Overview

Comvita Limited (CVT) is a bee products company which is listed on the NZX.

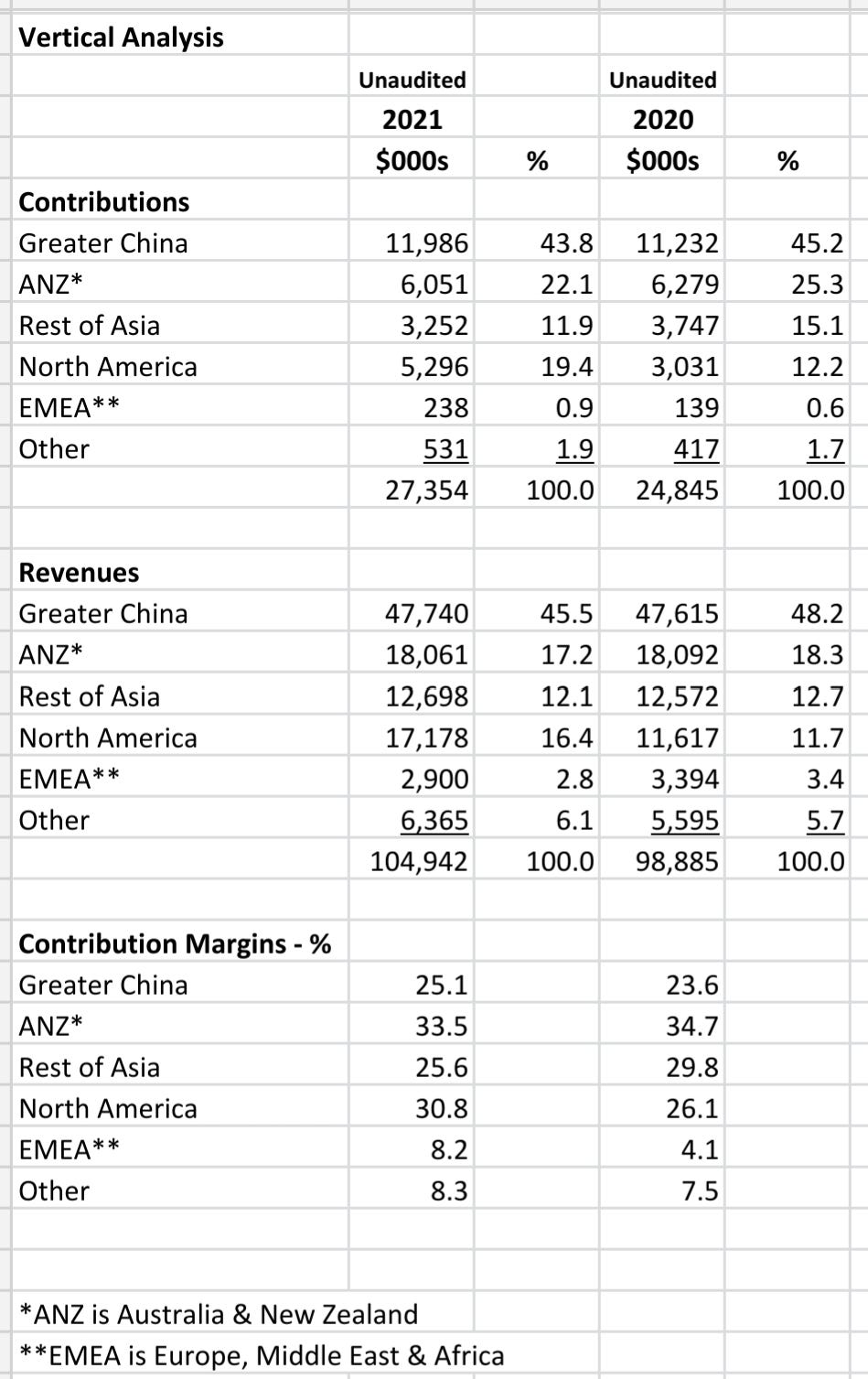

Nearly half its revenue is derived from Greater China and North America is its fastest growing market.

Two Year Trading History:

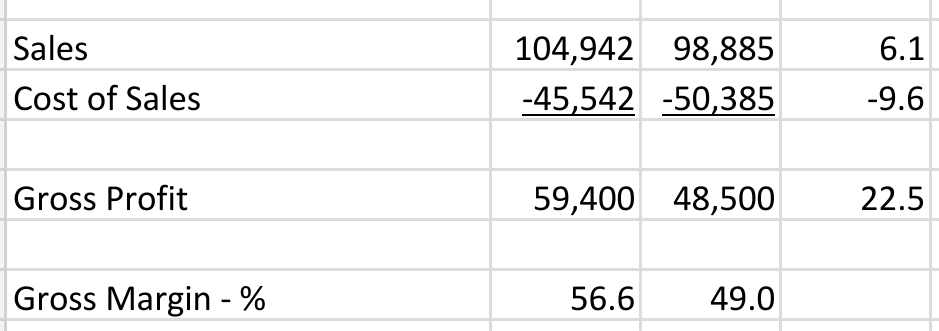

Recast Revenue Statement

Key Points:

