Note: My Food Bag (MFB.NZX, MFB.ASX)

FY23 Trading Update, Share Price, Balance Sheet, Significant Holder, Dividend

Note: All amounts in NZ$ unless otherwise stated.

Recent Trading History

NZX:

Source: Direct Broking

Source: Direct Broking

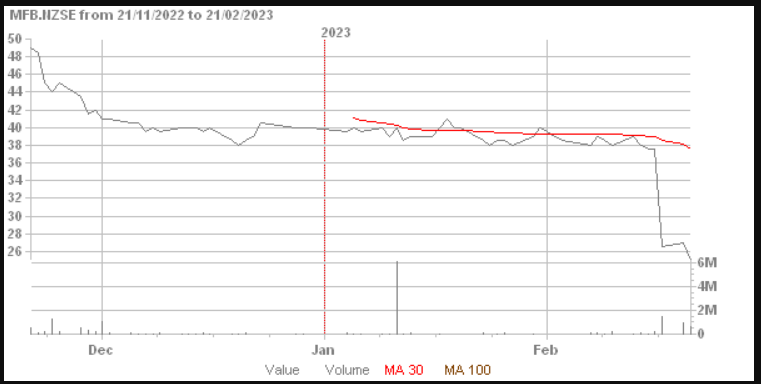

Share Price

The share price dropped on the Trading Update announcement of 17th February, 2023 to 27.5 cents from around 38.0 cents and then settled further to its current 25 cents.

Trading Before The Announcement

The three month chart doesn’t show it well but the trading before the announcement in the two year chart shows large and unusual volumes going through. The price was generally around 35-38 cents over this time. Draw your own conclusions but it seems like something a market watchdog should at least look at.

Total Losses To Investors Since IPO

The company listed in early 2021 at an IPO price of $1.85. Investors have lost, given a 1.0% brokerage fee on sale and at the current share price of 25.0 cents, $388.5m. This is extraordinary for a profitable company on any bourse.

Significant Shareholder Reducing Investment

Harbour Asset Management and their related body corporate Jarden Securities Limited today - 21st February, 2023 - made an SPH Notice announcement advising that they had reduced their holdings from a joint 15.794% to 14.737%.

They have lost considerable amounts of money when the unrealised value of their shares are added to their realised losses.

Earnings Quality

Earnings quality is actually quite good given that the company’s products are paid for mostly a few days from order placement by its customers. It’s good to see that undelivered kits are deferred revenue until delivery occurs.

However, earnings are declining but by how much is uncertain as the company only provided EBITDA percentage decline figures. Earnings are likely to be much lower given year-to-date (YTD) January 2023 revenue is down 9.0% while EBITDA is down 39.2%.

The operating cash flow is likely to be significantly worse in FY23 and it was poor in HY23 anyway.

Balance Sheet

The balance sheet has a significant and obvious problem in the level of intangibles it was loaded with in the period leading up to the IPO.

Intangibles represent 82.5% of total assets a very worrying percentage.

There were no impairments booked for the company’s single CGU (cash generating unit) in FY22 or in HY23 and this was not questioned and also signed off by the auditors.

Impairments must surely come now in FY23.

FY23 Dividend

The full year dividend has been cancelled. The Chairman stated in the announcement that dividends are expected to be paid again in FY24.

Is there a capital raise ahead?

The equity ratio of 59.3% at HY23 would surely now be overstated if repeated in FY23 because intangible valuations must fall through impairments. The NTA/share is also negative.

What would the level of impairments be? Only a (probably useless) guess can be made.

Somewhere in the very wide range of $10m and $40m if done in one hit (which is not much of a guess at all). Added to declining profits and cash flows in the CGU is the rising discount rate that would need to be applied to the calculation.

A capital raise will be needed if the company gets significant impairments.

Conclusion

This is a profitable company with, from many reports, a good set of products. The balance sheet is a mess with its current intangibles level.

The revenue statement is somewhat more encouraging but profits are falling fast and the sustainable profitability level is uncertain.

If the company improves its balance sheet through a capital rasing, restores dividends and runs a sustainably profitable business a hypothetical recovery in the stock price could provide much better gains than those of a more established companies.

But who can say where the bottom is likely to be? The announcement of a capital raising could have a negative effect on the share price.

This company is a classic study in the behaviour of private equity companies, founders and other involved organisations. It’s worth following purely on the basis of the lessons it provides to all investors.

Thanks Lewis!

A good summary.