Key Points

Unrealised property revaluations of $93.6 mn

EBIT of $79.0 mn

High equity ratio of 64.2%

Dividend 2.75 cents per share

Operating cash flow of $10.0 mn

Mixed use property was highest contributor to profits

Funding cost cover 4.0

Source: Direct Broking

The accounts discussed are for the two six month periods ending 30 September, 2021 and 2020.

The Kiwi Property Group is a large listed property company which has in its portfolio assets such as Sylvia Park in Auckland.

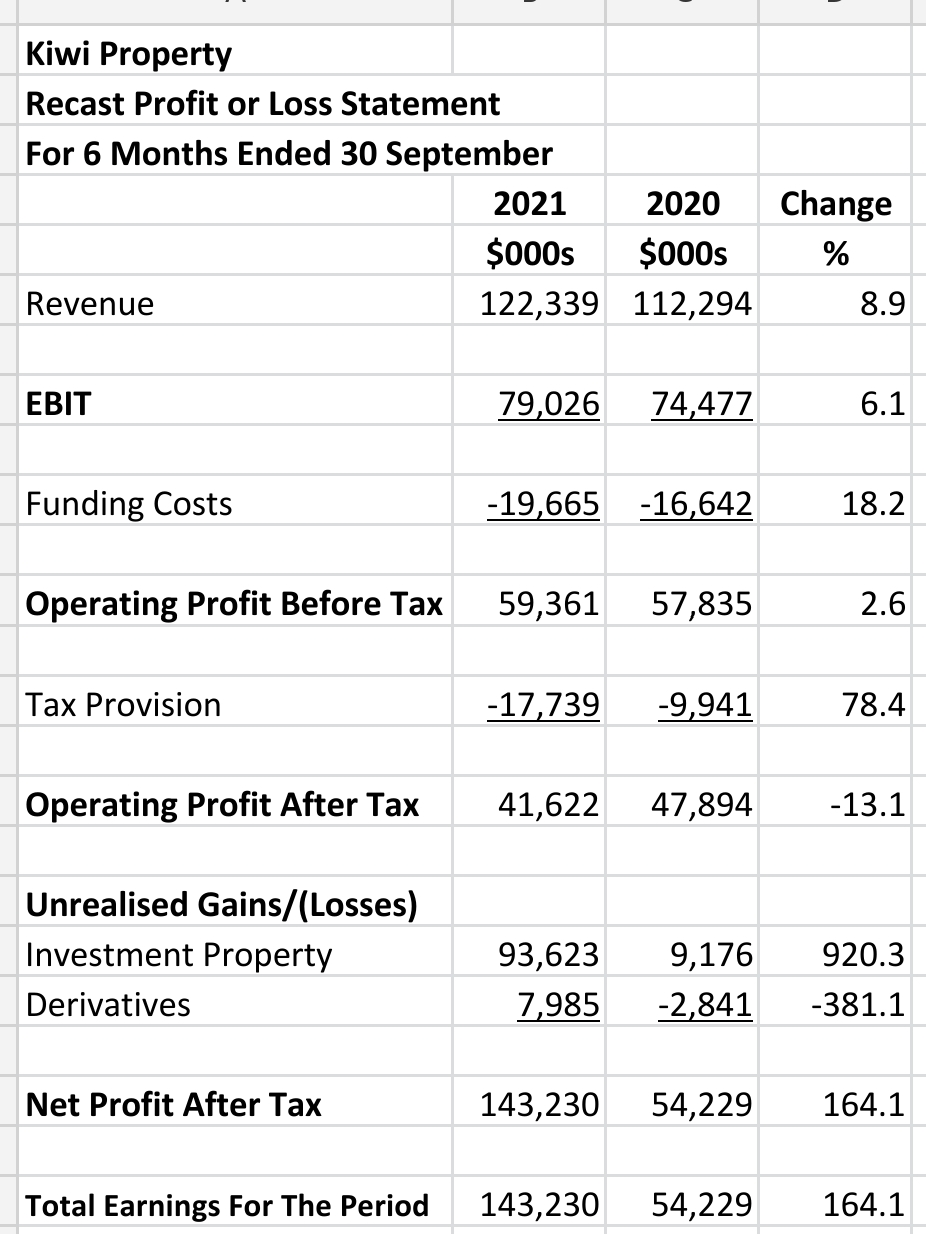

Recast Revenue Statement

Revenue rose in the latest six month period by 8.9% to $122.3 mn. EBIT also rose, to $79.0 mn.

