Photo by Pascal Meier on Unsplash

Source: Direct Broking

AIA would be one of the companies one would think would have had a particularly hard time of Covid.

Tourist inflows and outflows of New Zealand have been greatly reduced. Services to airlines are down as are ancillary services such as car park income.

However, you would be mistaken. With the New Zealand central bank, the RBNZ reacting to Covid with what is called money printing and exceptionally low interest rates things have been quite ok at AIA if one takes into account unrealised property revaluation gains.

Commercial property in Auckland may not have had massive rental growth but capitalisation rates have firmed up. AIA has been a major beneficiary of this situation.

This analysis is for the year ended 30 June, 2021.

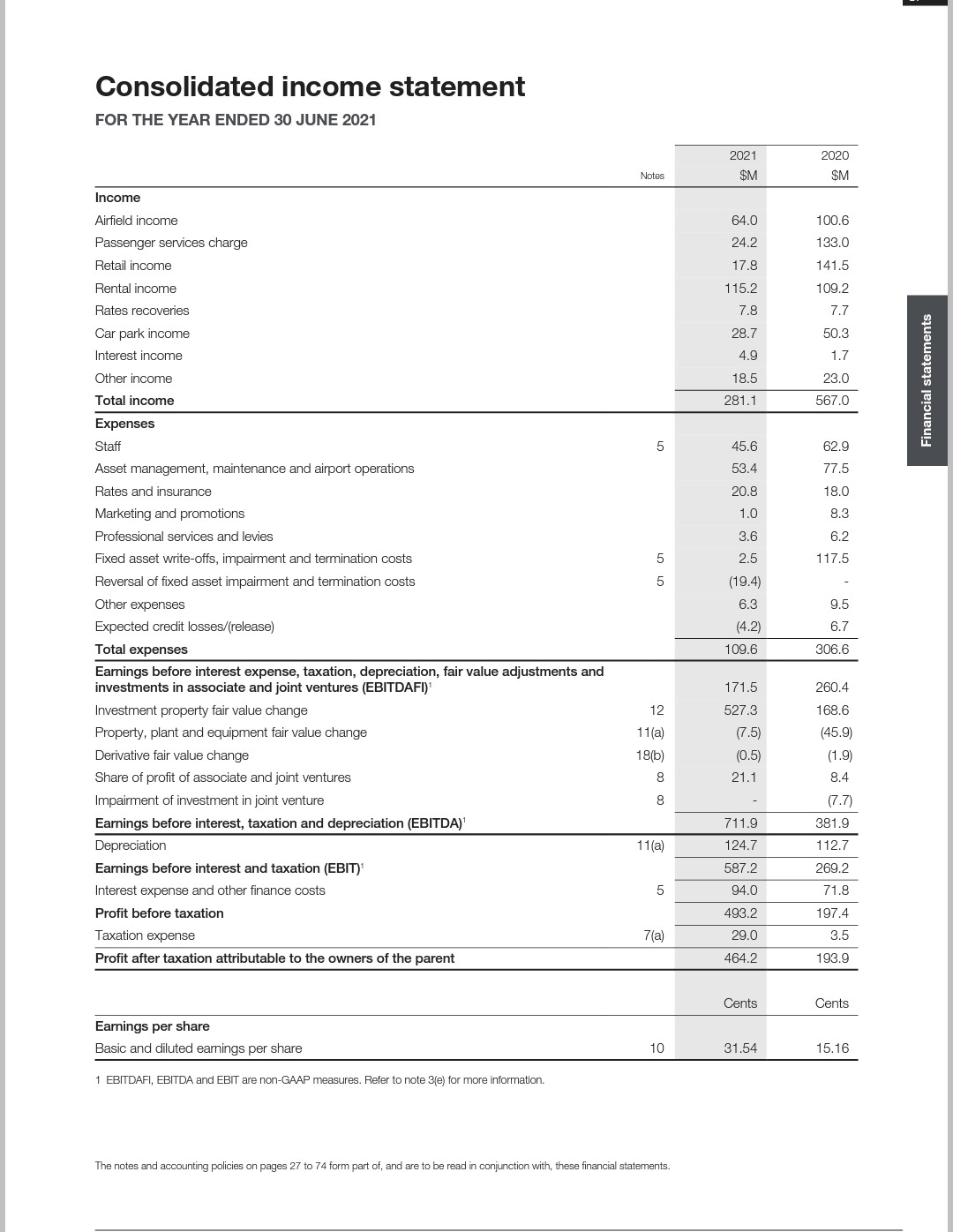

Original Revenue Statement & Comprehensive Income

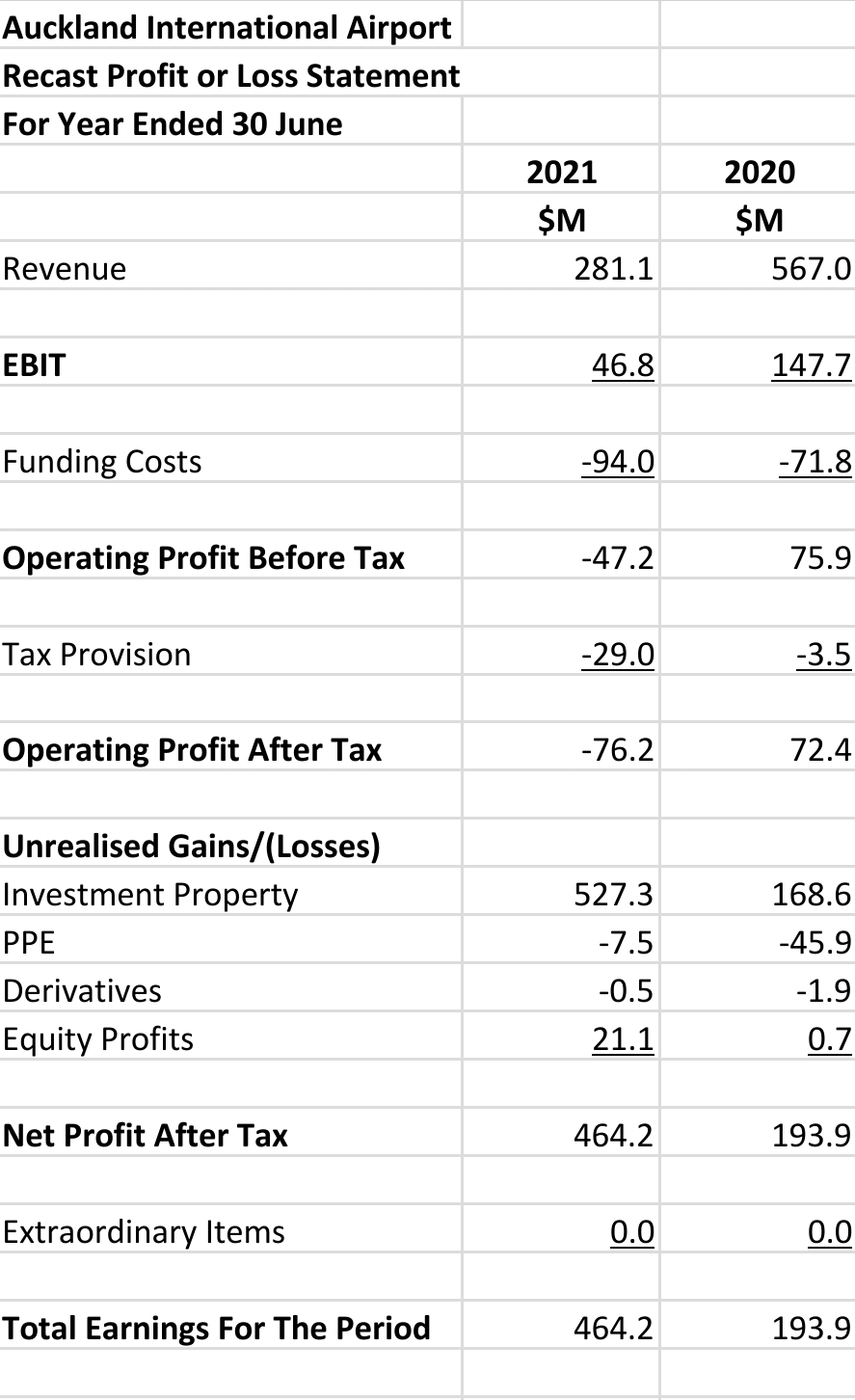

Recast Revenue Statement

Comments

The main difference between the statements is that unrealised gains and losses have been placed towards to bottom of the recast statement. These gains are of lower quality because there is no outside supporting transaction.

