Statement of Cash Flows: Dividends & Interest

Recasting dividends & interest both paid and received ...

The treatments of dividends paid, interest paid and lease payments were covered in this previous article; Dividends Paid, Lease Liability Payments & Cash Flow.

They should appear in the same section of statements or cash flows as they are both payments for the use of capital, either debt or equity.

Additionally, dividends received and interest received will be discussed.

Lease payments will not be covered in this article. Lease payments under some accounting rules are complex and require a full discussion.

The current treatments in statements of cash flows for interest and dividends depends on whether accounts are prepared under International Financial Reporting Standards (IFRS) or United States Generally Accepted Accounting Principles (US GAAP).

International Accounting Standard (IAS) 7 Statement of Cash Flows sets out the formats for cash flow statements under IFRS.

Accounting Standards Codification (ASC) 230 Statement of Cash Flows details the requirements for cash flow statements under US GAAP.

There are significant differences.

Both accounting methods divide cash flow statements up into three categories; operating, investing and financing cash flows.

IFRS

IAS 7 has a flexible treatment of interest and dividends.

Interest paid can be recorded in the cash flow statement under operating, investing or financing cash flows.

Interest received can be recorded under operating or investing cash flows.

Dividends paid are recorded under financing cash flows while dividends received can be either operating or investing cash flows.

US GAAP

US GAAP offers no choice in the way interest and dividends both paid and received are recorded in statements of cash flows.

Interest paid and received are operating cash flows.

Dividends received are operating cash flows while dividends paid are financing cash flows.

Operating Cash Flow

Net operating cash flow is a very important figure on cash flow statements.

The Corporate Finance Institute defines operating cash flow as follows:

… the amount of cash generated by the regular operating activities of a business within a specific time period.

Source: Corporate Finance Institute

‘Regular’ means recurring or constant and interest and dividends are neither because they depend upon the capital structures of businesses.

Interest and dividends are outside the framework of businesses’ regular operations unless they are banks, finance companies or investment businesses.

A manufacturer with a finance company division financing customer purchases has regular businesses in both categories. In this case the operating cash flows from the financing operations should be recast separately from the operating cash flows of its manufacturing operations. Both would be included in operating cash flows section of the consolidated statement of cash flows.

Recast Treatments

Both interest paid and dividends paid are both financing cash flows.

The capital side of financing always appears in financing cash flows whether recast or not. However, the payments for the uses of those funds should also be included in financing cash flows. As stated above they are not part of regular operations of businesses (with exceptions).

Without including them in financing cash flows that section lacks completeness and therefore distorts understanding of the cash flows of the business. If they were included in operating or investing cash flows they would distort the actual operating or investing cash flows of businesses and ratios thus derived.

Additionally, changes in capital structures of businesses might affect their operating cash flows under the current rules making operating cash flow figures unreliable guides to cash changes in core operations.

If interest paid and dividends paid both appear in operating cash flows key cash flow relationships between suppliers, employees and customers are distorted.

Therefore, recast financial statements require interest and dividends paid to be recorded in financing cash flows.

Interest received is income from investments. For example interest is received on cash deposits and advances.

Dividends received are the returns for equity investments.

Including interest and dividends received in operating cash flows distorts operating cash flows and investing cash flows.

Recast financial statements place interest and dividends received in investing cash flow.

The treatments of interest and dividends in the statement of cash flows are shown in the table below:

Source: Table Generator

Effect of Recasting the Statement of Cash Flows

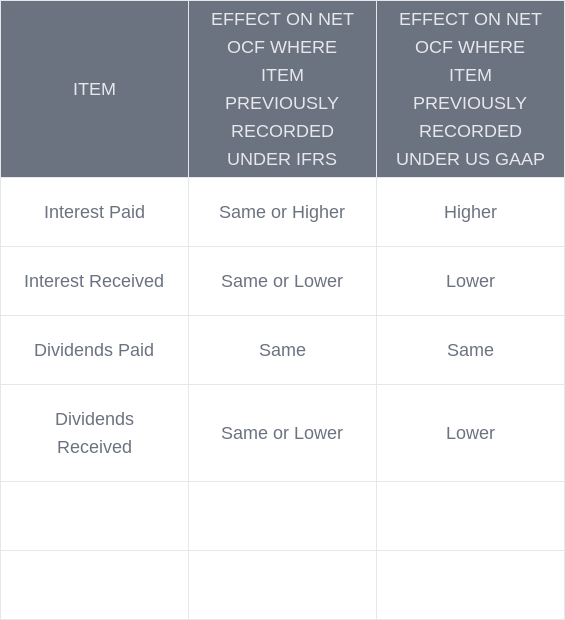

Recasting the statement of cash flows as discussed above will have the following effects on net operating cash flows (Net OCF):

Source: Table Generator

As shown in the table recasting of dividends paid has no effect on Net OCF as in both IFRS and US GAAP it is not recorded there.