EBIT up 29.2% to $7.3 mn from prior period

Gross margin up from 49.0% to 56.6%

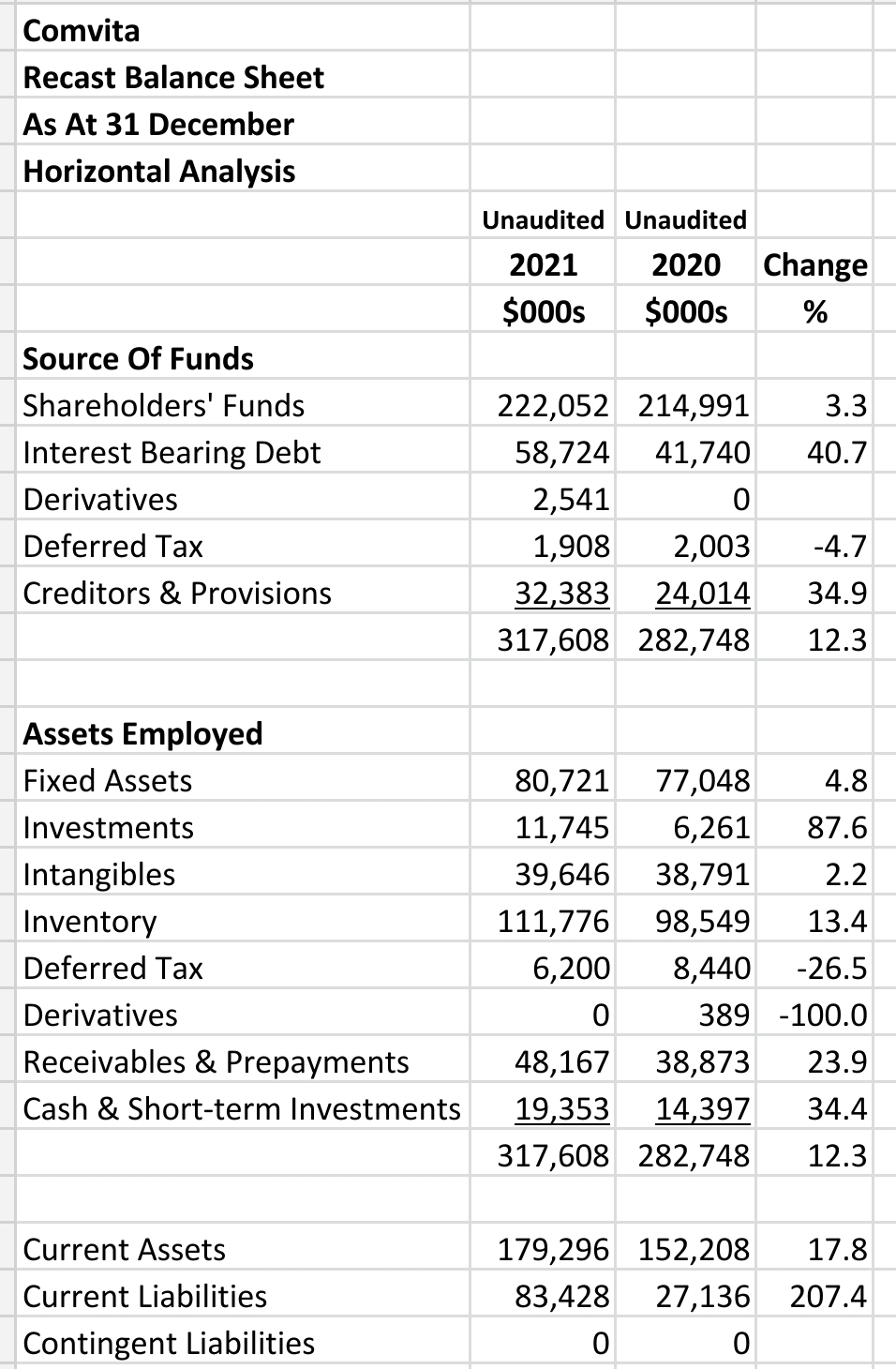

Recast Balance Sheet

Key Points:

40.7% increase in interest bearing debt

34.9% increase in creditors

Large increase in current liabilities

Equity ratio down from 76.0% to 69.9%

Horizontal Analysis:

Vertical Analysis:

Recast Movements In Equity

Key Points:

Shareholders' funds are 3.3 % higher than the prior period

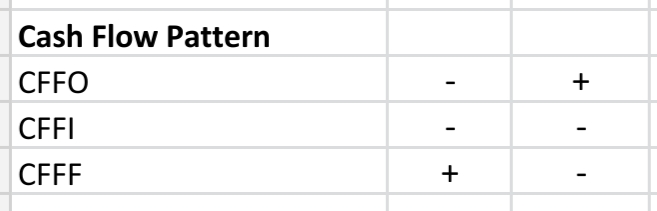

Recast Cash Flow Statement

Key Points:

-$7.7 mn in operating cash flow including dividend payments

Large cash flow from borrowings of $21.6 mn

Ratio Analysis

Key Points:

Current ratio declined to 2.15 times

Acceptable funding cost cover of 5.8 times

Segmental Analysis

Key Points:

Greater China is the most important market

The North American market is increasing in importance

Horizontal Analysis:

Vertical Analysis:

Summary

Comvita's most concerning accounting item is the negative operating cash flow of $7.7 mn which includes dividends paid of $2.9 mn.

Negative operating cash flows are often a signal that things are not going well for a company.

The company has taken on significantly more debt which has reduced its equity ratio which is, however, still strong.

The increasing importance of the North American market is spreading risk away from too much reliance on Greater China.

The company uses the metric EBITDA when announcing its profits which can show an overly positive performance.

We use EBIT.

Total earnings for the period were up by an anaemic 1.0% to $3.5 mn for the six month period.

The gross margin improved to 56.6% from 49.0% in the prior period which is very encouraging.

Total assets stood at $317.6 mn at balance date.

Shareholders' funds stood at $222.1 mn at balance date so the return on equity was around 1.57% for the interim period.

This is not much above commercial bank deposit rates for six months.

The annual result for the June 2022 year will be released in a couple of months and we will review it when it is published.