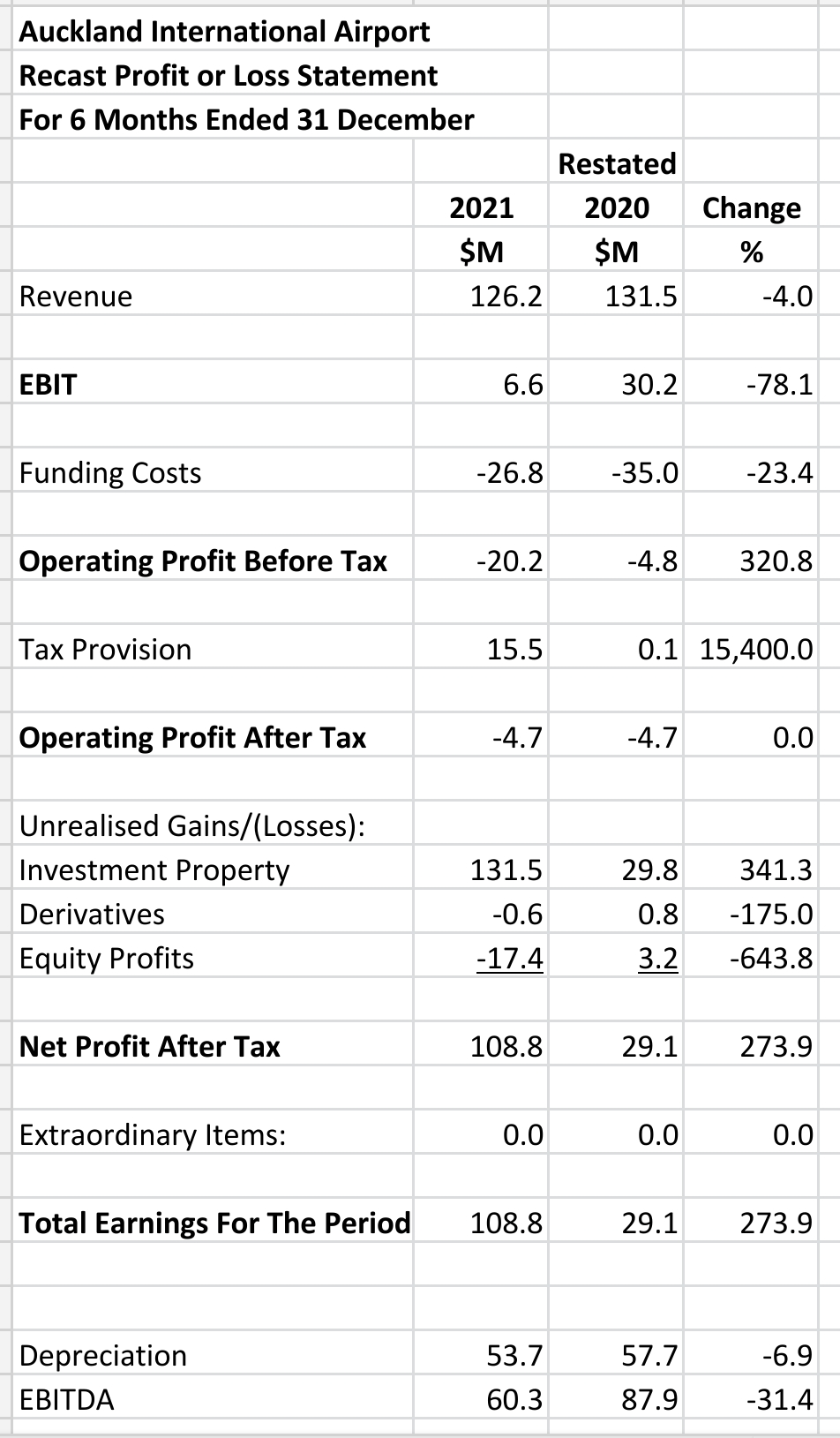

Recast Revenue Statement

So many listed New Zealand companies do relatively poorly in their core businesses but then unrealised property revaluations come to the rescue.

Certainly the listed property companies fall into this category but they are arguably in business for the capital gains, realised or otherwise.

Our approach is to put the unrealised items towards the bottom of the revenue statement because of their lower quality.

EBIT declined by 78.1% to $6.6 mn. Our EBIT calculation differs from the way others calculate it because we take unrealised and extraordinary items to lower down the revenue statement.