The profit picture becomes much different as operating profit before tax is strongly negative at -$47.2 mn in the current period. Net profit after tax is -$76.2 mn which is a big reversal on 2020’s $72.4 mn.

The company cut costs significantly but it was not enough to sustain the EBIT of $147.7 mn in the 2020 year and the current period's EBIT was only $46.8 mn. Revenue was down 50.42% in the current period which shows the effect of Covid.

However, when massive property revaluations are added to NPAT the companies revenue statement looks great at total earnings of $464.2 mn.

The comprehensive income statement is integrated into movements in equity.

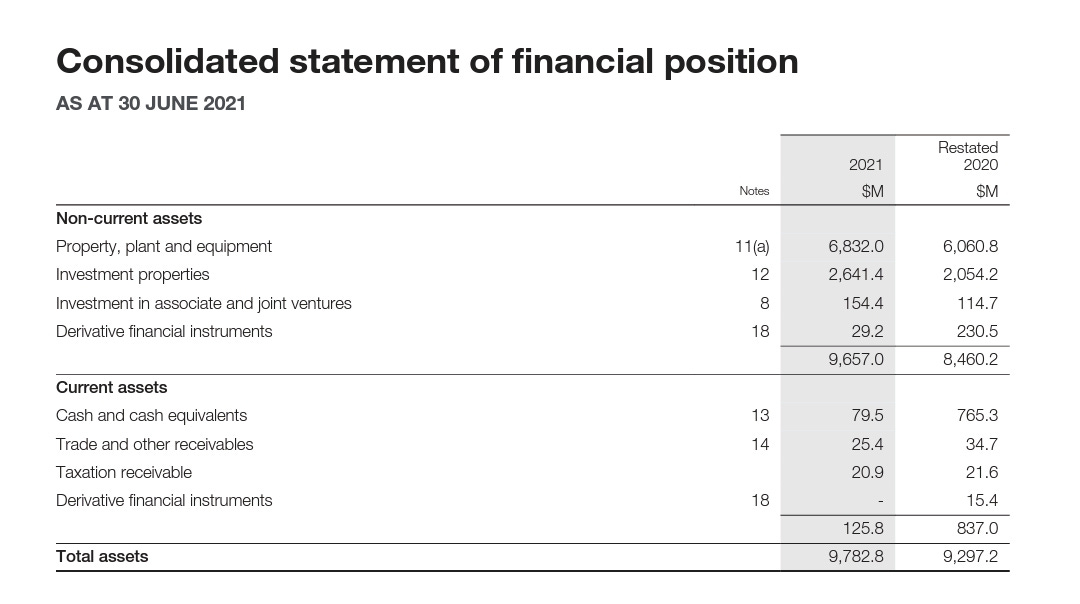

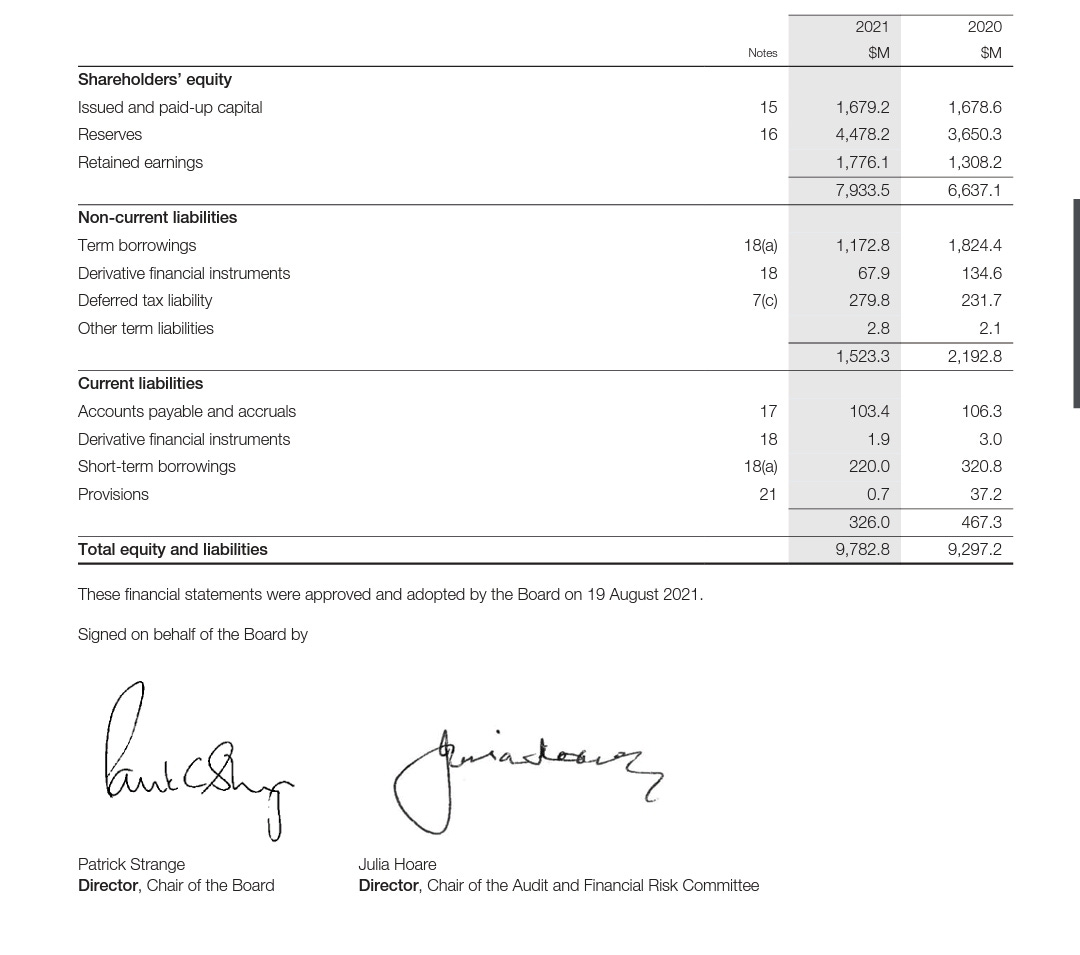

Original Balance Sheet

Recast Balance Sheet

Comments

Working capital has deteriorated with current liabilities significantly above current assets and no inventory.

The company has very high levels of shareholders’ funds much of which is due to property revaluations over the years.

Interest bearing debt is well down on the prior period at $1,392.8 mn.