After significant interest and tax charges the company produced an operating profit after tax of $41.6 mn which was 13.1% down on the prior period.

As is typical of listed New Zealand property companies a massive unrealised property revaluation of $93.6 mn helped create total earnings for the period of $143.2 mn.

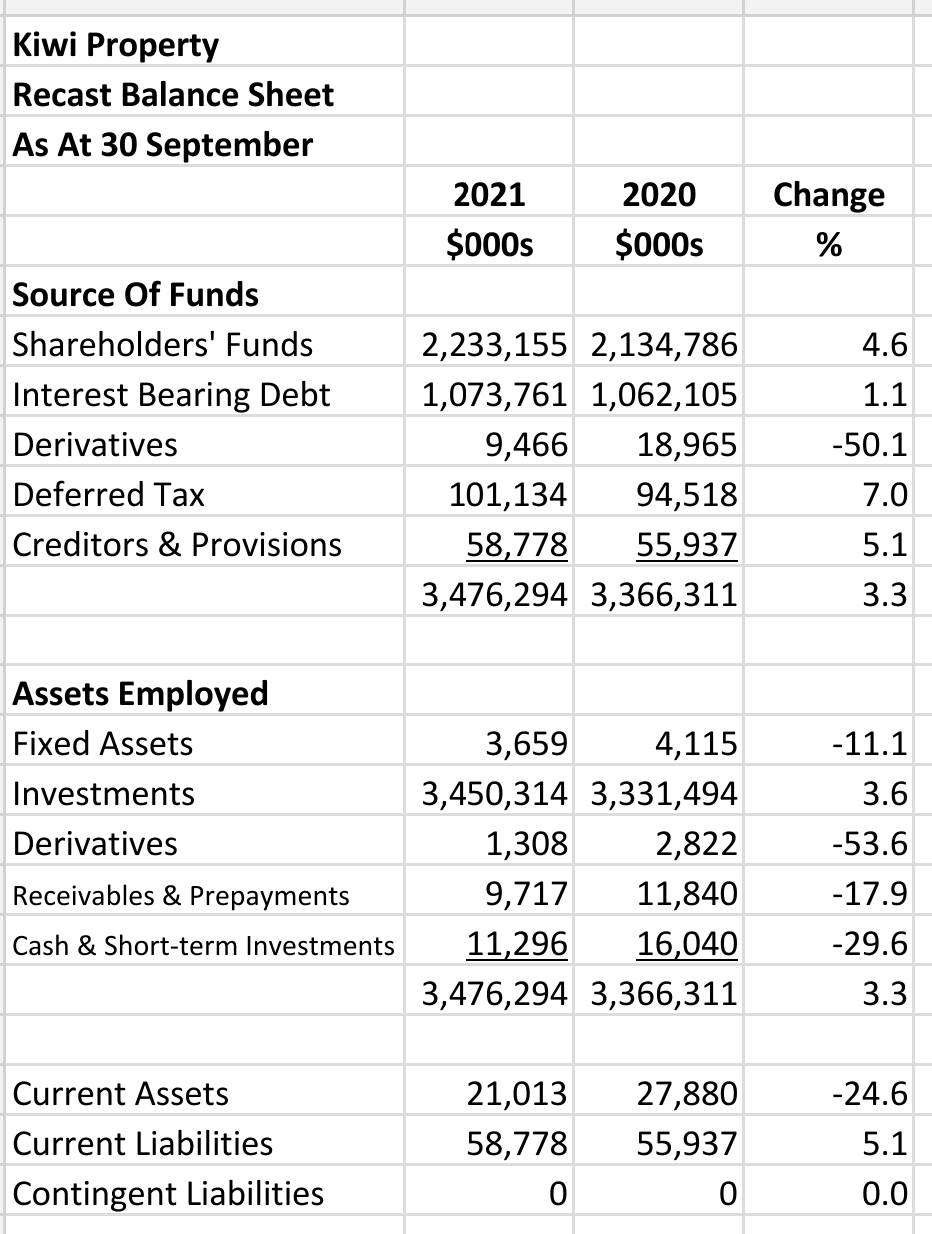

Recast Balance Sheet

The company had an equity ratio at balance date of 64.2%. Shareholders' funds were $2.2 bn against total assets of 4.5 bn.

