Trading History

Source: Direct Broking

Source: Direct Broking

Discussion

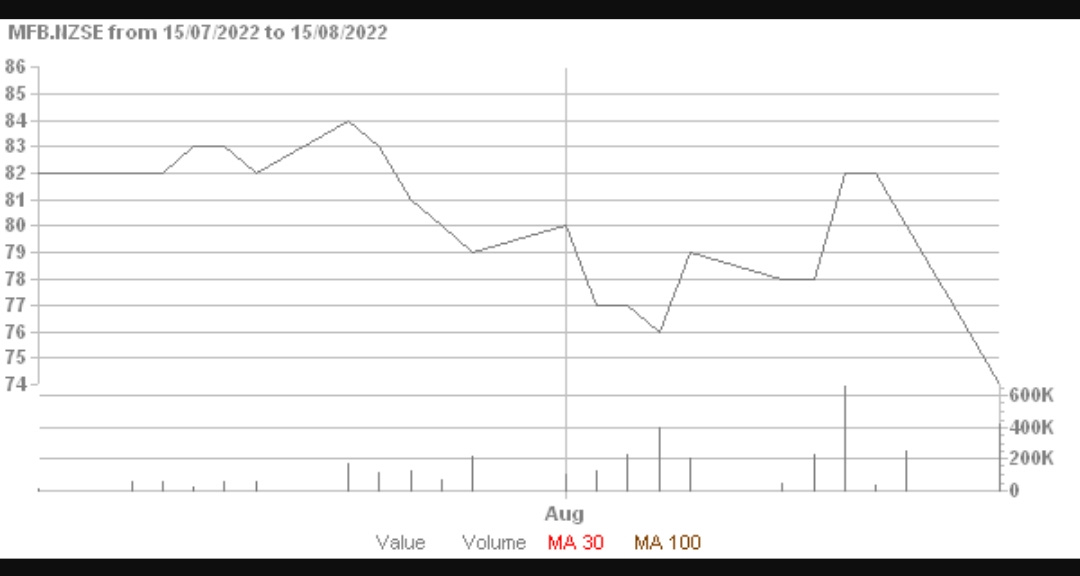

MFB briefly touched a low of 73 cents today compared to its IPO (initial public offering) price of $1.85. It closed at 74 cents down six cents or 7.5% for the day.

At the stock’s low today and including likely brokerage fees investors are sitting on losses of over $275 mn since the IPO share issue.

The share price drop was a reaction to today's market announcement made before trading on the early FY23 (full year 2023) company performance.

The price leading up to the announcement had been showing some strength in the last month and reached a high of 84 cents in July.

MFB’s balance date is 31st March.

The market announcement stated revenue was up 2.5% for the first four months (April, May, June & July) of FY23 year-on-year. EBITDA (earnings before interest, tax, depreciation & amortisation) however, was down by a [very significant] 8.5% for the same period.

EBITDA is largely a nonsense metric except perhaps for comparison purposes between companies. The key number, the net profit after tax, was not mentioned in the announcement.

The EBITDA decline probably indicates that profitability is under strong pressure and that net profit after tax will be lower for the four month period.

It’s concerning that the company additionally signaled that its earnings for FY23 will be below FY22.

It’ll be interesting to see if the stock continues to fall as this news filters out to investors.

Note:

Comments and suggestions can be made below. All discussion related to this article or other issues are welcome and always appreciated.

If you know someone who might be interested in this article or this website please share using the icon below.

Thank you.