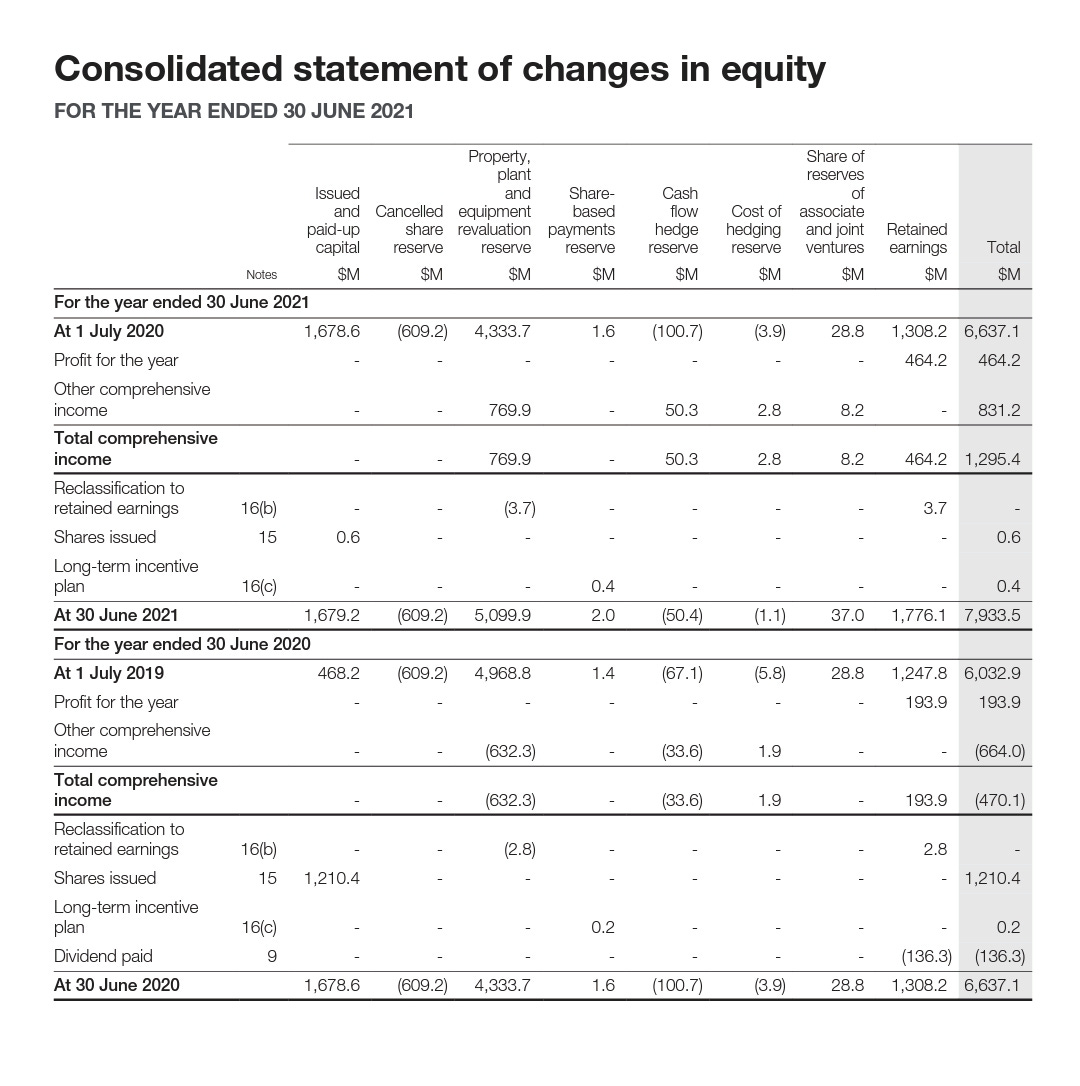

Original Statement of Movements in Equity

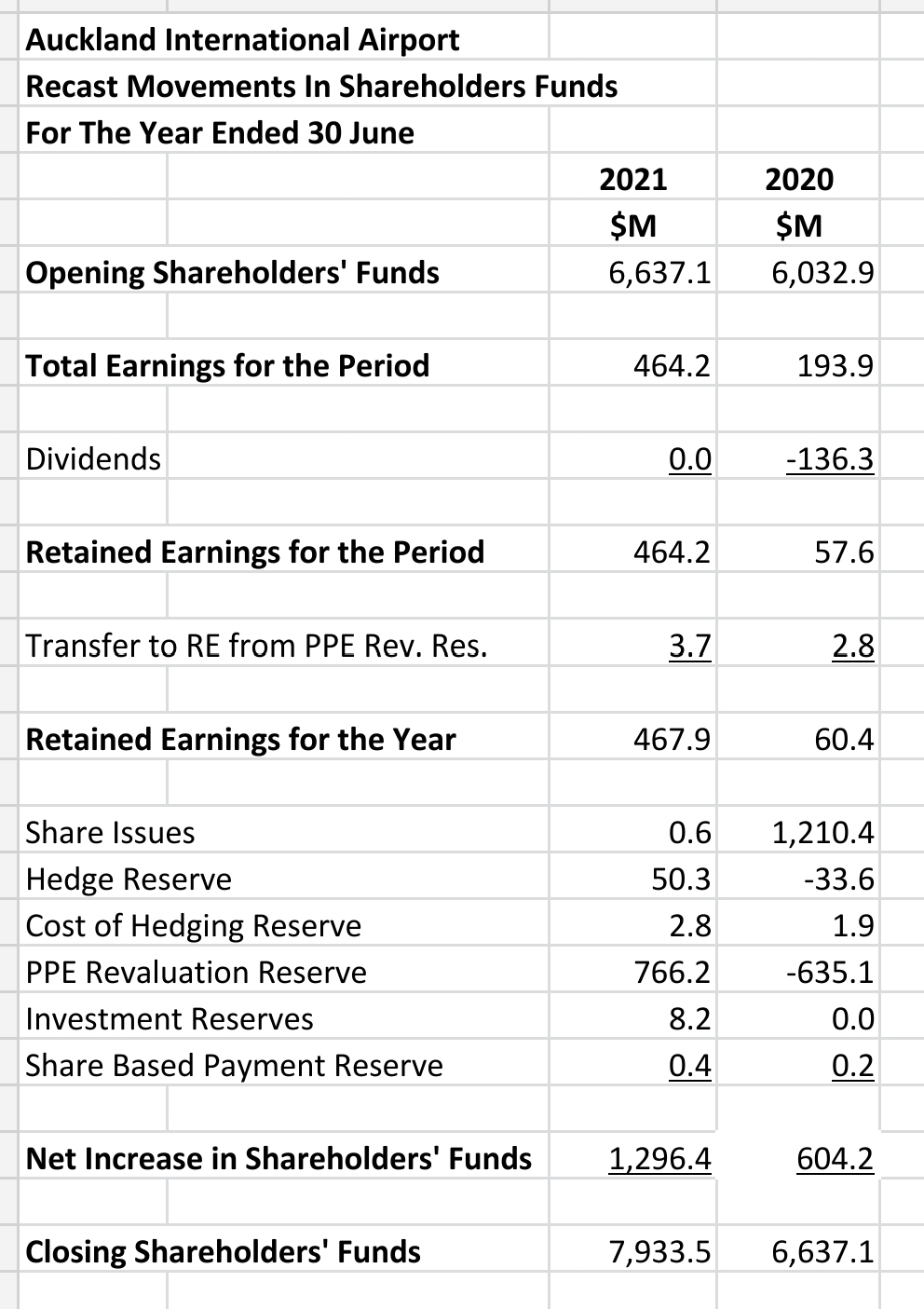

Recast Statement of Movements in Equity

Comments

The reformatted and recast statement clearly shows the impact of property revaluations both from the revenue statement by way of earnings and also through the reserve account PPE revaluations.

Original Statement of Cash Flows

Recast Statement of Cash Flows

Comments

Operating cash flows are down even when the prior periods dividends are included in the operating cash flow section. The company chose not to distribute a dividend.

The company rather chose to repay interest bearing debt and purchase additional fixed assets used in its operations.

Ratio Analysis

The company does not cover it's funding costs from EBIT as against the prior year when funding cost cover was a better 2.06.

The equity ratio has improved as a result of some revaluations to an extremely healthy 81.1%.

All earnings in the current year apart from total earnings (due to revaluations) were very poor.

And the P/E ratio in the current year based on total earnings is 23.6 which doesn't seem out of bounds in the current low interest environment. But when most of the earning come from unrealised gains the P/E is less justifiable.

There are no dividends in the current year.

Segmental Analysis

Comments

The company does not provide enough information in its notes to the accounts to analyse the segments of its business.

All that can be said is that rental income at $115.2 mn and airfield income at $64.0 mn are the most important parts of its business at least from a revenue perspective.

Summary

Given the uncertainty surrounding covid the company has done some things well. Reducing debt, cancelling dividends, issuing shares and paying down debt were smart moves given the risks in the industry currently.

However, earnings are weak in the business's core activities and only unrealised property gains make the accounts look good.

If circumstances in commercial property change and there is a rise in interest rates leading to a fall in capitalisation rates things may change for the company quickly. Property devaluations can reduce shareholders’ funds quickly however the company has very high equity which will protect it from write-downs initially.

The interim accounts for the half year to 31 December, 2021 are to be released soon and this analysis will be updated accordingly.