The effects on the Net OCFs for the other items depend on whether they were recorded in the statements of cash flows under IFRS or US GAAP.

Recasting interest paid under IFRS results in Net OCFs the same or higher while under US GAAP recasting increases Net OCFs.

Recasting interest received under IFRS results in Net OCFs the same or lower while under US GAAP recasting lwers Net OCFs.

Recasting dividends received under IFRS results in Net OCFs the same or lower while under US GAAP recasting lowers Net OCFs.

Direct and Indirect Methods

A further complication arises with regard to the direct and indirect methods of formatting statements of cash flows.

These two methods relate to the format of the operating cash flow sections of statements of cash flows.

The direct method is essentially the cash book of the businesses’ operating cash flows while the indirect method uses some variant of income as the starting point.

As the starting point in the indirect method is an accrual item, adjustments must be made to match the net operating cash flows determined under the direct method.

Why is the indirect method used at all?

It’s useful to be able to relate the profits from revenue statements to statements of cash flows. Setting out how profits convert to net operating cash flows explain why there are variances, sometimes significant variances in these items.

Where the direct method for the operating cash flow portion of financial statements is used, recasting is quite straight forward. Interest and dividends both paid and received are usually listed separately.

However, where businesses use the indirect method the items can be hard to determine.

Interest paid and received and dividends received will usually be part of net income. Sometimes other types of income will be used but the starting figure for the indirect method will be some variant of income.

Options for finding the three missing items; interest paid and received and dividends received include:

Checking the notes to the accounts for direct methods of operating cash flows. If available then just select the items and reduce or increase OCF as required. The selected items will then just be recast into either investing or financing cash flows.

Check supplementary information for the information in 1). If available then follow the same procedure in 1).

Cash dividends received information can often be determined from the separate dividend information in the notes to the accounts

If the information is not available as outlined in 1), 2) or 3) then the process is a little more difficult. The accrual accounting related items will appear in revenue statements or their notes to the accounts. Make an estimate of the three items by obtaining the interest income, interest expense and dividend income from the revenue statements or the notes to the accounts. Deduct the relevant accrued items (asset or liability) at the end of the period from the balance sheets or notes to the accounts. This should result in a reasonable estimate of the cash flows related to the items. Use these figures in the recast cash flow statements. For example, interest expense; (from revenue statement or notes) - accrued interest at balance date (from balance sheet or notes) = interest paid (cash flow item).

If none of these options works then make contact with businesses’ investor services divisions and ask for information directly. If the businesses are privately held approach the businesses’ in-house accountants directly or external accountants with permission.

Benefits of Recasting the Statement of Cash Flows

Removing interest and dividends from operating cash flows shows better how businesses’ operating cash flows reflect their operating activities, namely mostly receiving from and paying money to customers/employees and suppliers respectively.

Recasting investing and financing cash flows better reflects the true situations in businesses’ investing and financing activities. Investing and financing items are contained in those specific sections of statements of cash flows.

Investing activities will include both capital and income items as will financing activities.

Thus the recast statements of cash flows are clearer pictures of cash flows relating to each of the three categories; operating, investing and financing.

Interest and dividends paid are not core activities of most organisations. They are core activities, however of banks, finance companies and investment companies however.

These kinds of businesses will be addressed in a future article.

When net operating cash flows are presented without including interest and dividends it’s easier to compare businesses’ abilities to cover cash interest and dividends paid.

Summary

In summary, interest and dividends are presented in the following ways in recasted statements of cash flows:

Direct Method

Indirect Method

None of the interest or dividend items appear in the operating cash flows section of the recast statements of cash flows.

Recasting produces operating cash flows that are not distorted by investing and financing items.

Cash flows from operations should be considered independently of debt and equity structures of businesses and therefore interest and dividend items should be excluded.

Note:

It’s important to remember that when financial statements are recast many financial ratios will change.

Thus comparing ratios from recast statements to non-recast statements is not like-for-like.

Calculating financial ratios must be done on a consistent basis across reporting periods.