Photo by Josh Olalde on Unsplash

Key Points

Financially very sound

Increasing profitability

High operating cash flow

High returns in core activities

Excellent funding cost cover

Source: Direct Broking

Recast Revenue Statement

Revenue was up 11.1% for the period while funding cost were reduced by 27.5%.

The company returned to a positive EBIT of $608 mn in the current period from a very low figure of $12 mn the year before.

Total earnings rebounded to $305 mn from the previous years loss of $196 mn.

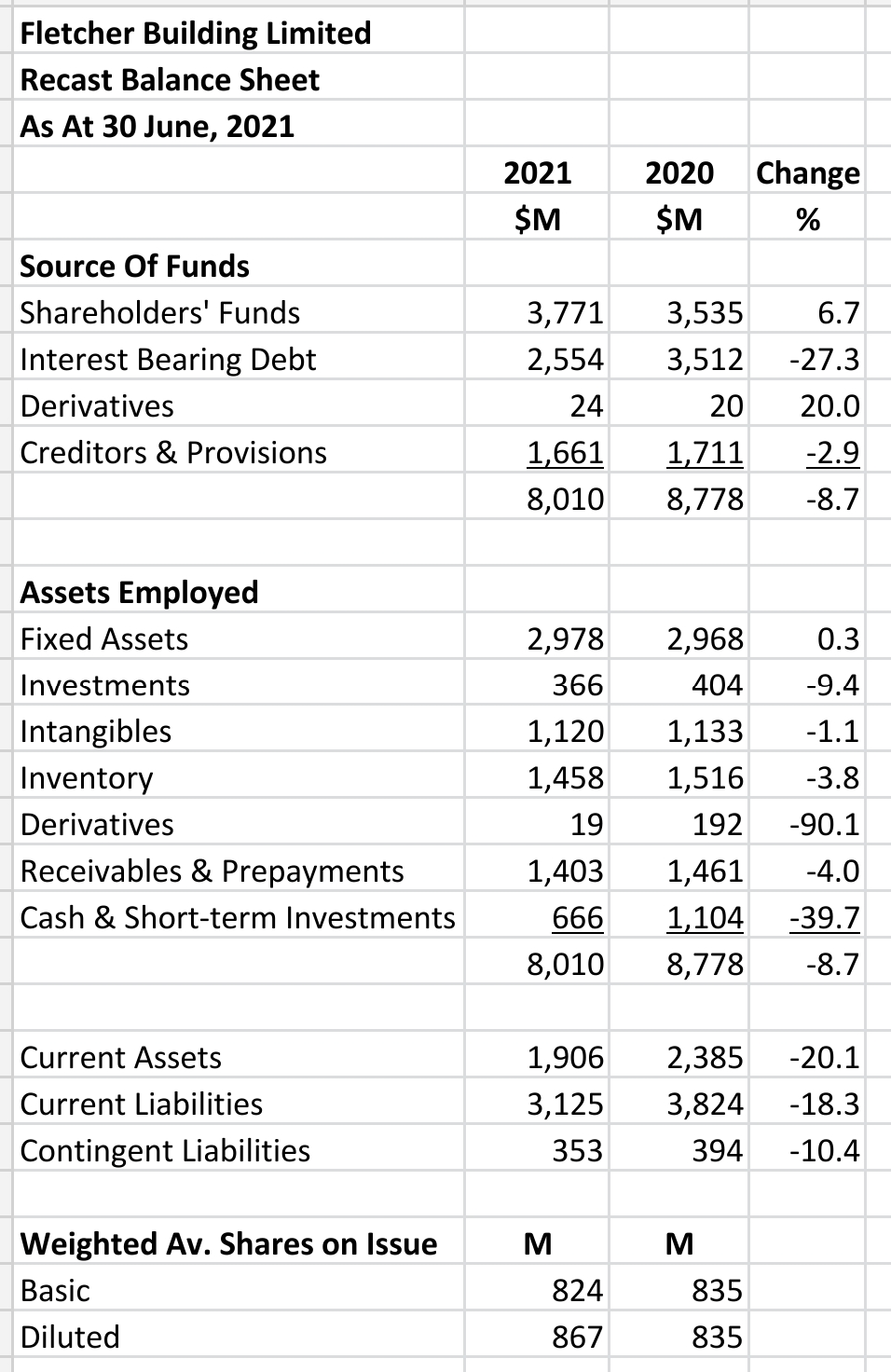

Recast Balance Sheet

Horizontal Analysis:

