Photo by Zac Gudakov on Unsplash

Key Points

No traditional interest bearing debt.

Significant right-of-use liabilities

Strong financial performance with total earnings of $47.5 mn.

Improving equity ratio at 43.3%

Excellent operational cash flow of $15.4 mn after dividends

Good dividend of 13.5 cps

Source: Direct Broking

Overview

The company operates the Briscoes stores and the Rebel Sports stores in New Zealand.

It's listed under the code BGP on both the NZX and the ASX.

This analysis covers the latest publicly available accounts which are two interim periods; the 26 weeks ending 26 July, 2020 and the 26 weeks ending 1 August, 2021

The accounts are unaudited.

Recast Revenue Statement

Revenue rose 23.2% to $360.5 mn while EBIT increased by an impressive 58.5% to $73.2 mn. These are extremely good figures considering they are for a half year period which occurred during the Covid era.

The tax bill was a significant percentage of the profit which indicates few if any tax minimisation schemes were employed to save tax.

Total earnings were up 69.6% from the previous period to $47.5 mn.

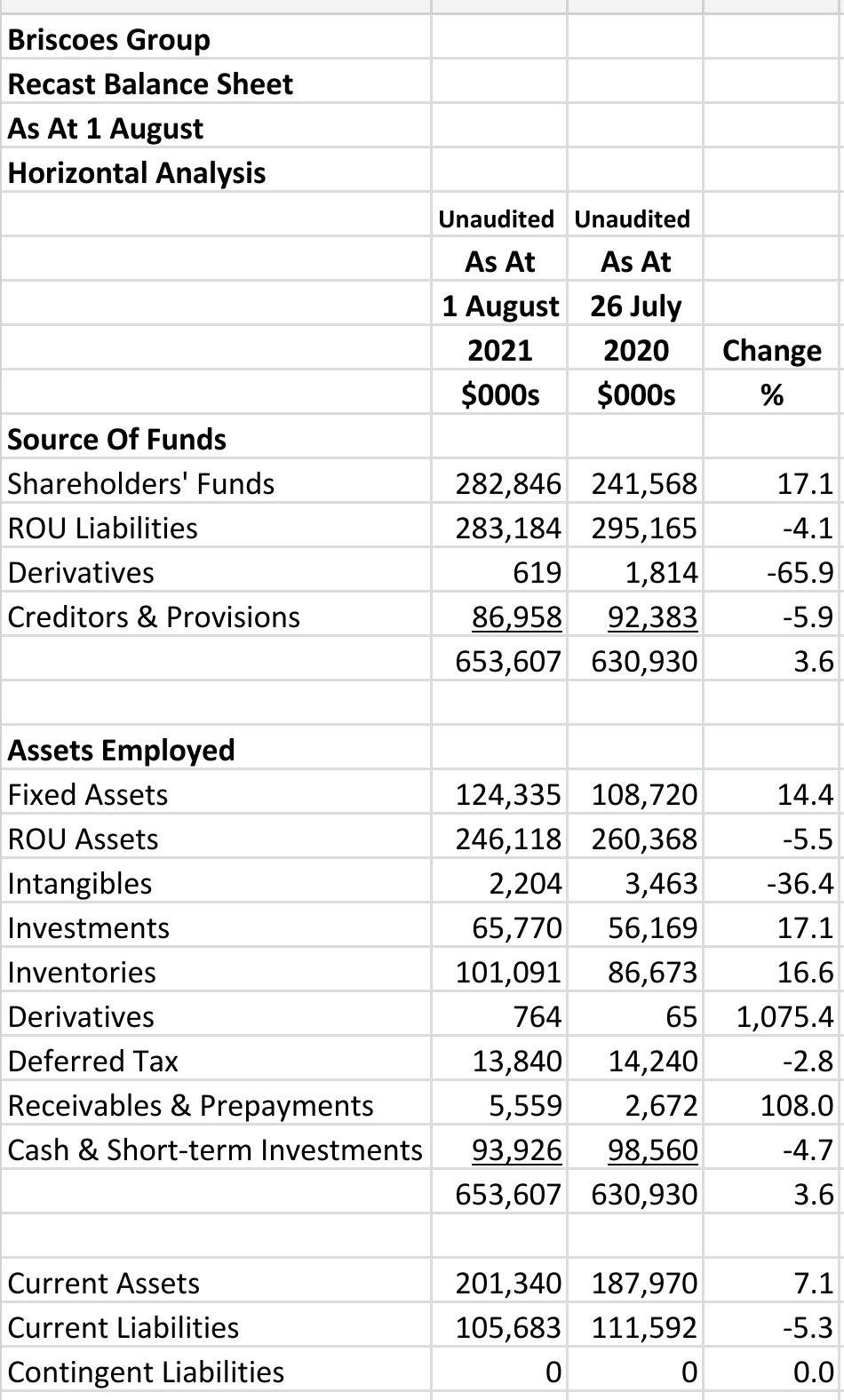

Recast Balance Sheet

Horizontal Analysis:

The excellent profit lead to a significant increase in shareholders’ funds which rose by 17.1%.