There is $101.1 mn of deferred tax on the balance sheet.

Current liabilities are more than double current assets but this is not concerning in a business with these high cash flows.

The company had cash of $11.3 mn at balance date which is low compared to its total assets.

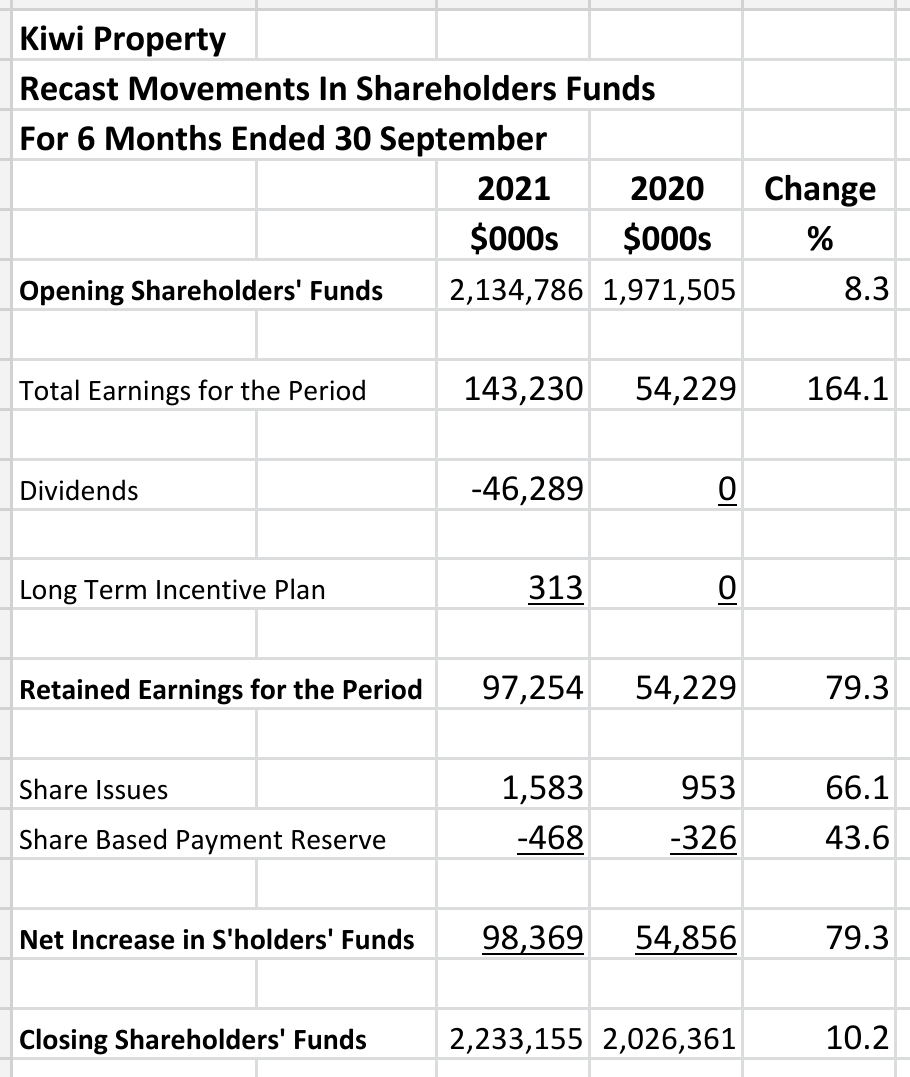

Recast Statement of Movements in Equity

Recasting the statement of movements in equity in this vertical format makes the information easier to understand.

It would be useful if the company kept all its unrealised property revaluations in a separate reserves account. Of course this would mean the amounts couldn't appear high up in the revenue statement which is what shows the company in the best light.