Shareholders' funds few by 6.7% to $3.771 mn while interest bearing debt was reduced by a massive 27.3% to $2.554 mn.

Both current liabilities and current assets were reduced significantly.

Cash & short-term investments were 39.7% less than the prior period at $666 mn.

Vertical Analysis:

The equity ratio improved to 47.1% in the current period.

Recast Movements in Shareholders' Funds

The recast format more clearly shows the movement in shareholders’ funds during the periods than the published format.

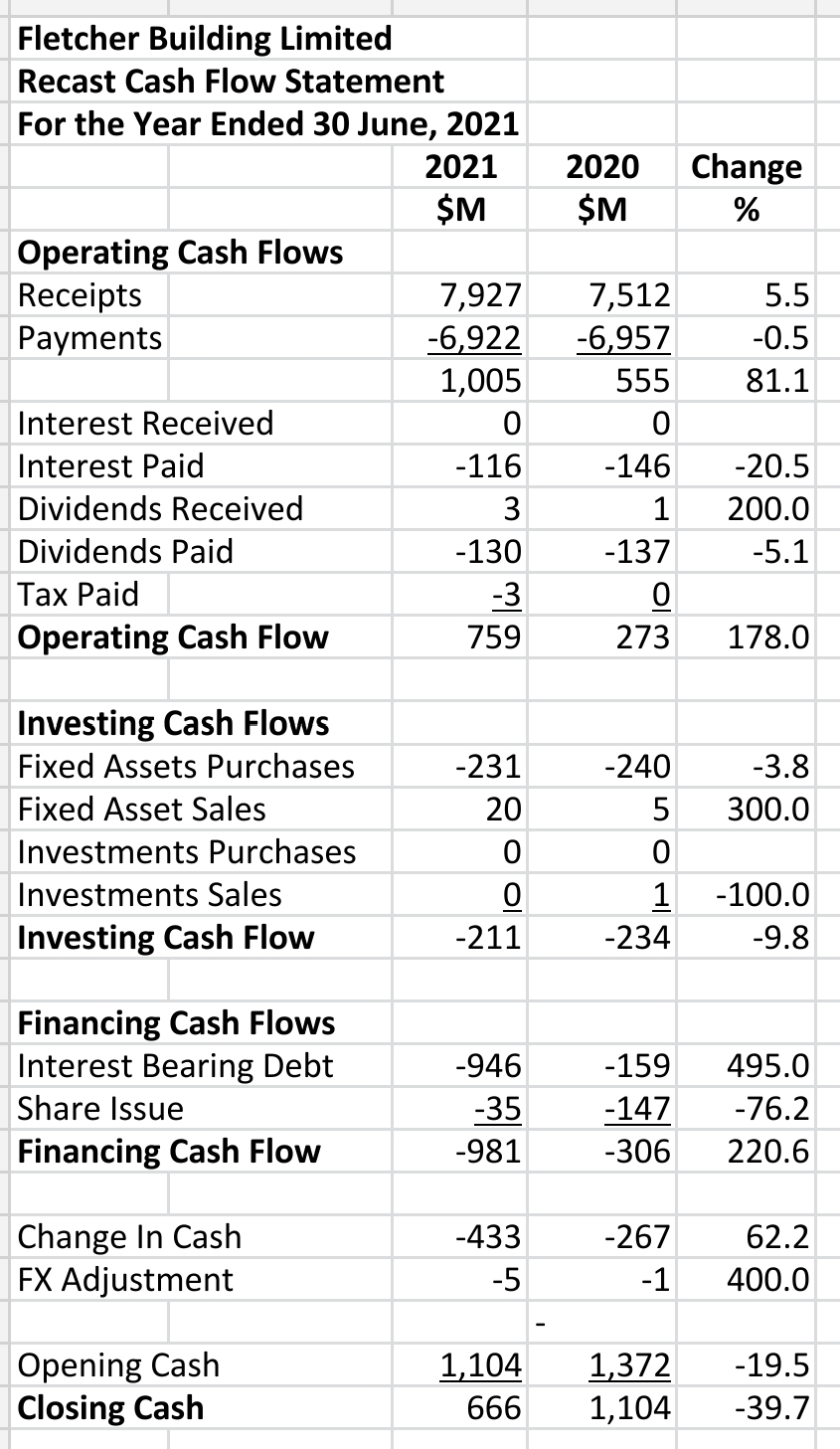

Recast Statement of Cash Flows

The recast statement of cash flows shows strong operating cash flows in both periods even when the dividends paid are included.

The operating cash flows improved 178% to $795 mn in the current period.

Closing cash & cash equivalents were $666 mn.