Investments and inventories increased by 17.1% and 16.6% respectively.

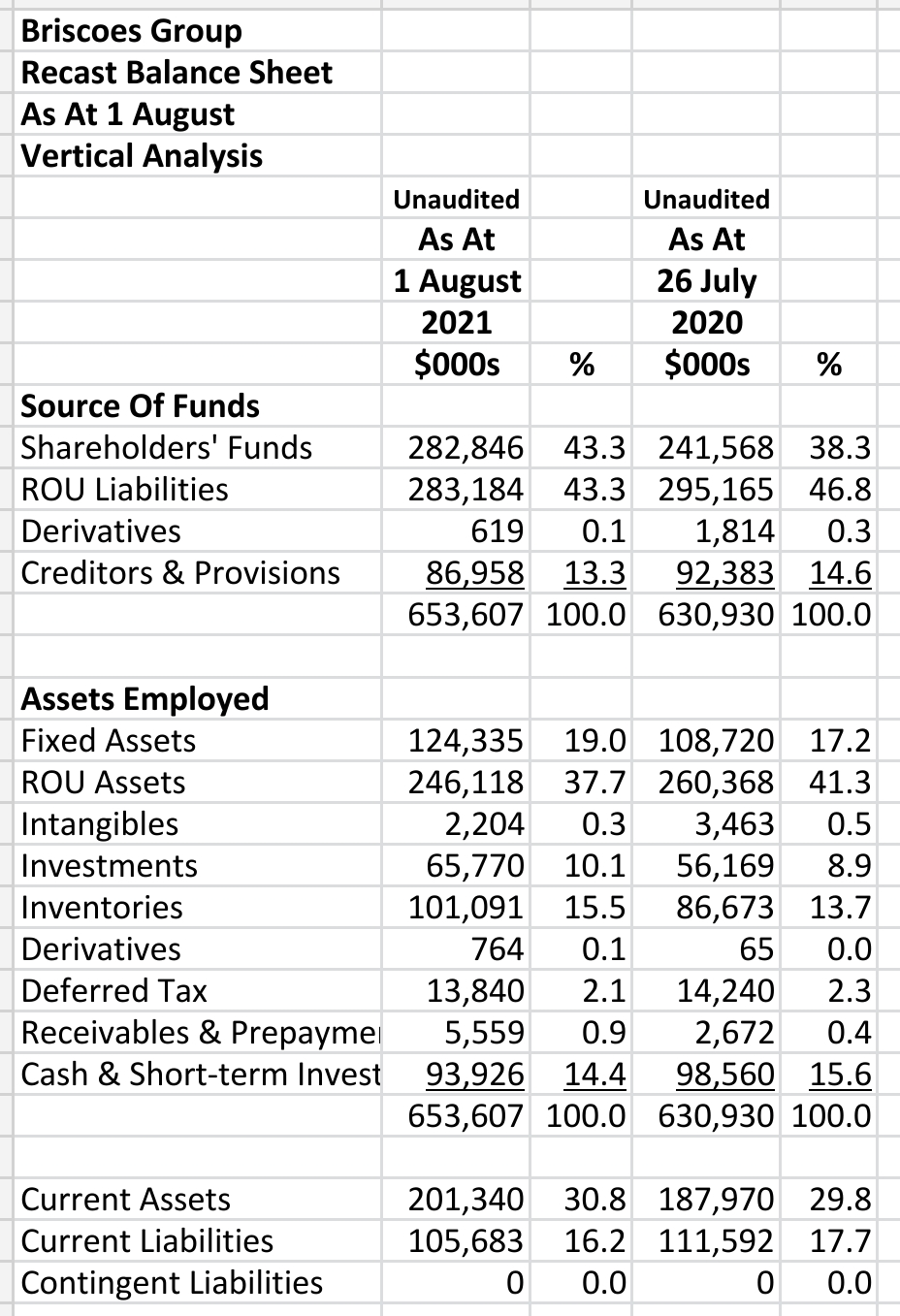

Vertical Analysis:

The equity ratio improved from a quite poor 38.3% to a barely acceptable 43.3%.

One notable feature of the balance sheet is that there is no interest bearing debt in the strict sense.

The borrowings are in the form of right-of-use (ROU) liabilities. Obligations for rental payments are capitalised up into these liabilities.

The assets concerned appear as ROU assets and make up 37.7% of total assets.