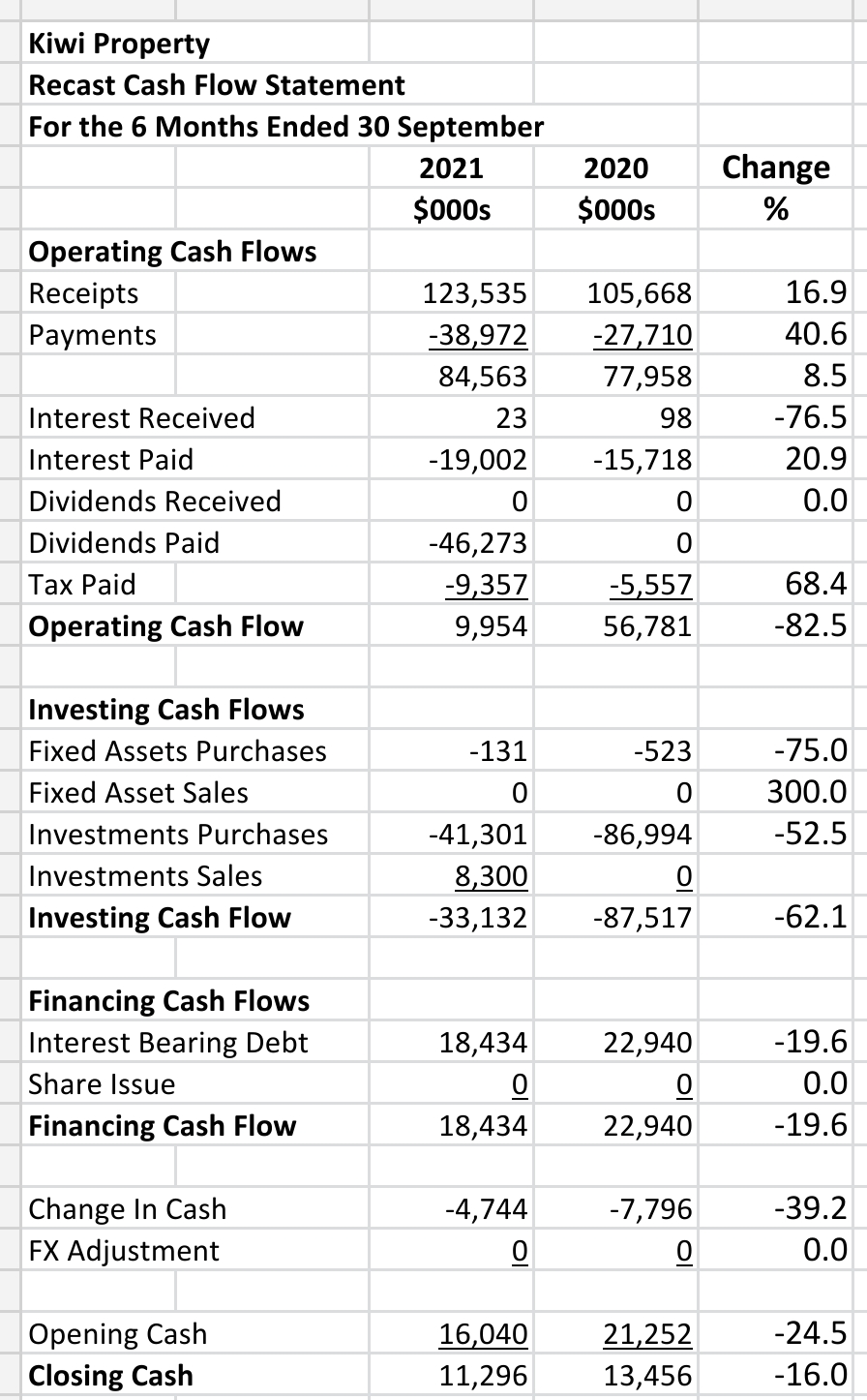

Recast Cash Flow Statement

Placing dividends paid in operating cash flow reduces the latter dramatically to $10.0 mn. This is much lower than the prior period when no dividend was paid.

In both periods the company made significant property purchases and in both periods the company increased its interest bearing debt.