The company made an operating loss after tax (a large credit) of $4.7 mn. The operating loss before the large tax credit of $15.5 mn was $20.2 mn.

Unrealised property revaluations of $131.5 mn were offset by equity losses of $17.4 mn which resulted in total earnings of $108.8 mn for the six months to 31 December, 2021.

Total earnings were 273.9% higher than the previous six month period ending 31 December, 2020.

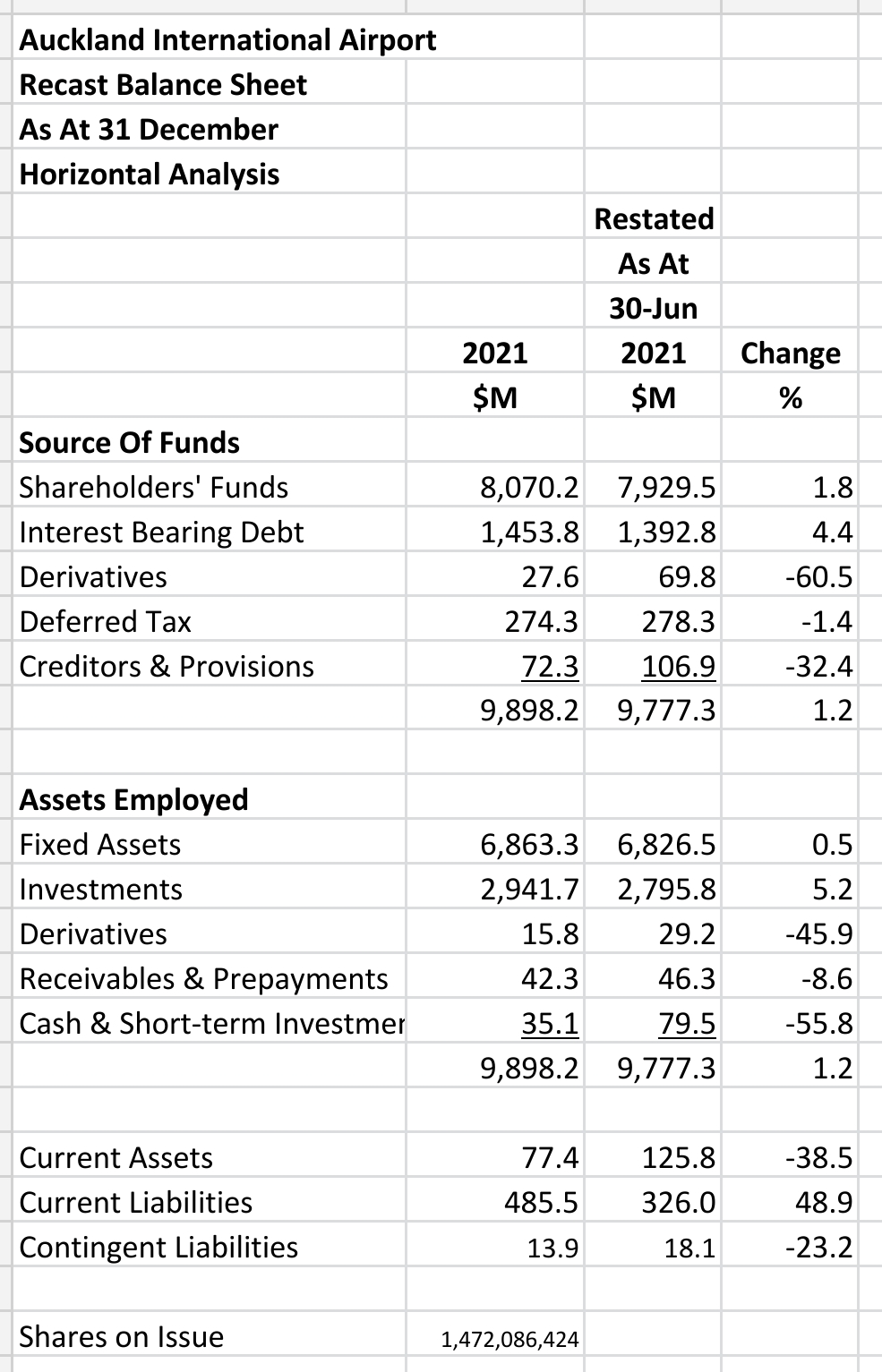

Recast Balance Sheet

Horizontal Analysis:

The prior period for the balance sheet is not the same as the other financial statements as explained above.

Unlike the other statements' the periods are consecutive.

