Photo by Jake Nebov on Unsplash

Key Points:

Good operating cash flow

High equity ratio

Relies on unrealised investment property revaluations which are very high

Good funding cost cover

Reasonable interest bearing debt

No revaluation reserve account in financial statements

Source: Direct Broking

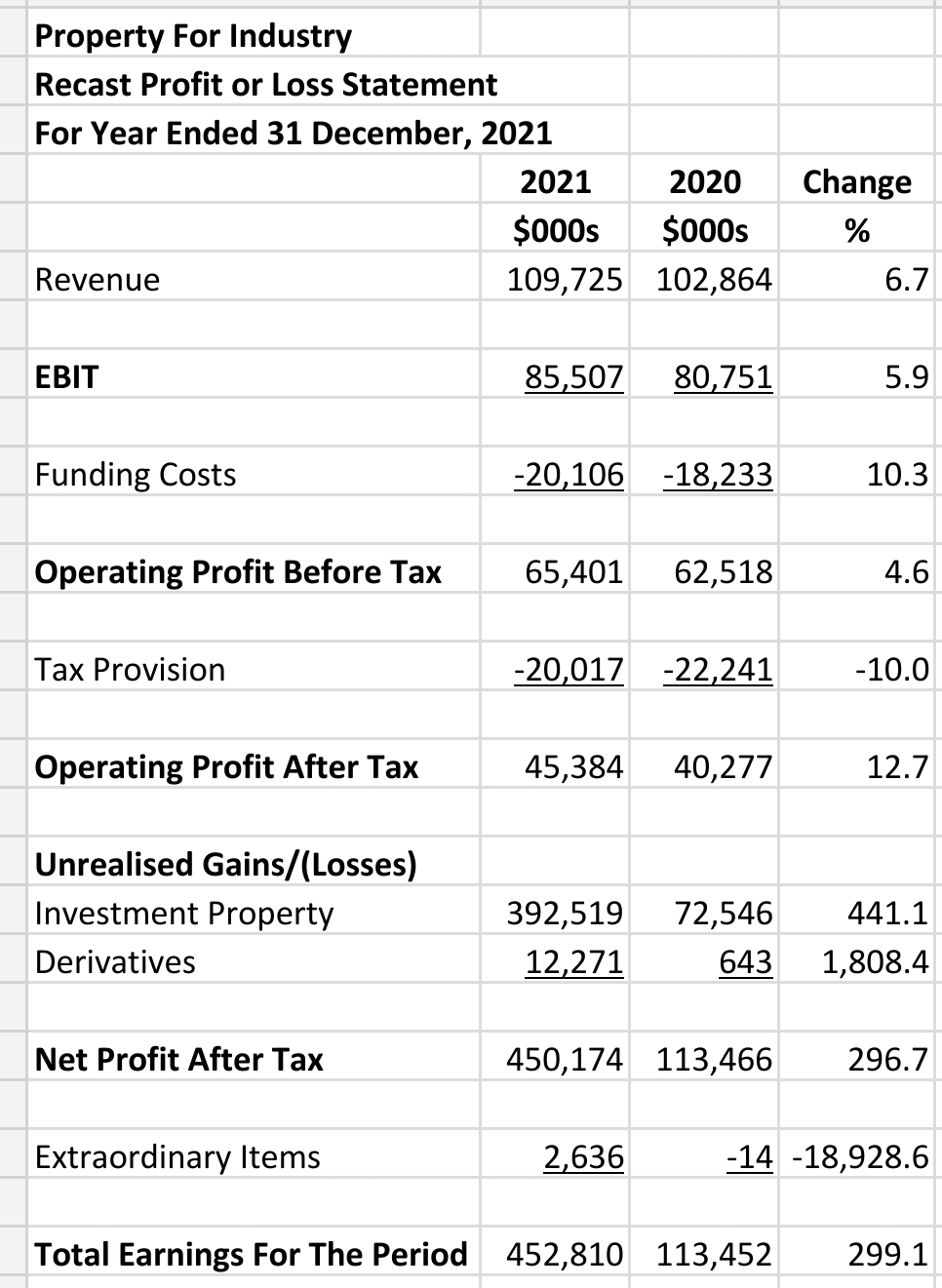

Recast Revenue Statement

The company produced an EBIT increase of 5.9% to $85.5 mn in the year to 31 December, 2021 (current period).

The operating profit after tax was $45.4 mn a significant increase on the prior year.

The company's massive total earnings of $452.8 mn, however included extremely large unrealised investment property revaluations of $392.5 mn.

