Photo by Jonathan Forage on Unsplash

Key Positives:

Rip Curl is making money

A dividend was paid

Reduced interest bearing debt

No contingent liabilities

Key Negatives:

Kathmandu is losing money

Oboz is losing money

All business segments have declining performance

Very poor cash flow from operations

Cannot service funding costs from EBIT

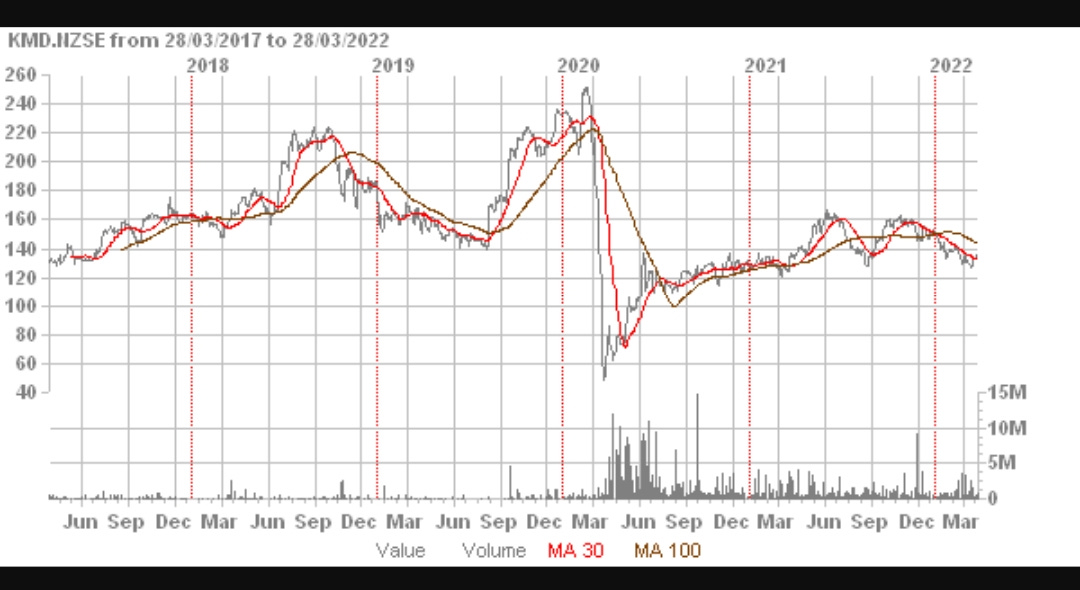

Five year trading history:

Source: Direct Broking

History

KMD Brands (KMD) is a parent company which owns several brand businesses. It currently has three; Kathmandu, Rip Curl and Oboz.

The company was previously known as Kathmandu and recently had a name change.

KMD is listed on both the New Zealand Stock Exchange (NZX) and the Australian Stock Exchange (ASX) under the code KMD.

Overview

KMD opened 12 new owned or licensed stores during the latest period and also focused on developing its online businesses.

It has been badly affected by both trading and supply problems during the Covid period.

Despite making a loss the company still decided to pay a significant dividend for the latest interim period.

The company seems positive that its profits will rebound in the next full financial year which ends 31 July, 2023.

