Five Year Trading History

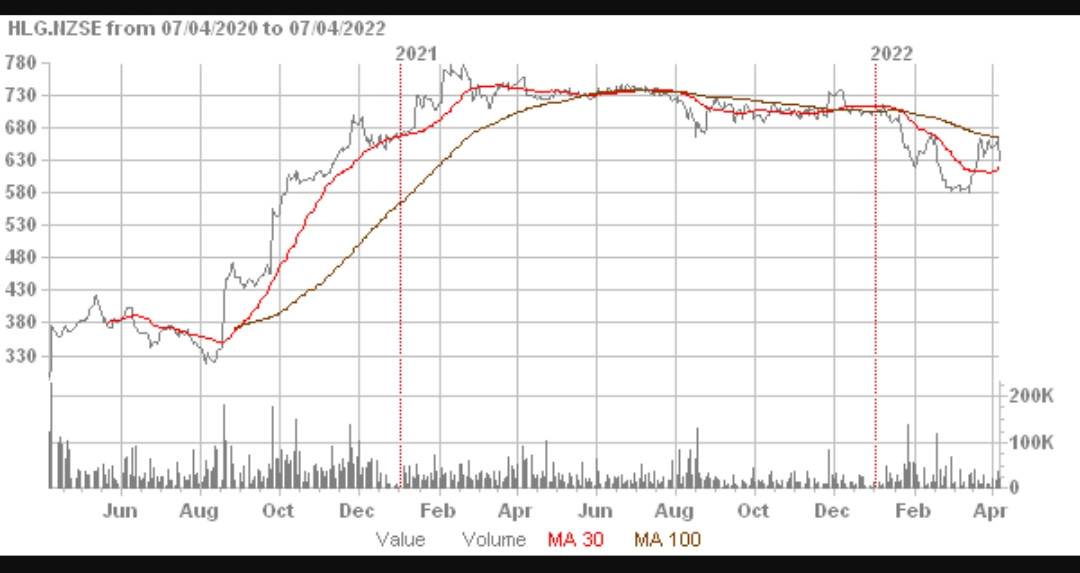

Two Year Trading History

Overview

Hallenstein Glasson Holdings (HLG) comprises four main operating segments:

The mostly New Zealand based Hallenstein chain of clothing stores.

The New Zealand Glasson's stores.

The Australian Glasson's stores.

Commercial properties.

HLG is listed under the code HLG on both the NZX and the ASX.