Are these enormous revaluations justified? Well, they are supported no doubt by valuations but given the extremely stimulative policies of the RBNZ they may well be valid.

But they are not the result of external accounting transactions and therefore must be viewed sceptically.

The company is well able to support the payment of interest through EBIT.

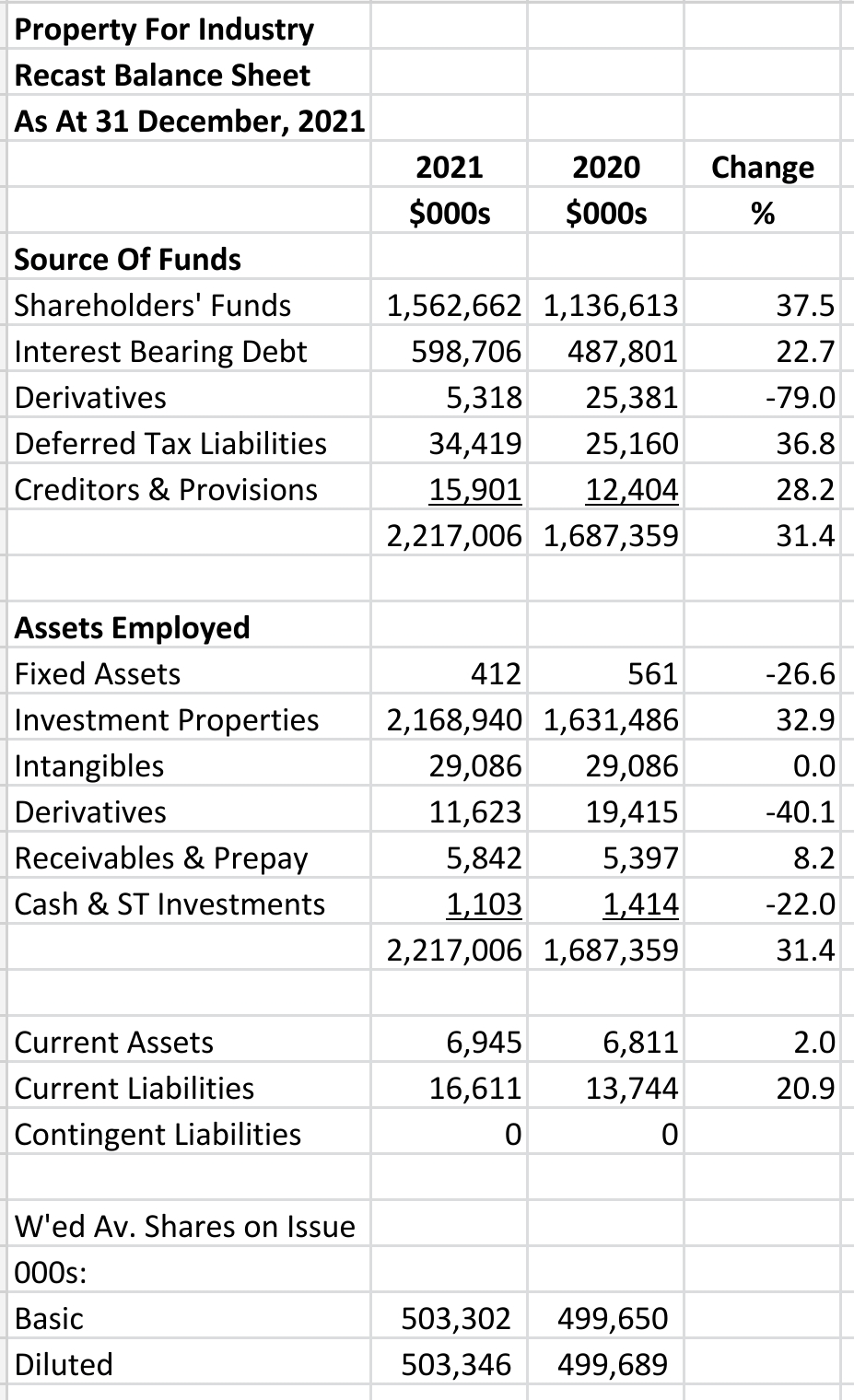

Recast Balance Sheet

Shareholders' funds rose a massive 37.5% on the back of unrealised property investment revaluations to $1,562.7 mn.

Interest bearing debt rose 22.7% to $598.7 mn.

Total assets increased to $2.217 mn again on the back of the revaluations.