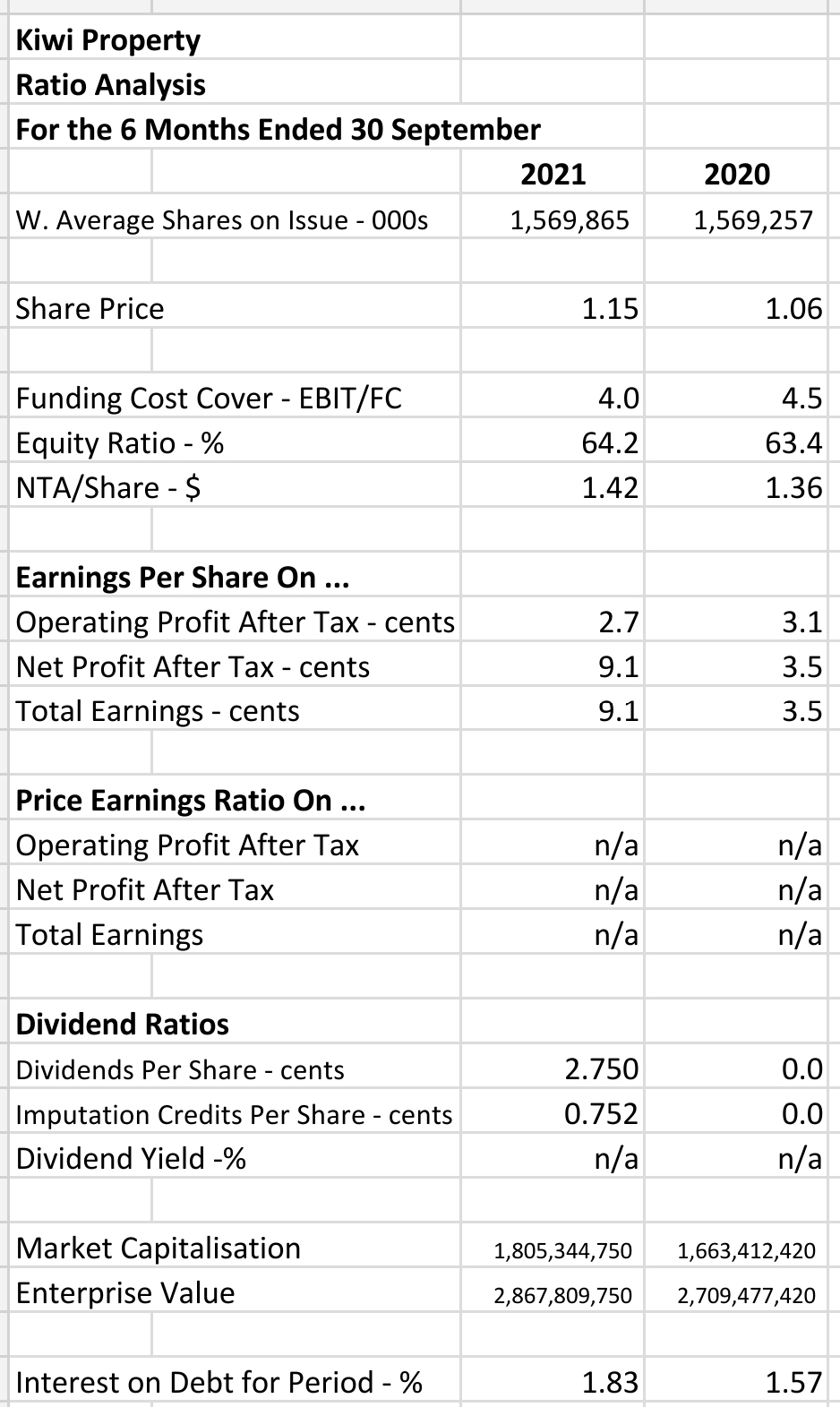

Ratio Analysis

The company had a market capitalisation at balance date of $1.81 bn and an enterprise value of $2.87 bn. The enterprise value is the market value plus interest bearing debt less cash.

Interestingly, the NTA per share at $1.42 is a higher than the share price which at balance date was $1.15.

Segmental Analysis

Mixed use investments made the most contribution to profit.

Summary

The company is financially sound with high cash flows and a conservative balance sheet.

However, it has relied on unrealised property revaluations for a large proportion of its profit and therefore its retained earnings.

The Covid period with its central bank 'money printing' has indeed been very kind to property companies in New Zealand.