Current assets declined by 38.5% while current liabilities increased by 48.9%.

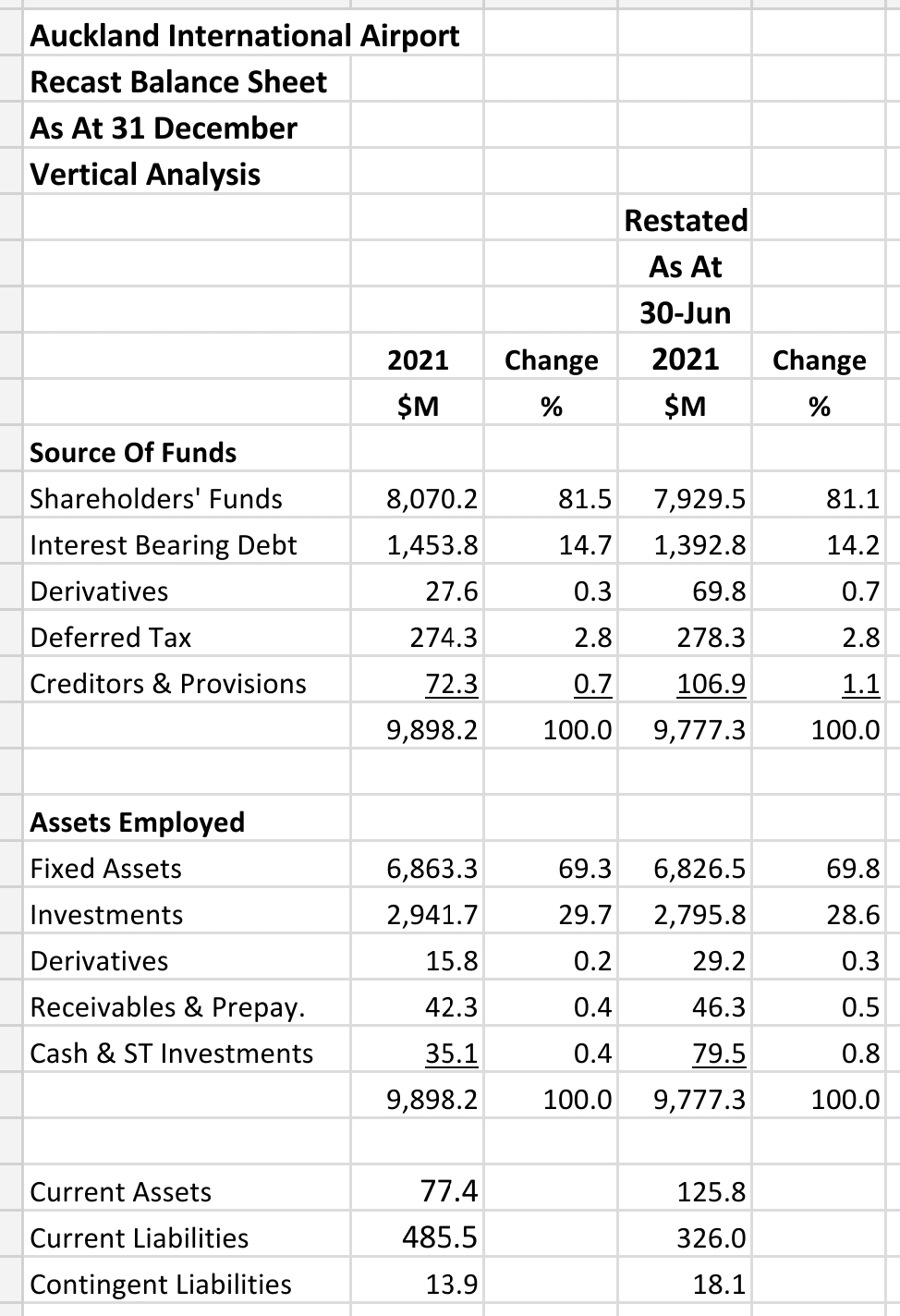

Vertical Analysis:

The shareholders' funds are a very high 81.5% of total assets. Interest bearing debt is only 14.7% of total assets.

It’s a high quality balance sheet with no intangibles. Fixed assets and investments make up the vast majority of assets.