The company had an excellent cash at balance date of $93.9 mn.

Recast Movements in Shareholders' Equity

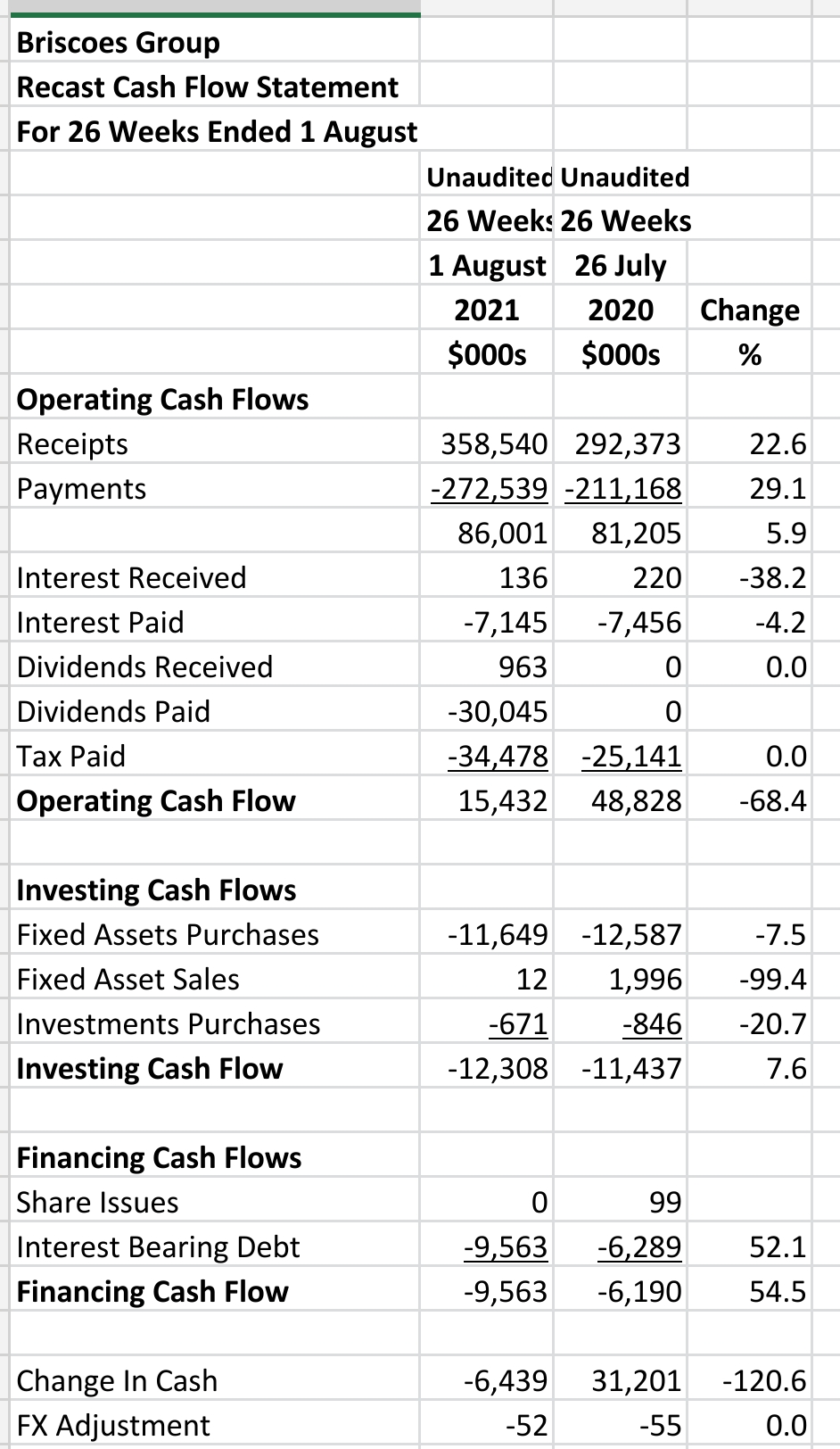

Recast Cash Flow Statement

The company produced excellent cash flows from operations in both periods.

The operating cash flow in the latest period was $15.4 mn which is significant as we included a $30.0 mn dividend in this cash flow category.

Changes in lease liabilities were put into the interest bearing debt item for the cash flow from financing category.