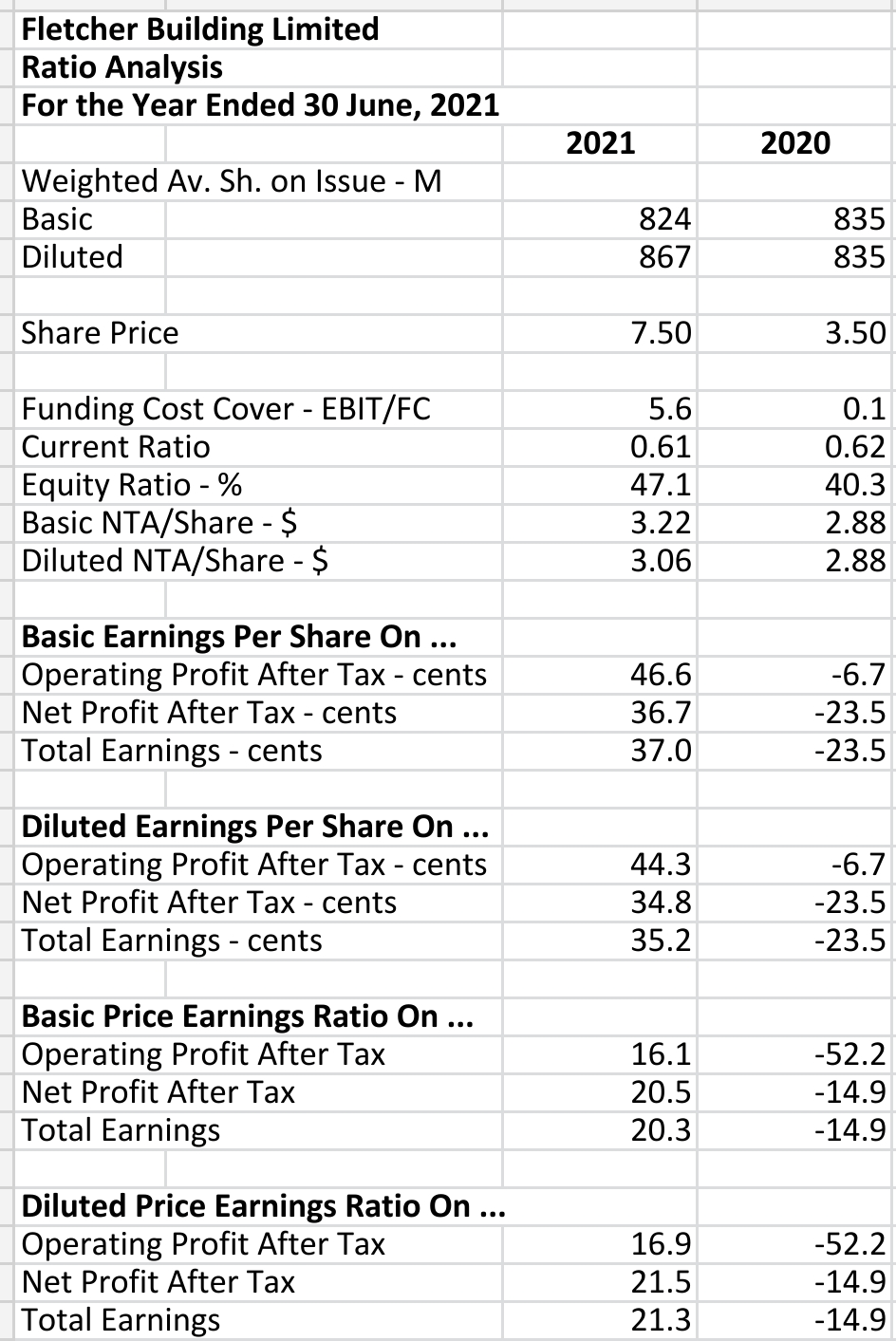

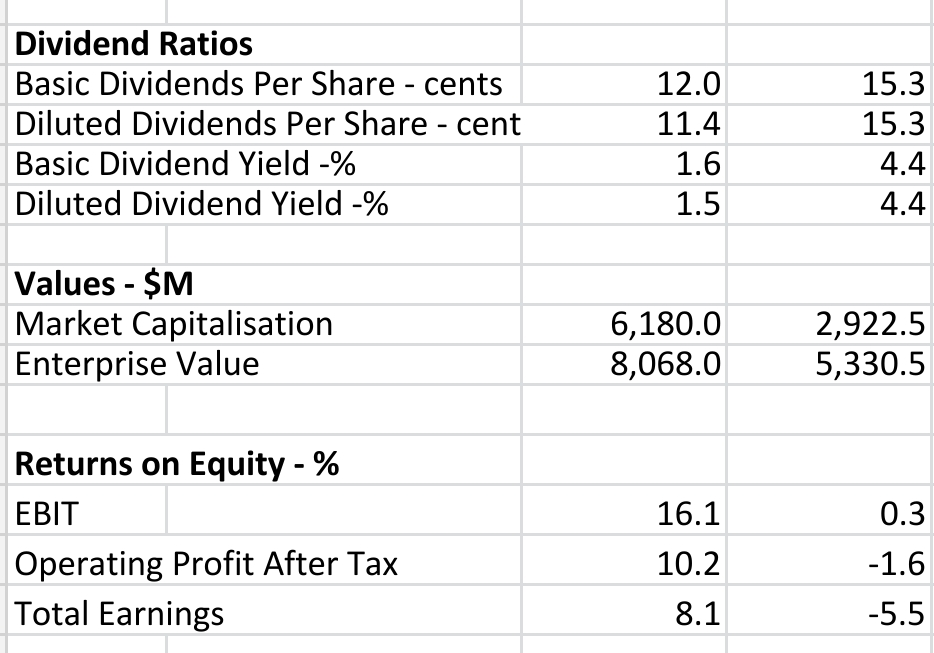

Ratio Analysis

Funding cost cover was a high 5.6 in the current period.

The current ratio, however was only 0.61.

The basic NTA per share was $3.22.

The basic price to earnings ratio in the current period ranges from 14.8 to 18.6 depending on which profit figure is used. This is bases on a strong share price some seven months after this last accounting period.

Segments

The company shows very high returns of EBIT before significant items to funds employed.

They range as high as 40.7% for distribution.

For core activities of building products, concrete and residential & development the returns are all over 10% which, in the current low interest rate environment are high.

Summary

The company is in excellent financial shape with plenty of cash, an acceptable equity ratio, high cash flow from operations and excellent returns from funds employed in its core activities.

Profitability is improving and high. Interest bearing debt is relatively low as are intangibles.