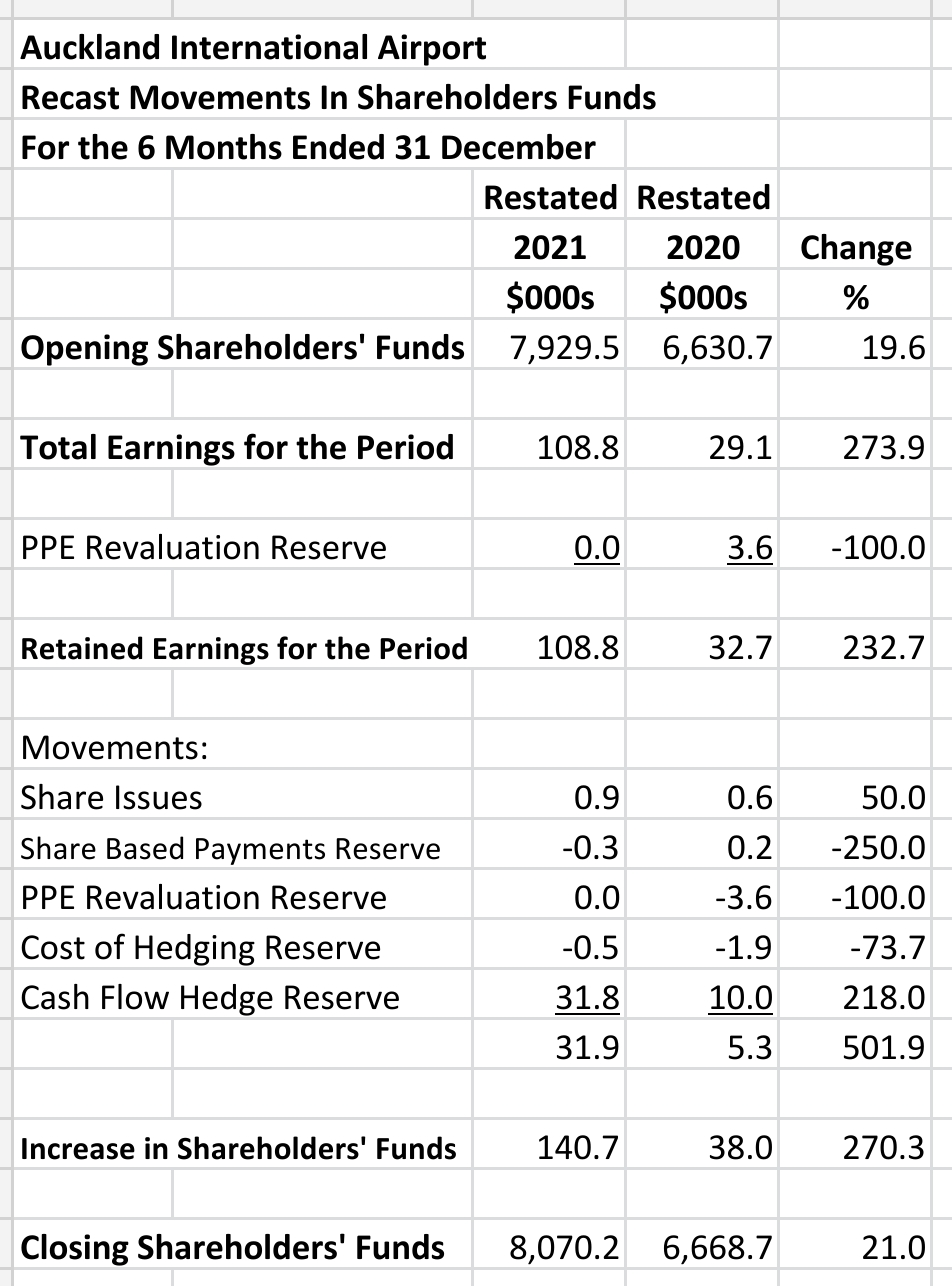

Recast Statement of Movements in Equity

The vertical format allows movements in equity to be seen much more easily.

The comprehensive income statement is redundant as the entries appear in the statement of movements in shareholders' equity anyway.

Recast Cash Flow Statement

The operating cash flow is positive in both periods although it declined by 5.1% in the current period to $25.8 mn.

Operating cash flow and $76.0 mn of new debt funded purchases of fixed assets and investments of $146.2 mn.

The end of period cash balance was $35.1 mn which was way down on the prior period’s closing cash balance.