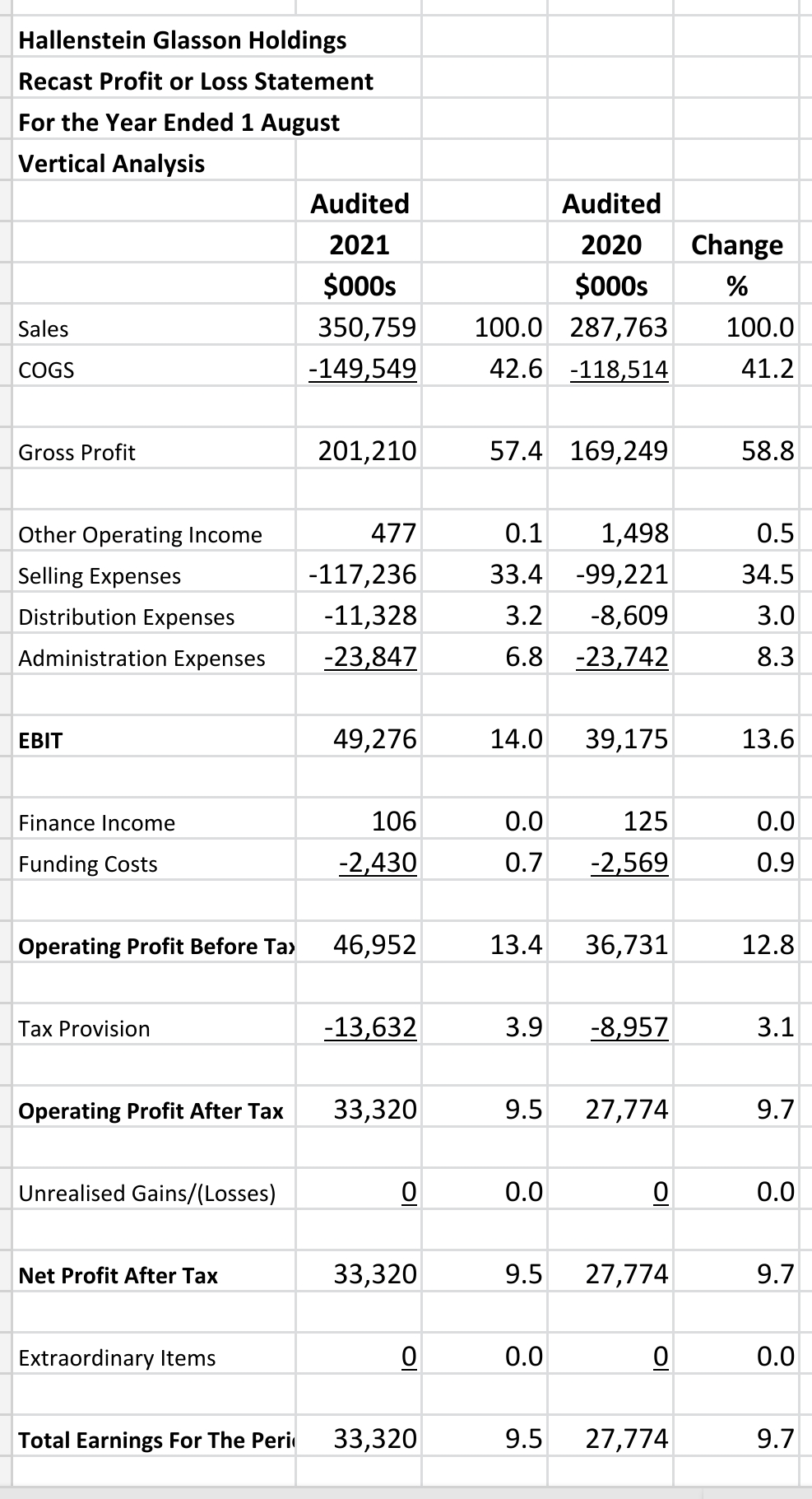

Revenue Statement

Takeaways:

Sales rose 21.9% to $350.8 mn

EBIT rose 25.8% to $49.3 mn

Selling expenses increased 18.2% while distribution expenses increased 31.6%

Total earnings increased 20.0% to $33.3 mn

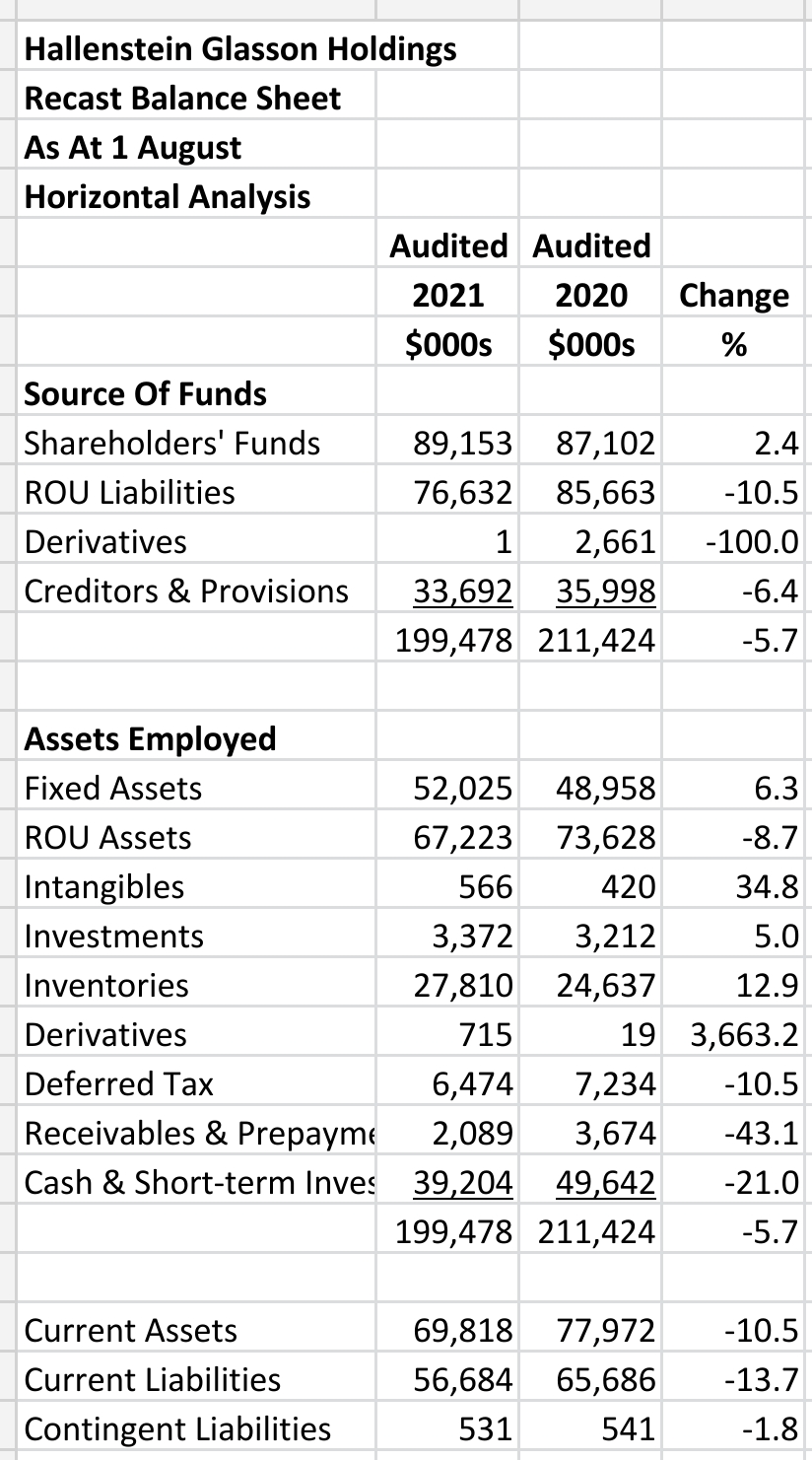

Balance Sheet

Takeaways:

43.1% drop in receivables

21% decline in cash & short-term investments

12.9% increase in inventories on a 21.9% sales increase

No interest bearing debt

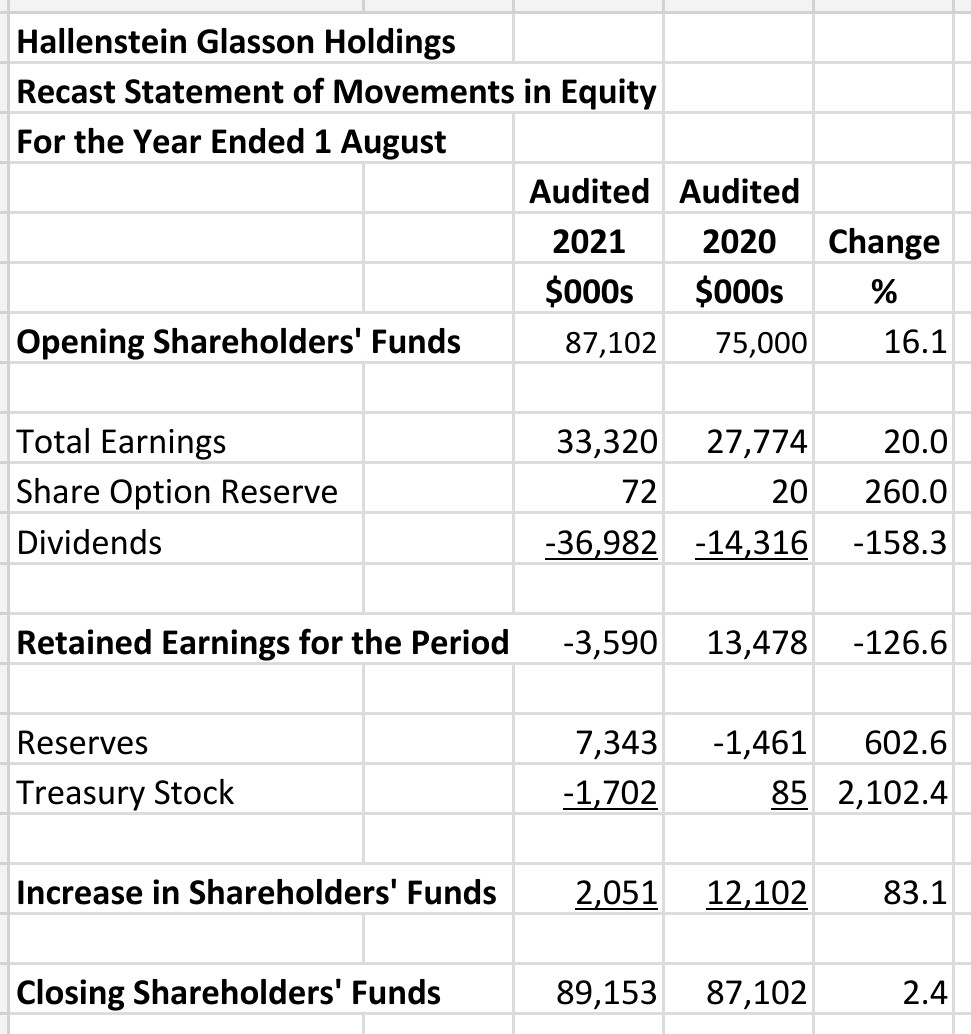

Movements in Equity

Takeaways:

Property revaluations run through reserves not the revenue statement

Negative retained earnings of $3.6 mn due to high dividend of $37.9 mn

Shareholders' funds would have declined had it not been for unrealised property revaluations