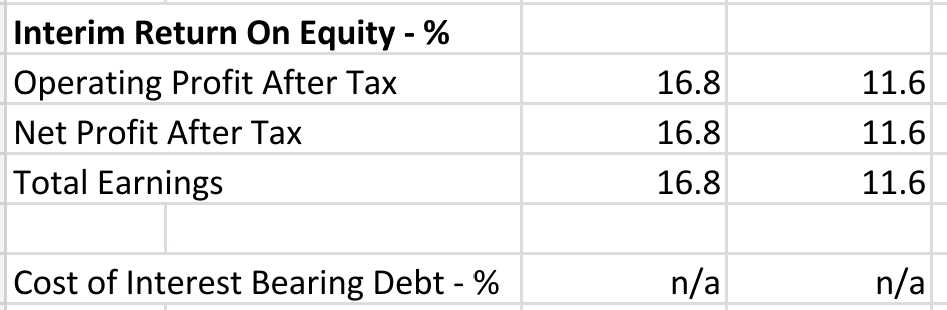

Ratio Analysis

The company had a superb funding cost cover in the latest period of 10.2 times.

The earnings per share were very good and the company had nearly doubled its market capitalisation by the end of the latest period.

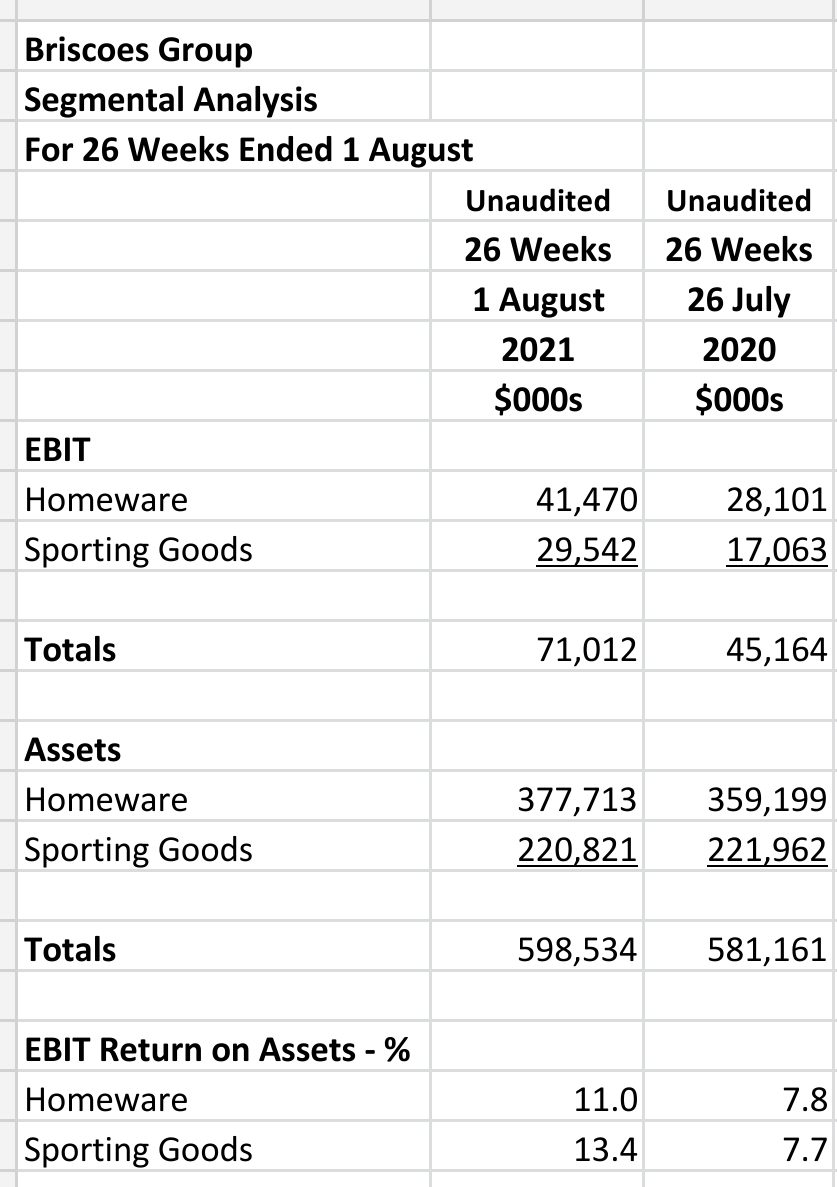

Segmental Analysis

EBIT returns improved in both of the company's main trading categories in the latest period. They improved by very significant amounts as well.

Summary

BGP has always struck us as being almost too good to be true. The financials are excellent and the company earns great returns.

Even through the Covid period there was an increase in revenues and profits as though the period had produced more opportunities than problems.

They did, in prior years make an investment which required a significant write-down in the previous interim period. That write-down however was taken through the reserves and not the revenue statement.

It is almost as if this company operates in some netherworld where the competition is hardly present and profits can be made reliably and easily.

It stands out as one of the best companies on the New Zealand exchange and we await the shortly to be released annual report with interest.