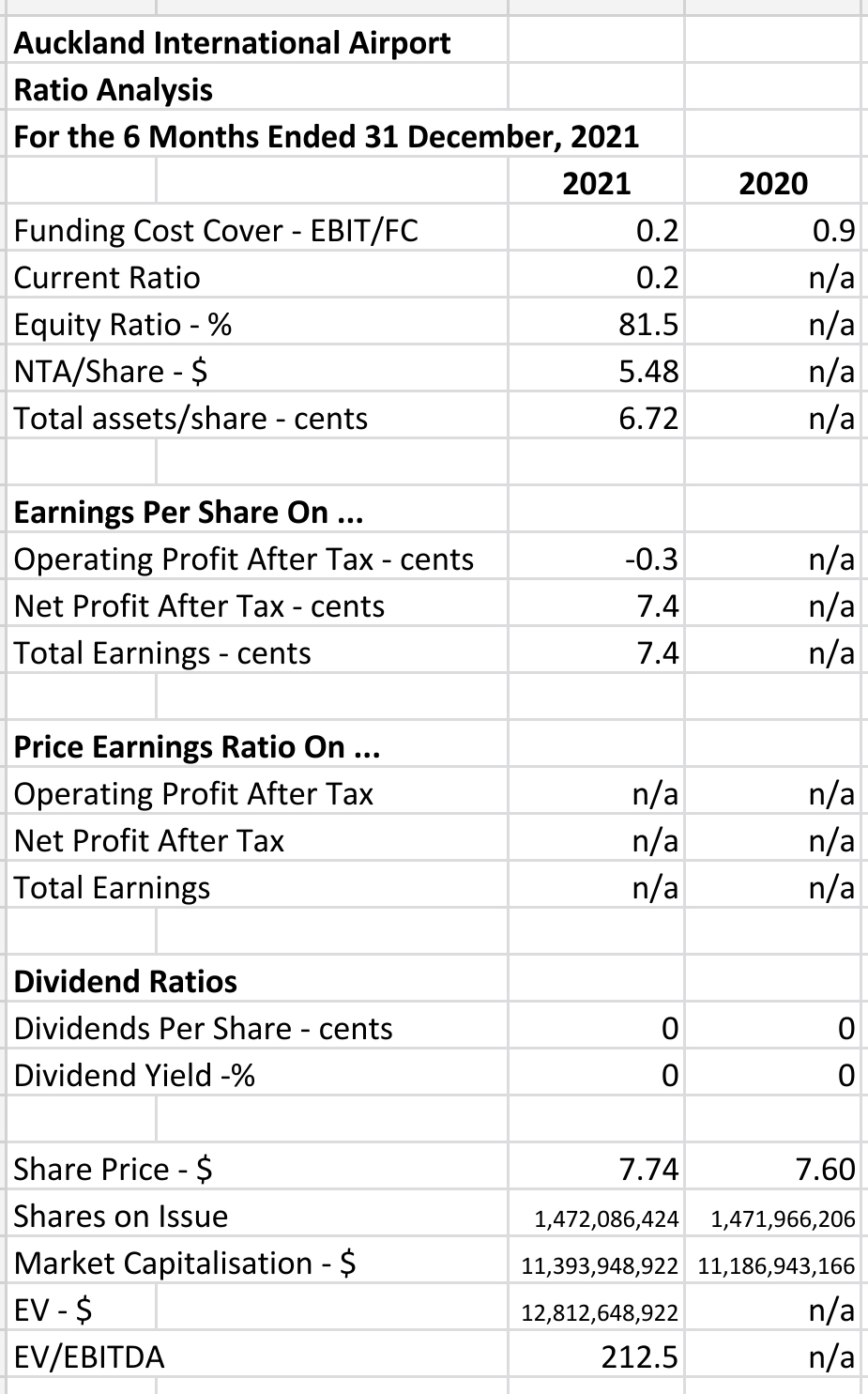

Ratio Analysis

Many ratios could not be calculated for the prior period as already explained. The prior period revenue statement and balance sheet cover different periods.

The price earnings ratios were not calculated for the current period because the statements don't cover a full year.

The company does not even cover it's funding costs. In the current period funding cost cover was only 0.2.

The current ratio is very poor also at 0.2.

The company loses 0.3 cents per share on operating profit after tax.

Segmental Analysis

The company does not provide sufficient information to calculate returns in its different business segments. Only EBITDAFI figures are available.

Those figures show that the core business operations of aeronautical and retail are way down.

Summary

This company has a great balance sheet but poor profitability from its core business operations.

It has used large unrealised property revaluations to create a profit.

The cash flow from operations is acceptable and it has acquired fixed assets and investments during the current period.

The company may improve core profitability quite quickly if New Zealand's borders open to foreign tourists this year.