Photo by Christopher Burns on Unsplash

Key Points

EBIT $18.6 mn

Operating profit after tax $12.8 mn

Creditors & provisions up 45.0%

Equity 53.3%

Strong operating cash flow at $24.4 mn but down 20.6%

IBD down 11.8%

Cash $25.0 mn up 43.7%

Funding cost cover 3.2

EPS 7.7-9.7 cents/share

P/E 11.7-14.7

ROE 7.2-9.4%

Source: Direct Broking

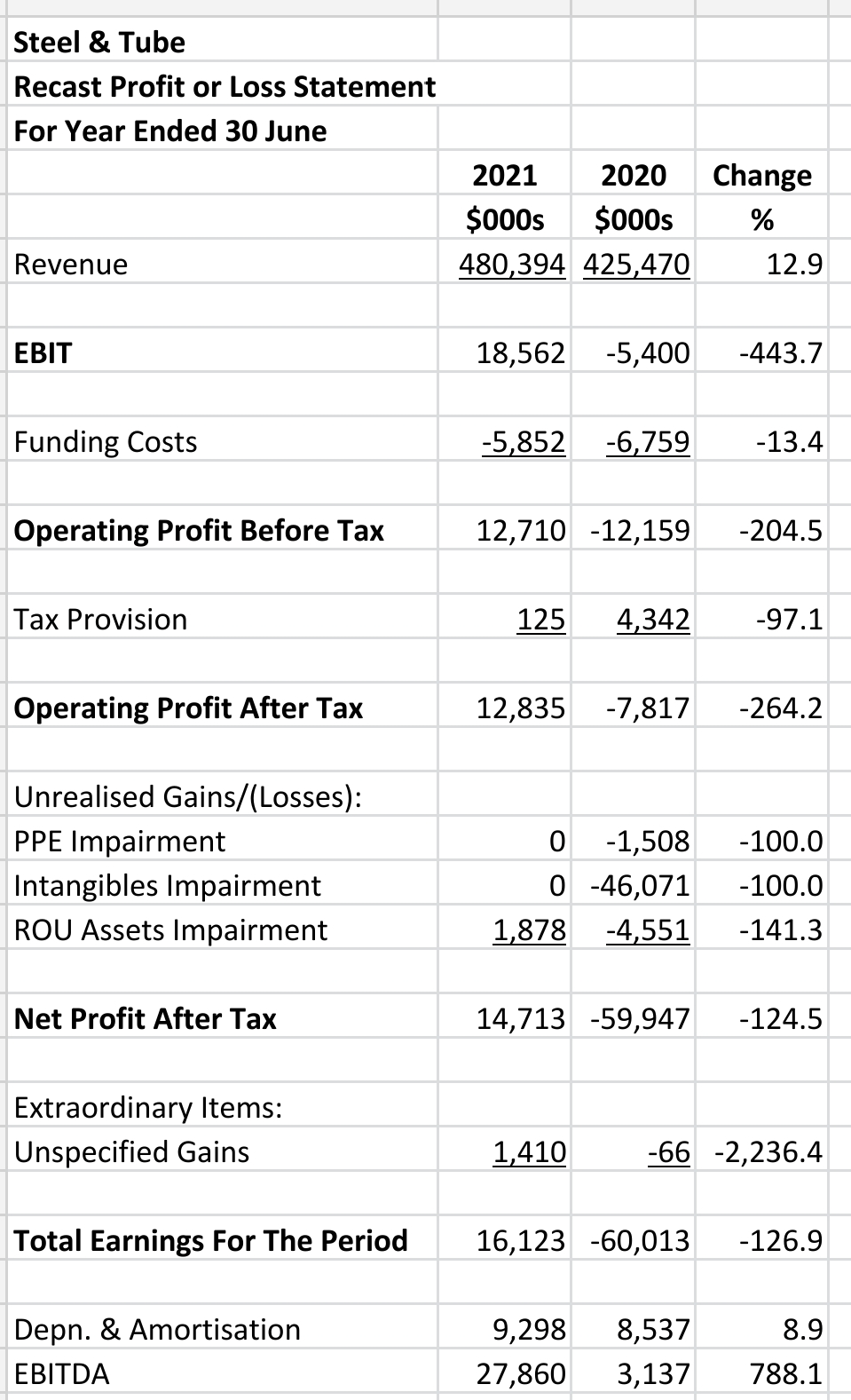

Recast Revenue Statement

The company increased its revenue by 12.9% to $480.4 mn in the current period of six months ended 30 June, 2021.