The company's assets are overwhelmingly investment properties which ended the year at $2,168.9 mn in value.

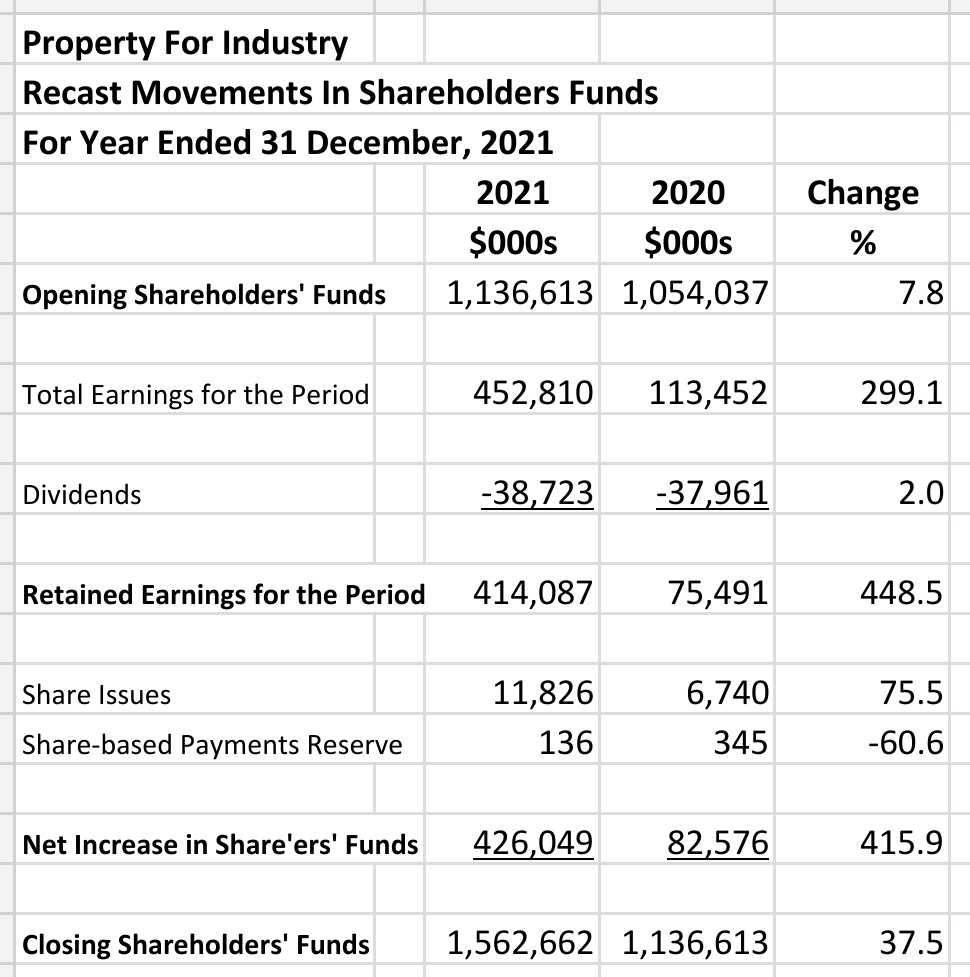

Recast Movements in Equity

The recasting of the statement of movements in shareholders' equity to the vertical format shows the changes much more clearly.

It is really unfortunate that the company doesn't separate an investment property revaluation reserve out from the other items so that the extent of the revaluations over the years can be seen.