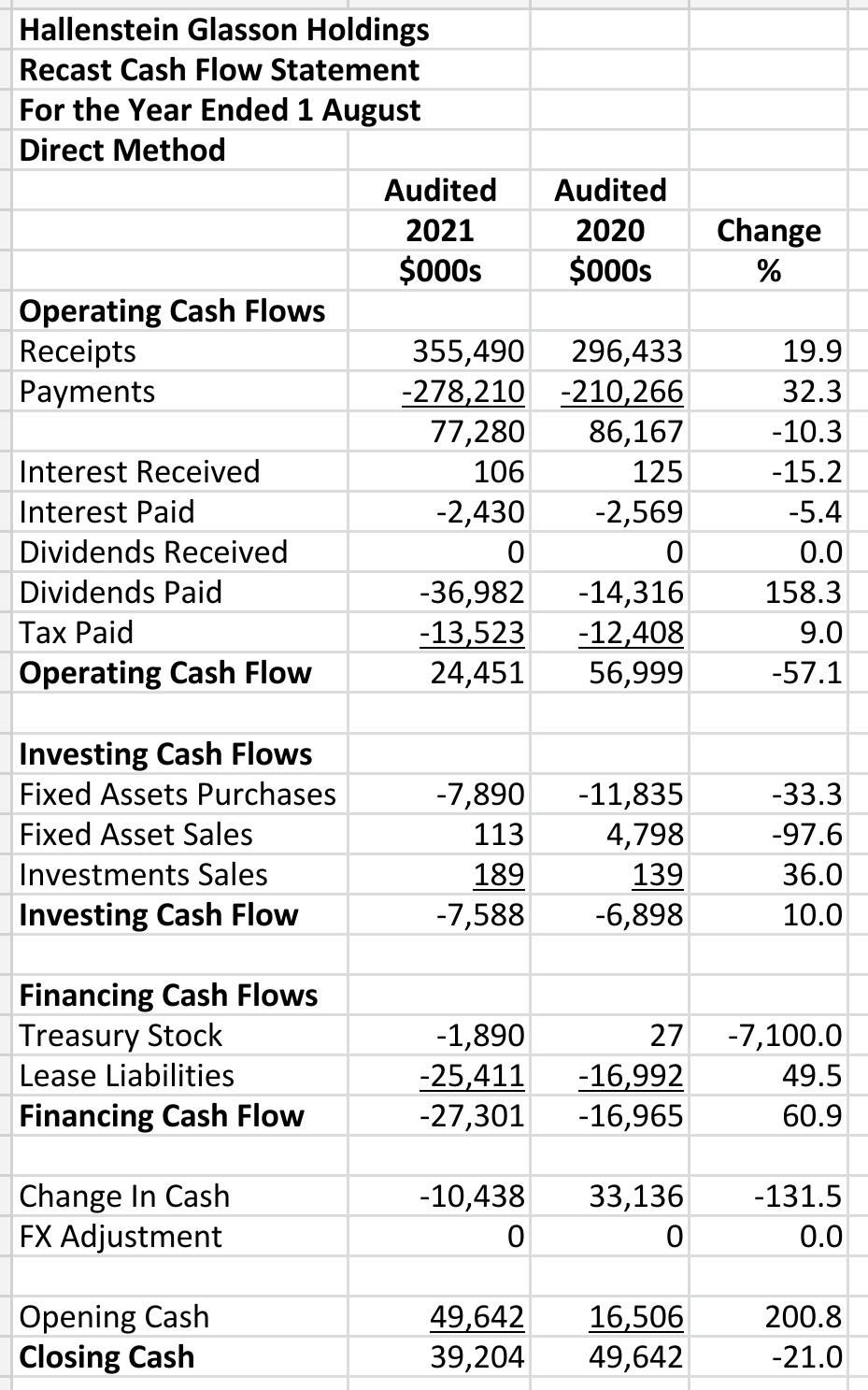

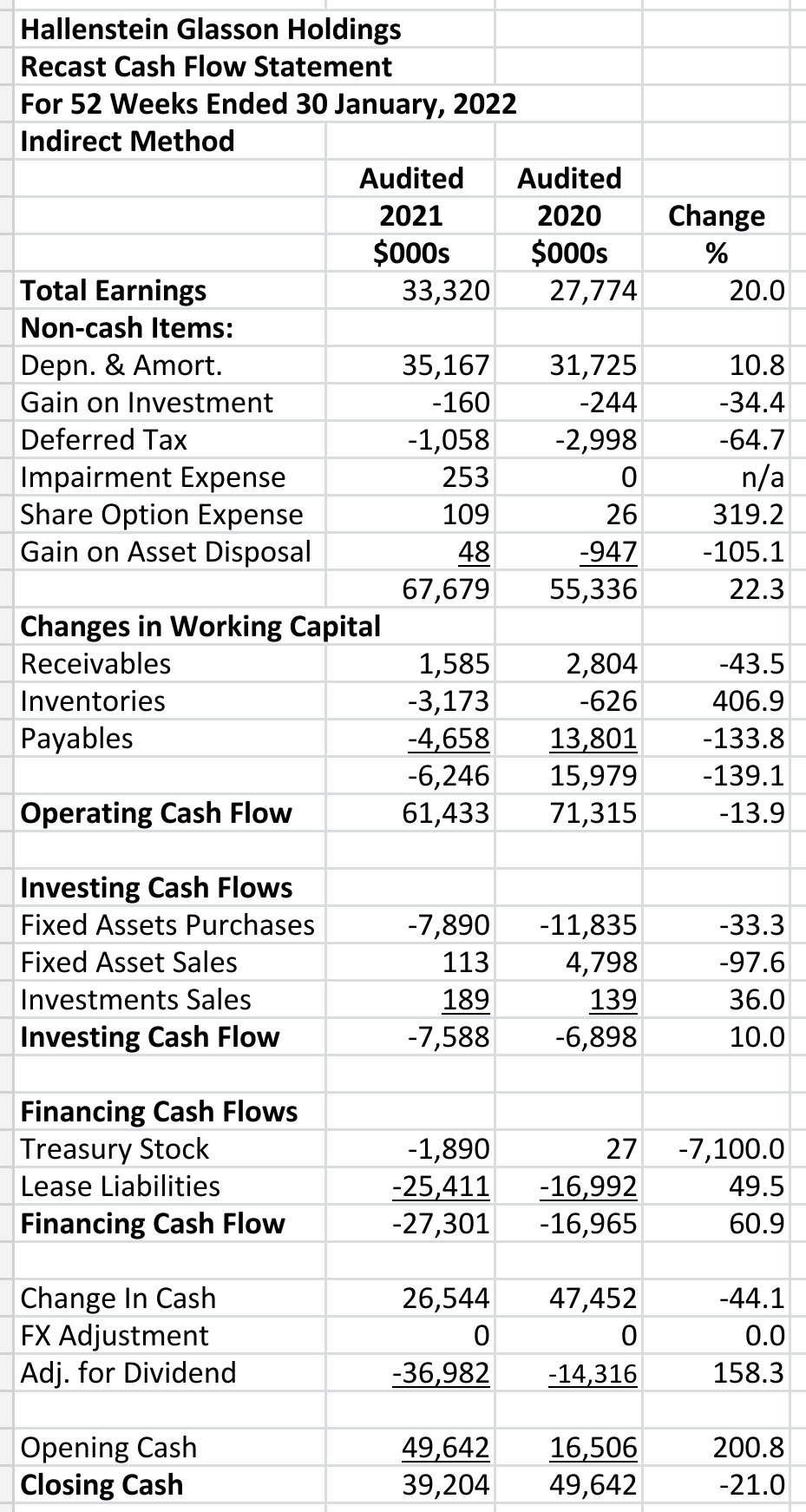

Cash Flows

Takeaways:

Positive cash flow from operations in both periods even with dividends paid included

Declining operating cash flow

$25.4 mn of lease liabilities paid down

$7.9 mn of fixed assets purchased

Closing cash balance down 21.0%

Cash flow pattern good with both periods' operating cash flows used for PPE purchases and liability reductions

Ratio Analysis

Takeaways:

Very high funding cost cover of 20.3

Improving equity ratio at 44.7%

High earnings per share of 55.9 cents

Reasonable P/E ratio of 13.0 times

Raw dividend yield of 5.2% on share price at balance date

Market capitalisation of $432.5 mn at balance date

High return on equity of 37.4%

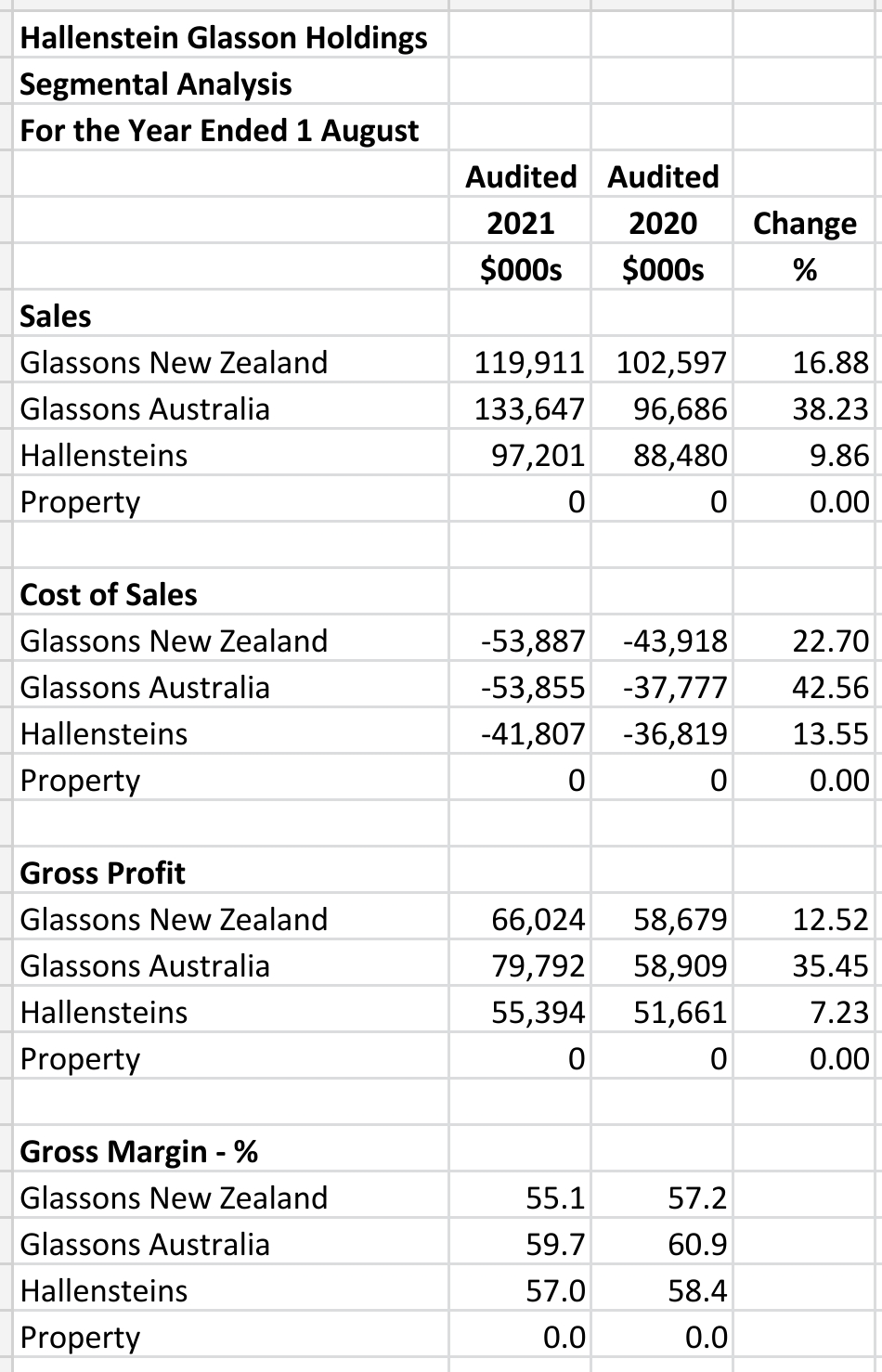

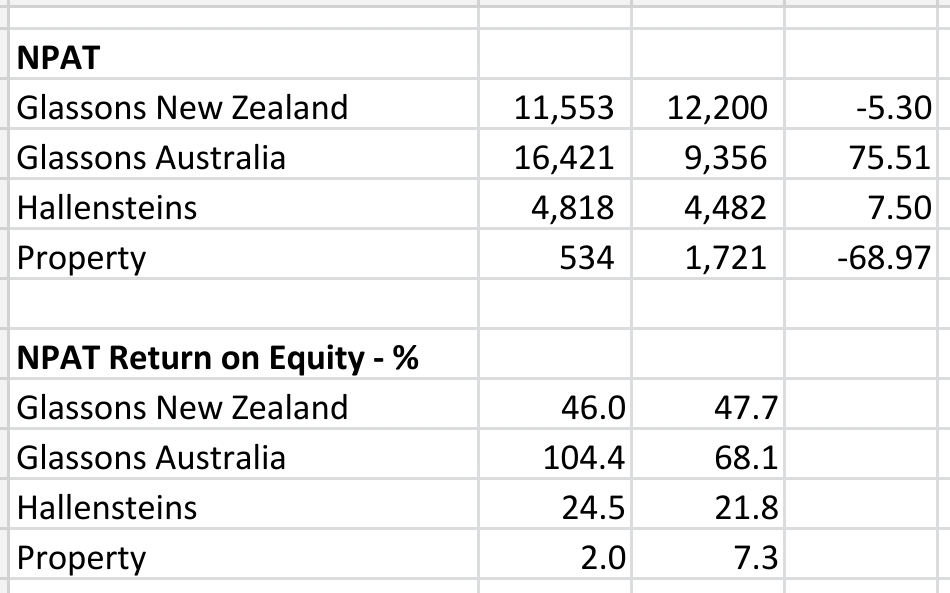

Segmental Analysis

Takeaways:

Gross margins declining slightly across all segments

Glassons Australia has highest EBIT return on assets at 131.5%

Glassons Australia has highest EBIT return on equity at 426.4%

All Hallenstein & Glasson segments make high returns in equity

Summary

The company paid a large dividend of $37.0 mn which was greater than its total earnings of $33.3 mn.

The question therefore is whether this high dividend is sustainable.

The company would need a significant increase in total earnings to keep paying out this kind of dividend.

Profits did rise by 20.0% however in what was a difficult trading environment.

Sales also increased significantly, by 21.9%.

Cash flows from operations were strongly positive.

The company appears to be coming out of the Covid period in good shape with strong profitability and a good balance sheet.

Glasson's Australia in particular is doing well.

The lack of interest bearing debt gives the company financial room to expand.

But it’s nice to see a company run in this conservative way even though it might not be maximising its returns in doing so.