In the prior year there was a massive inventory and right-of-use impairments which resulted in total earnings of -$60.0 mn.

EBIT was -$5.4 mn.

The situation turned around in the current period resulting in an EBIT of $18.6 mn and total earnings of $16.1 mn.

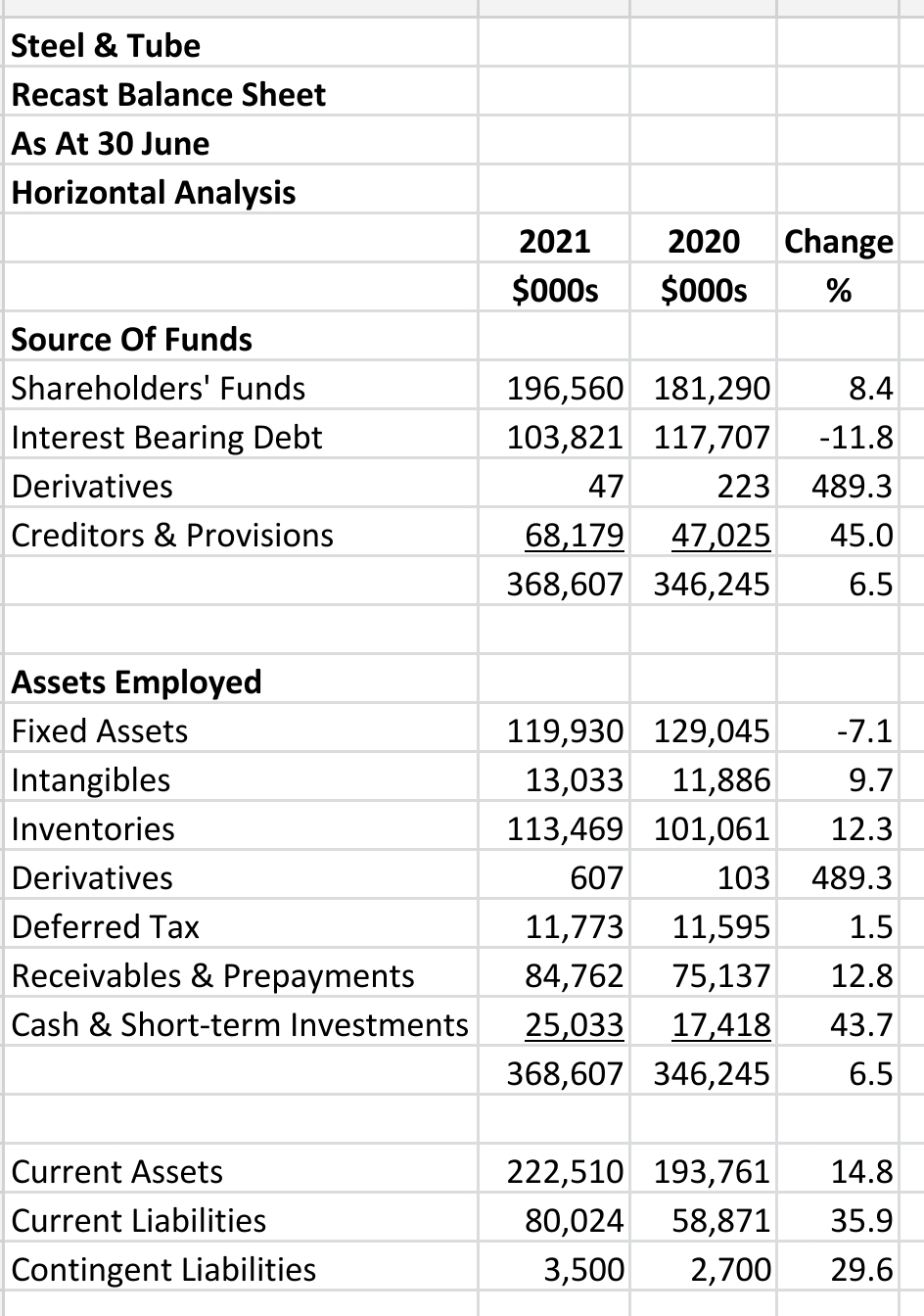

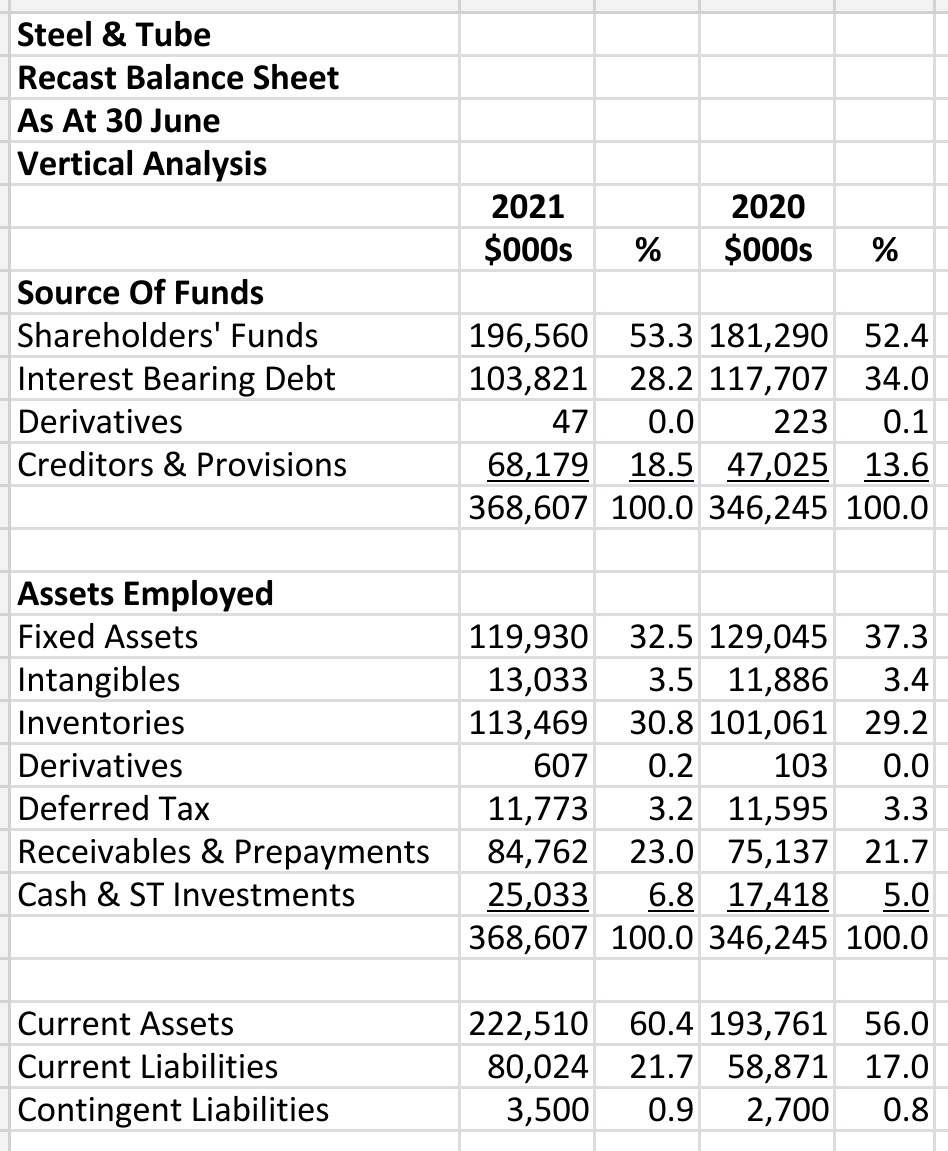

Recast Balance Sheet

Horizontal Analysis:

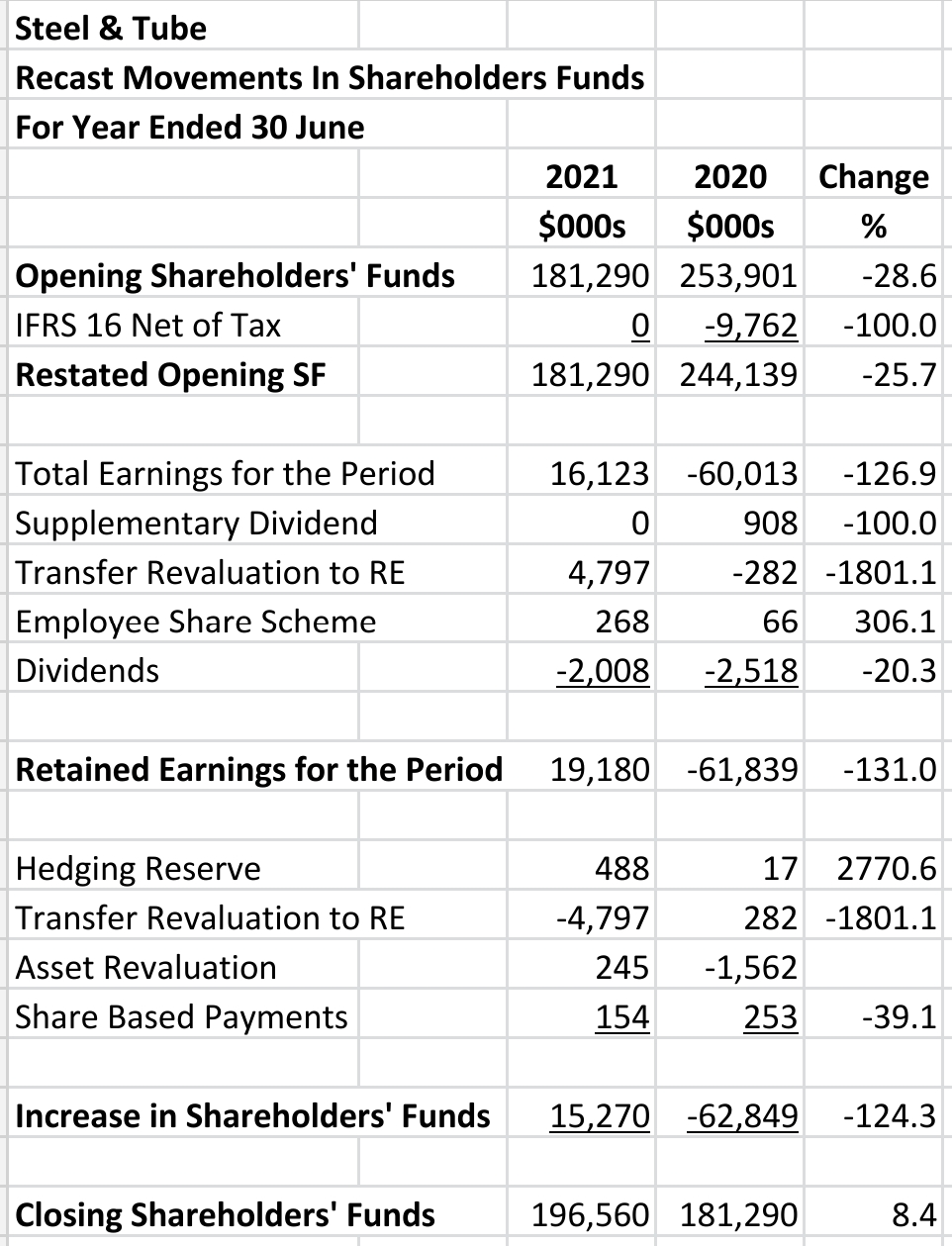

Shareholders' funds increased by 8.4% to $196.6 mn. There was also a significant increase in cash and a reduction in interest bearing debt.

Current liabilities blew out by 35.9% but were well covered by current assets.

Vertical Analysis:

The equity ratio was acceptable at 53.3% and the balance sheet had good quality assets with few intangibles (only 3.5%).