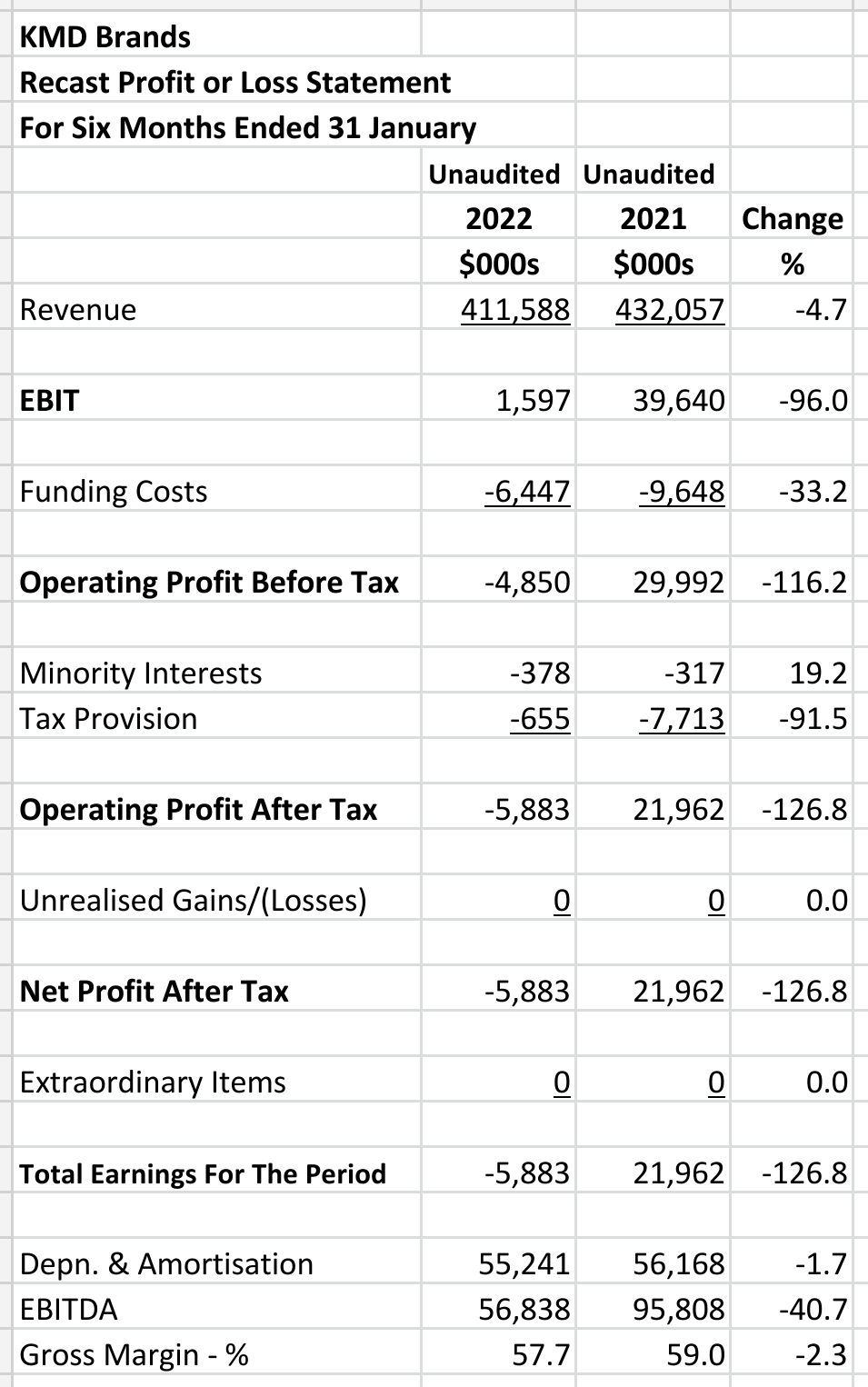

Recast Revenue Statement

Essentials:

EBIT down 96.9% from period to period.

Total earnings of -$5.9 mn

Gross margin dropped from 59% to 57.7%

Revenue Statement Overall:

Revenue Statement Breakdown:

The breakdown of revenue above produces a slightly different EBIT as a slightly different income figure is used.

Revenue fell slightly while COGS rose a little.

This produced a gross profit of $234.9 mn which is 3.1% down on the previous period.

The gross margin declined overall from 59.0% to 57.7%.

Administration & general expenses were 15.8% higher in the latest period.