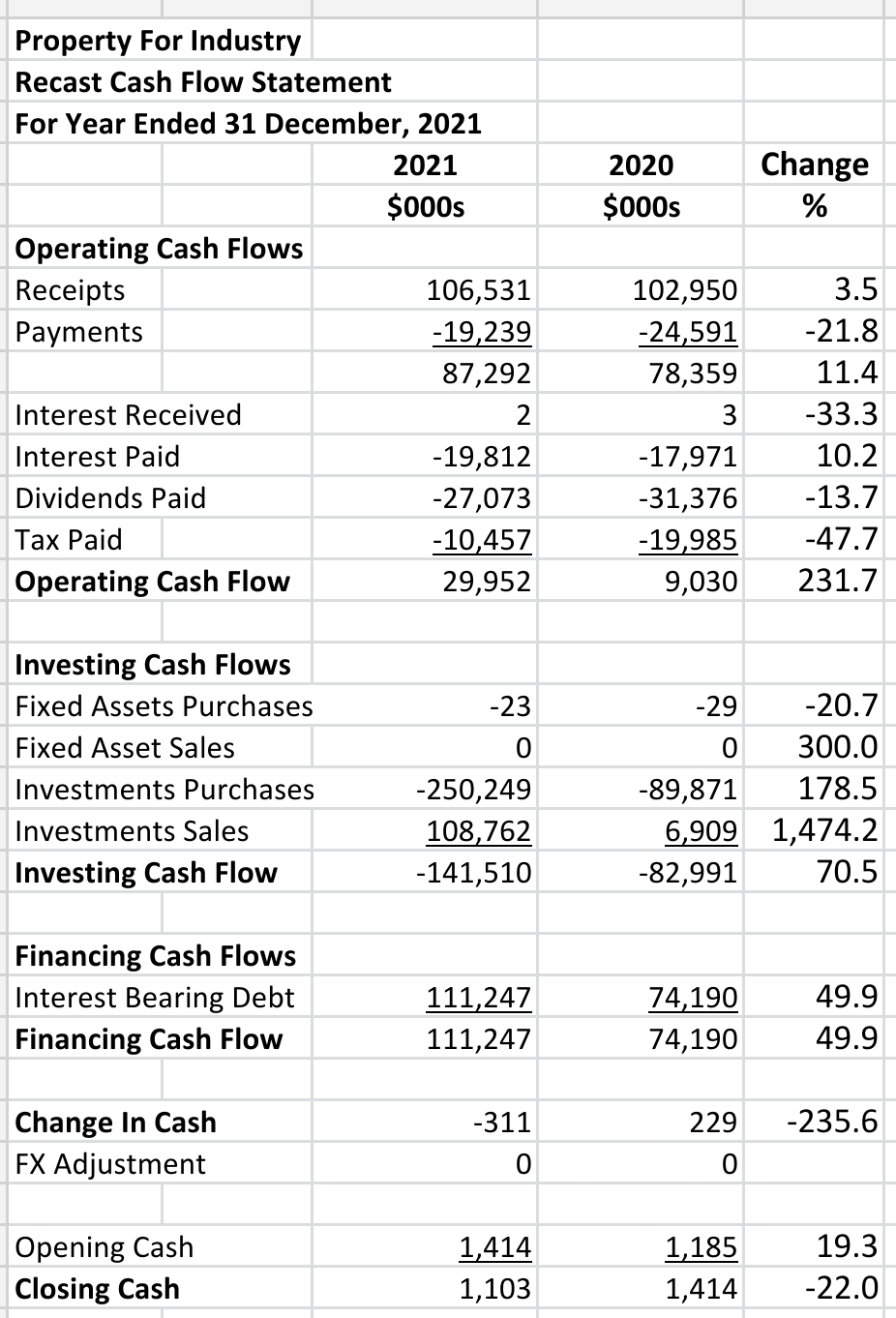

Recast Cash Flow Statement

The company has very good operating cash flow even when the dividends paid are included in the calculation. Operating cash flow increased by 231.7% in the period which is phenomenal.

The company has very strong liquidity.

A net $141.5 mn was used almost exclusively on investments.

Interest bearing debt added a net $111.2 mn to the overall cash flow.

The closing cash at bank for the business was a paltry $1.1 mn.

Ratio Analysis

The company has strong funding cost cover at 4.3 times which is a slight decrease over the previous period's amount.

The equity ratio is a high 70.5% which of course is based to a large degree on revaluations which are unrealised.

There are a range of figures for both earnings per share and the price earnings ratio depending on what profit figure is used and the share number used.

The current ratio is poor at 0.42.

Segmental Analysis

None.

Summary

The company has a great balance sheet but it relies on unrealised revaluations of its properties over the years to create it.

The company is liquid and financially sound with regard to cash flows and profits.

One day there may be a correction in commercial property prices but the company is pretty conservative in everything except its massive revaluations.

Anyone who went through the 1990s property crash saw unrealised revaluations wiped out in the cases of listed property companies such as Chase Corporation and Robert Jones Investments.

Will those times come again? Who knows. But one thing that is different is the massive money printing and low interest rates of the RBNZ.

The truth is that the New Zealand dollar is a dreadful store of value and has been for quite some time.

Physical assets especially leveraged ones have been a protection from the RBNZ's recklessness. And who knows if that will continue.

It is said more and more that interest rates will rise but that remains to be seen.

If rates do go up it’s likely so will capitalisation rates on commercial property. That will lead to some large write-downs on values notwithstanding offsetting rental increases.