Recast Movements in Shareholders' Equity

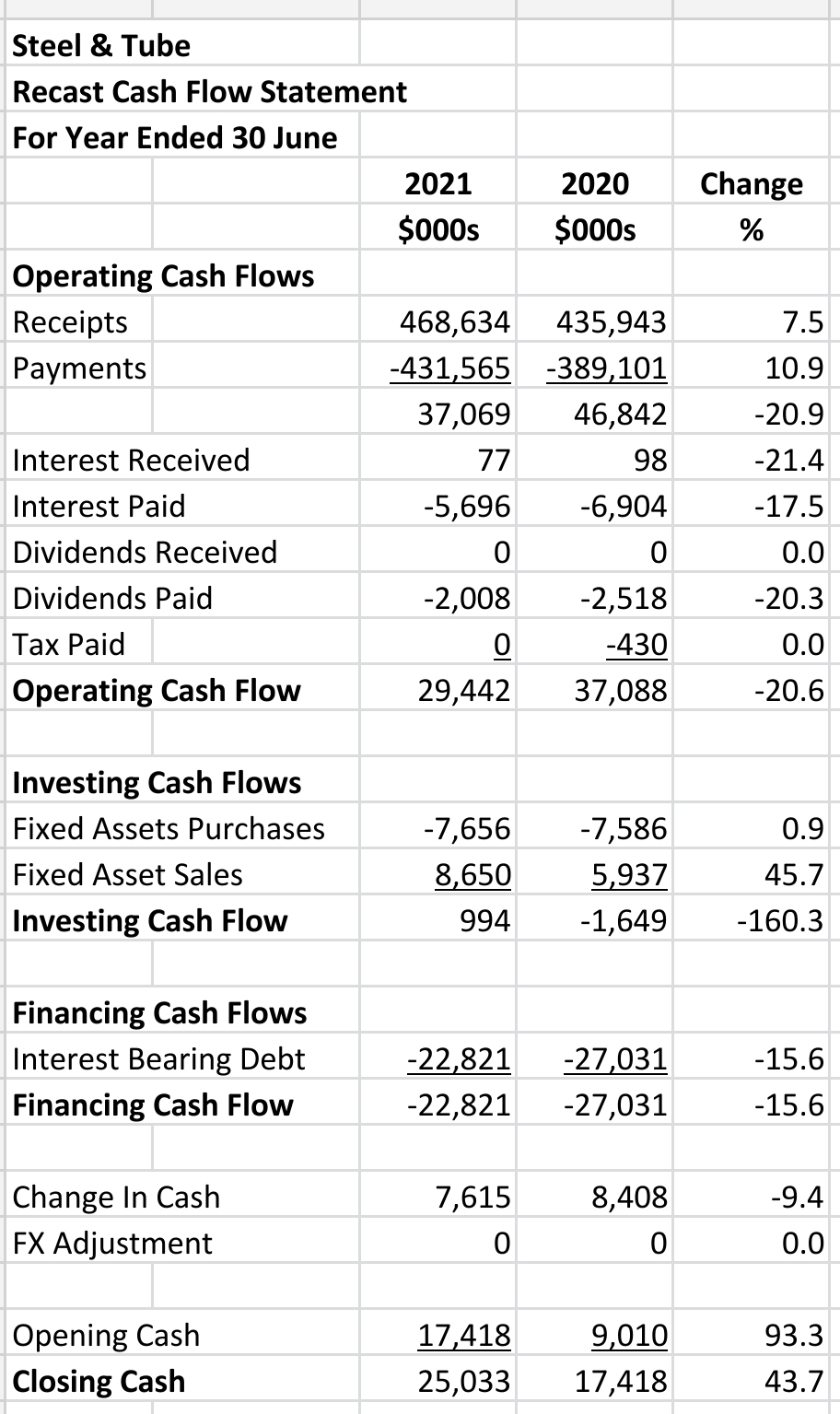

Recast Cash Flow Statement

Even with placing the dividends paid item in the operating cash flow section the company still recordrd a positive operating cash flow of $29.4 mn.