Photo by Jeremy Bishop on Unsplash

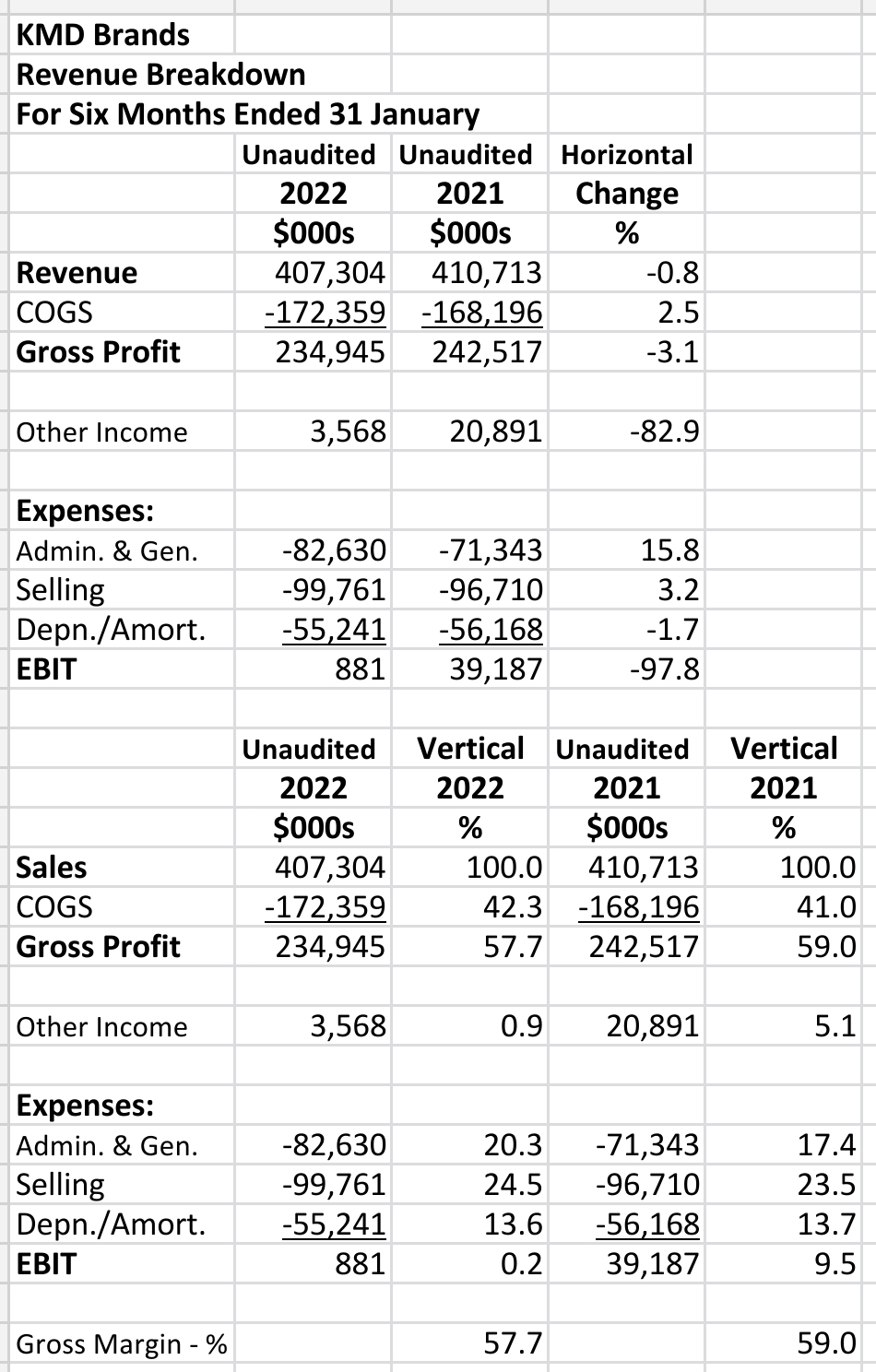

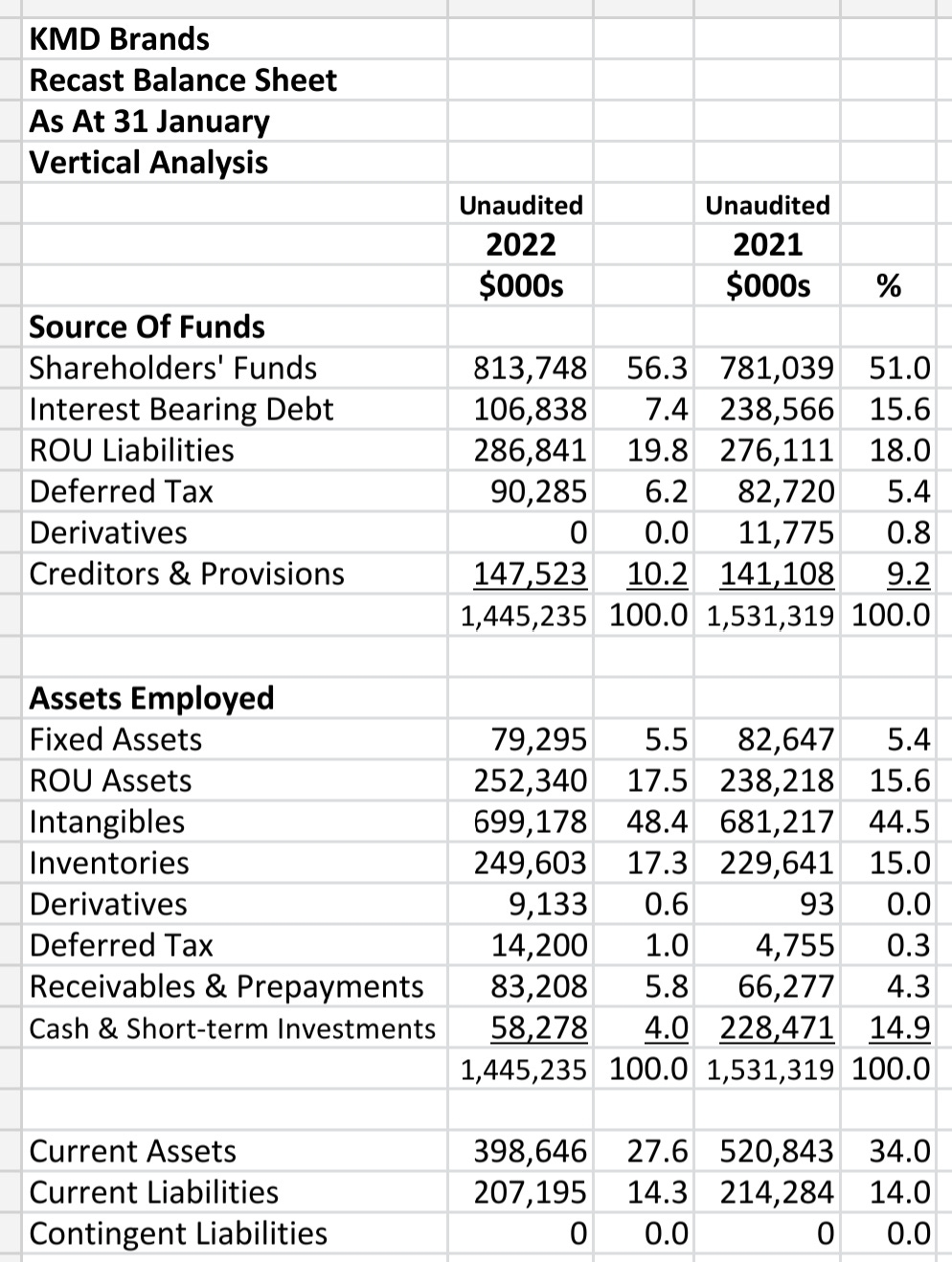

Recast Balance Sheets

Essentials:

Interest bearing debt down 55.2% to $106.8 mn

Receivables increased by 25.5% to $83.2 mn

Equity ratio improved to 56.3%

Total assets down 5.6% to $1,445.2 mn

Cash & short-term investments down 74.5% to $58.3 mn

Revenue fell slightly while inventory rose 8.7%

Horizontal Analysis:

Vertical Analysis:

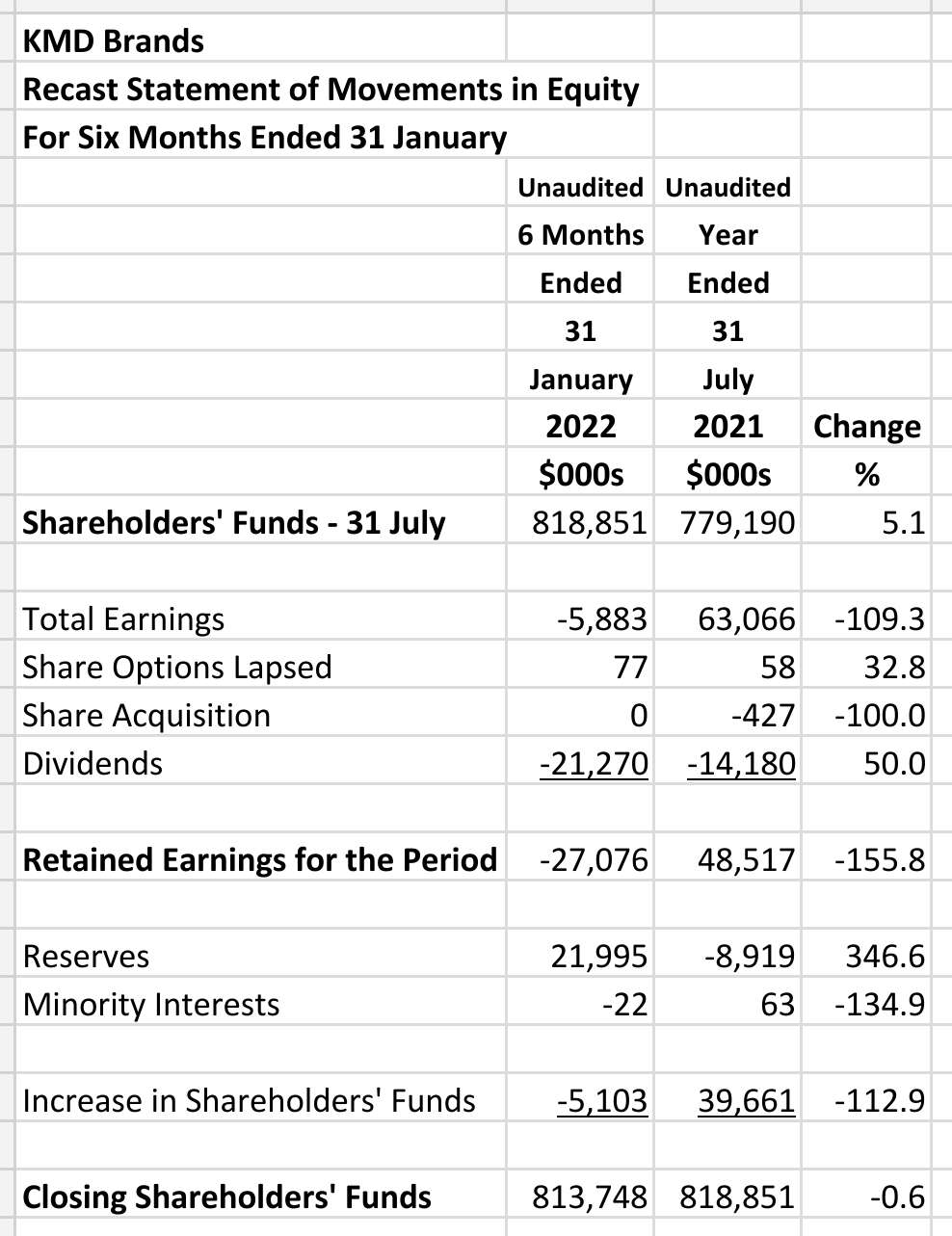

Recast Movements in Shareholders' Equity

Essentials:

High dividend of $21.3 mn paid despite loss

The prior period in the movements in shareholders’ funds is for the full year to 1 July, 2021. This was the way it was presented in the interim accounts.

The company paid a $21.3 mn dividend in the latest period even though it had lost $5.9 mn.

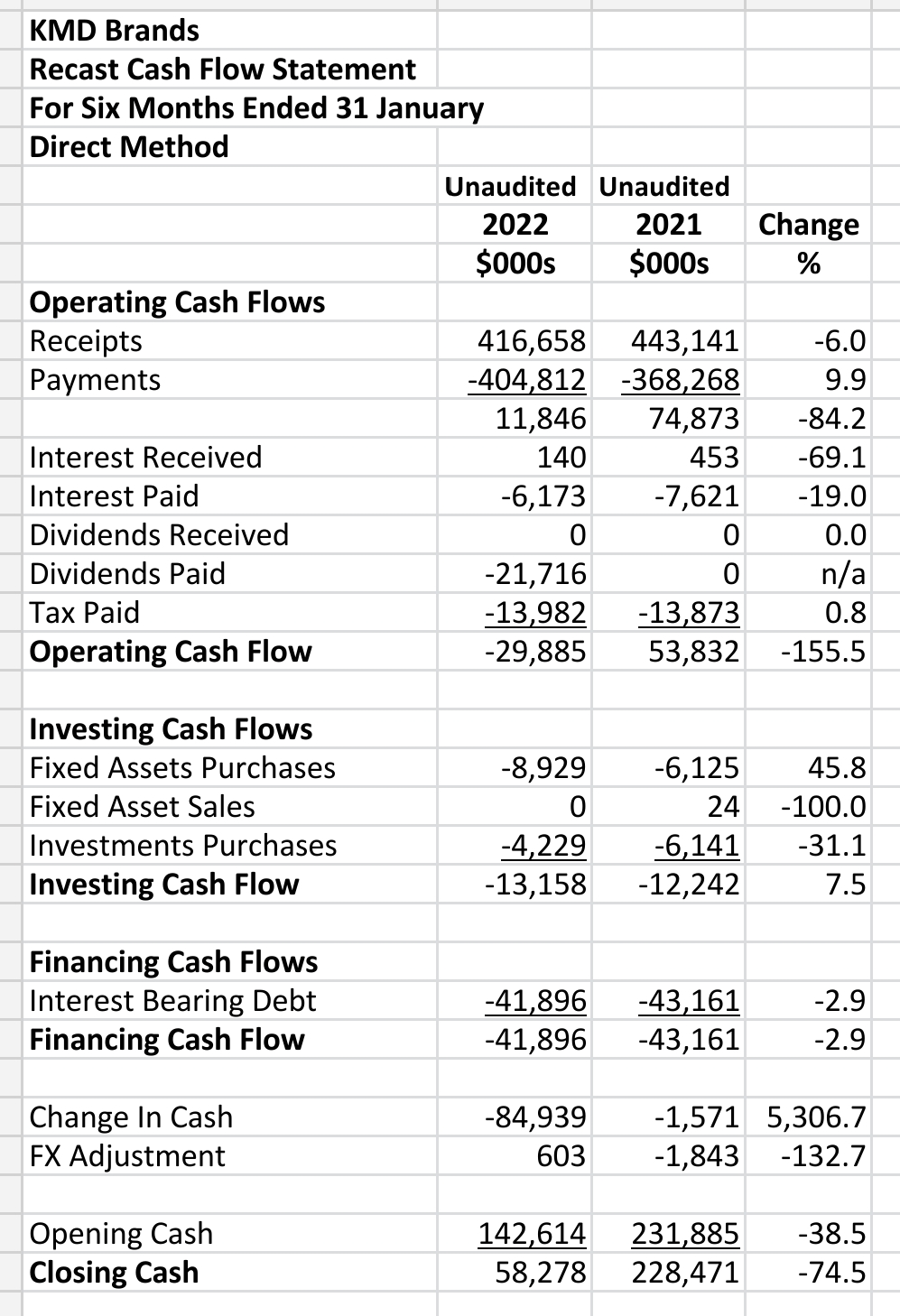

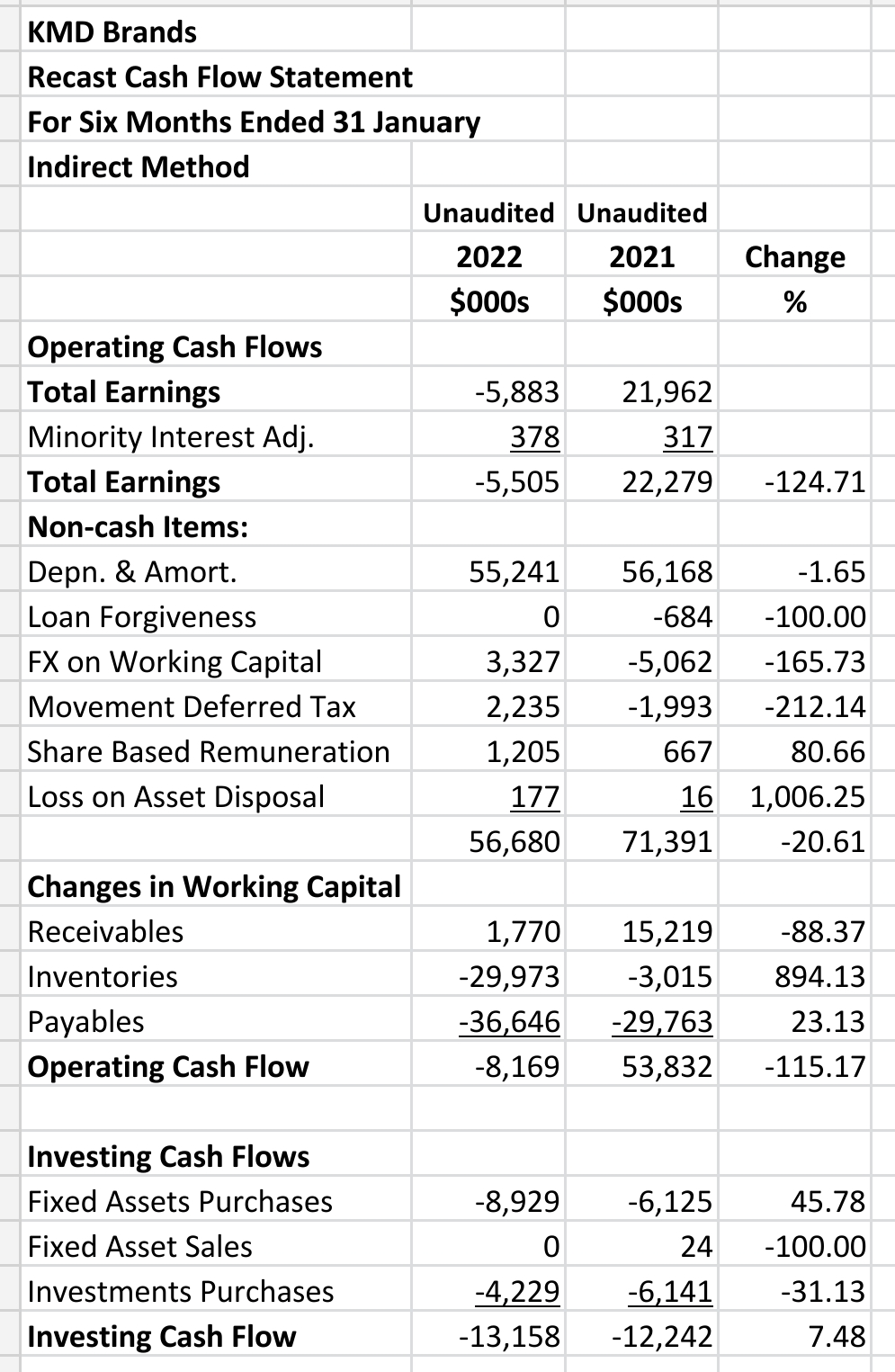

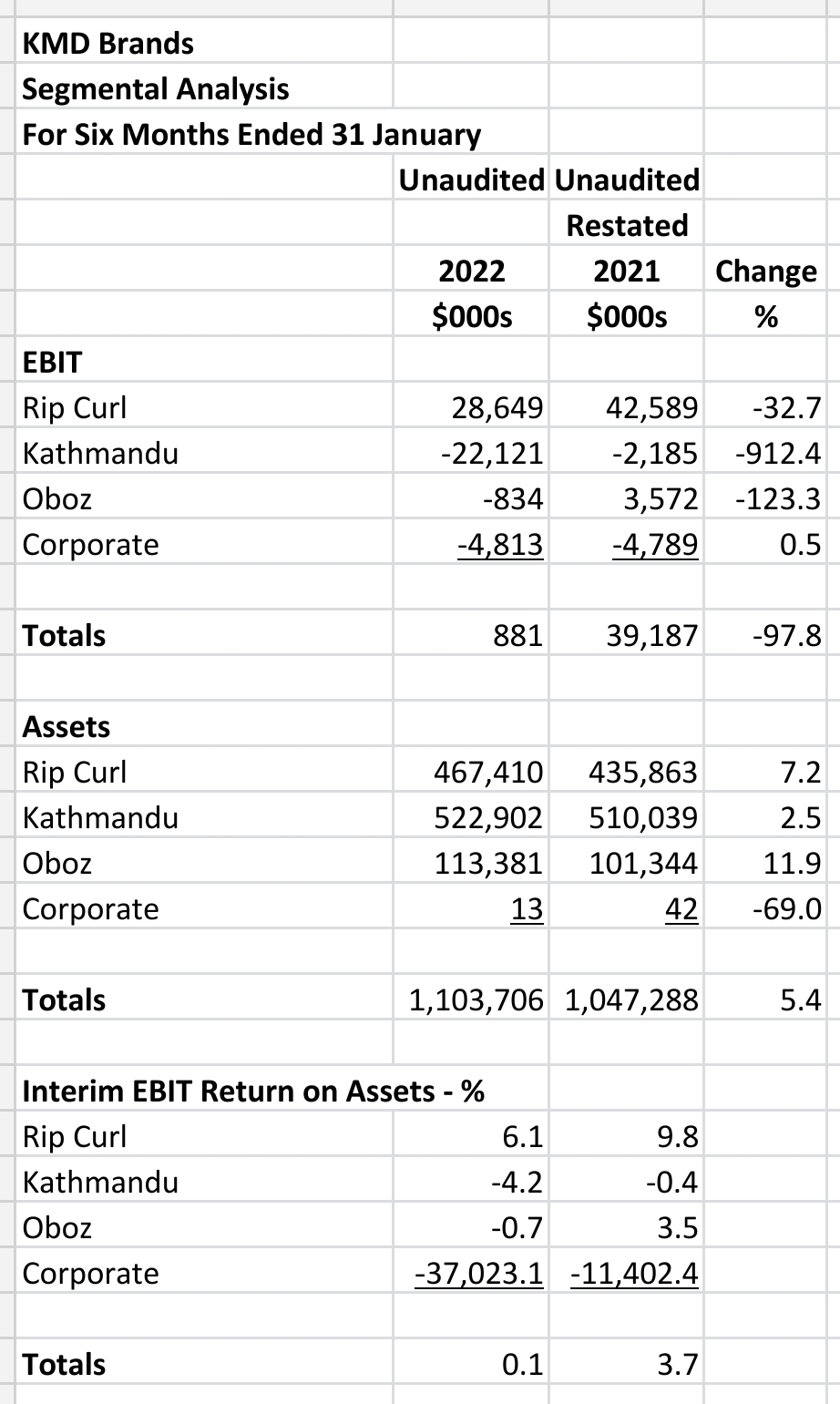

Recast Cash Flow Statements

Essentials:

Massive decline in cash flow from operations to -$28.9 mn.

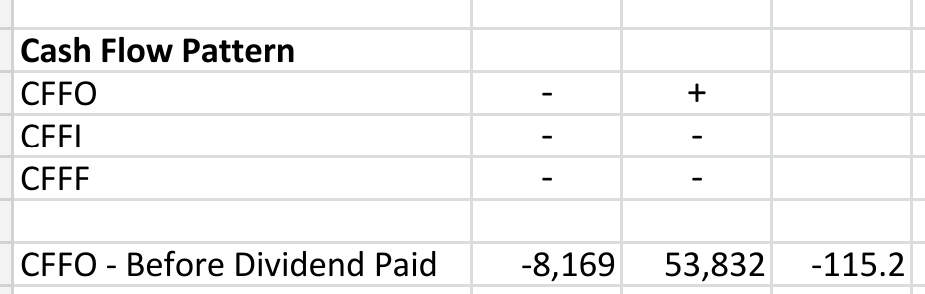

Poor cash flow pattern in latest period