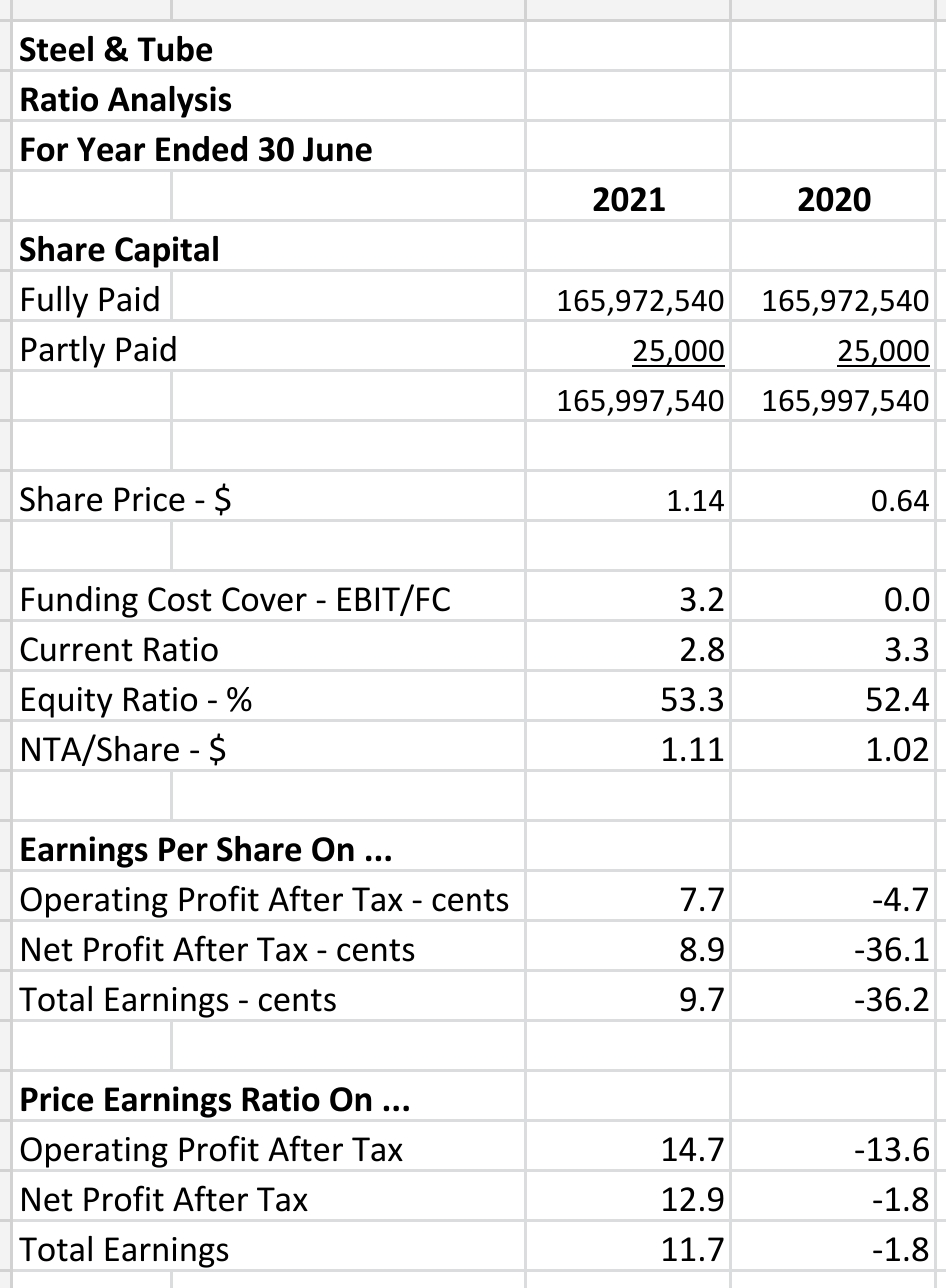

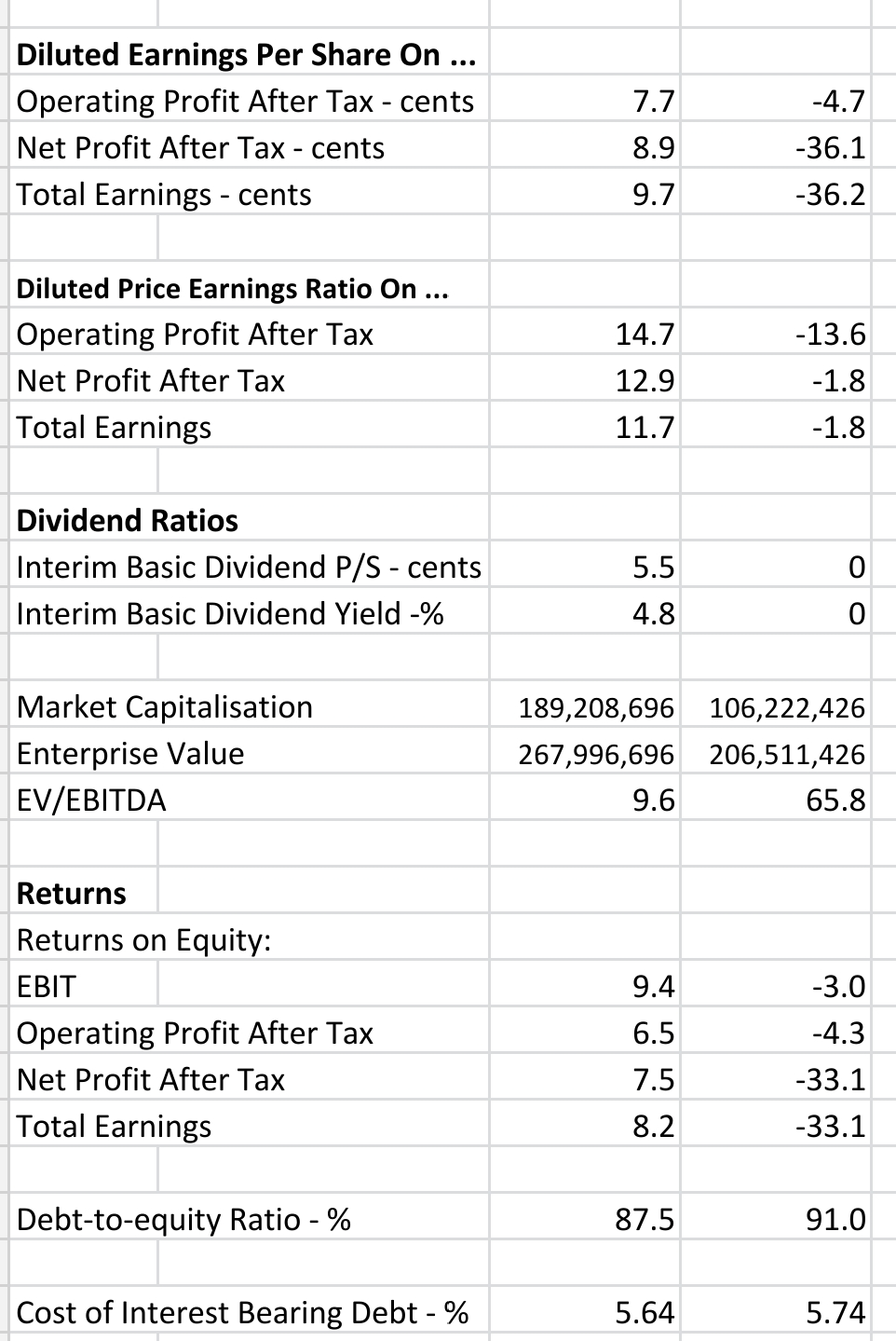

Ratio Analysis

The company has an NTA of $1.11 per share compared to its share price at the current period balance date of $1.14.

Returns on equity are high single figures in the current period.

Market capitalisation has increased dramatically over the prior period at $188.2 mn versus $106.2 mn.