Direct Method:

We include dividends paid in operating cash flows. The operating cash flow would still be negative even if dividends were not included.

Indirect Method:

Photo by Andrew Neel on Unsplash

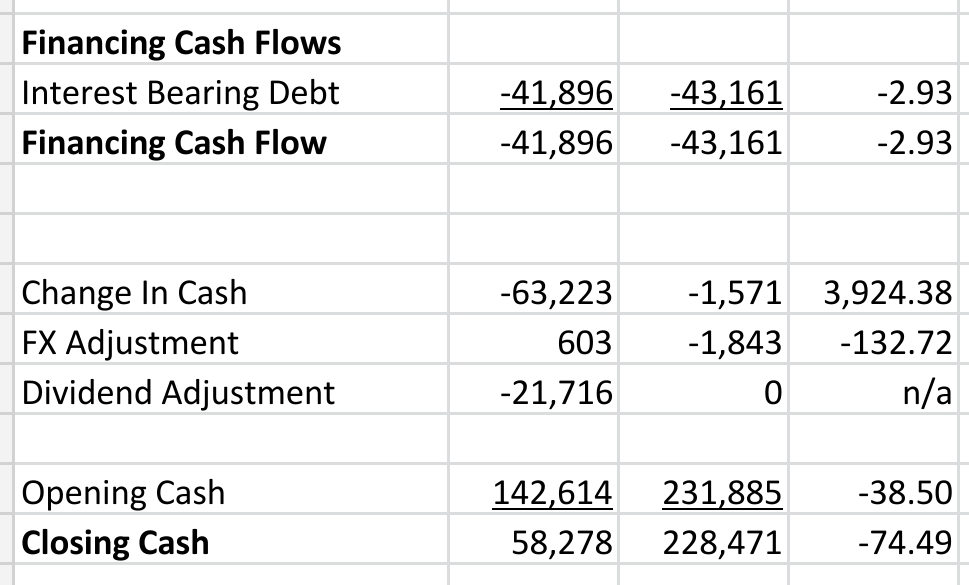

Ratio Analysis

Essentials:

Very low funding cost cover of 0.2 in the latest period

NTA per share of 16 cents

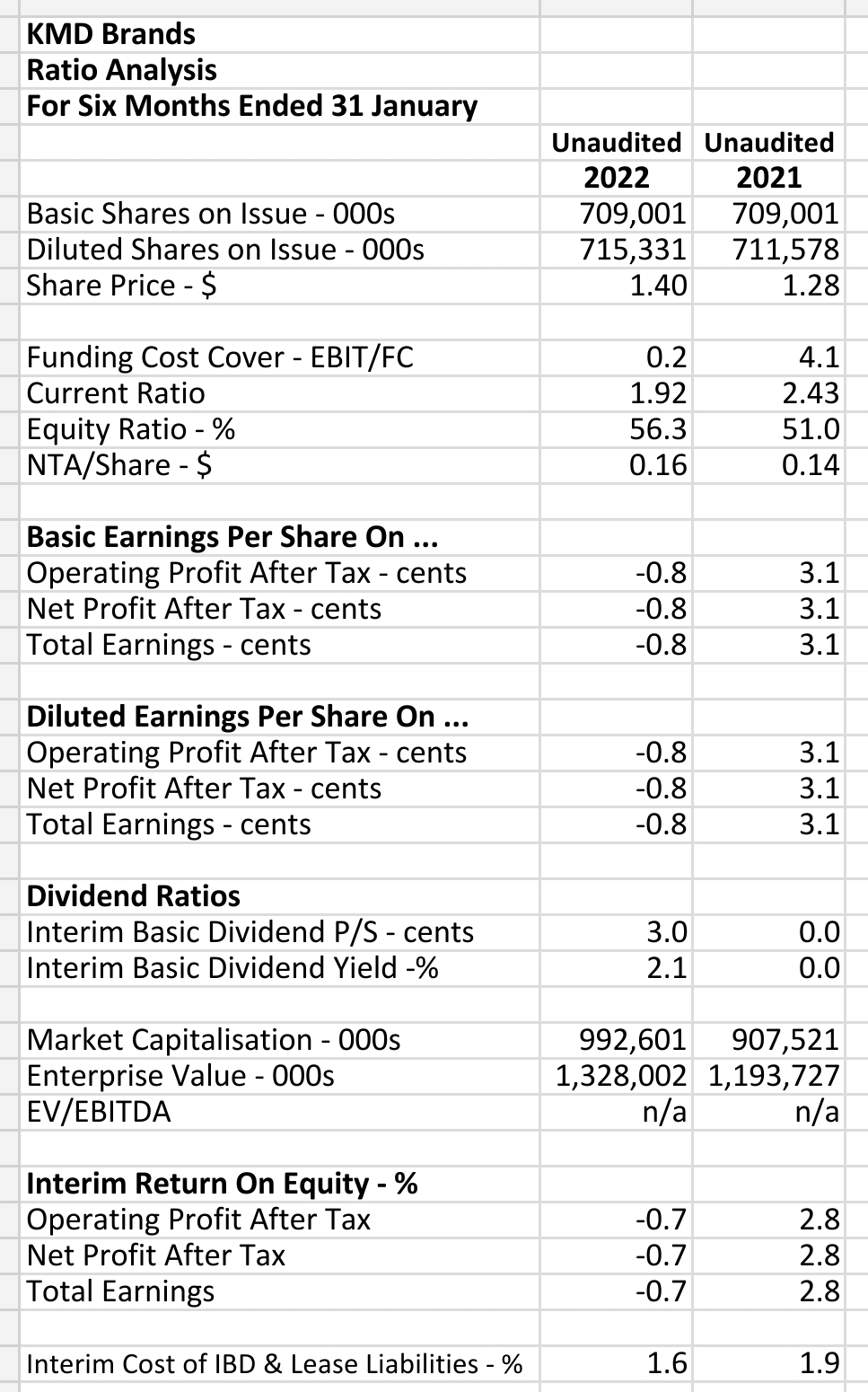

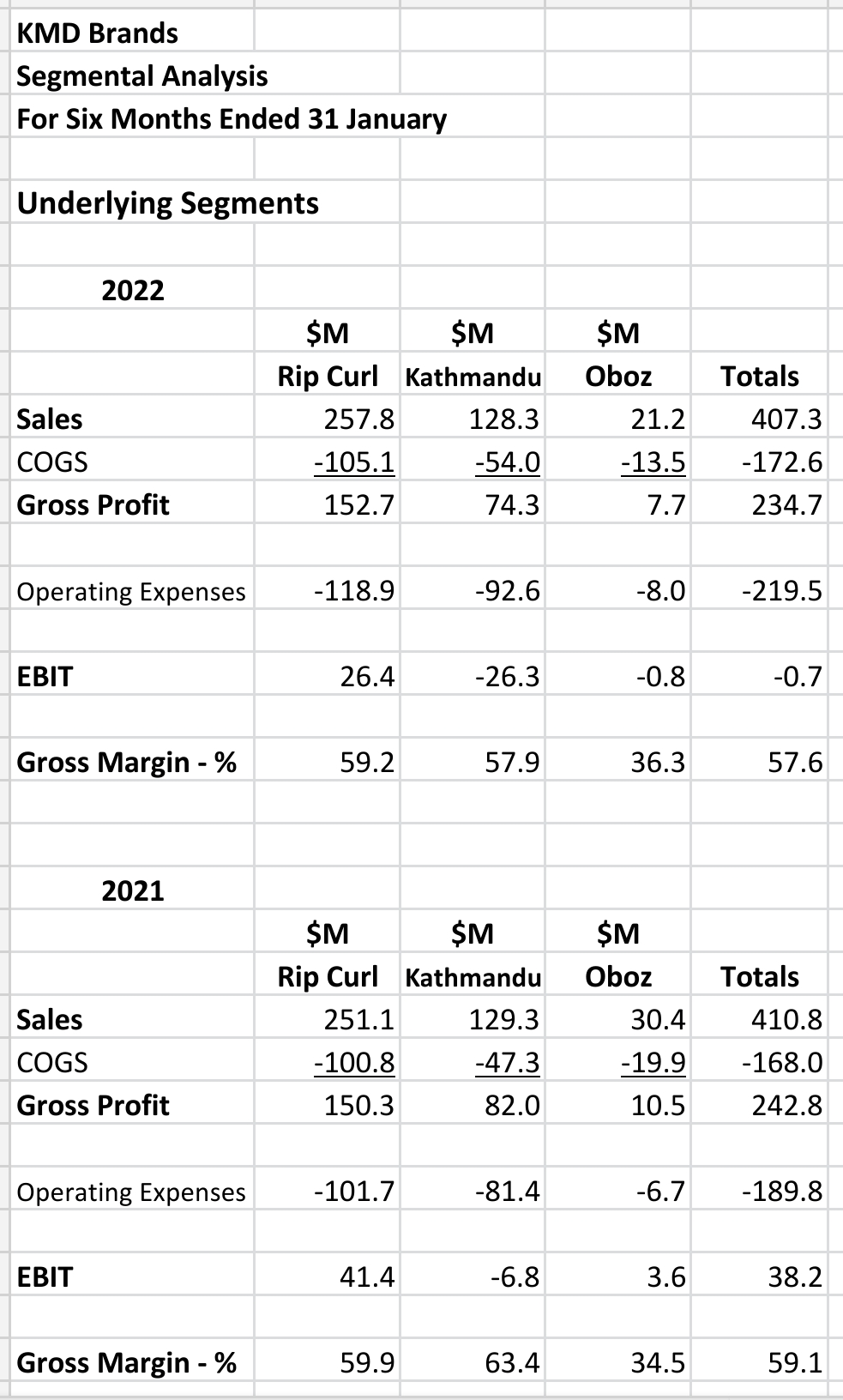

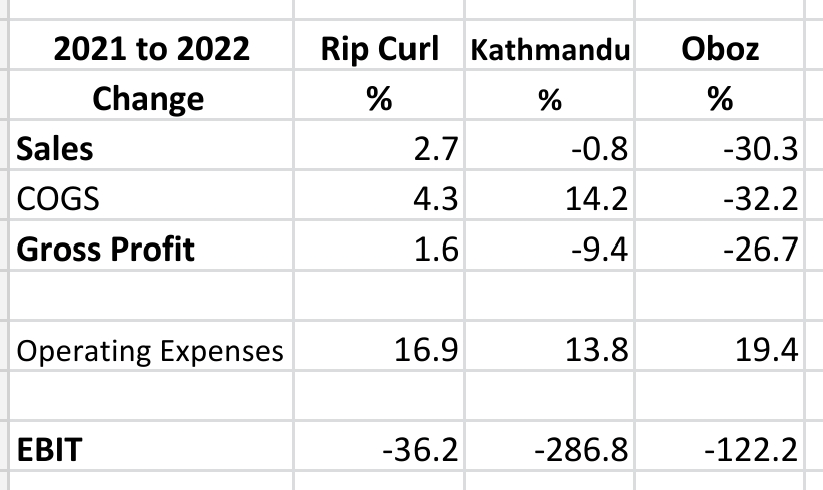

Segmental Analysis

Essentials:

Rip curl is profitable although its performance is declining

Kathmandu is losing money and its performance is declining

Oboz is losing money and its performance is declining

Segments:

Underlying Segments:

In its interim report the company does not lay out what comprises underlying segments.

They provide the following information.

Underlying Oboz sales are down 30.3% while it's COGS is down more.

COGS rose 14.2% for Kathmandu on slightly lower sales.

Rip Curl was the most consistent but still it's EBIT declined 36.2% on sales and costs metrics not much different from the prior period.

Operating expenses were up sharply across all three brands.

Dividends

The company declared a dividend of $21.3 mn in the latest period.

This presumably came from cash & short-term investments.

Is this dividend sustainable?

The cash & short-term investments at the latest balance date were $58.3 mn which was a lot less than the balance at the end of the prior period a year earlier which was $228.5 mn.

Future dividends will probably rely on a return to profitability which the company believes will occur. However, the negative cash flow from operations (before dividends) of $8.2 mn raises the question of just how confident we can be in the return to profitability.

However, the company also has the ability to drawdown on its interest bearing debt facilities which, of course is not ideal.

The CEO Michael Daly discusses in the interim financial report the company's 'significant funding headroom' of circa $250 mn.

If profitability returns slowly (or not at all) perhaps the dividend will be sustained from cash or debt or a combination thereof.

Forecast

The company is positioned to recover some of its performance if the economy keeps heading in a positive direction.

Supply chains are improving on their deliveries and the company is keeping substantial inventories.

But with so much uncertainty around the world it's impossible to model future earnings with any degree of accuracy.

Thus an intrinsic valuation model cannot be constructed.

Summary

The company, like many, has been through an extremely difficult period. And that period continues despite positive comments from management and directors.

Supply chains are improving according to the company but the historical financial results we analysed are very poor.

The company has a negative operating cash flow, is losing money overall and every segment of its business is declining in performance from period to period in the analysed interim accounts.

The business is not able to generate positive cash flows from its core businesses in aggregate which is troubling.

Kathmandu in particular is concerning with declining metrics and significant losses.

Its market value has risen however as the expectation on a forward-looking bourse seems to be that things will improve quite quickly.

This, however remains to be seen.