The current period also saw the reintroduction of a dividend of 5.5 cps.

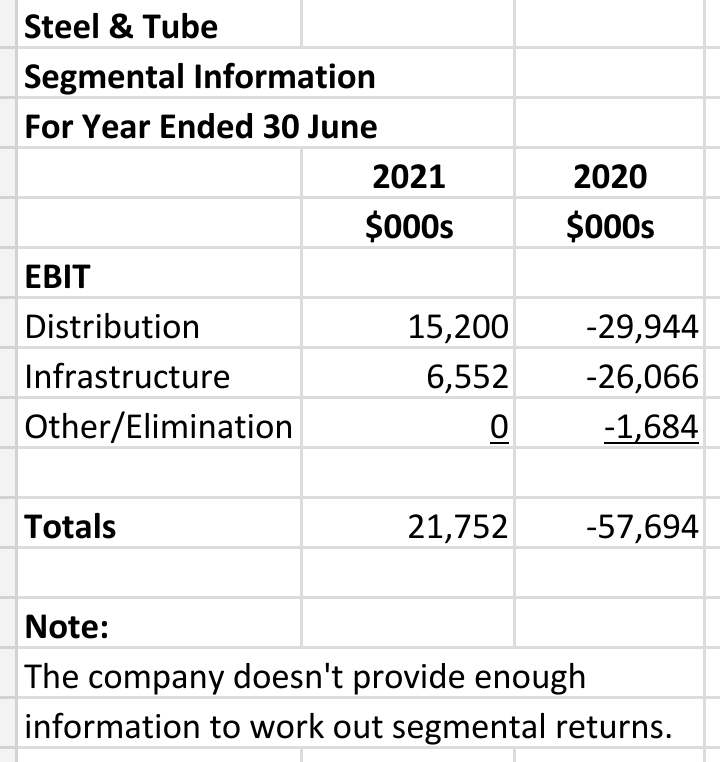

Segmental Analysis

Summary

The fortunes of the company have improved significantly over the latest period although it is important to mention that while profits have gone up massively the company's operating cash flow fell significantly.

The payment of a dividend has helped the stock price go from $0.64 to $1.14 at balance date.